Study Says Community Reinvestment Act Induced Banks To Take Bad Risks

'twas Wall Street greed what done it, some folks say, when it comes to explaining the spectacular housing meltdown of recent years, which had its roots in a great many astonishingly risky loans. Other folks suggest that the federal government just may have played something of a role in inducing, even strong-arming, banks to take risks they otherwise would have avoided. Specifically, the Community Reinvestment Act and related policy pressures are pointed to as culprits, part of a government effort to extend home-ownership in lower-income neighborhoods. Now comes a new study from the National Bureau of Economic Research that says, quite bluntly. that the CRA played a major role.

In the academic world, mealy-mouthed delivery of even powerful conclusions is the norm, so it's refreshing to see authors Sumit Agarwal, Efraim Benmelech, Nittai Bergman, Amit Seru answer the title's question, "Did the Community Reinvestment Act (CRA) Lead to Risky Lending?," with the clear, "Yes, it did. … We find that adherence to the act led to riskier lending by banks." The full abstract reads:

Yes, it did. We use exogenous variation in banks' incentives to conform to the standards of the Community Reinvestment Act (CRA) around regulatory exam dates to trace out the effect of the CRA on lending activity. Our empirical strategy compares lending behavior of banks undergoing CRA exams within a given census tract in a given month to the behavior of banks operating in the same census tract-month that do not face these exams. We find that adherence to the act led to riskier lending by banks: in the six quarters surrounding the CRA exams lending is elevated on average by about 5 percent every quarter and loans in these quarters default by about 15 percent more often. These patterns are accentuated in CRA-eligible census tracts and are concentrated among large banks. The effects are strongest during the time period when the market for private securitization was booming.

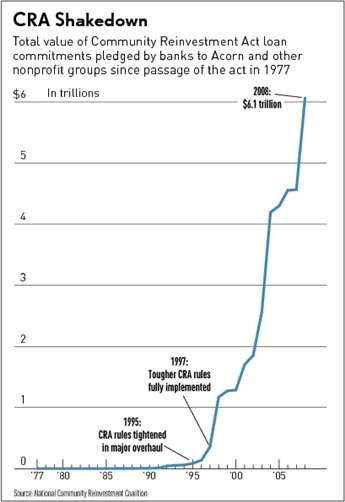

Investors Business Daily does a very nice job of summarizing the nature of the pressure brought on lenders (that's IBD's most excellent graphic, above):

"We want your CRA loans because they help us meet our housing goals," Fannie Vice Chair Jamie Gorelick beseeched lenders gathered at a banking conference in 2000, just after HUD hiked the mortgage giant's affordable housing quotas to 50% and pressed it to buy more CRA-eligible loans to help meet those new targets. "We will buy them from your portfolios or package them into securities."

She described "CRA-friendly products" as mortgages with less than "3% down" and "flexible underwriting."

From 2001-2007, Fannie and Freddie bought roughly half of all CRA home loans, most carrying subprime features.

Note that the authors of the study caution that their work here may actually understate the impact of the CRA. How? Because the study assumes that the major impact of CRA took place when banks were undergoing examination regarding their compliance with CRA goals. If banks found it difficult to shift gears in preparation for such exams, they may have altered their overall behavior to satisfy politicians and regulators. Or, as the authors put it in their conclusion, "If adjustment costs in lending behavior are large and banks can't easily tilt their loan portfolio toward greater CRA compliance, the full impact of the CRA is potentially much greater than that estimated by the change in lending behavior around CRA exams."

The housing meltdown and the Great Recession. Something else for which you can thank the feds.

See other Reason writers on this issue.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

A new study from the institute of "well, duh!"

Big Red Truck!

Shreek, you fucking idiot, if the words aren't too bug, READ THIS!

I don't know, it looks like most of the damage was done under Bush. I think shrike's got you on this one.

Problem is Bush tried to do something about it, but got cockblocked by Bernie Sanders and Chris Dodd.

I was just fuckin' with Sevo, 'cause he's preemptively feeding the bush-troll.

Idiocy. Bush blocked a GOP-led GSE Reform Act (HR 1461).

Dodd and Sanders had nothing to do with it.

Palin's Buttplug| 12.21.12 @ 9:26PM |#

"Idiocy"

Yes, asshole. Every one of your posts are idiocy.

Every word shriek writes is idiocy, including "and" and "the".

