Poverty Wages? Uber Drivers Make $37 Per Hour on Average, Survey Finds

How much do Uber drivers make, and why does that matter?

Uber drivers who say they are working long hours and making less than the minimum wage are a key part of the legal and political case against ride-sharing.

Barbara Ann Berwick, who sued Uber in 2015, claimed that she should be compensated and classified as a employee. In the course of driving for Uber from July to September 2014, working 60 to 80 hours a week, she told The New York Times, she earned about $11,000 before expenses and taxes. "If you work it out, if I didn't get compensated for expenses, I'd be working for less than minimum wage," she told the paper for a June 2015 story.

A California judge ruled that Uber owed Berwick more than $4,000 in back pay, but the decision to classify Berwick as an employee did not apply to other drivers.

More recently, protests against Uber (and fellow ride-sharing firm, Lyft) have focused attention on the earnings of drivers. "All we want is an increase in our wages so we can make a decent living," an Uber driver who participated in a large protest at Los Angeles International Airport in August told a local TV station.

These protests are meant to inspire political action, either against Uber and Lyft directly, by banning ride-sharing or limiting it (to the advantage of taxi companies and others), or in a more general way by getting lawmakers to lump independent contractors in with salaried and hourly employees.

A major problem, though, is that all the data is anecdotal. Do the complaints about making "poverty wages" come from average Uber drivers, or do they represent a small outlier group? That's the question Will Rinehart, director of Technology and Innovation Policy at the American Action Forum, a Washington D.C. center-right think tank, tries to answer in his new research paper, released Wednesday. The answer might surprise you.

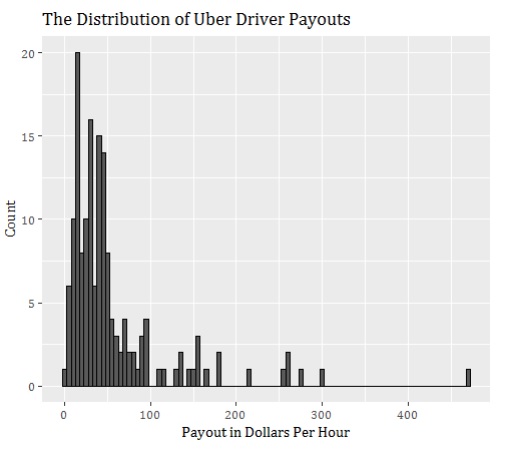

After trawling through two websites where Uber and Lyft drivers congreagate to swap stories and share tips—specifically, the "UberDrivers" subreddit on Reddit.com, and the website UberDrivers.net—Rinehart collected a year's worth of information on how much specific drivers earned on the job. After taking Uber's cut out of the equation, the median hourly payout per hour came out to $37.98, his research shows.

That's not the whole story, of course. He found wide variance in how much drivers earned. One payout resulted in the driver pocketing just $2.23 per hour, while another driver made $472 per hour. Payouts over $100 are not common, he says, but they did occur, and payments cluster around the $37 mark.

"When I talk to drivers, they often cite flexibility as the reason for driving," Rinehart told Reason. "This evidence suggests that there is an important upside to this flexibly. Drivers can make a wide variation in pay, especially if they are watching and reacting to the changes in demand."

Because the data comes from websites where Uber drivers are congregating, it is skewed in that it comes from a select group of dedicated drivers, Rinehart admits. It's significantly higher than other estimates, like one from Glassdoor, a job search company that tracks salaries across occupations. Glassdoor estimates that Uber drivers make about $15 per hour, on average, based on anonomously sourced data. A Buzzfeed analysis of Uber data from 2015 found that they earn around $14 per hour in Houston and nearly $17 per hour in Denver, on average. Still, not exactly poverty wages.

Rinehart says his research suggests another important conclusion: that Uber drivers earn more when they are better at their jobs. That's important for the drivers, of course, because it means they can boost earnings through means that are entirely within their own control.

It also matters for the legal and political debate surrounding Uber drivers. While the Internal Revenue Service, the Department of Labor, and various state and local agenices use different classifications for employee or independent contractor, drivers have one thing in common.

"Drivers have control over their work, and can be fairly categorized as independent contractors as a result," says Rinehart.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

If you feel you are not being compensated fairly by Uber or any employer, simply quit and find a better job.

