Trump's Tax Plan: Lower Tax Rates, Fewer Tax Breaks

Some good news, but will there be any spending cuts?

Under President Donald Trump's proposed tax reforms, individuals and corporations would see lower tax rates, and the number of tax brackets would be reduced, but the reforms would also eliminate most other deductions beyond the standard deduction, charitable contributions, and deductions for mortgage interest.

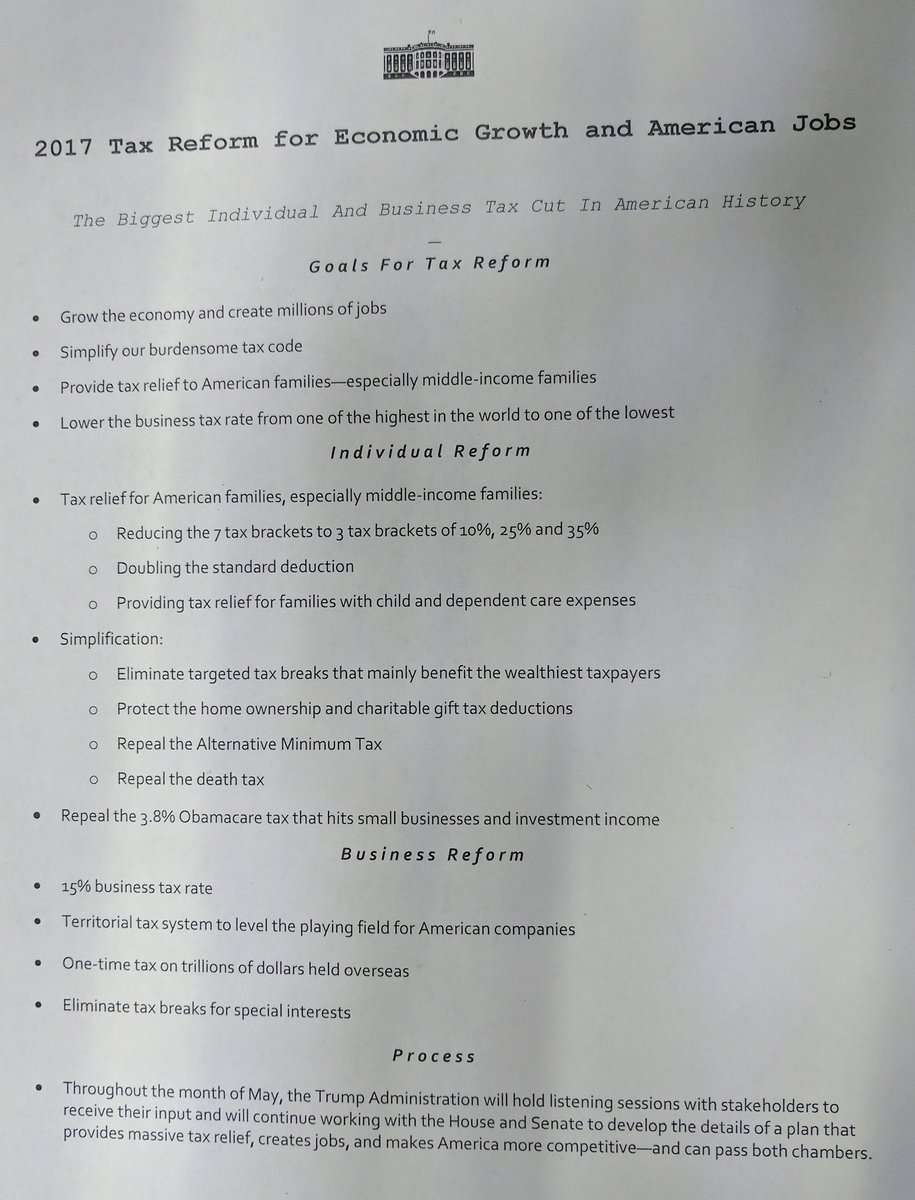

The standard deduction would be doubled, corporate income taxes would drop to 15 percent, and Trump wants to repeal the alternative minimum tax and the estate tax (a.k.a. death tax). The information available right now is basic. So basic, in fact, that I can toss up an image of the one-page release handed out to journalists who attended the White House rollout, courtesy of Lachlan Markay of The Daily Beast:

There will be plenty to analyze, so stay tuned. One potential point of contention: It would eliminate deductions people claim for paying state and local income taxes, which could impact people who live in states like California and New York. Treasury Secretary Steve Mnuchin said it wasn't the federal government's job to "subsidize" these states.