Just in case anyone still cares, read this.

http://uspolitics.about.com/b/.....othing.htm

Some choice phrases for Shrike:

"According to the New York Times, in September 2003 the BUSH ADMINISTRATION (emphasis added) "recommended the most significant regulatory overhaul in the housing finance industry since the savings and loan crisis a decade ago."

"HR 1461 remained stalled in the Senate: last action, 31 October 2005, referred to the Committee on Banking, Housing, and Urban Affairs."

How did Bush block an act that stalled out in the Senate? Separation of powers, what the fuck are those?

Whatever.

Bush fucked your mom while she blew Bernie "The Colonel" Sanders, and Dodd rubbed his cock in the highback chair in the corner, as he liked to watch. You'd escape from your room and rub your un-descended balls through your abdomen while watching through the keyhole. A sad life for a forty year-old, but we all need our kicks, eh Shrike?

Bush knew you were looking the whole time, it's what really got him off, not your mom's fat, curdled milk ass.

No shreek, you're the fucking idiot. We've been telling you about Bush and the CRA since you first started coming here stinking up the place with your bushpig nonsense.

And you've repeatedly been corrected factually on the historical path of the recession, its causes, and the failures of others to correct the problems, yet you still cling to your bushpig (HOHO!!!"PALINS BUTTPLUG!!!"THIS DUDE IS HILARIOUS!!!) idiocy like a starving rat to a piece of moldy cheese.

You are a dying breed. Once your hero gets done destroying what's left of our recovery, people will shun your types like the plague.

Enjoy the dying of the light.

You're a liar.

You're a liar.

General Butt Naked| 12.21.12 @ 8:51PM |#

"I don't know, it looks like most of the damage was done under Bush. I think shrike's got you on this one."

Wrong issue.

Dipshit claims the CRA had no effect on the bubble. Whether the damage was done "under" one pres or the other is irrelevant.

I must remind you of the first rule of HitandRun Club - you cannot criticize Bush! Verbotten! Bush is a demi-god here - I am well aware.

I got a serious LP demerit for crapping on Bush so I should know.

Palin's Buttplug| 12.21.12 @ 9:35PM |#

"I must remind you of the first rule of HitandRun Club"

Shut up, asshole.

I'm starting to think that Shriek might be truly, actually brain damaged. Which would kind of make us all assholes for ragging on him.

Generic Stranger| 12.21.12 @ 10:32PM |#

"I'm starting to think that Shriek might be truly, actually brain damaged."

It's possible that there are underlying physical causes for asshole's lies and dishonesty, but that doesn't mean s/he shouldn't be called on every lie s/he posts.

S/he is a lying asshole and should never get the benefit of the doubt regardless of the cause.

Just as a Peanuts character once said:

"What if Charlie Brown really is a blockhead?"

The first rule of H&R Club is, there is no H&R Club.

Admit you were, yet again, wrong.

Are you arguing with science?

People asked for more government, and they got what they asked for.

Good and hard

Let me ask you: where in the CRA does it say: make loans to people who can't afford to repay? No-where! And the fact is, the lending practices that are causing problems today were driven by a desire for market share and revenue growth ... pure and simple.

Republican FDIC Chair Sheila Bair.

http://money.usnews.com/money/.....stment-act

No bank was ever forced to make a loan - it is pure wingnut myth.

"No bank was ever forced to make a loan - it is pure wingnut myth."

Quick poll:

Is shreek really this stupid, or is shreek dumb enough to hope others won't see the dishonesty?

IOWs, roughly how stupid is shreek?

1) Dumb enough to require reminders to take breaths?

or

2) Dumb enough to occasionally ignore the reminders?

But he's right, banks were never "forced" to give anyone loans. They were merely persuaded to do so by government policies and accusations / lawsuit of discrimination.

Also, when anyone is on welfare, they don't have to sign contract that literally says "if you're on welfare, you cannot work, like ever". They have incentive not to work because they're on the government dole, but making that kind of distinction is wingnutry.

Did you guys know that Obamacare doesn't actually mandate rationing. That's right, rationing is only an logical result of that policy, but that's totally different.

XM| 12.21.12 @ 8:40PM |#

"But he's right, banks were never "forced" to give anyone loans"

Yes that asshole is "right". He's also a lying sleazebag for claiming that is the driver in the train-wreck.

Yep, we can say they were coerced i.e. threatened instead.

And yeah, Obamacare is the same, not direct force per se, as it would've been had they justified it under the Commerce Clause, but a prelude to it--coercion in the form of a penaltax

I wasn't forced to hand my wallet to that nice fellow. After all, he didn't shoot me.