No, see, it's a natural human right to be able to make at least $15 per hour doing whatever you feel like doing wherever and whenever you feel like doing it.

For retirement I plan to hang out on the park bench feeding pidgeons, then demanding the city pay be minimum wage. Beats social security.

classic liberal game: its all about the feeeeeelz

Funny, they just inspire rage in me.

the decision to classify Berwick as an employee did not apply to other drivers.

It's because Berwick is a *woman*, right? RIGHT?!

"Drivers have control over their work, and can be fairly categorized as independent contractors as a result," says Rinehart.

But in fact this is the real core of the debate: Do rideshare drivers "have control over their work"?

They get to decide WHEN they drive. Literally every other aspect of the engagement is controlled by the company,

I'm sorry, but anyone who thinks that's "control" -- from Rinehart to Boehm -- is just too ignorant to be taken seriuously on the subject.

It's one thing to say "this law is dumb, obsolete or unjust and should be changed." It's another to say, "this law is dumb, obsolete or unjust and should be ignored because what I happen to be doing is neat-o."

"I'm sorry, but anyone who thinks that's "control" -- from Rinehart to Boehm -- is just too ignorant to be taken seriuously on the subject."

Anyone who makes this claim is just too stupid to listen to.

What control do you want the drivers to have? What are they missing, specifically, that you think they "deserve"?

Have you ever been an independent contractor before? Once they take on a contract, they have similar levels of control over their job.

The IRS classifies them as Contractors because they provide their own tools (vehicle), pay related expenses (fuel, insurance, etc), and control their own schedule. They can also choose to accept or reject specific projects and accept or not accept the pay being offered for that project.

The company merely provides the connection between client and contractor and processes the payment. For that they take a commission. I can't find any way that's a statutory employee.

No one is happier than I to see the destruction of the taxi cartels.

But for most people driving for Uber isn't a great deal.

And the data used in this research paper are collected from reddit posts. Not exactly a bias-free sample.

You can make decent money driving for Uber, but you have to know what you are doing. Buy a used car. Don't chase surges. Learn the most profitable driving hours in your area.

What happens is new folks get sucked in by the allure. (And setting your own hours is very alluring). They make the mistake of getting a new car and end up transferring the value of the that car to Uber. They don't factor in their expenses. They don't realize they have to pay the self-employment tax. Eventually it dawns on them they aren't making as much money as they believed and they either quit or get smart.

One problem is if only smart drivers drove, there wouldn't be enough slack in the system. Uber needs a constant new supply of clueless drivers to churn through.

Note: I am not saying this should be illegal. People need to be free to make their own ill-informed decisions.

Also, Uber continues to burn through their VC money at a frightening rate. It will be interesting to see at what level fares need to be for the TNC's to be profitable.

I would only consider it for making pocket money in my spare time - trying to do it as your only job always seemed like a strange choice to me. And now those people are trying to make it so people like me can't get such a job.

That's why Uber has all those TV ads pitching it as a side hustle.

They don't realize they have to pay the self-employment tax.

Huh, not such a great job then. Still, high taxes are not Uber's fault.

Uber has a page that talks about needing to pay the self-employment tax. It's hardly their fault that people don't read up on these things. Moreover, self-employment tax can have some advantages, if you take the time to work things out. For instance, Uber drivers can deduct basically all of their expenses incurred while driving, as it's necessary for their work.

I would also think that (like any independent contractor) Uber drivers could form an S-corporation, hire themselves as drivers, pay out (for example) half of their earnings to themselves as salary and reinvest the other half as dividends, subject to the lower capital gains tax instead of income tax. Does anyone know if Uber allows a driver to work with them through an S-corporation?

I forgot. You can also deduct half of your FICA taxes from your income taxes. It doesn't make up the difference entirely, but it helps.

With the exception of the S-corporation (which would require paying a lawyer a couple hundred bucks), all of this can be done in TurboTax.

Interesting points. I'll admit I know virtually nothing about how that works, but I suspect that what is being said here is that most people are indeed so sheltered from how taxes work (be it from working for a corporation, or any other 'standard' employer) that when confronted with the realities of our tax system people get mad. Unfortunately, they blame the employer for not sheltering them better from their politicians. Sort of ironic, in my view.

