Will Cigarettes Someday Replace Marijuana in the Drug War?

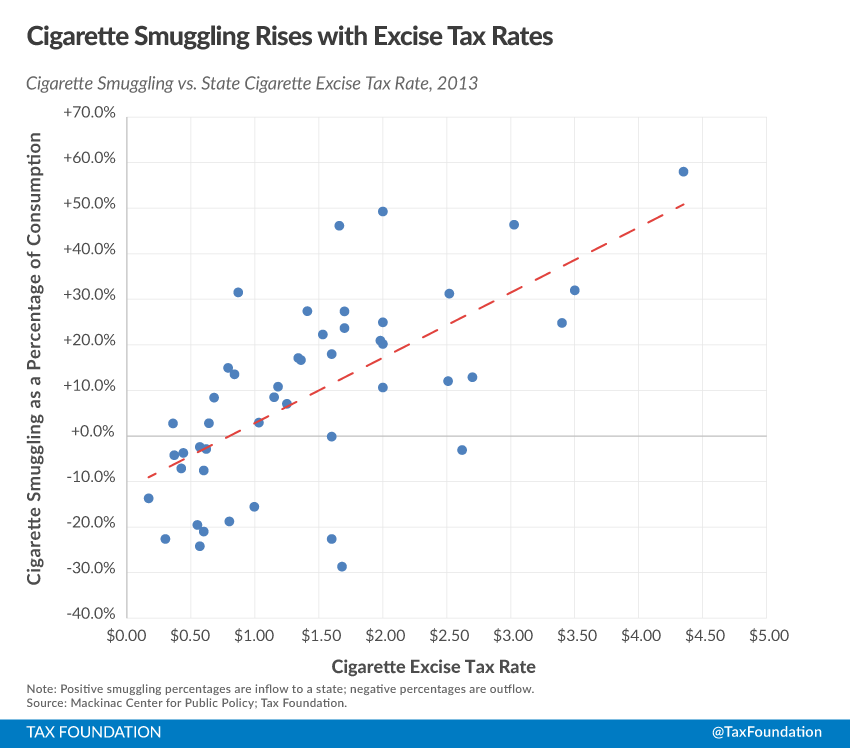

States see big increases in smuggling as taxes jump.

New York's huge taxes on cigarettes and the black market they have created got some major, unwanted attention last year, when New York City's enforcement against the sale of loose, untaxed cigarettes (loosies) led to a deadly encounter between the New York Police Department and Eric Garner.

Every year Michigan's Mackinac Center for Public Policy attempts to calculate how much of the cigarette market is taken up with smuggled or black market cigarettes. This year they've partnered with the Tax Foundation in Washington, D.C., to truly delve into the numbers from 2013. They get these numbers by comparing the adult smoking rates per capita to actual legal cigarette sales.