Veronique de Rugy, Reason columnist and senior research fellow at the Mercatus Center of George Mason University, had a quick initial response:

I am glad to see that the president seems committed to his campaign promise of lowering the corporate income tax rate to 15 percent. He is correct to want to do without being constraint by the fake concept of revenue neutrality. First, deficit neutrality should be achieved through spending cuts rather than revenue increases. Second, experiences around the world have shown that a reduction of the corporate rate pays for itself. Canada and England have dramatically cut their rates and their revenue to GDP have stayed the same. Also, we know that the payoff in term of economic growth will be huge.

I am not too crazy about the president's plan to increase the standard deduction. While it will indeed simplify filing one's taxes for many, I think it is a problem to exclude more people from the tax rolls.

Cutting the capital gain tax rate is good and so is his proposal to end many deductions. Plus ending the death tax and the AMT is excellent. I like the individual tax reform based on what I have seen but where are the spending cuts?

"Where are the spending cuts?" is going to likely be a refrain we'll be hearing a lot from both libertarian and small government conservatives who otherwise have positive feelings about these changes.

As to whether these reforms have a chance to get anywhere, reporters asked Mnuchin whether Trump was going to release his tax returns. Mnuchin's response: he has "no intention." While there shouldn't be a relationship between tax reform and Trump's lack of transparency, it seems clear that his opponents will attempt to use his secrecy as a way of trying to block these changes.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

RE: Trump's Tax Plan: Lower Tax Rates, Fewer Tax Breaks

Some good news, but will there be any spending cuts?

The good news: A proposal for tax reduction.

The bad news: No call to eliminate the hated and reviled income tax and possibly replacing it with something saner, like a national sales tax.

More bad news: Nothing significant said about spending cuts.

Stay tuned.

Silly rabbit, every one knows that taxes have to be progressive!

The really bad news is the increased standard deduction. Everyone should pay so everyone feels the pain of the goodies, er, caluable government services they get.

"The really bad news is the increased standard deduction. Everyone should pay so everyone feels the pain of the goodies, er, caluable government services they get."

Is this what is known as "group punishment?"

Start earning $90/hourly for working online from your home for few hours each day... Get regular payment on a weekly basis... All you need is a computer, internet connection and a litte free time...

Read more here,.,.,.,.,.,>>>> http://www.foxnews20.com

I'm making over $7k a month working part time. I kept hearing other people tell me how much money they can make online so I decided to look into it. Well, it was all true and has totally changed my life.

This is what I do.,.,.,.,., http://www.careerstoday100.com

I'm making over $7k a month working part time. I kept hearing other people tell me how much money they can make online so I decided to look into it. Well, it was all true and has totally changed my life.

This is what I do,,..,.,.,.,... http://www.careerstoday100.com

Taxes have to be progressive because the spending and borrowing benefits progressively as well.

You used the right words but you think it means that the rich get more. They don't. Taxation is progressive (hits the rich --really highest income-- more) and spending is progressive (benefits the rich least).

Sales tax is disproportionally high for the poor and the retired if relied on at an increased instead of income tax would be classed as regressive, so as they say in dubbed for TV movies "forget that"

No, it is exactly proportionate. The fact that they consume more of their income is a separate matter. But even a consumption tax can be made progressive.

A national sales tax is about as IN-sane as you could get.

Witness the history of such taxes in all other countries; the never-ending rate increases every time the government wants more revenue. How any intelligent American could not learn from this is beyond me.

There are very few things which now differentiate the US from other countries. Low state sales taxes, low energy taxes and the absence of a national sales tax are the handful remaining.

Where are the spending cuts? Duh. There aren't any.

Shhh.

Does anyone know what the income thresholds would be on the 3 proposed tax brackets, because at current numbers this seems like smoke and mirrors.