We had to pay a lump sum at the end of one year because my fianc?s employer classed her as an independent contractor behind her back and, even after reporting him to the IRS, she still had to make that payment at the end of the year. Fortunately, since we have two incomes it wasn't a problem but it was illustrative that we do in fact pay into the tax system. It's not a 'rebate' or a 'return' at the end of the year. Most don't understand this concept, and that's a fairly simple one to grasp.

It's kind of interesting, no? Taxes may end up being a significant portion of one's expenses in a given year, yet they pay very little attention to it. For a single person earning $100k taking the standard deduction and not contributing to a retirement account (for ease of calculation), the tax burden will be ~$20k. That's a bit more than a $1,500/month rent/mortgage, multiple times more than groceries, vehicle expenses, etc. I'm willing to bet people put a lot more time into researching/thinking about decisions associated with those expenses than they do taxes, even though you can do a lot more to lower your tax burden than you can to lower the other expenses. It's astonishing.

Income taxes are fucking insane aren't they? Combining fed, state, FICA, it's my biggest bill.

Yea. I meant to say that's just the federal tax burden.

It's even more fun to realize how much your taxes would pay in taxes if they were a person and then be told you're not paying your fair share. And there's very little you can do to lower your tax burden when your compensation is almost all salary.

Having been an employer for decades, and acting as the government's tax collector, I've often thought how employees would react if they felt the full thrust of taxes all at once, rather than the piecemeal withholdings done for them by their employers.

The government insists that employers withhold a small amount of employees' earnings each pay period to be sent to the US Treasury in payment of taxes accrued. And let us not forget that this also assists our insane governance a predictable cash monthly cash flow. That way no one but the evil capitalist employer knows the real truth of our tax system and how it is played by our governing fools.

I'm sure the average employee who has never had to pay taxes in one lump sum, so has no experience with our hellish tax code, has no idea how crushing it is.

"I've often thought how employees would react if they felt the full thrust of taxes all at once, rather than the piecemeal withholdings done for them by their employers."

Which is WHY taxes are withheld rather than simply billed as a lump sum. That's almost as cynical a scam as giving people a "refund" that the stupid ones can celebrate, not realizing they're just getting back their change from being overcharged all year.

They make the mistake of getting a new car

Really though? How many people actually do this? Only a few morons, I'd bet.

"Uber drivers who say they are working long hours and making less than the minimum wage are a key part of the legal and political case against ride-sharing."

Last time I used Uber, I noticed the front seat passenger holding that gun and telling the driver he MUST be an Uber driver or else!

so the obvious answer is to ban guns, thus eliminating all the pressure for ?ber drivers to drive for them. Simple solution.

Are you fucking kidding me the research was "trawling a website"? I drove Uber for a year a couple years ago and after deducting milage you don't make shit. In fact it's like using your car as a credit card. Now there are certain times when it's good but I never pulled 37 a hour on average especially after figuring in costs. God damn this article is misinformation.

Costs including a special lease? Or costs that are just the difference between owning a car anyway and putting a bunch of extra miles on it? Because if you already have the car, the difference in costs for the extra mileage is only about 10?/mile (mostly fuel).

Not sure that's fair. You also need to factor in maintenance costs, vehicle depreciation due to mileage, etc. The federal standard is $0.51/mile. I've personally gotten down to as low as $0.33/mile driving a 6 year old vehicle that got great gas mileage, needed little maintenance, and held its resale value well. I've never heard of $0.10/mile.

I don't understand this mentality. Someone gives you a job, and you thank them by suing them? If you don't like the pay, go drive a taxi! This isn't even like other jobs where switching employers is a significant task, just start working for Lyft.You're an independent operator, you should start acting like one.

I see a lot of cars with both Uber and Lyft stickers. Seem like independent contractors to me.

True. There aren't a lot of employers that would be okay with you working for their direct competitor.

I'd be willing to bet money that the taxi unions are behind a majority of these lawsuits/complaints.

If a small business owner or other type of independent contractor doesn't make minimum wage, who should bail them out?

no takers on your bet here.

