Don't Let Amtrak Con You

President Reagan is trying to cut Amtrak's billions in subsidies, but the great train bureaucracy is fighting back-with a lot of flimflam.

The Reagan administration, as part of its deficit reduction package earlier this year, proposed the elimination of Amtrak subsidies. This move to cut federal largesse has brought forth howls of protest from a small but vociferous clique of rail passengers, Amtrak management, and selected members of Congress.

Amtrak's management has launched a propaganda blitz aimed at obscuring the facts in order to protect continued subsidies. Included in this blitz are assertions that Amtrak has made "substantial progress," that Amtrak serves vital national purposes, and most important, that Amtrak is actually undersubsidized when compared to aviation- and highway-transportation alternatives. All of these assertions are either exaggerated or false.

Take the claim that Amtrak has made substantial progress. In fiscal year (FY) 1972, its first full year of operation, Amtrak reported a deficit of $153 million. But in its FY 1983 annual report, Amtrak's deficit had mushroomed to $805 million. Admittedly, the FY 1983 deficit was not as enormous as the FY 1981 $871-million deficit, but it is higher than FY 1982's $795-million loss. The prognosis is for annual losses in the $700–900 million range for the foreseeable future.

Interestingly, the official losses reported by Amtrak are only the tip of the iceberg of public subsidies. Over the FY 1979–1983 period, Amtrak's acknowledged losses have amounted to $3.8 billion. However, these do not include the interest-free, 99-year, renewable loans it has received from the federal government. When total government assistance to Amtrak over those years is added up, the sum actually reaches nearly $6.3 billion. Thus, the losses are far larger than Amtrak itself would admit.

Other typical measures of Amtrak's progress such as number of passengers, passenger miles of travel, and market share have declined rather than advanced over the past five years. Substantial progress has not been achieved, nor is it likely as long as Amtrak has access to public subsidies. Politics and bureaucracy ensure that no significant gains can be made for this government-owned rail system.

What vital national purposes does Amtrak serve? Of those long touted by Amtrak, there are none of any significance that cannot be attained via more cost-effective means. Environmentally, Amtrak generates more air pollution per passenger mile of travel than either intercity buses or commercial airlines, according to a 1981 study by economist Francis Mulvey of Northeastern University. On a passenger-mile basis, Amtrak isn't any more fuel-efficient than the average automobile, Mulvey's research revealed.

As for the social-welfare implications, Amtrak can't even use the excuse that the poor are dependent upon its service. The Congressional Budget Office, in its 1982 report Federal Subsidies for Rail Passenger Service, pointed out that most Amtrak riders have higher incomes than most taxpayers. As a result, the effect of continued Amtrak subsidies is to transfer income from poorer to richer people.

In addition to this redistribution of wealth, Amtrak subsidies have other effects on the entire economy. Amtrak frequently boasts of all the jobs it "creates." They have the payroll receipts and the invoices to "prove" their case. However, this is a classic case of superficial analysis. While the end of federal subsidies would result in lost employment at Amtrak and some of its suppliers, the alternative uses of these funds in the private sector would produce many more jobs. The reason is that loss-generating uses of resources like Amtrak consume and extinguish capital. Profit-making uses of resources, in contrast, increase available capital. Thus, since it requires capital to support employment, the net effect of Amtrak subsidies is actually to reduce employment. From its beginning to FY 1983, the $17 billion in capital consumed by Amtrak has resulted in a permanent loss of between 150,000 and 400,000 jobs (using the generally accepted figures of between $40,000 and $100,000 of capital investment per new job created).

But the keystone of Amtrak's argument for continued government subsidies is that other forms of transportation receive even larger subsidies. We can be grateful that Amtrak has raised this issue—but, unfortunately for Amtrak, it does not bolster its case for continued funding.

Playing the Numbers Game

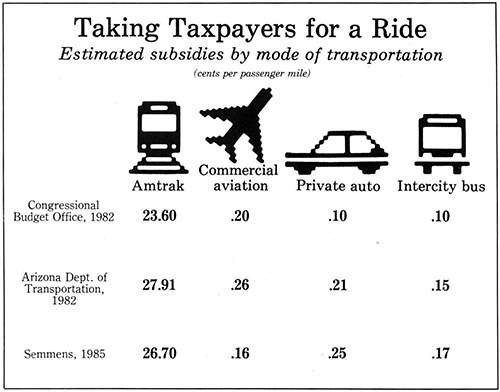

To begin with, subsidies create both inefficiency and inequities. Moreover, the figures on subsidies by type of transportation system show that Amtrak receives a far larger subsidy per passenger mile than any other form of transportation. The 1982 Congressional Budget Office study found that per passenger mile, Amtrak subsidies were over 100 times larger than subsidies to air, bus, or auto passengers. The Arizona Department of Transportation came up with similar figures in a study published in 1982, and my own calculations based on more recent data produce the same type of results (see chart, p. 38).

Why is Amtrak's performance so bad compared with other passenger transportation? First, there is Amtrak's relative unattractiveness. As a means of intercity passenger transportation, Amtrak appeals to less than one percent of the traveling public. Based on 1983 data, Amtrak's share of intercity passenger traffic was a measly 26/100ths of one percent. Amtrak's claims of progress notwithstanding, this share is even lower than the miniscule 31/100ths of a percent it achieved in 1980.

Second, user taxes in aviation and highways cover most of the government's costs of providing services to them. Ticket taxes and fuel taxes generate around $3.5 billion per year for the aviation trust fund, enough to cover about two-thirds of total federal expenditures on airports and air-traffic control. And of the $12 billion spent on highways by the federal government, all comes from user taxes. The only subsidies to highway users come from state and local governments. (Of course, this doesn't make these subsidies any more justified, but Congress has no direct authority to end such subsidies.) In stark contrast to air and highway travelers, Amtrak riders pay no user taxes. So when it comes to subsidies, taxpayers are paying a lot and Amtrak is producing very little by way of actual passenger service.

