Oil Output Freeze by Russia, Saudi Arabia, Venezuela, and Qatar: So What?

Would-be oil cartelizers will fail in the long run

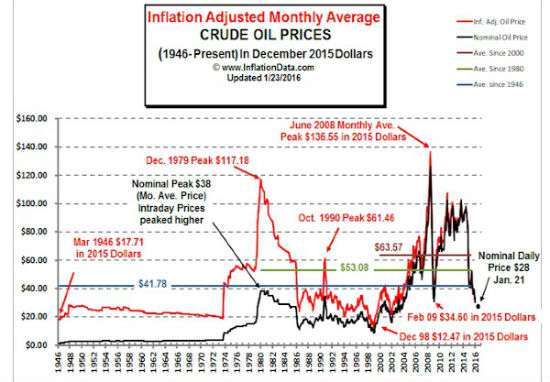

Can oil production be effectively cartelized over the long run? During the 1970s "energy crisis," the world quaked in fear from OPEC's every ukase concerning oil production quotas. But high prices brought in their wake more exploration and more technology and oil prices fell in the 1980s and stayed there for the next two decades. The last decade saw another super-cycle run up in petroleum prices. Again more exploration and new technology (horizontal drilling and fracking) boosted global oil production and the price of abundant crude has dropped steeply in the past year. Will the world now see a replay of something like the 1980s and 1990s with regard to crude oil prices? Very likely.

The "freeze" will fail to signficantly increase prices. Why? First, fracking technology now makes the U.S. and any other countries that permit the technology the real "swing" producers - they can ramp up production fairly easily whenever prices surge. Second, there are a lot of oil producing countries on the sidelines now due to political disarray -Libya, South Sudan, and Iraq - that will eagerly sell into global markets when their domestic situations eventually calm down.

In fact, markets reacted initially to the freeze announcement by bumping up prices a bit, but West Texas Intermediate is once again trading under $30 per barrel.

And just as happened in the 1980s, bankruptcies and unemployment are already rising in the oil industry.

Update: From OilPrice.com Intelligence Report this afternoon:

Judging by the reaction in the markets – oil prices staged a brief rally but the gains were quickly erased as reality set in – oil traders are disappointed with the outcome.

Disappointed? Really?

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

"First, fracking technology now makes the U.S. and any other countries that permit the technology the real "swing" producers - they can ramp up production fairly easily whenever prices surge."

Daniel Yergin was quoted at Davos essentially saying the same thing. Basically, technology and methodology has made what was previously thought of as $90 barrel oil into $60 barrel oil.

Our land in Colorado is currently getting 2 wells. The exploration company merely did it so that they didn't lose their option to explore on the land. They have been very up front that they won't be extracting (and paying us royalties) until oil prices rebound...and of course, this is alright by me.

Peak Derp?

Unfortunately, derp knows no peak. 🙁

Kevin R

Yeah, it's one big game of poker right now between oil producers on who will fold first. Lots of wells are unprofitable at oil's current price, but people keep pumping from them because it costs less to keep running than to shut them down. Everyone is trying to hold out longer than their neighbor, because it's a common belief that once a couple people bankruptcy and their oil production goes off market we should be back in the black (though not as well as we were. Just not laying people off every week bad anymore).

Its already down. Midstreams are starting to charge producers for missing their minimum capacity targets. Refineries are cutting production, although I haven't seen any extended refits this season. Maybe in the fall. I'm gonna be back in software dev by then unless something happens. Although, I may survive as we are doing a bunch of "process studies" in place of actual builds this year.

I'd bet on the private companies folding first. The state-owned oil companies are incapable of making an economic decision, and all of them will cheat on their production limits.

Yup. The curve has huge inventories waiting in the wings. Not just proven reserves but pumpable in a week or two. Let the WTI jump to $40 and every company with a well in the ground will pump it back down to $35 or below. Once the buyouts start to cycle up, all the sunk costs go away and the experienced cost per barrel to produce goes down. The bought out company won't get their sunk cost back and the buyer has a well ready to go.

Cartels are never viable. Eventually someone breaks down and cheats. It is simple game theory. And that is assuming the cartel actually controls the market, which thanks to fracking this one doesn't even come close to doing so.

Well and succinctly said. The incentive is to cheat, and incentives matter.

Has anyone ever successfully "cornered the market" ?

Has anyone ever successfully "cornered the market" ?

The government can get pretty close if it puts its mind to it, especially at the local level and in infrastructure-heavy industries/services.

Otherwise, no.

I hear a lot about de Beers. I read a story about them a few years back and it sounds like they are (were?) close. But that is the only example I can come up with that even passes the smell test.

deBeers is a real outlier. They do come close to cornering the market on a product that is not essential. Quite literally, no one needs a diamond ring.

There are industrial uses for diamonds, but I think they are generally served by the "fake" (lab-grown) kind.

"There are industrial uses for diamonds, but I think they are generally served by the "fake" (lab-grown) kind."

And the non-gem-quality stones.

Venezuela's melting down according to socialists because Chavez/Maduro didn't nationalize enough industries...

http://www.globalresearch.ca/c.....is/5507973

Only a movement of the working class, independent of the Bolivian PSUV and linked in struggle with the workers of North and South America, can oppose efforts by MUD and US imperialism to further carve up the country on behalf of Wall Street.

aw man that's funny.

If only the Venezuelans had used the Bernie Sanders model of socialism, they would be a utopia by now. #GetBernt

Never seen that site before.

I'm not going to search, but dollars to dougnuts they maintain that global trade ruins the lives of 'the working man', while also claiming Cuba is a shot-hole as a result of the US not trading with them.

You can smell a lefty lie a mile off.

"dollars to dougnuts"

Isn't the average price of a doughnut more than a dollar now? Does this saying still make sense? Is this the kind of thing we consult Nikki on?

Oh, very well. "Donuts to dollars", then.

Fractional doughnuts, i.e. doughnut holes.

Damn US Imperialism, always getting in the way of great leaders like Chavez, Castro, and Mao.

BTW, one of the problems I have with that chart and similar ones has to do with the pricing in paper dollars.

In '73, Nixon removed the international gold anchor from the dollar; the dollar price of gold tripled.

The Saudi riyal was still gold-based, and you'll notice the price of oil from the time Nixon pulled the switcheroo until '78, the price of oil (driven by the Saudis) just about matched that increase.

So, along with Tricky's other smooth moves, we can pretty much include a tripling of energy prices.

Gold/oil ratio at 40. Great opp to go long on oil and short on gold.

Hate to sound like shriek, re gold. But that ratio wont hold 5-20 is normal range.

Unless something has changed, it will bounce back to thst ratio. So either 60 oil or 600 gold, or 40/800 more likely.

The thing that makes me not worry about gold prices is that there is virtually no inventory being reported by the clearinghouses. I mean, historic lows for what they are even willing to claim is deliverable.

I don't think you can get low prices and low supply at the same time.

Note: the gold market is the most massively rigged market on the planet. So, anything is possible, including the breaking of historic ratios like oil:gold and silver:gold.

dude, that makes no sense at all man. None.

http://www.Anon-Net.tk

http://www.hydrocarbons-techno.....countries/

LOL !!! Sure cut production. =D

Nothing like an oil price article to bring the woodchippers out of the woodwork. FYI, UK admitted today that Assad is 'key recruiter' for Daesh. Destroy destroy!

The technology is so developed that we can watch videos, live streaming, TV serials and any of our missed programs within our mobiles and PCs. Showbox

All we need is a mobile or PC with a very good internet connection. There are many applications by which we can enjoy videos, our missed programs, live streaming etc.