I've been convinced every government action (lawsuit, pleas for new laws, sanctions, etc) have come from disgruntled real taxi drivers and/or relatives/close friends/lawyers setting them up to go to work for the rideshares, instruct them how to do miserably at it, then go all legal.

Just like ambilance chasers and ADA wolves.

A Buzzfeed analysis of Uber data from 2015 found that they earn around $14 per hour in Houston and nearly $17 per hour in Denver, on average. Still, not exactly poverty wages.

I'm not saying Uber is to blame but, if they are self-employed, that is pretty close to poverty

The real issue is that most people don't realize how much a business costs until they run their own. They are sheltered from a lot of that as an employee.

If 14-17 per hour is 'close to poverty' I'm curious how you're defining 'poverty'.

I take it you've never been self-employed

I simply asked how you're defining poverty, and it appears you're unable to answer that fairly straight forward question.

I assume you're saying it's an unfair burden to set aside a part of your income to pay taxes?

Oh I'm sure it was a straightforward question, which is probably why you're now assuming something I never implied.

For a modern fairly expensive city like they mentioned, I'd define poverty as trying to live off $7 an hour....which is roughly what a self-employment rate of $14 translates to after taxes, expenses etc

That doesn't mean that these Uber drivers are poverty stricken, we don't know what their specific circumstances are...but if the article writer is going to take the rate at face value then I think I'm entitled to as well

For the record, I made $16 an hour at my most recent "employee" job....but I now work freelance and my rate is about double that because my expenses and taxes are much higher. I am not some sheltered ignoramus, just someone who has experienced this type of situation firsthand

Oh I'm sure it was a straightforward question, which is probably why you're now assuming something I never implied.

It actually was, which is why I asked it. I assumed because you did not clarify. You make a valid point regarding taxation, and I wanted to hear a more specific illustration. You are saying that someone working in Denver as an independent contractor pays a 50% tax rate? A 20% tax rate with 30% expenses? That is news to me, and if it's true it is absurd for that income bracket. I have my doubts that fully half of their income goes to vehicle maintenance and taxes though.

Cost of living will definitely be higher in a place like Denver than, say, Amarillo but that sort of makes me wonder how someone could live there in the first place when you're choosing to work at the equivalent of minimum wage in such an expensive city with a vehicle that meets the Uber/Lyft vehicle requirements. Somehow, these people were able to buy a brand new vehicle pretty recently. Odd, that. Maybe their parents bought it for them?

It doesn't look like it's a 50% rate, or even 20%, to me.

Remember that 15.3% comes off the top for So-so security and FICA which is double the 7.65% a regular employee pays. That adds to the lowest current tax bracket of 10% for a total of 25.3%. A person in Denver also pays 4.63% to Colorado bringing the marginal rate to 29.93%. Sure it's only 7.65% higher than the regular employee but it would cut the $17 rate down to $11.91 which is just about the federal level for a family of four.

Uber was never meant to be a person's primary source of income. It's part of a part time sharing economy, not meant to be an 8 to 5 job. At the same time, it's pretty good wages for someone right out of the gate.

When the fuck did we get the idea that you're supposed to graduate from freebie college straight into a $100,000 job? If you're thinking that you and your Prius and an Uber app is going to net you a lifetime career with a trendy loft in Brooklyn and avocado toast every morning, you're on fucking crack.

is that 14-17/hour net of all expenses and deductibles? Fuel, insuranc,e maintainance, tyres, depreciation, on the road food, cleaning up after the pigs that ride? HUGE difference, and one only a self-employed operator would know.. because HE has to pay them out of his grosss. If that figure is net of everything, that's not bad.

Well, if driving for a rideshare is such a shitty, no-win situation the problem will solve itself, won't it? The companies will dry up for lack of drivers.

Every server that works for a restaurant across the entire United States are paid even less than Uber / Lyft yet somehow restaurants still have servers. Weird, right?

No it's not weird BYODB. You have no clue. Talk to a server in any average kind of restaurant or diner and learn about the reasons they have this job. And how well it's working for them.

You will find that most all women working as servers (and that is overwhelming majority of them) are single mothers who cannot work normal hours because they take care of their children. And there's no way they can use daycare or a individual babysitter. The costs of that are more than or nearly equal to their earnings.

