As Hurricane Irma Bears Down on Florida, the Broken Window Fallacy Is Back

Say it with me: natural disasters are not good for economic growth.

With Hurricane Irma bearing down on the southeastern United States this weekend, cue another round of economic illiteracy from pundits and officials who will try to argue that all those flooded homes, torn-off roofs, and broken windows are actually a good thing for the economy.

The latest culprit of such misinformation is someone who should probably know better: William Dudey, president of the Federal Reserve Bank of New York.

In an interveiw with CNBC on Friday, Dudley trotted out of the ol' broken window fallacy in an effort to find a silver lining to Irma's impending, potentially devastating landfall in Florida.

"The long-run effect of these disasters unfortunately is it actually lifts economic activity because you have to rebuild all the things that have been damaged by the storms," Dudley said. "I would expect that by the time we get to the end of the year and early 2018, the transitory negative effects of this storm I think will be over and we actually will start to see some of the benefits of the rebuilding efforts in terms of boosting the economy."

As a clearly exasperated Michael Tanner, a senior fellow at the Cato Institute, asked this week in response to similar arguments made in the wake of Hurricane Harvey's assault on coastal Texas: "Do we really need to say it? Hurricanes are bad."

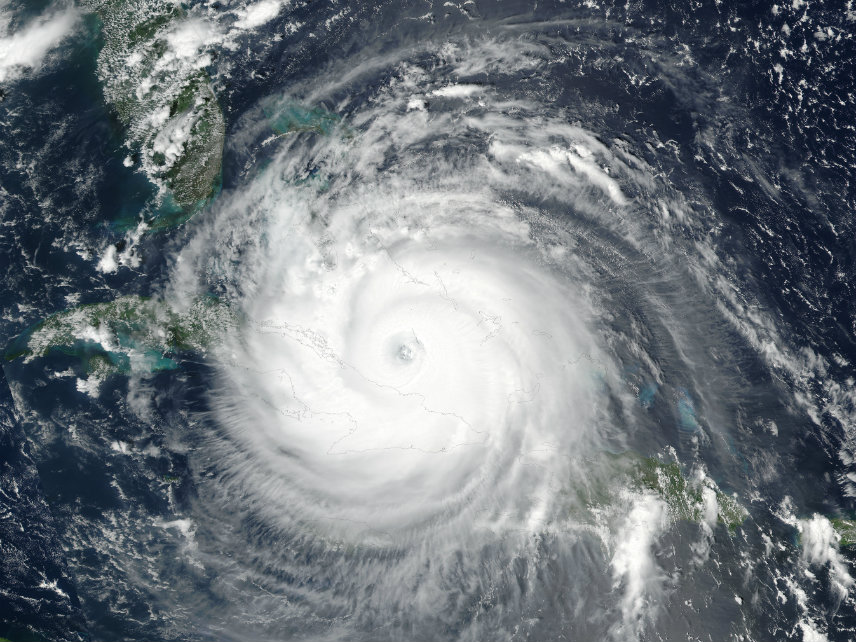

Harvey rained down an estimated $20 billion in property damage (and incalculable amounts of human suffering, including at least 70 deaths) on Texas, and Irma is poised to be perhaps worse. The storm is one of the strongest ever recorded in the Atlantic basin, bringing winds of up to 150 MPH with it as it takes aim at Florida.

According to the National Weather Service, Irma made landfall in the Florida Keys on Sunday morning. The storm is forecast to strafe the western coast of Florida, with a second landfall possible in the vicinity of St. Petersburg or Tampa. Early estimates say the storm might cause more than $200 billion in damage.

If you're only looking at GDP data, sure, storms like Harvey and Irma might cause a temporary uptick in spending as people and businesses repair and rebuild. But that's not economic growth; it's just replacing what's been lost. Those resources could have been allocated in different, more productive ways if they hadn't been forced to be used rebuilding after a natural disaster.

In his piece this week, Tanner explains the so-called "broken window fallacy," first explained as an economic parable by 19th Century French economist Frédéric Bastiat:

In Bastiat's parable, a shopkeeper's careless son breaks a pane of glass in his father's store. According to the economic theory popular at the time, the broken window was actually a good thing, because it meant that the shopkeeper would have to pay the glazier to repair it. The glazier then would use his new income to buy a pair of shoes, and the shoemaker would spend the money, etc. The cycle continues, and the economy is stimulated. As Bastiat noted, "You come to the conclusion, as is too often the case, that it is a good thing to break windows, that it causes money to circulate, and that the encouragement of industry, in general, will be the result of it."

