California Uses One State Credit Card To Pay Off Another

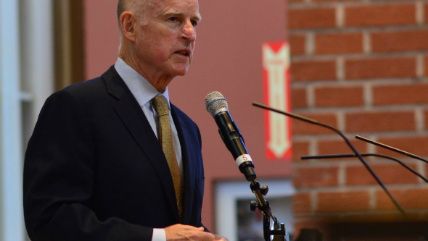

Gov. Jerry Brown wants to borrow $6 billion to pay for California's underfunded public employee pensions.

California Gov. Jerry Brown has a plan to address his state's hundreds of billions of dollars in unfunded pension liabilities: Borrow money at low rates and invest it in a hopefully higher-yielding state pension fund.

Over the past two decades, several states and localities have borrowed to cover exploding pension liabilities. But the practice is fraught with risk, and it has backfired spectacularly on more than a few occasions. The City of Oakland, for instance, lost $250 million on a similar borrow-and-invest pension funding scheme when projected returns did not pan out. When New Jersey tried borrowing to cover pension obligations, it ended up being charged with securities fraud.

These risks do not seem to bother Brown, whose pension proposal—released as part of his "May Revision" budget—calls for borrowing $6 billion from a state savings account at 1.5 to 3.5 percent interest rates and investing that money in CalPERS, the state's pension investment fund, which Brown is counting on to make 7 percent returns.

If all goes according to the governor's plan, that $6 billion investment will be enough to save $11 billion in pension costs and pay back the state savings account. But that's a pretty big "if," especially given CalPERS' recent track record.

In 2014 CalPERS had a return target of 7.8 percent. Instead it brought in a measly 2.4 percent. That was bad, but at least it was better than 2015's .61 percent return. Last year saw a jump to 5.8 percent—better, but still far below what Brown needs.

Meanwhile, an economic downturn could wreak havoc with CalPERS' already depressed returns. Indeed, recessions are the main reason this approach to budgeting is so inherently risky.

A comprehensive study by Boston College's Center for Retirement Research found that states and localities that borrowed funds to cover pension obligations in the years leading up to an economic contraction overwhelmingly witnessed negative returns. CalPERS itself saw a negative 24 percent return on investment during the worst of the Great Recession.

Brown is clearly aware of this recessionary risk, saying as he announced his pension proposal that "an economic recovery won't last forever." So why is he pushing a proposal that depends on an ongoing economic recovery? The answer, according to that Boston College study, is necessity: Financial pressure, not fiscal wisdom, plays the biggest role in which states and localities go for this option. California currently faces a $5.8 billion budget shortfall, forcing the governor to scramble for any savings he can find.

Needless to say, that's not how the governor justified his move. He claims his proposal would "reduce unfunded liabilities and stabilize state contribution rates." A little context: California is looking at anywhere from $242 billion to $767 billion in unfunded pension liabilities. Even if Brown gets those $11 billion, the money will be a drop in the bucket compared to the tab coming due.

Rent Free is a weekly newsletter from Christian Britschgi on urbanism and the fight for less regulation, more housing, more property rights, and more freedom in America's cities.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

California will probably be the first state in US history to declare bankruptcy.

What moron allows another moron to borrow to support a ponzi scheme?

All dem morons in the legislature, dat's who.

As a proud Illinoisan, I say "Thems fightin' words!" Illinois is doing its best to win 1st place in this retarded race.

Man, when you have a star player like moonbeam leading the team, everyone else is fighting for second place!

Remember Moneyball. It's not about your star player, it's about the team that backs him up. And California has one hell of a team!

But CA has the benefit of actually being a nice place, so people want to live there despite the crappy state government. Illinois has no such draw.

Here's to the memory of Carlo Pietro Giovanni Guglielmo Tebaldo Ponzi, a truly great somebody else's baby.

He lives on in various multilevel marketing schemes, and the Social Security Administration.

Why can't one heteresexual guy tell another heterosexual guy that his ponzi scheme is fly?