Try 12 CFR 25.22

(b) Performance criteria. The OCC evaluates a bank's lending performance pursuant to the following criteria:

(1) Lending activity. The number and amount of the bank's home mortgage, small business, small farm, and consumer loans, if applicable, in the bank's assessment area(s);

...

(5) Innovative or flexible lending practices. The bank's use of innovative or flexible lending practices in a safe and sound manner to address the credit needs of low- or moderate-income individuals or geographies.

Logic fail for Buttplug, once again. What bank wants to turn down a mortgage that might be profitable? None of them. Ah, but the feds want more lending to the "underserved" (poor and minority) community, and if banks don't reach reach the proper targets, they get punished. So of course they aren't "forced to make" any particular loan, but the loans they make must fit the pre-determined government goal of lending to people who are greater default risks, as the statistics quoted above prove.

PapayaSF| 12.21.12 @ 8:38PM |#

"Logic fail for Buttplug, once again."

I doubt seriously if this is a failure of logic. It's simply flat-out lying about cause and effect.

Even rocks know incentives exist beyond "force" and asshole is trying to claim that the distortion couldn't have happened absent coercion; an obvious lie.

That's the reason for the poll; pretty sure anyone capable of breathing knows that.

You both should try to learn about markets - seriously. You are deluded.

Bubbles occur in markets due to faith and fantasy. Gold is a great example of a current bubble. Gold has little intrinsic value and is poised for a crash when the "story" is pierced as a lie (that gold only appreciates).

Gold is the current delusion of Wingnuttopia.

Break free, man. It is a lie.

Palin's Buttplug| 12.21.12 @ 9:01PM |#

"You both should try to learn about markets - seriously. You are deluded."

Dipshit, just shut up. That's all. Your stupidity and dishonesty are more than obvious, dipshit. Just shut up

Seriously, you are not beyond help. The great capitalist Soros defined a concept called Reflexivity thusly:

Reflexivity is best observed under special conditions where investor bias grows and spreads throughout the investment arena. Examples of factors that may give rise to this bias include (a) equity leveraging or (b) the trend-following habits of speculators.

Reflexivity appears intermittently since it is most likely to be revealed under certain conditions; i.e., the character of the equilibrium process is best considered in terms of probabilities.

Investors' observation of and participation in the capital markets may at times influence valuations and fundamental conditions or outcomes.

Gold is in stage one now. The bias and "story" are still intact.

Watch for the second phase and finally capitulation - when investors panic and sell.

Gold $400/oz then.

Palin's Buttplug| 12.21.12 @ 9:13PM |#

"Seriously, you are not beyond help."

Shut up asshole. You've been busted for stupidity and dishonesty. It's a tired act.

Just STFU, asshole.

Good. At that point I buy, presuming I can find gold that isn't gold-plated tungsten, which will be the real reason for the crash.

Bubbles don't blow up to the stratospheric heights of the housing bubble without government intervention. The Fed delayed the inevitable market correction several times.

Hey stupid dipfuck, the reason why gold is in such a bubble is because your sick hero "Barbasol" Ben Bernanke has distorted all the markets more than they have ever been distorted by the government before in a misguided attempt to try and reinflate all the other asset bubbles.

So of course they aren't "forced to make" any particular loan, but the loans they make must fit the pre-determined government goal of lending to people who are greater default risks, as the statistics quoted above prove.

And failure to meet those targets had consequences like preventing future branch expansion and even limiting the installation of ATMs.

Basically every bank that failed to meet the targets became a take over target for larger operations.

So not only did CRA encourage bad lending practices but it also contributed to banking sector consolidation in the 90s and 00s.

Which was in and of itself a contributing factor to the credit bubble.

Not to mention the Fed keeping interest rates unrealistically low for years on end.

Long time back, I was talking with a postal carrier who told me that paying taxes was voluntary even though: "You might have to go to jail."

True you have a choice between paying up or being punished.

So, true, banks didn't HAVE to make risky loans, of course, they might be subject to lawsuits for non-compliance, or worse, but they didn't have to make the loans.

The icing, of course, Fannie Mae ready to buy those loans.

You can squirm out of the inevitable conclusion only by emulating a worm.

It was the carrot and the stick.

They took away most of the risks of giving bad loans and encouraged banks to do so. Made it seem like the moral thing to do.

