Neither Major Party Gubernatorial Candidate Has a Serious Plan to Fix New Jersey's Pension Crisis

The state has a $135 billion pension debt, but Phil Murphy and Kim Guadagno would rather spend the campaign's final days fighting the culture war.

New Jersey, depending on how you count, has the nation's worst public pension debt or it ranks in the top three along with Illinois and California. The Garden State's estimated $135 billion pension debt—that's a tab of $15,000 for every man, woman, and child living in the state—is a serious problem for its long-term solvency.

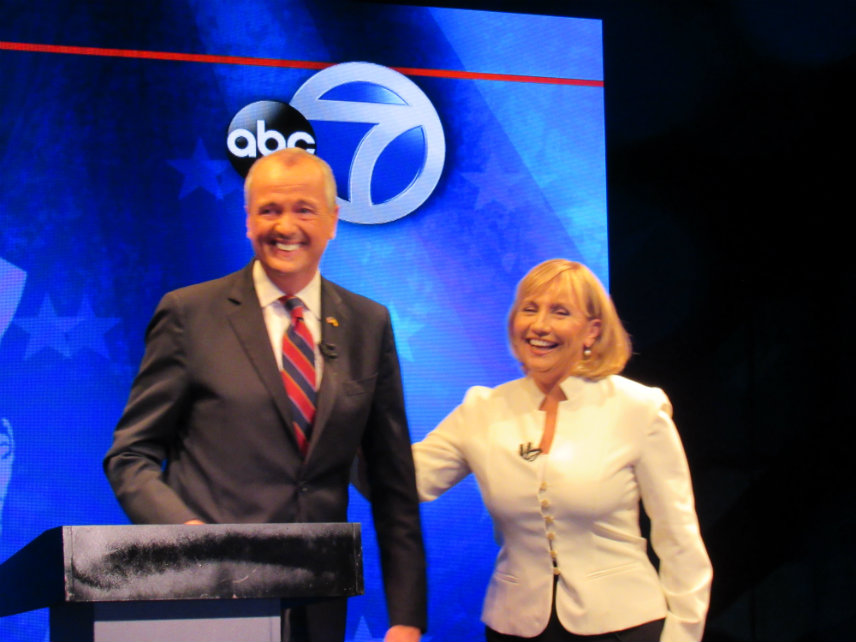

If you spent any amount of time on Sunday watching football in the Philadelphia media market, you may have been surprised the pension crisis went unmentioned in the blizzard of campaign ads for Republican Kim Guadagno and Democrat Phil Murphy in the race to replace New Jersey Gov. Chris Christie (who is not seeking re-election but remains deeply unpopular in the state).

Which is not to say that pensions haven't been discussed at all during the campaign. The two candidates sparred a bit over the pension crisis during an October debate, and both candidates' websites offer bare-bones plans for tackling the budget-busting problem.

What they've offered, though, leaves much to be desired.

Murphy seems to be a runaway favorite in tomorrow's election—though some polls show Guadagno closing the gap, slightly, in the race's final weeks—so let's start with his proposal. He says he will fully fund the state pension system, which is a step in the right direction.

Underfunding the pension system for decades is a major reason why the state now finds itself in such dire straits. But Murphy has given himself a lot of wiggle room with that promise. "We will fully fund our pension obligations, and we'll get there as fast as we can," he said last month, according to Philly.com.

Getting there will require either massive tax increases or huge cuts to government services. Fully funding the pension system this year would have required a $4 billion contribution, but the state is paying just $700 million. Even if Murphy is able to deliver on his promise to generate $1.5 billion in new revenue by legalizing and taxing marijuana, and increasing taxes on New Jersey's highest earners, he won't get close to meeting the pension obligations.

"We have a very, very, credible plan to … fully fund the pensions over the next several years as rapidly as possible," Murphy said during October's debate, according to NJ.com. "At least as fast—I hope a lot faster than this administration has been funding them."

Despite the fact that he's a Democrat, Murphy's plan sounds a lot like the Republican Christie's: ramping up contributions too slowly to make a dent in what the state owes. Most recently, Christie proposed shifting revenue from the state lottery into the pension system, a risky gamble considering that lottery sales have been declining in recent years.

Guadagno says fixing the pension problem is in everyone's best interest. "This problem will only be resolved by sides sitting down at the negotiating table and hammering out a solution," her campaign website proclaims. She's got some good ideas for structural reforms to the pension plan, like moving employees into so-called "cash balance" plans, a bit more like private sector retirement plans, and removing loopholes that allow some public officials to "double dip," or collect a pension from one public sector job while continuing to work at another.

But she has stopped short of pushing for funding changes necessary to save taxpayers from crushing pension costs. Guadagno says her administration would "honor our commitments to current retirees," but would "talk responsibly" about making changes for new hires. Changing the pension formula for future workers is a good idea—one that should have been implemented years ago—but it does nothing to address the existing $135 billion debt, which is entirely owed to current workers and retirees.

Peter Rohrman, the Libertarian Party nominee for governor, also calls for eliminating the "double-dipping" loopholes and says he would "make the public pension system voluntary instead of forcing employees into a bankrupt system."

In politics, when you can't propose a way to fix a problem, you try to blame your opponent for the existence of the problem. When it comes to New Jersey's pension crisis, both parties share the blame. The current unpaid tab for retired state workers and public school employees is the result of two decades of Republican and Democratic governors happily looking the other way while the state pension system was deliberately underfunded and making promises of retirement payouts to public sector employee unions crucial to electing them.

"New Jersey's politicians—both Republicans and Democrats—have succumbed to this clout and largely given the [New Jersey Education Association, the state's teacher's union] what it wanted," says Mike Lilley, an adjunct scholar at the American Enterprise Institute, a conservative think tank. "Too often, New Jersey citizens and taxpayers have been left out of the discussion, and yet it is they who will foot the bill."

Whoever wins tomorrow's election will have to take on the entrenched interests of the NJEA and other public sector unions, which survived Christie's attempts to bully them into giving concessions on the pension front. The election will determine the direction of New Jersey for the next four years, but there's no rosy outcome likely for taxpayers.

Show Comments (34)