Additionally, servers are paid less by their employers because the employer relies on the servers' tips to pay a living wage. A low living wage.

In the past I thought if someone doesn't like their job or how much they're earning, then rather than complain and whine, they should quit and get a better job.

I've revised my thinking since. The sickening truth is that these people and others in similar positions, cannot just quit. There are no better jobs for their skill level, education, and economic situation.

But there ought to be.

If our country had even close to a realistic economy, a less corrupt governance that incentivizes phony work and corporate welfare. And further, if it enabled any kind of honest reward for those who take chances and try to own and operate their own company, or work as an independent contractor.

But it doesn't. Too many on the public teat and too few teats.

So, you've basically explained that there's a healthy labor market for restaurant servers.

Waitress candidate: "I have no skills and need to work weird hours."

Restaurant: "You're in luck, because I have just the job for you. The pay's crappy though."

Waitress candidate: "But I want 15 bucks an hour."

Restaurant: "You're still here? I'm going to talk to the fifty people in line behind you who will do it for the crappy pay I'm offering."

Sounds like a pretty damned realistic economy to me.

There are no better jobs for their skill level, education, and economic situation.

But there ought to be.

and just WHO will be providing those jobs? Since gummit place so may hoops, hurdles, burdens, conditions, costs, on nearly anyone trying to set up and run a business, its nigh impossible to start one up.

Can't even paint someone's house for side money, nor bank some shingles on their roof.. Landscaping? Some places you can maybe mow their lawns for a fee once you bribe the city into "giving" you a business license, but don't you DARE take a pair of loppers to their trees... that's an "arborist's" job and for that you need TRAINING and a certificate you know how to drive those loppers, hundreds of hours education.... anyone else remember that older woman somewhere in the South was "caught" braiding her niece's hair.. for nothing... and was ordered to attend school for two years as a cosmetologist, three thousand hours of training. She fought, and sort of won.

Until government at all levels gets OUT of our way and lets a market economy build, Uber just may be a great deal for some.

You mean making poor decisions like having children you can't afford out of wedlock has negative consequences? Who knew! So unfair.

I do not run a taxi service, but the cost assumptions in the Buzzfeed/Uber study seem incredibly optimistic. For instance, it assumes a $16,000 that will get 250,000 miles and achieve 25 MPG in city living. I dunno. Does that car exist? If so, I would like to buy one tomorrow, and I am not an Uber driver. Also, when was the last time gas was $1.75 a gallon? It's $2.65 where I live. And your insurance/maintenance costs on a $16,000 car will amount to more than $3,000, especially once it gets close to 250,000 miles. I'd guess that a more realistic accounting would shave at least a few dollars off of those lower estimates.

Contractors drive a $16,000 vehicle, which has a 250,000-mile lifetime, resulting in depreciation costs of 6.4 cents per mile.

Gas costs drivers $1.75 per gallon and the vehicle gets 25 miles per gallon of gas, resulting in gas costs of 7 cents per mile.

Insurance, maintenance, and miscellaneous costs add up to $3,000 per year, or $1.50 per hour if the contractor drives 40 hours per week, 50 weeks per year.

Nobody disputes the reality of the situation. $15/hr is probably not enough to be your only source of income when you factor in buying insurance, maintaining a car, gasoline, etc.

The position being argued here is that if you don't make money driving for Uber, then don't drive for Uber. Uber will raise rates/compensation for drivers until they can hire enough drivers to fill their fleet. They'll either be forced to change their business model or go out of business. Suing them or complaining about what you're "entitled" to isn't going to fix your situation.

I am just saying that the study they are using seems like BS. Even the one that assumes the lower pay rates. Yeah, if it's not enough, don't drive for Uber. I get it. But to get to the rates of pay mentioned in this article you have to assume some things that do not seem like fair assumptions.

The whole point of the article is hey, these studies say that Uber people seem to be making decent money! In assessing such an article, it's worth exploring whether the studies are absurd. Feel free to right an article that says, "I don't care what Uber drivers make, because if they don't like it they can pound sand." But that's not actually what the original article is about.

