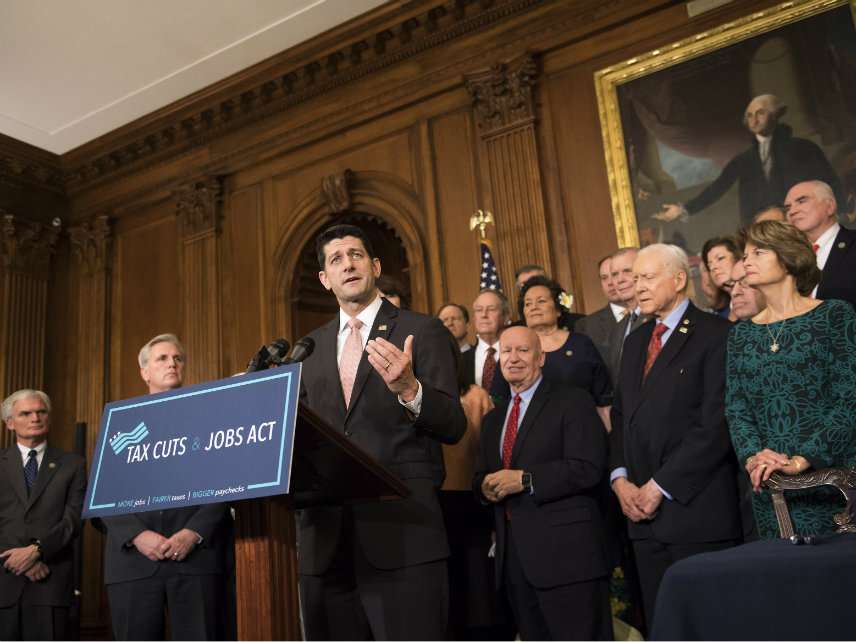

Is Tax Reform Already Working?

Companies are paying bonuses, raising wages, and committing to major new investments. Is this a sign of the tax law's success-or just clever corporate PR?

To read the press releases, you might think the GOP's new tax reform law is already a smash success.

The legislation, which permanently slashed corporate tax rates from 35 percent down to 21 percent, was only signed into law last month. But more than 100 companies have already indicated that they will make big moves to benefit workers and the economy—including raising wages, handing out bonuses, granting 401(k) increases, and committing to increased capital investment—while citing the law's reduction in the corporate income tax rate as at least part of the reason.

American for Tax Reform published an impressive list of the companies who have made such announcements so far, with quotes linking their action to the tax bill. Walmart increased its base wage for all hourly employees from $10 to $11 and granted $1,000 bonuses. Aflac Insurance is extending parental leave, increasing its 401(k) match from 50 percent to 100 percent on the first 4 percent of compensation, and making one-time $500 contributions to every employee's 401(k). That amounts to a $250 million increase in overall U.S. investment.

But it's not clear how many of these moves would have happened anyway, even if tax reform had never passed. The recent burst of activity isn't at all in line with the standard economic theory of how reductions in marginal federal business tax rates affect workers' compensation. Economists usually argue that lowering marginal tax rates on investment gives companies an incentive to earn more taxable income leading them to invest in other businesses and the expansion of their factories. This in turn raises workers' productivity, and ultimately leads to higher wages.

In other words, it takes time for companies to invest new capital, and reap the benefits of their investment.

This is clearly not what happened here, however, since many of the bonuses were announced after the House and the Senate passed the tax bill but before the president even signed it.

So what's really going on?

I asked tax expert Scott Greenberg at the Tax Foundation how he explains the discrepancy. He said that "an alternate theory may be needed to explain the recent bonuses and pay increases."

According to him, "One such theory, which has been suggested by Kevin Hassett, is that workers may have some ability to bargain for a share of the windfall from a business tax cut." He isn't sure how to evaluate yet whether that theory is correct, but he acknowledges that "it is true that some of the companies providing bonuses and wage increases have done so after demands by labor unions."