Let's look at an income of 45,000 for a single person with standard deductions.

For 2016, the standard deduction is $6300 and the standard exemption is $4050, so the total taxable amount starts off at $34,650.00.

$0-$9325 is taxed at 10%, totaling $932.50

$9326-$34650.00 is taxed at 15%, totaling $3798.75.

That's a total of $4731.25 in federal taxes, an effective federal tax rate of 10.5%.

Assuming there are no changes to the income brackets under Trump's new proposal, of which there obviously would be since he wants to eliminate it to three brackets of 10%, 25%, and 35%, let's base our estimates off the current numbers.

So the effective tax rates would be as follows:

$0-$9325 - 10%

$9325-$191,650 - 25%

191,651+ - 35%

Assuming that these would be the new brackets, which I don't believe would be the case, but will use for the time being, it seems like a backdoor increase on the middle class. Even if you double the personal exemption to $12,600, you still pay more in federal taxes:

$45,000 -$12,600 & $4,050 = $28,350 in taxable income.

$0-$9325 is taxed at 10%, totaling $932.50

$9326-$28,350 is taxed at 25%, totaling $4756.25.

That's a total of $5688.75 in federal taxes, an effective federal tax rate of 12.6% - a $957.50 increase over the current system.

Am I missing something here?

While that would be awesome I'm sure that the 10% bracket will be higher than it is now.

Does anyone know what the income thresholds would be on the 3 proposed tax brackets, because at current numbers this seems like smoke and mirrors.

Let's look at an income of 45,000 for a single person with standard deductions.

For 2016, the standard deduction is $6300 and the standard exemption is $4050, so the total taxable amount starts off at $34,650.00.

$0-$9325 is taxed at 10%, totaling $932.50

$9326-$34650.00 is taxed at 15%, totaling $3798.75.

That's a total of $4731.25 in federal taxes, an effective federal tax rate of 10.5%.

Assuming there are no changes to the income brackets under Trump's new proposal, of which there obviously would be since he wants to eliminate it to three brackets of 10%, 25%, and 35%, let's base our estimates off the current numbers.

So the effective tax rates would be as follows:

$0-$9325 - 10%

$9325-$191,650 - 25%

191,651+ - 35%

Assuming that these would be the new brackets, which I don't believe would be the case, but will use for the time being, it seems like a backdoor increase on the middle class. Even if you double the personal exemption to $12,600, you still pay more in federal taxes:

$45,000 -$12,600 & $4,050 = $28,350 in taxable income.

$0-$9325 is taxed at 10%, totaling $932.50

$9326-$28,350 is taxed at 25%, totaling $4756.25.

That's a total of $5688.75 in federal taxes, an effective federal tax rate of 12.6% - a $957.50 increase over the current system.

Am I missing something here?

So ..... what you're asking is .... if x + 2 * z + a ** b == 0, what happens if i and j are changed but w is left alone?

IOW, there's no info, your question is meaningless.

Wrong. I'm saying releasing the marginal tax rates without what the tax brackets are is pretty much useless, however, curious as to what info people do have and what appearances it initially gives.

But thanks for being the personification of one shitting into their own hands and clapping. That's cute.

Insult-thrower, you asked people to fill in the blanks in an equation full of them, and no one knows what those blanks are.

Trump: I'm changing income taxes ... maybe ... in unknown ways

You: Here's a bunch of calculations using made up numbers which have no bearing on what might happen.

It's a start, but still too many rates and deductions. I don't like taking even more lower income people out of paying taxes. Everyone needs to be paying for this bloated govt, especially those getting the largest cuts of spending, income support.

RE: especially those getting the largest cuts of spending, income support.

Funny you mention that. A new NBER paper shows that rich people get ~$130,000 more in government benefits, on average, because of differences in life expectancy. I.e., they live longer, collect SS longer, and end up getting more from the government.

Linky

Which still doesn't make up for what they pay.

Linky

No, of course not. But that's not quite the point, is it?

And we are not talking about changes to FICA.

Flat tax starting at the first $50k of income.

Or full repeal and replace with nothing.

A one-page tax reform/tax cut plan? *yawn* Wake me when the WH proposes something serious.

