Brother, Can you Spare a Sack of Money?

Ever pay 50,000 pesos for a candy bar? Bolivians did.

Americans, like so many people, are given to complaining about the state of the economy. Presidential elections turn on the issue; incumbents are in grave danger if the annual inflation rate reaches double digits. And news of hyperinflations around the globe—1,100 percent in Argentina, 370 percent in Israel—produces disbelieving stares.

Try, then, to imagine the situation in Bolivia just a few months ago. Double-digit inflation would have been a blessing—the inflation rate last January reached an incredible 116,000 percent. And though new President Victor Paz Estenssoro has calmed things down a bit with his bold austerity program, the Bolivian disaster provides a rare glimpse into the causes and consequences of out-of-control inflation.

For one thing, people take to carrying their money in bags, sacks, or publicly visible bundles. This is perhaps the quaintest aspect of hyperinflation, giving it a colorful, almost picturesque flavor. Foreign visitors derive much mock-horrified amusement from the spectacle of men and women walking down the street, sacks of money swung over their shoulders. But for Bolivians, this sad situation was no laughing matter; inflation becomes an inescapable fact of everyday life, to be coped with the best way one can.

Though the severity of Bolivia's recent inflationary nightmare may be difficult to comprehend, there is really nothing mysterious about its origin. This latest calamity visited upon this unfortunate country is just another example of politicians ignoring writer Henry Hazlitt's famous lesson of economics: "The art of economics consists in looking not merely at the immediate but at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups." Bolivia's experience is a textbook case of how short-sighted monetary policy and political instability can combine to destroy an economy.

Yet most observers and commentators follow Hazlitt's sage advice no more than Bolivia's politicians. The extraordinary developments of the past few years—hyperinflation, the Latin American debt crisis, the turbulent rule of a leftist coalition led by Dr. Siles Zuazo, growing social unrest—diverted analysts' attention from the very foolish government policies of the 1970s that were the real cause of the disaster in Bolivia.

The problems that plagued Bolivia are the inevitable outcome of policies adopted in the relatively quiet '70s and the failure of governments of different ideological stripes to take corrective action. The reluctance of governments to make tough but necessary decisions and their stubborn "live for today" attitudes only postponed the day of reckoning and were responsible for the Bolivian catastrophe.

The dark cloud of inflation was seeded in Bolivia in the 1970s. Between 1972 and 1979 the government increased the money supply by a factor of 4.5; not surprisingly, domestic prices quadrupled. Despite this domestic inflation, the government clung tenaciously to a policy of stabilizing the external value of the country's currency, the peso, maintaining at all costs an exchange rate of 20 pesos per dollar.

By 1977, the evidence that the peso was far overvalued was unmistakable. Though the peso's internal purchasing power had declined by 50 percent since 1972, it still bought the same amount of dollars. Compounding Bolivia's troubles was a rapidly increasing foreign debt load. Between 1974 and 1979 the nation's external public debt rose by almost $2 billion.

Nevertheless, Bolivia's economy was still salvageable in the late '70s. It was down, though by no means out. But at a time when economic realism was an absolute necessity, Bolivia struggled under seemingly endless transition governments. To make a very depressing story short, from 1978 to 1982 the country had three general elections and an astounding 10 governments, three civilian and seven military.

Neither the feeble elected governments nor those that seized power by military coup were willing or able to face the hard choices confronting the country. As a result, the insidious evil of inflation was allowed to follow its natural course.

One civilian president, Mrs. Lidia Gueiler, made courageous but inadequate efforts to devalue the peso by 25 percent, but it remained wildly overvalued. And the staggering foreign debt mounted. Finally, in August 1981 the inevitable happened: a check drawn by the Bolivian Central Bank on a New York bank was rejected for lack of funds.

In early 1982 the government devalued the official foreign exchange rate of the peso to 44 pesos per dollar. Though labeled a "floating exchange rate" (ironically, on the same day as the official Day of the Sea), the new set-up was in fact a dual exchange rate. A new free-market rate, which increased to 200 pesos per dollar by October, was permitted in addition to the official rate of 44.

Alas, the government made yet another tragic mistake. Though imports were sold at the free-market rate, exporters were required to exchange 40 percent of their proceeds at the Bolivian Central Bank at the official rate. So exports, the ultimate supply of foreign exchange, were discouraged.