Greenberg also offered another, more cynical theory. "Companies may have been planning on raising labor compensation anyway, due to increasingly tight labor market, and chose to attribute bonuses and wage increases to the tax bill, as part of an effort to build public goodwill for the legislation." With Moody's estimating that the unemployment rate will drop to 3.5 percent by the end of the year, the raises probably indicate a tighter labor market, and employers taking steps to retain their employees.

If this theory is correct, it is a brilliant public relations move from companies who for years have been labeled greedy bastards who always keep all their profits and will keep the benefits from the tax cuts all to themselves while leaving their employees out to dry. But it's not exactly a sign that the tax law is an instant hit.

Now, this could play out in multiple ways. On one hand, based on the commitment made by many companies on the ATR list to increase their capital expenses significantly in 2018, more wage increases could be coming as the standard theory predicts. It will take some time to materialize, but it will happen.

On the other hand, the narrative that the bonus frenzy is a direct result of successful tax reform legislation could backfire. For one thing, Americans and employees may incorrectly expect for it to happen year after year. And while tax reform will indeed grow wages over time, it will never be as visible and marketable as the rollout of these announcements at the end of last year. When that doesn't happen it could be used as evidence that tax reform is a failure.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

I so love economic astrology. It's one of the most under appreciated disciplines. Unemployment rate has been the same for 2 years. Were wages increasing substantially last year? The year before? Ah, see a future 3.5% unemployment is magic which finally (FINALLY!) signals full employment and must result in wage growth.

Im making over $7k a month working part time. I kept hearing other people tell me how much money they can make online so I decided to look into it. Well, it was all true and has totally changed my life.

This is what I do =====??? http://www.startonlinejob.com

surprisingly topical today!

Finally! There is a great way how you can work online from your home using your computer and earn in the same time... Only basic internet knowledge needed and fast internet connection... Earn as much as $3000 a week....... http://www.startonlinejob.com

Start earning $90/hourly for working online from your home for few hours each day... Get regular payment on a weekly basis... All you need is a computer, internet connection and a litte free time...

Read more here..... http://www.startonlinejob.com

Traffic was pretty light on my commute this morning, which I can only assume is the result of the tax cut.

I've had this cough for like three months and it's finally starting to go away, almost certainly because of the tax cut.

You should have said something. I could have diagnosed you via the interwebs.

You had taxestoohighforAmericanitus.

The only cure is lower taxes. Good thing for you, there was some recent lowering of the taxes.

It's already "working" in CA:

"California Democrats want businesses to give half their tax-cut savings to state"

[...]

"A proposed Assembly Constitutional Amendment by Assemblymen Kevin McCarty, D-Sacramento, and Phil Ting, D-San Francisco, would create a tax surcharge on California companies making more than $1 million so that half of their federal tax cut would instead go to programs that benefit low-income and middle-class families."

http://www.sfgate.com/bayarea/.....508742.php

Hey, it's cheap when you can buy votes with other people's money.

Fffuuuuhhhh ...

I've read Phil Ting's name twice in my life. Both today. He is also the genius behind the plan to ban all internal combustion cars in CA.

So glad I don't live in that liberal hell-hole of CA and instead live in the bastion of freedom that is MA... wait.. shit.

California even makes NY look sane in comparison.

Appropriate for a member of the moonbeam state.

Any state that elects a two-term governor to be governor again after being grandfathered in on a two-term governor limitation deserves what they get.

Governor Moonbeam was a political hack back in the 1970s and still is.

[Apple CEO Tim Cook] said that 'While some of these efforts were indeed in the works, Washington enabled most of this job-creating plan to occur by changing the tax code to allow companies to return capital to all stakeholders,' a series of reforms that [he] has championed for quite a long time.

http://www.cnbc.com/2018/01/17/cramer.....ation.html

Businesses don't make investments based on taxable activity in the past. They budget based on what they think it likely to happen in the future. If they're tax bill is lower in the future than it would have been otherwise, they have more money to play with. Training and retention are important in every business, and if labor markets are tightening, one of the best ways to make sure you keep your best people is to make sure they're being well paid.

