Forget Reagan: Trump's Tax Plan Is More Like George W. Bush

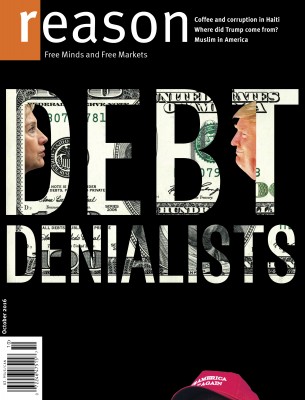

Instead of permanent tax reform we get temporary taxcut-and-spend, again.

In the run-up to today's big White House tax-reform announcement, the question among many analysts was: Would President Donald Trump's ideas look more like Ronald Reagan in 1981 (when he and a bipartisan congressional majority cut rates) or 1986, when they simplified the code? While Treasury Secretary Steven Mnuchin, flanked by National Economic Director Gary Cohn, bragged that the administration's plan was both "the biggest tax cut" and the "largest tax reform" in U.S. history—1981 and 1986 at the same time, only more!—the more apt and less comforting historical precedent might be the guy who Trump never tires of bashing: George W. Bush.

The second President Bush pushed through tax cuts in 2001 and 2003, each of which passed with fewer than the 60 Senate votes required by an amendment to the 1974 Congressional Budget Act that demanding a supermajority for any piece of legislation seen as worsening the federal deficit 10-plus years down the road. How did the Bush cuts pass with only 58 and 51 votes, respectively? By including sunset provisions right at that 10-year mark. You can't be accused of affecting the year-11 deficit if you die at age 10!

In word and deed, President Trump appears poised to follow down Bush's path of temporary tax reform through budget reconciliation; i.e., passing it on a party-line, simple-majority vote. "I hope [Democrats] don't stand in the way," Mnuchin said at the press conference. "And I hope we see many Democrats who cross the aisle and support this. Having said that, if they don't, we are prepared to look at the reconciliation process." House Speaker Paul Ryan (R-Wisc.) echoed the sentiment: "We want to look at every avenue, but we think reconciliation is the preferred process, we think that's the most logical process to bring tax reform through," Ryan told reporters Wednesday.

There are exactly two ways you can sidestep the 60-vote rule. The first is to make sure the tax changes project to being deficit-neutral a decade from now. Given that Trump's campaign tax-reform framework, upon which today's announcement was largely based, had previously produced revenue estimates from conservative outfits showing a decrease of around $3.5 trillion over 10 years, it's damn near impossible to imagine the Congressional Budget Office or the Joint Committee on Taxation (Congress' go-to economic projection shops) torturing those 13-figure numbers out of existence, no matter how "dynamic" their scoring.

Worsening those prospects—though arguably making the policy world a better place—the Mnuchin/Cohn duo swatted away one of the main proposed revenue-generators of 2017 tax reform: Paul Ryan's treasured and troublesome "border adjustment tax," a tariff by any other name that the speaker was counting on to offset the revenue hits by $1 trillion.

Americans for Tax Reform President Grover Norquist, no fan of either taxes or tariffs, told me last week that he was in favor of the Border Adjustment Tax as the price for getting a $2.5 trillion tax cut. Without it? "There are two options to that," Norquist said. "You could have a smaller tax cut, not get rid of the death tax, not take the individual rates down or the corporate rates down as much. But you have to find a trillion dollars in less tax-cutting. Or you could have a tax that replaced it, some tax somewhere else. I'm not sure there's one that's an improvement."

Well, Mnuchin and Cohn did include a big revenue generator in today's press conference, in the form of eliminating the federal tax deductions that Americans can take on their state and local taxes, a change that the Washington Post says "could save more than $1 trillion over 10 years." This idea, which makes intuitive sense, would nonetheless be heavily disruptive to those of us who live in high-tax states. And not just in those Democratic-bubble strongholds like New York, California, and Illinois—according to this WalletHub analysis, vying for worst American state/local tax burden are the deep red states of Nebraska and Iowa (ranked 50th and 43rd out of 51, respectively), plus the Trump swing states of Michigan (44th) and Ohio (45th). That's five Republican senators right there, at a time when the GOP advantage in the Senate is just 52-48. If this provision passes, I'll eat my baseball glove. (And then move to Nevada.)

