Dallas Mayor Wants Someone to go to Jail Over Pension Disaster

The Texas Rangers (and possibly the FBI) are on it, but maybe we should consider a broader definition of pension crime?

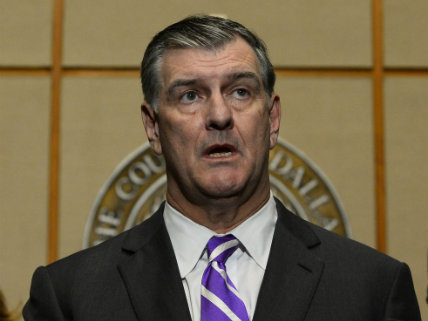

The retirement fund for firefighters and police officers in Dallas is more than $5 billion in the red, and Mayor Mike Rawlings thinks someone should have to go to jail for messing things up so badly.

"As I have learned more in recent years and months about how the [DPFP] reached its current crisis, I have come to believe the conduct in question may rise to the level of criminal offenses," Rawlings said in a statement posted to his official Facebook page last week. "Anyone brazen enough to commit crimes that harmed those who sacrifice so much to keep our city safe must be brought to justice."

Rawlings said he spoke with the director of the state Department of Public Safety. The Texas Rangers confirmed to The Dallas Morning News they have launched an investigation of former pension fund administrators.

The Texas Rangers might be getting the second bite at the apple. As the Morning News pointed out this week, the FBI last year raided the offices of CDK Realty Advisors, which worked closely with the pension fund's former managers. The FBI doesn't confirm or deny investigations or targets, so the raid could be completely unconnected to the pension crisis.

A criminal investigation into pension mismanagement is unusual, but not totally unprecedented. Pension fund managers from California to Michigan to New York have been investigated and charged in recent years, usually for running some sort of self-enrichment scheme involving pension funds or contractors.

The difference in Dallas is that, so far at least, there's not any evidence of that type of corruption. That doesn't mean that the Texas Rangers or the FBI won't uncover such a thing, of course, but the problems sinking the Dallas police and firefighters pension plan have more to do with the structure of the fund than any overt criminality.

Put another way: even if the Rangers or the FBI find that there was criminal behavior happening inside the Dallas pension fund, it likely won't explain away the underlying, structural problems. Moody's estimates that the fund could be out of money by the mid-2020s, and that's not because someone on the inside is stealing cash from the vault.

The big problem for the Dallas pension fund is that benefits promised by city officials were too generous relative to what the city was contributing, and the investment returns failed to make up the difference. Add in a special provision that allowed members to withdraw their investments as a lump sum at retirement—which drains the fund of needed capital for future investments—and you have a formula for failure.

Dallas hasn't fully funded the pension system since 2009, and shortchanged it by $14 million this year, according to the Dallas Morning News. Now, an immediate infusion of $600 million—equal to 20 cents of every dollar the city spends in its current budget—to fix the city's pension problem, members of the pension board told the city council in May.

The problems aren't new, either. Dallas knew the pension fund was in trouble in 2005, when the city sold $535 million in bonds to refill the Dallas Police and Fire City Pension Fund. In essence, that moved the debt from one pile (the pension system) to another pile (the city's municipal debt obligations), in the hope that payments on that debt would be less, in the long term, than the cost of the pension system. Like in other places where similar pension obligation bonds have been used, it was a risky move—like "taking $535 million and throwing it on the dice table," said city council member Mitchell Rasansky at the time.

Internally, the pension fund made other mistakes. It overinvested in real estate (at one point, the Dallas police and fire pension plan had the highest percentage of real estate holdings of any major pension fund in the country, according to one report), leaving it vulnerable to downturns in the housing market.

If that poor investment strategy rises to the level of criminality is a question for prosecutors. What's really criminal about some public pension systems—and Dallas is hardly the only perpetrator here—is the gap between what some public sector workers get for retirement and what the average private sector worker does.

I'm thinking of situations like the one in El Monte, California, where two former city managers are getting pensions in excess of $200,000 annually while a quarter of the population lives in poverty and the average household income is just $32,000.

There won't be a criminal investigation into those arrangements, though, because they were legally approved by city governments. The most important difference between a retired city worker getting a $200,000 pension and a pension fund manager running a pay-to-play scheme is that one of those people is stealing from the taxpayers with the backing of city council.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Mayor Mike Rawlings seems to be looking for accountability here.

Or am I incorrect?

That was my read. "I'm mad as hell, and I'm not taking it any more. If this was big - and Dallas pension funds does look big - then it was probably criminal. Someone must've done something bad, and they should stop doing that."

He's going to be in for a big surprise that it's more like the half-arsed incompetency that touches everything funded by governments, short-sighted confirmation bias and forgetting how compound percentages work.

Then put every government-sector employee in jail.

This is Texas. Think Big!

Try death camps.

HoD - "The Dallas City Workers Pension! Brought to you by the same people who founded Social

Security."

Yeah, it just needs some tweaking and it'll be just fine!