And we're seeing labor markets tighten for a number of reasons--I would point to Trump's spree of deregulation as a part of the explanation for that, some of which has directly impacted the costs of employing people. Trump got rid of the employer mandate, and we shouldn't forget the direct impact of income taxes on the cost of hiring people. Businesses have to pay employees enough to cover the cost of paying income taxes. When income taxes go down, the cost of hiring people and paying them their take home pay goes down.

I also wonder how much of this is a ploy on the part of WalMart and others to cement the "temporary" tax cuts into place? If the indeed sunset in 10 years, then the companies can use this history to immediate clobber a whole bunch of wages, directing the anger at the politicians letting the cuts sunset.

I believe - and correct me if I'm wrong - that the corporate tax rate change is permanent (unless acted upon, obv.). It's the income tax changes that are set to expire in 10 years.

Still - you're probably right that many of the companies see this as a opportunity to put this cause-and-effect into the history books just in case (ha!) the D's try to raise the corporate rate later on.

The idea that businesses invest their profits in expanding their businesses or that employees do better in expanding businesses whose profits aren't being taxed away and squandered on government largess . . .

These ideas don't need much help from the headline to convince me. I'm already on board.

There are a lot of average people out there, however, who imagine that sustainable economic growth comes from the government taxing profits away from businesses and spending the money on things with a negative profit.

It's dumber than creationism.

In creationism, you just have to believe that there's a god that's capable of creating the universe with the power of his will.

To believe that sustainable economic growth comes from government taxing and spending, you have to believe that the politicians in Washington are capable of performing miracles.

Jesus feeding the 5,000 with two loaves and five fishes ain't got nothin' on Bernie Sanders.

From a purely political perspective, the provision in the tax reform bill that put a one time tax on money held in foreign countries was a stroke of genius. When Apple announced, yesterday, that they were paying $38 billion in taxes to repatriate those profits, people should understand, that 15% tax to repatriate would have been eaten up by the one time 15% tax on foreign profits that weren't repatriated, too. The decision was between paying the $38 billion to keep it out of country, only to be be taxed again when they finally repatriated, or only pay the tax once now.

Awful from a libertarian perspective.

Genius if you're running for congress or president.

I don't understand how that is awful from a libertarian perspective. I mean, paying a tax one time is better than paying it twice.

You're forcing people to move money across borders with the tax code.

That isn't how free markets work.

That isn't competing with lower taxes.

That's double taxation.

Businesses should be making decisions about what to do with their money based on the fundamentals of the markets they serve--not because of one time tax penalties.

The government is stacking the deck here. They're saying that in order for that money to be invested inside the U.S., you can lose $38 billion, in Apple's case, and still come out ahead by avoiding the double taxation.

"But it's not clear how many of these moves would have happened anyway, even if tax reform had never passed."

Let me make it clear for you. I've spent the last 3 weeks of work going through how my company will invest roughly a third of their $100M tax savings in growth projects. At least another third will go back to investors in the form of dividends and at least some of the rest will go to all employees.

Absolutely NONE of this would be happening without the tax reform. We already had our 2018 Annual Operating Plan locked down in early December. All of it got revisit ONLY because of the change in our tax structure.

Businesses are handing out cash to employees like it's toilet paper? They do that in Venezuela, too. Maybe the smart money guys suspect something about the value of a dollar?

Lefties hate any benefit from rolling back government and they are crying over this.

That is all the proof you need that the tax cuts are working and good for Americans.

How is this rolling back government? It's borrowing more and taxing less.

Smoke and mirrors, at least for some of it. Walmart also laid off like a 1000 workers or something and the bonuses (ie. not permanent raises) could be given and still save money. Comcast said they would invest 50 billion but then that already is in line with the current forecasted expenditures before the bill was even passed.