I think we should lower taxes on the wealthy and increase it on the middle class. Yes, I said it.

The problem is over half of America doesn't pay any income taxes at all, so they vote for more shit since they don't pay. My prog roommate loves that Bernie Sanders crap, but would he like it if his taxes suddenly tripped.

Keep spending the same and raise taxes to pay down the debt. Then pass the balanced budget amendment so if anyone wants to lower taxes, you have to lower spending. And they will be more likely to do that after they ACTUALLY START HAVING TO PAY TAXES

In Bernie Sanders' defense, he was planning on raising middle class taxes. He was going to raise upper class taxes by a whole lot more of course, but middle class people were going to pay significantly more taxes.

I sort of agree with you though. It'd be nice to see some a more honest, bold stance from Democrats when it came to their proposals. For instance, if they truly believe whatever program they want is valuable, they should be willing to say "This program is really good and I'm going to raise taxes on everyone to fund it; it's that important." As it stands, Democrats fall short of this and instead rely on wringing the sponge of the rich. That only goes so far.

Democrat politicians' demands to "tax the rich" are mostly boob bait for the Team Blue rubes, just like "repeal ObamaCare" was boob bait for the Team Red rubes. The Dem pols know that all they have to do is to make a gesture towards increasing taxes on the rich in order to pretend to hate the rich, and then do what they always do - borrow money in order to pay for the ever-growing welfare state.

No one is going to vote for that, because that is a surefire recipe to get voted out of office at the next elections. Your hope is that people would react to the increased taxes by demanding spending cuts to lower taxes, when the far more likely outcome is that they vote for someone promising to lower their taxes, increase taxes on the rich, and not touch (or increase) spending.

Cool.

Then make sure that it is to the extent necessary to have a balanced budget.

The problem today is that the wealthy pay the most taxes, and benefit from the spending the most as well. For what they put in.

Cue: Medicare and SS. Those are paid largely through the taxes already collected.

Oh bullshit. They do not benefit more from spending. The largest total subsidy goes to the middle class. The largest percentage subsidy goes to the poor.

Yeah, that doesn't make a lick of sense. "The wealthy" pay a majority of the taxes - if you count maybe the top 10-15% as "wealthy". But most spending goes to redistribution programs - medicare, medicaid, social security, and the military. "the wealthy" only get to dip from the last bucket in appreciable amounts relative to what they pay in - and that's a fairly small number of folks getting a fairly large dollop of pork.

That accounts for 3/4 of spending - and is roughly equal to all tax receipts, not just income taxes. So the wealthy couldn't' possibly benefit the most for what they put in. (although I have heard the ridiculous argument that redistribution programs primarily benefit the wealthy because they keep the poor from storming their mansions and raping and pillaging. )

I find the resistance to removing the mortgage interest tax deduction short sighted.

I realize that this juicy, but limited, deduction is popular - I am sure our President would think so. In fact without this item 'Itemized Deductions' becomes irrelevant; with the exception of the ACA.

The only time my wife and I were able to 'Itemize' was when we paid ACA premiums. Of course the pols would say the ACA was a benefit despite's the fact the we depleted our saving by 'net' $9,000 for this benefit.

The UK phased out the mortgage interest deduction centuries ago 🙂 (Thanks Margaret) even when it was limited to a mortgage of a mere $45,000 (somewhat dated dollars}. The impact on house prices was limited once the inevitable load of the deduction was removed from the process.

The deduction is just another form of subsidy. And like sudden loans it is just another way to entice folks into debt.

Sorry 'student' not 'sudden'

IT sux & I am IT (retired)

It should go, but you'd probably have to include a grandfather clause to have any hope of passing.

what do we think that would do to home prices, since much of the valuation in buying a house (your monthly pmt) is based on that interest deduction. I'd think it would depress prices since demand would go down. I don't own a house and I would love bay area prices to go down, but good luck ever getting that to pass.

Yes. Probably too disruptive otherwise.

FYCS

FYCS

"Where are the spending cuts?" is going to likely be a refrain we'll be hearing a lot from both libertarian and small government conservatives who otherwise have positive feelings about these changes.