"Math is hard."

/Police Officer Barbie

It certainly looks like he's looking for accountability. But, like any good gov official or bureaucrat, he's looking to pin it on someone else. When in fact it was The Dallas City council's fault. Maybe there was some crony capitalism involved in the way it was set up. But, the main problem is/was with the way the city structured the retirement fund and then didn't fully fund it. The city guaranteed an 8% return on funds in a retirees DROP account and they also guaranteed a 4% cost of living adjustment every year. Which seemed to have worked out great for the retirees based on how the Dallas Morning News reported it (see below). But, that certainly isn't the accountability that the Dallas Mayor is fishing for.

* "Hundreds of officers and firefighters became millionaires from the accruals. And the pension had no limits on withdrawals or deferrals, meaning DROP essentially became a guaranteed high-interest checking account, even in the worst of financial times."

* http://www.dallasnews.com/news.....ithdrawals

LOL. Politicians give out incredible benefits to get votes, then when the shit hits the fan, IT MUST BE SOMEONE ELSE'S FAULT

Like how Venezuela keeps blaming those greedy capitalists.

Progs really are a sight to behold

there is no fixing illegal ponzi schemes called defined benefits. prosecute actuaries. they know they are running ponzi schemes.

The most important difference between a retired city worker getting a $200,000 pension and a pension fund manager running a pay-to-play scheme is that one of those people is stealing from the taxpayers with the backing of city council.

And that city council is usually elected over and over again, so they must be doing it right.

Finally a politician who wants to throw people in jail for non-violent crimes.

The unions' local bosses? I'd got for that.

"I blame society."

So are they going to go after the people who negotiated the agreements that brought these funds into existence?

The sad, mad, bad thing is that somebody is going to get fingered for the crime of not delivering on the flying unicorns the government's been promising since forever. You know who's responsible for this shit? The politicians who've been promising the flying unicorns. And yet he's going to act shocked to find the flying unicorns aren't going to get delivered as promised and start going through this charade of looking under the sofa cushions for the sonofabitch that stole the flying unicorns and the public's gonna applaud when he drags some unlucky patsy out on stage and announces he's found the culprit responsible for stealing the flying unicorns.

I'm pretty sure that

fund lot money here in Tucson

^^ lost

"Dallas Mayor Wants Someone to go to Jail Over Pension Disaster"

Just find some guy on the street selling loosies and grab him. Try not to kill him, and then blame this all on that guy. Problem solved. Anyway, Paul Krugman said that the best thing they can do is to keep spending money they don't have. And Krugman has some sort of prize, so it must be true.

Only under Democrats though. Under Republicans the laws of economics reassert themselves. So really, Dallas should be fine.

Errrmmmm....

I wonder how many 401K accounts aren't fully funded? Employers ditched "defined benefit" pensions as quickly as they could once the roller coaster markets combined with more retirees than active employees to put such plans under water. Mostly it is government employees who have avoided the self-responsibility that comes with making financial plans for the future.

RE: Dallas Mayor Wants Someone to go to Jail Over Pension Disaster

The Texas Rangers (and possibly the FBI) are on it, but maybe we should consider a broader definition of pension crime?

Not to worry here folks.

As long as there is no transparency on where the taxpayer's money goes, all will be well with our ruling elitist turds that enslave us all...and isn't that what we all really want deep in our hearts?

"Anyone brazen enough to commit crimes that harmed those who sacrifice so much to keep our city safe must be brought to justice."

I'm looking at the firefighters and police officers. But hey, that's just me.

Add in a special provision that allowed members to withdraw their investments as a lump sum at retirement?which drains the fund of needed capital for future investments?and you have a formula for failure..

I'm guessing the special provision was put in by smart people who knew what was going on. Because sans that provision... well, you know where I'm going with this.

I'm pretty sure Mexicans caused this.

If only the people who expected to benefit had some skin in the game and had some incentive to safeguard their investment. Alas, it's no one's investment, and the people getting the shaft aren't the one's getting the reward. If only there were some mechanism to align risk and reward and incentive......

I will keep promoting my solution to underfunded public employee pension funds: take the needed money out of the salaries of current public employees. Totally fair.

Yes -- if the fund projects 7.5% ROI and it actually comes in at 1.1%, make up the 6.4% from employees. You can bet they'd be howling for better management then. Well, no, actually they'd be howling for more pay and to shift the makeup to the taxpayers. But.

Just tax public sector pension payouts to make up the difference.

defined benefits are Ponzi schemes. Actuaries play number games, they engage in fraud, to keep the Ponzi scheme going.

defined benefits are illegal Ponzi schemes and the actuaries running them know it.

Prosecute actuaries for fraud. they know what they are doing. they know they are running ponzi schemes, defined benefits actuaries are crooks. they all know, as they make their high salaries in a job that otherwise does not exist, they all know these are Ponzi schemes. Like the enron employees, they want it to be real. but like all ponzi schemes, they run out of other people's money to spend

prosecute actuaries first.