There might be some good but getting pennies back from overseas in exchange for 1.5 trillion in debt still makes me think that maybe, just maybe, this shouldn't have been rushed through in the middle of the night. They only had years and years to formulate a well thought out plan that shouldn't have such glaring holes.

Walmart is giving bonuses & (permanent) raises.

Also, the layoffs are coming from under-performing Sam's Club stores, not Walmart stores.

The increase in debt is troubling, to be sure.

Companies like the new tax rate. They want it to remain even if Republicans lose power. Obamacare was enormously unpopular from the outset and Republicans have seized that unpopularity as a motive to try to repeal and/or undermine Obamacare. Democrats would like to similarly attack the tax cuts and there's a good chance that in 3 years they will have the power to do so. In order to insulate the new tax rate from such an attack, companies need to ensure that the tax cuts are viewed favorably by the voters. These bonuses and wage increases are undermining the narrative the Democrats are currently trying to craft.

The Rethuglicans Final Solution to their Tax Problem will be the shut down of the government, which will stop the IRS from collecting taxes, and hurting the most vulnerable of Americans who depend on wealth redistribution.

Please, Mueller: stop the terror that is Trump.

I see you take your moniker seriously.

Armageddon!!

Reason can't support the notion that lower taxes facilitates a stronger economy because Trump is such a bore.

Nor can Reason support that Republican must separate tax reform and the federal budget legislation because Democrats will try and stop any rolling back of government.

They couldn't anything about tax reform because only a simple majority was required in the Senate for that.

Current Senate rules require 60 votes for fiscal legislation to pass.

"Companies may have been planning on raising labor compensation anyway, due to increasingly tight labor market"

"...that workers may have some ability to bargain for a share of the windfall from a business tax cut."

I personally think the companies that are doing this are trying to get out front of the coming labor shortage. If the labor market was tightening before the tax cut. One would assume that it's going to tighten more when the companies do start investing their tax savings. So, why not get out in front of it and maybe get a little good will too. Either way, it seems that the corporate tax cut just might be having the effect that we all thought it would.

The government is borrowing more and collecting less. They could have borrowed 150b per year for 10 years and sent 300m people $500 each for 10 years. That would have growth effects as well. It's Keynesian deficit spending by subtraction rather than addition.

Wrong. 2018 deficit projection is $392 billion which is the lowest since 2007. If the deficit goes up from that projection it won't be from collecting less. It will be from additional spending.

I can't believe how many people still don't understand that cutting tax rates increases tax receipts.

With rock bottom unemployment it is most likely the cynical explanation.

"...just clever corporate PR..."

If that's all it is, it's going to cost those companies a boatload of money. You can buy PR cheaper than that.

The increased compensation to employees may only be a preemptive strike by big business against having their employees stolen by smaller businesses. The deregulatory actions of the Trump administration increased the competitiveness of small to medium size businesses that compete with the huge multi-nationals. With more cash in the hands of small, agile companies they would almost certainly seek to go after niche markets currently served by the big guys, and to do that they will raid talent from their bigger competitors.

By comparison, the company that I work for has not only refused any increases in compensation but has demanded longer hours in addition to cutting back R&D and capital investment. They have no small companies directly competing in their markets and therefore actually feel that their increased after tax earnings means that are so rich that they can simply let their American workers leave and further invest in Asia. They don't need to bring back money from overseas to drive the stock price up, they can do it with their tax windfall. As a company run by "money men" devoid of vision beyond the next quarter's earnings report, the executives are quite content to run the company into the ground if they can get their stock options before the crash.

I love Veronique de Rugy but I don't think that she thought this one through far enough.

Overly simplistic answers to complicated questions.

Correlation does not imply causation!

We can see here the way to get the golf clash hack online and in this way we can now get the gems for the game online.