Nah, too many rich guys to tax. Until they leave.

I've got a better plan. California owns tons of fairly new state vehicles - a trip to TitleMax and invest the proceeds in lottery tickets.

Seems like the obvious solution to me. They have enough money going in that they could just buy lottery tickets for every possible combination of numbers. Then they're guaranteed to win!!!

Or sell of some that land.

How the hell did they only get a 5.8% return last year? I got 8.28% on my 401k and that's with 40% of my money in bond indexes.

By making the kind of socially responsible investments you like (and your 401k doesn't).

But I'll bet your fund ain't "socially conscious" like Cali's. Virtue signaling isn't cheap, but it's worth every penny if it's somebody else's money. You try diversifying your portfolio while refusing to buy any companies relating to oil, chemicals, tobacco, liquor, gambling, Israel, and, oh yeah, any company that doesn't have solid gender-inclusiveness, equal pay, workforce diversity, living wage, carbon neutral bona fides and probably non-GMO gluten-free organic free-range fair trade products.

Also, you have to screen out those evil companies that try to screw over the poor by making an excessive amount of profit. It would be downright unethical to invest in those.

The 7% target is actually a cap.

Note to California: borrowing money to get out of financial difficulty is not a solution.

It can be, but if and only if you're getting a better interest rate, which is doubtful in California's case.

If California could only print money!

Can you imagine the debt they would be in if they could sell bonds and do that? They would give the Feds a run for their money.

I remember when I moved to California during the real estate bubble. Some smart guy on the radio was saying old thinking was to pay off your mortgage. New thinking was to tap into that equity in your house and put it to work for you, in the stock market. I'm sure that worked out well for him and his listeners when housing fell 50 percent and the stock market crashed.

This all worked out so well for Greece, can't we have a go at it?

Who knows? Maybe that Nigerian prince dude will come through for Gov. Brown and the state can be awash in money once again!

Hey, Nigel Saladu is an honest man.

Oh, how I miss commie-kid and his fantasies of the CA 'balanced budget'.

You know, the one where moonbeam dug all the loose change out of the sofa and made the $25 minimum payment on the credit card balance and said everything was great!

But what's wrong with Kansas?

It's flat and has lots of tornadoes?

Can you imagine the great decisions we would have made as an independent nation if the whole CalExit thing had gone through?

California would still come out ahead on its own.

By "ahead" you mean Californians and Taxifornia businesses fleeing for America and taking their money with them.

I don't think so. They have so many takers and they would be responsible for all pensions for everyone. Their own SNAP program and no federal highway funds. You think they have unfunded liabilities now. Section 8 would be gone so the state would have that too. I don't think they gave thought this out very well.

I don't think so. They have so many takers and they would be responsible for all pensions for everyone. Their own SNAP program and no federal highway funds. You think they have unfunded liabilities now. Section 8 would be gone so the state would have that too. I don't think they gave thought this out very well.

These risks do not seem to bother Brown, whose pension proposal?released as part of his "May Revision" budget?calls for borrowing $6 billion from a state savings account at 1.5 to 3.5 percent interest rates and investing that money in CalPERS, the state's pension investment fund, which Brown is counting on to make 7 percent returns.

Umm, doesn't CalPERS regularly post returns below 7%?

Umm, don't late commenters have time to RTFA before posting inanity?

Read the article? No. This is Hit'n'Run.

It is understood that every comment begins with tl; dr. We just leave it out through linguistic drift.

You must be new here. The process goes like this:

1. Scan article headline.

2. Assume what is being said.

3. Check for alt-text on the photo.

4. Post comment based on No. 2.

There are articles?

You left out "scan byline," which usually comes immediately after your number 1 but sometimes before it.

This is a good idea.

Ya gotta spend money to make money!

Why can't the Federal government just let California print it's own money? Then all the problems will be solved. All the money Moonbeam could ever want. In no time we would be like the glorious Venezuela!