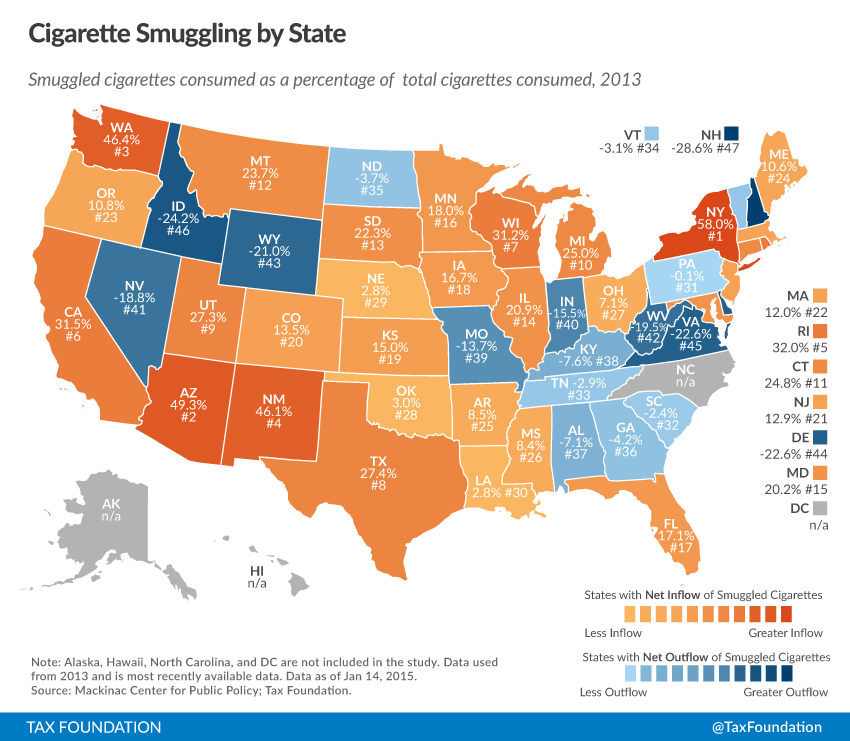

The latest report has New York on top of the list of states as having the greatest consumption of smuggled cigarettes at a whopping 58 percent of the total state market. It's the only state above the 50 percent mark. Arizona, Washington, and Rhode Island, just beneath New York on the list, are edging ever closer, though.

Furthermore, the top 30 states on the list have all seen increases in the consumption of smuggled cigarettes since 2006, many of them seeing percentage jumps in the double digits. Unsurprisingly, many of the states have also increased the taxes applied to packs of cigarettes during that time. The Tax Foundation points to Illinois, a state struggling with significant debt, to show how attempts to get more revenue from sin taxes can backfire:

Smuggling in Illinois has also increased dramatically, from 1.1 percent to 20.9 percent since the last data release. This is likely related to the fact that the Illinois state cigarette tax rate was hiked from $0.98 to $1.98 in mid-2012. This increase in smuggling may continue in future data editions, as more recent increases in both the Cook County rate (from $2.00 to $3.00 per pack, effective March 1, 2013) and the Chicago municipal rate (from $0.68 to $1.18, effective January 10, 2014) have brought the combined state-county-municipal rate to $6.16 per pack of cigarettes, the highest combined rate in the country.

As a result, the Tax Foundation noted, Illinois fell short of its revenue predictions when it calculated how much it would receive from the tax increase.

Check out this lovely chart and map by the Tax Foundation helping document the rise in black market cigarettes:

Read more here. As taxation and regulations regarding cigarettes make it harder and harsher for people to legally acquire and smoke their cancer sticks, this black market is going to continue expanding, even as the laws slowly loosen over marijuana possession and use.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

The Tax Foundation points to Illinois, a state struggling with significant debt, to show how attempts to get more revenue from sin taxes can backfire...

The most effective public policies are those that at least attempt to take human nature into account.

They very well may be. The thing to remember is that most of the Progs who support marijuana legalization don't do so out of any concern for freedom. For them like most things, marijuana legalization is just another front in the culture war. They like pot smokers and view marijuana legalization as a weapon to be used against people they don't like. Their support of it says nothing more than they see law and government as a means of rewarding those they like and punishing those they don't.

Most progs in contrast to pot smokers loath cigarette smokers. The cigarette has come to be associated with that most loathsome and evil of class in the Progs' eyes, the white working class and poor. They therefore are totally supportive of any law that will make life harder and more expensive for cigarette smokers. They likely will never get an outright ban. They very well may however get taxes raised to such a degree that legal smoking though possible is economically impossible for all but the rich.

I sometimes think that if the progs keep this up they'll make cigarette smoking "cool" again because it will be a way to rebel. If that happens I will laugh loud and long.

They very well may however get taxes raised to such a degree that legal smoking though possible is economically impossible for all but the rich.

And the fact that black people get killed in the process of making untaxed cigarettes available to them will obviously be a result of racism by the white working class cops.

Will Cigarettes Someday Replace Marijuana in the Drug War?

Replace? Replace? Not a chance. This is statism we're talking about, and statists never replace the object of their scorn with anything. They only add it to the list. A better question would be:

Will Cigarettes Someday Join Marijuana in the Drug War?

The answer is Yes.

Gotta pointlessly and violently prohibit somethin'.

Where the numbers go negative, is that a result of people over-reporting how much they smoke, or are those the states cigarets are being smuggled out of?

The interesting thing is, in the Garner incident, n one has yet come forward with any concrete evidence proving WHERE Mr. Garner purchased the packet from which he had been selling loosies. Since he did not seem to be the sort to travel much, it seems at least plausible he had bought a single pack locally, thus paying th onerous cugarette tax as requried by law, and was merely "breaking the set" and selling ones and twos at a markup. The tax, it seems, WAS in fact paid on the pack from which he was dealing loosies. Some folks just don't have the cash to spring for a whole pack.. not at New York's outrageous tax bite rates, anyway.

If I had to guess that 46% in Washington state is bullshit and is inflated by people legally buying their smokes at the various Indian Reservations that are all over the state.