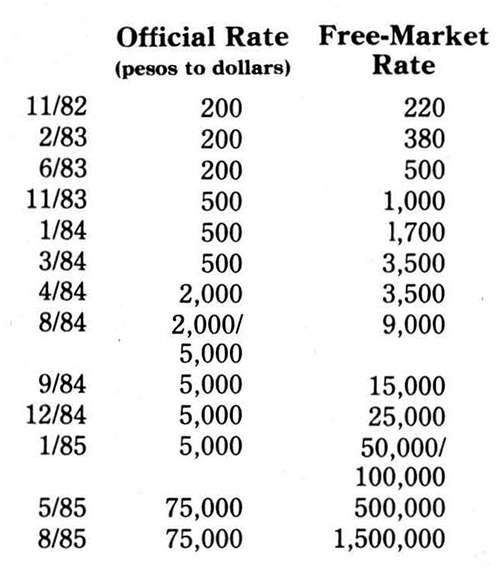

Finally, there was an inordinate surge in government spending in 1982—double, in real terms, 1981 spending. The rest, as they say, is history. The evolution of the exchange rate is the best indicator of the course of inflation:

By this time the country was swamped in banknotes, which had to be lugged around in string-tied bundles. Even small to medium transactions posed problems. Given the practical difficulty of counting 25 million pesos ($50) in 1,000-peso notes, money received in payment had to be accepted with some degree of faith. Not a few abuses (and fistfights) resulted.

In spite of these difficulties, most transactions were carried out in cash, and checks were only rarely used for special types of payments. Interestingly, the use of checks declined even before the onset of hyperinflation, largely because a series of bank strikes in the early '80s eroded public confidence in these institutions.

As in most inflationary episodes, inflation was not an unmitigated disaster for everyone. Businesses lucky enough to obtain peso-denominated loans profited handsomely—at the 200 percent yearly interest rates prevailing in January 1984, bank loans were very nearly outright cash gifts. And foreign money-printers were ecstatic—the government purchased more than $20 million of paper money from West German and British printers last year, making currency Bolivia's third-largest import.

But the beneficiaries of hyperinflation are few. For the many, survival depends on success in the underground economy. Cocaine traffic is the most notorious example, though the number of Bolivians involved in this is highly exaggerated.

The Bolivian case is a particularly vivid example of what happens to people's lives in such dire inflationary circumstances. Almost everyone participates in some kind of officially illegal or extralegal activity. Public employees supplement their incomes by graft; smuggling is a tolerated, even honored, occupation; speculation in scarce essential goods is rife; and black markets thrive in everything from powdered milk to gasoline. Political connections are capital assets, helpful in obtaining an extra 100-pound bag of sugar at the official price, a license for a smuggled car, or even "official" dollars for a trip abroad.

Bolivians learned to live by their wits; but inflation is a negative-sum game, and the struggle is eventually a losing one. Some got richer, but most got poorer, and Bolivia as a whole suffered greatly. The middle classes were forced to draw on their meager savings from earlier, better years, and the country as a whole depleted its stock of physical capital. Industrial machinery went without repair or maintenance, vehicles stopped rolling for lack of parts, wear and tear slowly eroded the entire fixed-capital structure. Businesses had little incentive to invest in productive capacity, and cash flow was directed toward more liquid and speculative investments.

The new government of President Victor Paz Estenssoro, formed in August 1985, is making a bold effort to revive the Bolivian economy. Exchange controls have been abolished, state companies are being decentralized, price supports for food and petroleum have ended, and state workers are being laid off. Though the trek back to economic health will be long and arduous, Paz's courageous measures are already bearing fruit. Prices of various goods, including staples such as eggs and beef, are actually declining. Whether Mr. Paz can stem the damage wrought by years of foolhardy economic policies is uncertain. One sincerely hopes so, as success in Bolivia could well serve as a model of what a market economy can do for other South American nations.

Bolivian Julio H. Cole is a visiting professor of finance at the Universidad Francisco Marroquin in Guatemala.

This article originally appeared in print under the headline "Brother, Can you Spare a Sack of Money?."

Hide Comments (0)

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Mute this user?

Ban this user?

Un-ban this user?

Nuke this user?

Un-nuke this user?

Flag this comment?

Un-flag this comment?