Steve Mnuchin can say that the tax cut "will pay for itself," but it is extraordinarily unlikely that any reputable governmental economic-projection outfit will agree. So what was that Option #2, Mr. Norquist?

"I'd have to give up on permanence, and make it temporary," he said. The problem with that: "Going to temporary means that people can't plan. And you won't get the economic benefit of reforms if people think they disappear in a few years."

It is true that some of Bush's tax cuts were eventually made permanent, and that Trump's people are clearly hoping to press whatever advantage they have now to maybe achieve that or other tax-code goals later. But it's also true that, coupled with his other commitments, Trump is setting himself up to mimic one of the signature aspects of a presidency he disdains. Taxcut-and-spend is back, baby, and with it any last claim that the Republican Party is serious about confronting the national debt.

There is plenty to like about the tax-reform bullet points distributed by the White House. A 15 percent corporate tax rate is one helluva lot better than 35, and could conceivably spur the kind of growth America has not seen this whole grim century. The Alternative Minimum Tax, among other intended hatchet victims, does not deserve our sympathy. And though it's getting much less play, the switch to a "territorial" tax system—meaning, you pay taxes on what you earn here, not what you earn abroad—is a welcome and long-overdue change in a global outlier of a tax policy. ("We want any American company that makes money in Germany to be able to bring it back easily and not be punished for bringing it back," Norquist said. "That's the way the rest of the world operates, it's not how we operate.")

But even if the economy responds to temporary tax cuts and aggressive regulatory rollbacks with a historic growth spurt (looming trade war be damned), that will not make up for the fact that President Trump has no demonstrated interest in cutting back the biggest drivers of federal spending: Social Security, Medicare, defense, and interest on the debt. His first proposed budget, a political nonstarter, only manages to keep spending flat by proposing agency cuts that Congress will never agree to. His infrastructure plan, as an opening bid, promised Democrats they could spend around $200 million of federal money (still not nearly enough for the Chuck Schumers of the world). He is so far operating a more interventionist foreign policy than he campaigned on. At a time of unprecedentedly worrisome debt overhangs and entitlement bubbles, Trump has steered an all-too-willing GOP into fiscal fantasyland.

Few politicians win elections by bumming out voters with the realities of trade-offs. As the late, great economist James Buchanan wrote midway through the Reagan presidency:

"The attractiveness of financing spending by debt issue to the elected politicians should be obvious. Borrowing allows spending to be made that will yield immediate political payoffs without the incurring of any immediate political cost."

What's more, Buchanan warned, "the replacement of current tax financing by government borrowing has the effect of reducing the 'perceived price' of government goods and services," with the result that taxpayers "increase their demands for such goods and services."

It was for this reason that Buchanan favored balanced budget amendments rather than an endless series of tax cuts. If voters knew how much their government actually cost, he reasoned, they might finally get serious about restraining it. As his former colleague Tyler Cowen put it in The New York Times in March 2011, Buchanan "argued that deficit spending would evolve into a permanent disconnect between spending and revenue, precisely because it brings short-term gains. We end up institutionalizing irresponsibility in the federal government."

There are a handful of politicians on Capitol Hill, many from the Tea Party wave beginning in 2010, who are aware of Buchanan's work, and even campaigned on openly confronting fiscal illusions and realistic tradeoffs. Some of those politicians, such as Rand Paul and Mike Lee, are among the razor-thin GOP majority in the Senate. It will be interesting to see how they react to the near-term scrums over government shutdowns, border-wall financing, emergency supplemental requests, and massive tax cuts.

As for Trump, he was already going into his presidency with a chance of topping even the flagrantly irresponsible Barack Obama in creating new debt. The economy, and American pocketbooks (outside of New York and California, anyway), might get a temporary sugar high, and here's hoping they do. But the long-term fiscal picture is arguably bleaker today than it was yesterday. Trump, whatever his many flaws, was supposed to at least provide a sharp break from politics as usual. With his Bush-style tax cuts and Obama-like spending, however, he is instead giving us more of what has made the 21st century so disappointing in the first place.

Show Comments (42)