Nevertheless, as Bastiat pointed out, that leaves out a crucial calculation: what the shopkeeper would have done with the money if he had not been obliged to buy a new window. What the broken-window advocates miss is the elements that are not seen: "It is not seen that as our shopkeeper has spent six francs upon one thing, he cannot spend them upon another," The accident only means that the shopkeeper has spent six francs to bring himself back to the economic state he was in before the window was broken; he is no richer for it, but six francs poorer.

Texas and Florida stand to be much less than six fancs poorer by the time this hurricane season is over. Harvey and Irma have the potential to pack a one-two punch unlike anything the United States has ever seen, and the damage caused by these two storms is anything but a blessing in disguise.

You might expect the chairman of a federal reserve bank to have a better grasp of economics—but, then again, you might expect the same of a Nobel prize-winning economist, and that's never stopped Paul Krugman from touting the benefits of broken windows, either.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Or alien invasion for that matter.

How can you create wealth if you don't destroy it?

Someone ought to ask confiscators the reverse -- how can you confiscate wealth if you don't let it be created?

"much less than six fancs poorer"

Is such sloppy writing and an absence of editing really the best that Eric could do?

If it's true that natural disasters result in increased economic growth, why don't we carpet bomb a major city every 5 years? Wouldn't that really cause a major increase in economic growth?

I'd like to see a carpet bomb.

Rug burn victims are no laughing matter, Earth Skeptic.

If you can explain this to a third grader by showing her how replacing a favorite doll she broke doesn't leave her any money in her allowance to buy a new video game, then how can grown men and women believe such nonsense?

Banker Dudley should be shown the door as quickly as possible. What's next...having an annual lottery to determine which state should be carpet-bombed so we can grow the economy by replacing all the infrastructure?

I know, I know...don't give them any ideas.

"If you can explain this to a third grader by showing her how replacing a favorite doll she broke doesn't leave her any money in her allowance to buy a new video game, then how can grown men and women believe such nonsense?"

If you need to give money you don't have to your daughter, why don't you borrow it like normal people?

mtrueman|8.30.17 @ 1:42PM|#

"Spouting nonsense is an end in itself."

You disapprove.

Ignoramus or mendacious apparatchik?

-jcr

Bastiat failed to recognized that the shopkeeper had federally subsidized window insurance, meaning that money came from someone else's pockets. The man who patents a tropical cyclone generator is going to be so wealthy.

I though Darth Chaney already had one.

That's really the key and explains why a FED president can predict "boosting the economy". Congress will approve spending hundreds of billions that they don't have, the FED will magically transform that debt into money, and everybody will get paid. Is it wealth creation? Well to the roofer getting double time rates it is, Is it sustainable? Well it is virtually impossible that taxpayers will ever be able to or made to pay off the federal debt so until the empire collapses, the part goes on.

the party goes on.

Even that doesn't make any sense because as you increase the money supply the value of each dollar goes down.

Which is what is really frustrating about our national debt. It is simply a promise of future servitude with no real net benefit. We'd be better off getting taxed at our true spending rate.

Let's all go and destroy Dudley's house. According to him, the effect will be a net positive.

"what the shopkeeper would have done with the money if he had not been obliged to buy a new window"

If it was this shopkeeper's intention to do nothing with the money, or just leave it in the till till closing time when he was going to put it under his mattress, then the broken window would indeed be an economic blessing. For currency to do its job, it needs to flow.

How many people REALLY put money under their mattress? Almost all savings are actually in financial accounts of one kind or another, and are being loaned out or otherwise put to use, just not by the owner of the money. Savings, or deferred consumption, are *essential* for increasing productivity and improving the economy. It's not just the flow of money that's important, but where it's coming from and how it's flowing.

However, it must be said that if someone *did* stick their money under their mattress, or put it in a box and buried it in their backyard, they would still be helping the economy by reducing the amount of currency in circulation and increasing the value of everybody else's currency. Money actually serves multiple uses, not just one.

"Savings, or deferred consumption, are *essential* for increasing productivity and improving the economy. It's not just the flow of money that's important, but where it's coming from and how it's flowing."

Savings? What a quaint notion. Americans are up to their eyes in debt.