Then on the other side is the possibility of lawsuits or fines for not lending to disadvantaged communities. Plus the bad publicity if they were singled out for refusing to make bad loans.

So, let's see you have people's natural tendency to want to make money coupled with reduced risk of bad loans since the govt will buy them. All wrapped up in good publicity for doing the wrong thing and bad for doing the right thing.

This was encouraged for decades by many politicians from both parties but got much worse with the CRA and the public/private nature of FannieMae. And it was, due to the nature of the two parties, more of a democratic issue although the repubs are not known to actually practice what the preach as far as fiscal responsibility.

BTW, a quick check here: http://www.nber.org/ will tell you the org isn't carrying anyone's water; the paper on food stamps certainly isn't 'approved' by those who claim government market distortions were a large driver of the 2008 mess.

Nope, sorry. It was greed, pure and simple. That's why lenders shelled out cash like drunken sailors to borrowers who would never...be able...to, um...

1%!!!!

Loaning money to people who won't pay it back is the secret to being rich! How could I not have seen this before? Warty, I will lend you the money so you can finally get your sex change!

I'm gonna be rich, bitches!

Of course it's counter-intuitive. If it was obvious, everyone would be rich already.

Actually, since banks literally create new money via new lending it can be profitable to originate loans whether they can be paid back or not.

The trick is to resell them before they go bad. Which the government helped facilitate.

It must have been greed. The Obamessiah said so!

No wai! The cannot be true! Market failure! Occupy Wall Street!

Like usual, total garbage from IBD.

There is no such thing as a CRA loan. There were loans in formerly red-lined areas but the study defines a CRA loan as one with "less than 3% down" and "flexible underwriting". Those tend to be subprime loans, not city loans. The vast majority of subprime was in the suburbs/rural areas.

IBD does note that Countrywide was not subject to CRA. Neither were all the other fly-by-night subprime whores issuing shitty paper that the likes of Lehman, Bear, and Merrill bought up (also not subject to CRA). Hell, NO ONE was subject to CRA other than to just stop red-lining. Some big banks refused to write subprime at all (PNC).

Wingnuttopia - say hello to IBD again.

I wish IBD would one day have the balls to write a column about why Lehman failed - an unregulated investment bank.

No way will that happen.

That's an awesome takedown of a publication that had nothing to do with the study under discussion above. Reading comprehension. How do it work?

Expecting coherence from that griefer socktroll was your first mistake, JD. PB is anonbots retarded cousin.

I'm not paying $5 for the idiot report. IBD should have cited some decent data from it but they whiffed completely.

Your side already lost this argument. The CRA is not even a conversation topic for overturning as it is still in effect.

No one gives a fuck about the CRA except Wingnuttopia.

Palin's Buttplug| 12.21.12 @ 7:50PM |#

"I'm not paying $5 for the idiot report"

Shut up, idiot. That's all, just STFU. You're beyond stupid; there are mud fences far more intelligent and honest than you. Just shut up.

I always find it interesting that Shrike will believe anything that any expert says without question so long as it confirms a belief he already has, but when MIT, Northwestern and University of Chicago professors come together and write a study that disagrees with something he believes, all of the sudden they're just a bunch of wingnuts who don't need to be listened to.

Super duper econ-genius Shrike doesn't have access to academic papers and doesn't know how to find free copies. One wonders how he became a super duper econ-genius.

He got it the same way Paul Verhoeven got Starship Troopers: He got a treatment of the synopsis from the intern kneeling under his desk.

I swear, when that prick (Verhoeven) dies, I'm going to make a special trip to piss on his grave.

You're a fraud and as much of a close-minded yokel as those rednecks you sneer at, Shriek.

You can download the paper here for free, douchebag:

http://papers.ssrn.com/sol3/pa.....id=2172549

Read it and learn something for a change.

Unregulated? Really?

Not subject to any regulatory agency?

Please explain how ANY financial business is not subject to regulations?

Lehman, Bear, et al were not commercial banks and not subject to CRA, FDIC, Fed, etc.

They were regulated by the SEC like any one else - say a widget manufacturer. They were lightly regulated as brokers - not a big deal either.

Palin's Buttplug| 12.21.12 @ 9:19PM |#

..."They were lightly regulated as brokers - not a big deal either."...

Just STFU. Everyone is tired of your fucking lies asshole. Just STFU.

HAHAHAHA! You're trying to tell me that fucking Lehman Brothers, the fourth largest investment bank in the US before its collapse, was lightly regulated?

