California Poverty Plan Offers a Wealth of Bad Ideas

Donations flowing to statewide initiative that would impose surcharge on pricey properties

As state legislators in California return to the Capitol in January, there's little question the issue of poverty will be high on the agenda. Legislative Democrats have been dismayed that the governor held the line on new social-welfare spending last session and are eager to step up public funding for new and existing programs. And news reports suggest a major new anti-poverty initiative, backed by some charitable organizations, already is garnering serious donations.

Expect poverty to be "big" this year. Even legislative Republicans haven't resisted too much. They've generally been OK with new spending proposals—provided they're funded without raising taxes. We'll have to wait and see any specifics from legislators, but we already know the details of the so-called "Lifting Children and Families Out of Poverty Act." It's likely to spark a spirited debate during the November 2016 election season given the size of the tax increase it would impose on property owners.

That initiative is one of several possible tax-hike intiatives on the ballot, and proponents appear ready to start collecting signatures. It would impose what supporters call "a sensible and fair surcharge on properties with values of over $3 million" that keeps "all Proposition 13 property tax protections against reassessments … in place."

As the official state summary explains, "Surcharge based on a sliding scale ranging from three-tenths of one percent for real property assessed at $3 million to eight-tenths of one percent for real property assessed at $10 million or more."

The resulting cash flow—between $6 billion and $7 billion a year, based on a Legislative Analyst's Office estimate—would fund anti-poverty programs. The money would be deposited in a new state fund. As the LAO explains, the initiative would identify high-poverty areas as "California Promise Zones" and earmark funds for home-visitation and prenatal services, job training tax credits, a personal income tax credit for low-income workers, and funding for the existing CalWORKS aid program and the California Earned Income Tax Credit.

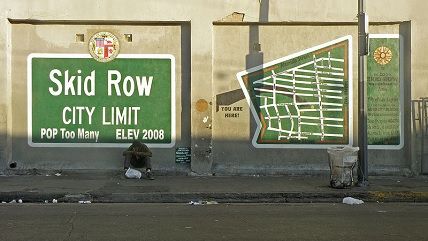

"Attacking poverty requires an unprecedented investment," the initiative argues. "There are proven and effective strategies to fight poverty, but to succeed on a large scale they must be fully funded and sustained over a generation." The term, "fully funded," is open ended, given the size of the existing need. The Census Bureau's new poverty measurement method places California at the top of the high-poverty list because of the state's high cost of living—with a poverty rate of more than 23 percent.

Even California has only a limited number of high end houses, so this measure becomes a new tax on many commercial properties. As a result, critics say it's a tax on job creation. It could make it more costly for brick-and-mortar companies to expand their operations. The measure was amended to include an exemption for all but the most costly rental properties based on a formula.

Business groups have had their hands full worrying about a variety of proposed tax increases that could make it onto the November ballot. Their chief concern: a new "split roll" tax system that would strip away tax-limiting Proposition 13's protections from commercial properties, but that idea has been punted until 2018. So this measure is likely to be the big property-tax-raising idea for the coming election season. Opponents are still analyzing the details, but we can expect a vigorous "no" campaign. Supporters need more than 585,000 signatures to qualify it for the ballot.

There's no question the advocates for the initiative, including the Daughters of Charity Foundation, identify a serious problem: "California has the highest rate of poverty in the nation… Without a comprehensive attack on poverty and its root causes, the future of California is at risk."

But critics say it's not the solution: "(The state) works really hard to disincentivize business and job creation," said Rex Hime, president of the California Business Properties Association. Then when people are in poverty because they can't get a good job, he said the state imposes even higher taxes on the businesses that create the jobs that reduce poverty.

Even with strong economic growth, the poverty rate remains extremely high in large part because of California's high housing costs, according to a recent analysis from the Public Policy Institute of California. As a result, poverty isn't just found in economically hard pressed areas (the San Joaquin Valley and Imperial Valley), but in otherwise booming—but costly—major metro areas such as San Diego and San Francisco. Without government social-service programs, PPIC added, "more Californians would live in poverty." That is true, but is more spending on those programs the main answer?

I suspect most Californians would prefer a good job and affordable housing to a bigger government-assistance check. "I am for doing good to the poor, but I differ in opinion about the means," said Benjamin Franklin. "I think the best way of doing good to the poor is not making them easy in poverty, but leading or driving them out of it." It would be a step forward if Franklin's point will at least be rasied as California leaders embark on yet another anti-poverty campaign.

Show Comments (23)