Oil Output Freeze by Russia, Saudi Arabia, Venezuela, and Qatar: So What?

Would-be oil cartelizers will fail in the long run

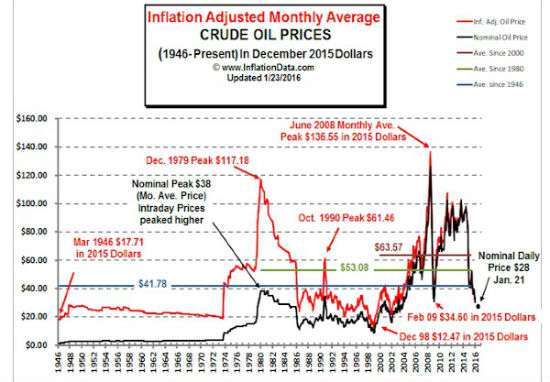

Can oil production be effectively cartelized over the long run? During the 1970s "energy crisis," the world quaked in fear from OPEC's every ukase concerning oil production quotas. But high prices brought in their wake more exploration and more technology and oil prices fell in the 1980s and stayed there for the next two decades. The last decade saw another super-cycle run up in petroleum prices. Again more exploration and new technology (horizontal drilling and fracking) boosted global oil production and the price of abundant crude has dropped steeply in the past year. Will the world now see a replay of something like the 1980s and 1990s with regard to crude oil prices? Very likely.

The "freeze" will fail to signficantly increase prices. Why? First, fracking technology now makes the U.S. and any other countries that permit the technology the real "swing" producers - they can ramp up production fairly easily whenever prices surge. Second, there are a lot of oil producing countries on the sidelines now due to political disarray -Libya, South Sudan, and Iraq - that will eagerly sell into global markets when their domestic situations eventually calm down.

In fact, markets reacted initially to the freeze announcement by bumping up prices a bit, but West Texas Intermediate is once again trading under $30 per barrel.

And just as happened in the 1980s, bankruptcies and unemployment are already rising in the oil industry.

Update: From OilPrice.com Intelligence Report this afternoon:

Judging by the reaction in the markets – oil prices staged a brief rally but the gains were quickly erased as reality set in – oil traders are disappointed with the outcome.

Disappointed? Really?

Show Comments (29)