"CRA, FDIC, Fed"

These are regulatory bodies?

Wait, you're blaming Glass-Steagall for this?

Hell, NO ONE was subject to CRA other than to just stop red-lining.

Bullshit, the CRA got it all started.

What happened is that proggy assholes in the government thought that they could stick it to the financial industry to help the poor and thereby get elected. Problem is the finance guys were too smart, and turned around and stuck it the government (and the rest of us.

Was it all driven by greed? Sure, everything related to finance is, and it all started with fucking greedy pols.

"There is no such thing as a CRA loan"

-This must be hard, unless you work at a bank. We would slap that label on any loan we could just to beat the OCC wolves back. Banks have to (or rather, are encouraged to) report CRA compliant loans during examinations. These include both COMMERCIAL and residential notes. Originators sell their notes to the big houses. Failure to report compliance resulted, ultimately, in the failure or acquisition of the bank (Or, bidder's being denied state or federal charters to acquire).

I will jump the Country Wide, Red-Lining dumb ass if I have too. It's Christmas and I am feeling nice

"Study Says Community Reinvestment Act Induced Banks To Take Bad Risks"

No, no, no...

It's because of the rich.

And greed.

I know becasue because Tony says so.

Blame the Republicans.

Specifically, if we have to tie it to a policy, it's the repeal of Glass-Steagal. That brought the whole system down!!

Your snark is right on. G-S (or its partial repeal) had nothing to do with the 2008 Crash.

In ProgNuttopia all that is needed is reinstatement of G-S. It is looney-think.

The silence is deafening whenever I ask proggies why Lord Obama didn't just do that instead of passing that monstrosity Dodd-Frank.

VG Zaytsev| 12.21.12 @ 10:51PM |#

"The silence is deafening whenever I ask proggies..."

Or the asshole known as shreek.

As usual, long on jargon and bullshit, short on relevant facts.

No one takes you seriously here, cock breath. You're a charlatan, a mountebank, a state-fellating toady whose asshole is at the 24/7 service of the DNC pole vault team.

Go belch your shit somewhere it won't be laughed off the forum.

In any market, business goals are always preferable to political goals, as the latter invariably have the effect of distorting outcomes that would otherwise be positive for both parties in a transaction.

Fist of Etiquette| 12.21.12 @ 8:10PM |#

"In any market, business goals are always preferable to political goals, as the latter invariably have the effect of distorting outcomes that would otherwise be positive for both parties in a transaction."

Markets tend to be pretty damn robust, but we find from CRA how much ruin there is in a particular market before the gov't screws the pooch.

From that graph, it looks like it took ~$4Tn cumulative distortion in a $900Bn ( http://gbr.pepperdine.edu/2010.....e-markets/ ) annual market to do the job.

And of course, with shreek as the obvious example of the idiot-cheerleader, the gov't then *extended* the distortions.

How long before this report gets the usual RACISM cry? I'm thinking 48 hours before it hits msnbc/huffpo and some blog starts pointing out its rasist. Although its been awhile since we've seen the "Wall Street Puppet" line. I miss the good old big oil days and halliburton controlling the world. They knew how to get things done.

There were a couple of things that really tipped me off to the fact that the housing market was going to run into big trouble.

First, the unbelievable appreceation in property values leading up to the bubble burst. I bought a house in 1984 and in 2001 I sold it for 3x the price. Now, I did do some nice work on the property, but no way near the profit that I made. And this was in a part of the country that property values were not just streaking right out of orbit.

2nd, when I sold that property, I was buying another and although I believe I was well qualified to buy the property, I wasn't getting in over my head or anything, the bank, to my astonishment, told me they didn't even need to do an appraisal on a property which they had never seen! I just really could not believe it. I mean I was happy, the price was right, the interest rate was right, but WTF? I still own the property today, which might be worth what I paid for it 11 years ago, after many improvements, but not more.

I am still really, really apprehensive about buyting any more property in the US today.

GD type-os, Fuck! I won't say it.

You're right. The housing bubble mirrored the tech bubble of 1997-2000. Buyers were confident that those asset values would only rise.

Risk was ignored. A classic boom/bust cycle.

But in Wingnuttopia markets don't do that.

Palin's Buttplug| 12.21.12 @ 8:53PM |#

"But in Wingnuttopia markets don't do that."

Yes, dipshit, please add more lies to your posts. They are amusing.