2017 Toyota Corrolla, MSRP 18,500 USD. 30 MPG City.

2017 Nissan Versa, MSRP 11,990 USD. 31 MPG city.

The Versa is an ugly POS. Go with the Corolla. It'll get you the 250000 miles. Or go with something like Ford Focus. It'll go forever and be about $15k. $10k or less if it's a few years old with about 50k miles already on it.

You can probably get a Prius that's a few years old for the same money. It seems the choice of most of the Lyft/Ubers here in SoCal.

While people are screaming about the wages of Uber drivers, major car manufacturers are buying into ride sharing services and driverless technology like crazy.

We'll see cab drivers' wages drop down to zero in our lifetime. Artificially inflating their wages will only accelerate the process.

It never made a lot of sense for a 'job' that most people perform every day for themselves would have such a high barrier of entry in the first place. I mean, seriously, virtually every adult in the United States is capable of driving a vehicle and navigating that vehicle to where they need to go. How is that a skill worthy of such rabid protectionism?

That type of labor should be dirt cheap, because it's a common skill that even most 16 year old teenagers are able to perform fairly consistently. Pretty ludicrous in my view.

Being the old crank that I am, I remember when a good taxi driver brought something extra to the table. He knew where everything in the city was and the quickest way to get there, including the quirky stuff most people didn't know about. He also knew everything that was going on in town. Over the past few years I haven't encountered a taxi driver like that; they don't know where anything is and just use GPS like everybody else does. Most of them can barely speak English.

This is a good reason that, frankly, I've long forgotten. Definitely no longer the case, although I'm sure there are exceptions.

Look up "The Knowledge" requirement for a London cab drivers license. This requires years of puttering around the London area on a motorscooter and learning every street, until one can pass an oral test by rattling off the route from any two randomly chosen points in the area. That knowledge was worth a lot before GPS, and it's still worth something; a licensed London cabbie should know more than any GPS database does about when and where roads are congested and pick a considerably faster route.

But AFAIK, no American city ever had a similar requirement, and where the regulation was tightest, it has now turned into merely a monopoly enforced by armed government agents. A taxi medallion in NYC may require the cab to pass an inspection, but it does not require any inspection of the driver beyond a commercial license and a criminal background check, and has come to be treated as property that can be bought and sold - with the value of up to $1 million pre-Uber, coming from the limited supply, to the detriment of anyone trying to get a taxi ride. Apparently the worst aspect of this wasn't the higher prices that the monopoly enabled (reflected in the market cost of a medallion), but that it was often difficult to get a ride at all.

And now with GPS, you don't even have to know where shit is. That used to be the cab driver's skill set, knowing where almost anything is in the city. Not anymore.

"All we want is an increase in our wages so we can make a decent living."

Then go get a real job, Cupcake. It's not Uber's place to make sure you make enough money, just to pay you what you AGREED to when you signed up. If it's not enough, you shouldn't have agreed to it. Good news: you aren't a a slave, so you don't have to continue.

This is as stupid as the assholes who want $15 an hour at McDonalds.

Like a lot of free market arguments, this study is tangential to the fundamental principle that nobody is holding a gun to these drivers' head to force them to drive for Uber. Drivers and Uber make a voluntary exchange for EVERY SINGLE FARE!

GET OFF MY LAWN!

These are gross wages, on 1099 work. So it is not the same as $15/hr fry cook, (15% Fed tax), vs. $15/hr Uber Driver (39% Fed tax). But hey! Trump is waaaaay out of line asking that 1099 be lowered to 25%, think of all the non-1099's people! Think of them!!!

Shared a house with a chap some years back he drove taxi for Yellow Cab in the rather large city we lived near. He had learned the city, the routes, demands, HE got to choose his shifts and got the most lucrative ones. He knew that huge city like his own backyard, every shortcut, what time of which days this or that way is faster. He knew just where to sit at a stand and for how long.... he made far more money than nearly all the other drivers in the fleet..... the owner for whom he worked went way out of his way to keep this guy on HIS team... my friend made big bux, and so did the cab's owners. His skill as a driver and attention to the tiny details all over the city made him a hugely successful player. I was always astounded at the momey he dragged back each week. SO were the owners.

The average joe signing up for Uber will be relatively clueless how to really make money. A seasoned taxi driver switching will do very well. SO MUCH hangs on the driver as an individual.