Sure, Americans have too much debt. But it's still economically true that the way to increase productivity is with deferred consumption. And of course, a big reason we have too much debt is that the Federal Reserve's policy of continual inflation that favors debtors over savers. The Fed's currency injections don't create sustainable improvements to the economy the way savings does, it just diverts the economy instead of growing it.

a big reason we have too much debt is that the Federal Reserve's policy of continual inflation that favors debtors over savers

Most specifically Uncle Sam who is the biggest debtor of them all.

"But it's still economically true that the way to increase productivity is with deferred consumption. "

Productivity has been increasing over the past decades, going hand in hand with ballooning debt. If anyone is favoured by government policies, it's lenders, isn't it? They've been doing very well.

Do you read the crap that comes off of your keyboard?

Epic troll is epic.

If it was this shopkeeper's intention to do nothing with the money, or just leave it in the till till closing time when he was going to put it under his mattress, then the broken window would indeed be an economic blessing. For currency to do its job, it needs to flow.

Dear lord.

Lets just say this is true for the sake of argument.

When did the government start only taxing money that is hoarded?

When did hurricanes/tornados/antifa activists start targeting only money hoarders?

I've seen this argument before, it is the most asinine, idiotic thing I've ever read.

The latest culprit of such misinformation is someone who should probably know better: William Dudey, president of the Federal Reserve Bank of New York.

He does know better but you're assuming that the Fed gives a crap about anything other than the health of the big banks and their VIP clients.

He's not really committing the fallacy. He does say "unfortunately," so it's not as if he's praising hurricanes. The empirical evidence is that they really don't increase GDP (even given all the problems with GDP, which, as he says, only measures "activity" not wealth).

"The latest culprit of such misinformation is someone who should probably know better: William Dudey, president of the Federal Reserve Bank of New York."

Oh,

em,

gee!

"The long-run effect of these wars unfortunately is it actually lifts economic activity because you have to rebuild all the things that have been damaged by the bombs. I would expect that by the time we get to the end of the year and early 2018, the transitory negative effects of Kim's attacks I think will be over and we actually will start to see some of the benefits of the rebuilding efforts in terms of boosting the economy."

They don't mention the part about printing/borrowing all of that money. They could instead have not spent it or spent it on something far more useful.

Austrian economics: don't bother me with evidence, it's true because it is SIMPLE.

This has nothing to do with Austrian economics. It's the observation that the production possibilities frontier shifts in during the hurricane and simply shifts back to it's original position.

Tony economics: don't bother me with reality, I've got printing presses!

The economics of the broken window fallacy are so simplistic: what, with their "trade offs" and "opportunity costs".

They can't embrace the complexity of modern economics, which clearly states that anything that causes money to flow is good. I know that can seem complex to simpletons, but, when you think about it long enough, hard enough, it makes sense (if you're smart enough).

I have an idea to boost the economy!

You pay Tony 1000 dollars to eat shit, THEN, he pays you 1000 dollars to eat shit. Money is flowing, and us simple libertarians get a great lesson in economics that we so direly need!

So you'd be quite happy to spend your money fixing a broken window instead of spending it on something else? You'd think you were economically better off fixing the broken window??

I don't want my windows to be broken, but if they get broken, I will spend money on better windows. More energy efficient even. Now, if that money was targeted for other more useful purposes, the result would be negative, but if I was just going to stick it in a savings account, it's more productive being spent on the improved windows. Just depends.

And this is where the straw man of the libertarian economic becomes clear:

No one is saying that anything that causes money to flow is good for the economy.

We're saying that anything that causes money to flow that would otherwise be in a savings account is good for the economy.

The strawman is so easy to spot by all the ways people make the proper argument and explicitly talk about savings accounts.

I don't have a lot of money in a savings account, but what do you think the banks do with the money that's in the savings accounts? Is it in the "vault" like in the movies? Or do you suppose that it's being lent out to other people to buy homes or cars or you know, those broken windows?

Considering the average person has virtually nothing in a savings account, the notion that a major storm puts vast quantities of supposedly underutilized funds to productive use is complete horse shit.

It means (particularly for those with inadequate insurance) taking on debt just to reacquire the things you previously had, while other useful things you might have wished to do are put on hold or never realized.

Bringing us back to the same old colossal blind spot that Keynsians have

You see builders building, and timber companies, window companies, etc all doing brisk business, and say "see, look at all that economic activity we have that otherwise would not have existed" while failing to recognize that all those resources are being used to rebuild or recreate things that were not at the end of their useful life, instead of being used to further advance individual goals. In other words, the destruction has reduced the wealth of those individuals, and society as a whole.