Maybe you missed the point of my post, which was that the appreciation in home value was artificially inflated, and that banks were making really unusually risky loans, for whatever reason. I don't see what that has to do with 'wingnuts', but whatever.

Agreed, your post was cogent.

Sevo is the one jumping around braying incoherently in this thread and the real true nutcase that will not here reason.

Palin's Buttplug| 12.21.12 @ 9:23PM |#

'Sevo is the one calling me on my lies and bullshit...'

FIFY, you lying asshole.

Good points.

Hey, you aren't the piano player, are you?

Meanwhile, in derptopia government incentives never cause or exacerbate problems.

"Risk was ignored."

It wasn't ignored, it was subsidized.

"There were a couple of things that really tipped me off..."

In SF, the gov't distorts the market such that new building is actively discouraged (while lefties still claim to desire more housing), so what would be bubble valuations in a freed market don't apply. And there are the obvious geographic limitations.

But `2005, a shirt-tail relative bought a home outside of Reno. There are no geographic limits, there are few regulation limits, so there is little reason for home prices to reflect other than land and construction costs plus profits.

Somehow, the relative decided to pay ~ 75% more than that. The relative walked when the market decided the value was closer to my estimate.

Sev, I really wish that I would have walked from buying that property. From somewhere in the depths of my soul, reason was calling to me, 'FUCK NO, just walk!, something is wrong with this market', but I didn't.

We need an edit feature on H&R and a rewind feature for life.

Agreed on the edit feature, but the rewind raises funny issues.

I'd have bought that Gullwing in the '70s for $5K, but then it wouldn't have been available for that. Cisco would have opened at $500.

It would have made the shreek/assholes of the world accept their stupidity. Or maybe not; shreek continues to advertise his absent the shame any human would show.

People always say "two wrongs don't make a right." Am I the only one who sees a problem with that equation?

Patriot| 12.21.12 @ 9:53PM |#

"People always say "two wrongs don't make a right." Am I the only one who sees a problem with that equation?"

Hard telling; you're an ignoramus, so your opinion is NWS.

And as a holiday break from the idiocy of (in this case) shreek (and the idiot claiming the handle of) Patriot, how about some Ode to Joy, not quite improv:

http://www.youtube.com/watch_p.....e=youtu.be

If you watch, there's a young woman who first tosses some geld in the hat. And she stands there to the right of the conductor watching the entire gathering/performance, seemingly enthralled the while.

It is a shame the conductor does not recognize her original contribution, nor makes any effort to include her regardless of her obvious interest.

And then she disappears in the final frames.

Shame on the conductor or the producer.

God Bless America!

If only the church ladies had been packing heat.

It really angers you that we're allowed to possess an effective means of self-defense, doesn't it?

you are deluded in your misguided illusion of self-protection.

Cops should just go out on the streets unarmed since the perp is always going to get the drop on them right? Not only should women not bother carrying a gun, maybe they should where crotchless panties, and keep a roofie to quaff down before the gang bang commences. It would be so much easier on everyone if victims would just stop resisting and let the wolves have their way.

The MR thread on this paper was pretty good. There's also a link to an ungated copy.

More drivel from Policeone.

Where they talk about brave stormtroopers who were shot by Matthew Stewart in self defense. Don't believe it was self defense? This same swat team also executed Todd Blair for holding a golf club when they barged in to his house on a no-knock warrant.

Link to a story about the Blair execution, since I can only do two per comment.

The only reason "dynamic entry" should be permitted is in a hostage situation where life is at stake. Never to find drugs or contraband.

Does anyone know where Jamie Gorelick is right now? She really is the Forrest Gump of awful things and her presence should be monitored 24/7 to ensure she isn't about to supervise the detonation of a secret Iranian nuke.

She's currently representing BP, so I suppose we can expect a gigantic oil-related disaster of some sort.

Dear shriek,

Here is Bill Clinton taking credit for the housing bubble.

Now shut the fuck up.

Your friend,

Jeff

Nice work, commentariat, eviscerating the sock puppet shreek. Wished I could have participated in real time.

Sounds like a solid plan to me dude. Wow.

http://www.AnonGlobal.tk

But Buuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuu

uuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuu

uuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuu

uuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuu

uuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuu

uuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuu

uuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuu

uuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuu

uuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuush!

Shockingly, race-based socialism doesn't work any better in the U.S. than it did in Zimbabwe.

Note that the authors of the study caution that their work here may actually understate the impact of the CRA.

harga besi beton polos