In fact, it would be cheaper for the government to provide free airline tickets than to continue operating Amtrak. Just the subsidy per passenger mile on Amtrak of 27 cents is more than double the total average air-fare cost of less than 12 cents per passenger mile. At this point, Amtrak apologists usually assert that at 100 percent load factors (in other words, if every seat on every train is filled for every minute of operation) rail passenger service is efficient. As unrealistic as this fantasy of 100 percent load factors is, Amtrak still costs more than air service. At 100 percent loads, the cost per passenger mile for air service would be 8 cents versus a subsidy of 13 cents for Amtrak.

In view of these facts, what are we to make of Amtrak's recent claim that other modes of travel are more heavily subsidized? In a February 22, 1985, news conference, Amtrak president W. Graham Claytor claimed that competing forms of transportation have large "hidden subsidies." He specifically mentioned highway construction funds, government-paid air traffic controllers, and tax deductions for business travel. Claytor claimed that the government actually spends about $42 subsidizing each airline passenger, compared with the $34-per-passenger Amtrak subsidy.

What Claytor was doing was the old trick of comparing apples and oranges. For Amtrak's highway and airline competitors, Claytor added up federal spending on each mode but ignored the substantial offsetting federal revenues from user taxes. In contrast, the figures to the right reflect net government spending—that is, expenditures minus revenues.

In addition, Claytor added in the dubious concept of "tax expenditures"—the federal tax revenue foregone due to the tax deductibility of business travel. Of the alleged $42 to subsidize each airline passenger, $33 of that figure is from this source and is not actually a subsidy at all—unless one is prepared to accept the premise that any of your money that government allows you to keep rather than taxing away is a subsidy to you!

Claytor's remaining $9-per-passenger airline subsidy is attributed to a difference between federal aviation expenditures and user-tax revenues, divided by the total number of airline passengers. This, too, is entirely spurious. A whole series of US Department of Transportation cost-allocation studies has concluded that the airlines more than pay their way in terms of user taxes. The only significant subsidization is of general aviation (business jets and private planes), not commercial aviation. Thus, Claytor has incorrectly attributed the subsidy to the wrong class of aviation users. Finally, the $34-per-passenger Amtrak figure reflects only the subsidy of operating costs. The billions of tax dollars spent on capital costs are excluded.

The measures of merit for any government program should be whether it is efficient and equitable. A program is efficient if it produces more in value than it costs to support. A program can be judged equitable if it adheres to a consistent ethical principle. Subsidies to Amtrak pass neither of these tests.

We can measure the value of Amtrak service by observing the choices people make, and Amtrak riders choose not to pay fares sufficient to cover the cost of service. Indeed, fares cover about one-third of the full cost of service. (Amtrak management claims that fares cover 55 percent of costs, but this calculation excludes capital costs. Another way of stating the fare-recovery statistics would be to say that riders cover 55 percent of operating costs and zero percent of capital costs.) Instead, many vocal Amtrak supporters make a different choice. They lobby Congress to force taxpayers to pay the bulk of the cost of the service. What this indicates is that Amtrak's riders don't feel the service is really worth the cost. The stridency of their demand that others be forced to pick up the tab is a clear demonstration that Amtrak's cost exceeds value. For its part, Amtrak management corroborates this view when it assures us that without forced extractions from unwilling taxpayers, no train service will be provided.

The Great Train Robbery, 1985

If there is an equity principle at work in the subsidizing of rail passenger service, it is difficult to imagine what it might be. Altruists must surely be repulsed by Amtrak's inverted Robin Hood technique of robbing the poor to give train rides to the rich. And there is the obvious injustice of coercing innocent taxpayers to pay for the special interest of a handful of rail passengers.

For its part, Amtrak justifies this coercive financing by arguing that "everybody else is doing it." One wonders how low public discourse has fallen with Amtrak resorting to such juvenile logic. The fact that European and Japanese governments routinely gouge their taxpayers to provide subsidized rail service hardly justifies emulation in this country. In addition, it may be no worse for Amtrak to be subsidized than for mass transit, or farmers, or any other special group to be subsidized. But it is wrong nonetheless.

Finally, what about Amtrak's claim that ending subsidies would result in the demise of the passenger train? Years ago, everyone who traveled between the United States and Europe went by boat. Since then, advances in technology have reduced ocean-going passenger travel to a tiny fraction of the total traffic. Fortunately, there is no "Amboat" consuming hundreds of millions of dollars each year in a futile effort to turn back the clock. Instead, there is a small but thriving market for privately owned and operated ocean cruises.

The millions of dollars worth of equipment and facilities that can produce only huge financial losses in the hands of a moribund corporation might, under the right circumstances, be turned to better use in the hands of new management. The vitality of the free market depends upon the ability to put resources to their best uses. It is possible that a residual demand for rail passenger service can be met in more effective fashion by the market.

In any event, Amtrak, as originally conceived, was to become a "for-profit corporation." It has abjectly failed to do so. This failure is no source of shame. The resort to taxpayer-funded subsidy, however, is.

John Semmens is a senior policy analyst with the Arizona Department of Transportation. The views expressed in this article are his own and do not necessarily reflect the views or policy of the department.

This article originally appeared in print under the headline "Don’t Let Amtrak Con You."

Hide Comments (0)

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Mute this user?

Ban this user?

Un-ban this user?

Nuke this user?

Un-nuke this user?

Flag this comment?

Un-flag this comment?