A financial advisor friend of mine says the stock market is up in anticipation of lower corp. tax rates and a better business climate under Trump. Should the Dems block those initiatives, he says the market will correct sharply - probably to between 17,000 and 18,000 on the Dow - and those states with underfunded pension plans will really suffer. Maybe Gov. Brown should be whispering the in ears of the California Democratic delegation?

Where will they go next, when arithmetic defies their magic? (We all know that arithmetic was invented by cis-hetero shitlords) Will they try robbing 401(k) accounts of private sector workers? Sell the Golden Gate Bridge to China? Beg for a Federal bailout?

Beg? Not at all, they will DEMAND a federal bailout.

Because after all, they NEEDED a big return, and that mean old calPERS did not deliver. So in order to validate their FEELINGS, the rest of the nation should kick in, because of the children (and illegals) who will starve.

First they'll want a bailout, but Congress will never agree to it. So they'll have to go bankrupt. Really, this move is a signal that if you haven't already divested from CA bonds, now is the time to do so.

How about a ten million tax on any Hollywood type, California politician, or IT executive who makes any kind of political speech or statement?

Not a restriction of free speech of course, just reasonable regulation. No different than getting a carry permit, other than the amount.

I remain stunned that Republicans/Trump haven't proposed a "Make American Entertainment Great Again Act" that charges a 95% tax rate on the Hollywood/media complex for any movie, concert, or album made outside the US, which incurs the tax on all revenues and incomes associated with that movie, concert, or album in perpetuity.

Which is another way of saying that the City of Oakland gambled the loan away.

And that, kids, is why Santa Claus doesn't exist.

This is much ado about nothing. The state is not going to borrow the money, despite what the article says. The state already has the money. Now Brown is deciding whether it's better sitting in a savings account earning 1-1/2% to 3.0% or sitting in the pension fund earning something else. Yes, there's a risk that the pension fund won't earn as much, but that's always a risk with a pension fund investing in risky assets. If one argues that the risk isn't worth it at this time, than that also applies to the all of the state's pension equity investments of $175 billion. So this really comes down to whether this is a good time to be invested in equities, which is a standard issue in investing, pensions or otherwise, not whether the state is "borrowing."

You missed the real headline: California has a savings account? Who knew?

How did they get their parents to co-sign?

So:

A) California is betting that a Trump Presidency will see the markets go up. That's...amazing on so many levels.

B) California is trying to pass single-payer health care right at this very moment, which is projected to double-plus size their expenditures over their current revenue.

C) WTF? New Jersey itself was in violation of the SEC? How is this the first time I'm hearing about that?

So really, the main takeaway other than C is that California is dead in the water and there is literally no possible hope for them to avoid bankruptcy. Also, their taxes are about to skyrocket like never before. I predict Texas will pick up more tech jobs, as well. This is actually very good news for me personally.

It's a certain thing Cali is screwed unless someone (FedGov) literally bails them out. Moonbeam is possibly one of the worst governors in the nation, although it seems there are some out there who manage to be more corrupt (or worse at hiding it).

States can't declare bankruptcy, so yeah, California is screwed unless the Feds come to their rescue. Which has happened before with New York.

Brown is trying to pay down the unfunded liabilities that the State already owes to CalPERS. Not a terrible idea on the face of it, but the State will not "get" any monies back, just the hope that they won't owe even more in interest to CalPERS as the years go forward. But with CalPERS record, I wouldn't trust that to be true either. If you or I pulled even half the crap CalPERS has done in the last 20 years, we'd be in jail for the rest of our natural lives!

You'd think California would play it smart and figure out how to invest their rainy day fund money better, but since it would be the same folks running that are running CalPERS...oh well!

True enough, but we'll see if they pass their single-payer on top of this. If they do, it will hopefully make a bigger splash than Vermont.

Like standing in a bucket and trying to lift yourself up by the handle.

California's Progressives are a criminal organization masquerading as a government.