Not at reason.com where Republicans posing as libertarians no longer care about deficits or that crushing debt given that the black guy is not president anymore, and really did not need to provide a stimulus.

When do we bomb Iran?

No, Trump is not cutting spending. Trump is intending to crash the dollar as quickly as he can.

We know the dollar is doomed and the quicker it crashes, the better for all. Yes, times will be tough, but it's a transition we must go through to take down the Deep State banking cabal. The sooner we get to that stage, the easier the transition will be, though it will certainly be difficult.

The fed, Obama and Bush all delayed the crash with QE and other shenanigans. But now Trump is intending to get make it happen as soon as possible. Thus increased spending.

The strike on Syria and the threat on Wikileaks are just diversions to fool the media and they bought these diversions hook, line and sinker.

So, Nth dimensional chess, then?

" 'Where are the spending cuts?' is going to likely be a refrain we'll be hearing a lot from both libertarian and small government conservatives who otherwise have positive feelings about these changes."

Yeah, all 23 of us.

Looking forward to the backwards thinking in mainstream media articles where they say that Trump is cutting taxes but not "paying for it" with less spending

(But of course we do need to cut spending no matter what happens with taxes)

What all you guys have ignored, is the myriad of CREDITS which benefit lots of low-mid income people. I volunteer for one of the free tax preparation programs, (Tax-Aide, VITA, NTC) and see this as a huge factor in people's tax bills. The nominal rates are only one part of the puzzle.

Earned Income Tax Credit -- a juicy credit which gives the right kind of taxpayer up to maybe $5000 in income. The source of lots of fraud, and it punishes certain people when they don't have bastard children. Don't see any mention of that in the Trump reports.

Child Tax Credit -- another juicy one, it effectively subsidizes having children. For many people there is $2000 relief right there.

And of course the damnable Obamacare, which seems to have no benefit to taxpayers whatsoever. Expanding Medicaid does help poor people at a price. But the insurance part of it does NOT provide health care. An insurance policy with $6000 cost (without subsidy) and $6000 deductible... who exactly does that help? That is not health care.

There is so damn much social engineering written into the tax code, it is a hugely complex way to grant favors. Of course certain people benefit from this. Intuit with its Turbo Tax is part of the swamp which must be drained. Decent common sense tax reform could cut the unit sales of tax software by 50%, and it would be a freeing thing for our economy.

He has a point.

This indeed has the effect of subsidizing a major portion of state tax income - probably to the tune of 20% or so, using blended tax rates.

For those who live in states without an income tax like my state - Florida - this is a de-facto transfer of money to California and New York. Two states who are very fond of complaining that they send more tax money to Washington than they get back.

I think it is a problem to exclude more people from the tax rolls.

Not even pretending to be a libertarian any more, eh? Fuck off, slaver.

-jcr

" I like the individual tax reform based on what I have seen but where are the spending cuts?"

Maybe the 'spending cuts' are missing because this is a document about taxes (revenue) which is the opposite of spending.

??????O .Do You want to get good income at home? do you not know how to start earnings on Internet? there are some popular methods to earn huge income at your home, but when people try that, they bump into a scam so I thought i must share a verified and guaranteed way for free to earn a great sum of money at home. Anyone who is interested should read the given article... .??????? ?????____BIG.....EARN....MONEY..___???????-

A step in the right direction but in addition to ending deductions for state and local taxes include muni bonds. States and localities bear the cost of their own spending and don't get the rest of the nation to subsidize them. Nothing better for fiscal restraint than to force fiscal pain for the spending.

This is a proposal for tax cuts.

It is not a proposal for spending cuts.

The two are unrelated.

For spending cuts, see sending k-12 education back to the states, see lots fewer IRS bureaucrats, see a growing economy, see the miracle of a political party with a majority in both houses actually PASSING any of this!

"It would eliminate deductions people claim for paying state and local income taxes, which could impact people who live in states like California and New York. Treasury Secretary Steve Mnuchin said it wasn't the federal government's job to "subsidize" these states."

Wouldn't doubling the standard deduction cover this more or less? And it's not just states with income taxes. States with no income tax, like my state, have only sales taxes. I can deduct state sales taxes on my federal taxes. That would go away as well.