Hayek wins again

Ok, stupid threading malfunctions.

That wasn't meant to be a reply to you.,

IB -

What is your mechanism for proving the need for money to flow?

In other words, let's reverse the situation. Lets say I'm saving up to replace my inefficient boiler, but my windows get blown out in a hurricane and I need to spend my money on new windows. Would you admit, then, that said hurricane is a net detriment to the economy?

What statistics are you using to determine that a hurricane, or taxation, or any other means of money flowing are causing more money to flow than that would otherwise be in use or soon to be in use, or planned to be in use, especially for more efficient purposes?

Thing is, you have not the slightest fucking idea, and common sense, economics, logic, etc. all say that a human being knows better how to spend his damned money than a hurricane does.

Man.

So you get the "space" part of space-time continuum, but are struggling with the "time" part. Well, at least you're 3/4s of the way there.

What do you think people are saving that money *for*?

The problem is we're talking about two different subjects. I'm talking about productivity, and you're talking about human agency. The parable is about productivity outcomes, while you're simply assuming a bunch of stuff about what a hypothetical person might do.

The problem is that you're assuming you know what to do with that "hypothetical person"'s money better than they do.

To answer my own question: they save that money *to spend it later*, eg delaying gratification, either because they think they might need the money unexpectedly, or because they think they can get something more expensive later by saving up to buy it. Whereas you think that it should always be spent *now*, and think it's a good thing when they are forced to spend it sooner than they'd hoped. And that is what we call "central planning".

And when you pay the guy who fixes your window, what does he do with the money? Do you suppose he puts it in a bank? Maybe he has to pay the bank back some money he was loaned by the bank to buy windows and equipment and a truck?

Tony in other words:

Sometimes you make money if you guess the correct number in roulette, therefore, roulette is a great way to make money.

"I'm talking about productivity"

No you're not. Nothing was produced.

He had a window before. Now he has ... a window. One he paid for twice. That is not increased productivity. Now he has no beer.

Good point. Now please tell us where you live so we can destroy everything you own. Then you and the economy will be better off when you are forced to replace everything. Because we're all richer when we replace stuff, and poorer when we use that money for something else.

You don't even try anymore.

I completely agree. Now suppose there is some shitty run down area of town that burns down, and it replaced with something modern and higher quality. Unless you are one of those preppy east coasters that like your centuries old crappy buildings, oh sorry, "historical" districts

Then the company that was already planning to develop that neighborhood just got an unexpected subsidy on demolition costs from the Department of Mother Nature.

"Hipster" not "preppy".

"If you're only looking at GDP data, sure, storms like Harvey and Irma might cause a temporary uptick in spending as people and businesses repair and rebuild. But that's not economic growth; it's just replacing what's been lost. Those resources could have been allocated in different, more productive ways if they hadn't been forced to be used rebuilding after a natural disaster." Jeez Eric. You're living in the 70s man. Those resources wouldn't have been allocated otherwise because they wouldn't have existed. The FED will create those resources out of thin air.

Oh yeah, that Broken Window fallacy. I was expecting something about the Broken Windows theory of policing. I guess that's Windows in the plural, and this is Window in the singular? Both fallacies regardless.

you can't compare new orleans to palm beach county. rebuilding in the latter usually involves actual architectural and engineering progressiveness because they have the money to do so.

might try granite roofs this time bolted to the oak frame bolted to the foundation etc.....re-designed barrel-tile roof..etc.

If the Broken Window Fallacy were true, then the best course of action would be for the government to ban boarding up windows. Think about it.

I think what people keep mistaking as proof of the broken window fallacy working is the psychological impact major disasters and war can have.

When people are forced through either an existential threat or some other event to work harder, build, come up with new ideas (such as women working in WWII) that mindset can carry on well past the time immediately after the disaster and cause increases in productivity/efficiency.

This is not to say that hurricanes or war are the best method for increasing productivity, by any stretch, but I think it could be something for economists to explore a little bit, if they haven't already.

During storm one emergency is needed of electricity. But, do not try to figure out what fuse is off or what caused the issue as you may end up getting electrocuted. It is best to hire some carpenters or reliable electrician like City Electrician, Electricians King of Prussia PA, PA, etc., who are available for everyone who needs to repair or electrical work of their home or business after the storm and they knows how to determine what happened and how they can fix it as they know what to do in instances of no power.