Competition (Except Where Prohibited by Law)

The antitrust laws don't promote competition-they stifle it. But then, consider their source.

Successful businesses are routinely taken to court for offering great products at low prices, having thus become "dominant firms" in their industries. Cutting prices to meet the competition is a boon to consumers—but has been condemned by government authorities as "price discrimination" and "predatory pricing." When ready-to-eat cereal producers perceived that consumers want more than just plain corn flakes in the morning, they were accused of "sharing" a monopoly through the dubious tactic of "brand proliferation." The list of absurdities perpetrated in this country in the name of "antitrust" could go on and on.

The first antimonopoly law, the Sherman Antitrust Act, was passed nearly a century ago, and others have been added over the years. But disenchantment with these laws has been growing lately, for economists are finding plenty of evidence that they often suppress competition rather than encourage it.

Yale Brozen of the University of Chicago concludes that the antitrust laws "are themselves restraining output and the growth of productivity." Dominick Armentano of the University of Hartford offers even sharper criticism, charging that historical evidence shows the antitrust laws to be a major source of monopoly power, routinely used to protect inefficient firms. And Harold Demsetz of the University of California at Los Angeles says that if certain antitrust policies were continued, he would favor outright repeal of the Sherman Act. In fact, recent research has given rise to what Brozen calls "a revolution in economics—in that part of the field called industrial organization—which is nearly complete in the professional journals."

Despite all the evidence, however, economists are still generally inclined to have great faith in the necessity of antitrust laws in a competitive economy. They may admit that mistakes have been made, but the antitrust laws in general and the Sherman Antitrust Act in particular are still widely held as the guarantors of a competitive economy. There is a strongly held belief that there once was a "golden age of antitrust" in which these laws were implemented to brush back a "rising tide of monopoly power."

This is odd. In other domains, when a pattern of perverse economic behavior—in this case, the suppression of competitive activity in the name of antitrust—persists over several decades, economists usually ascribe it to something inherent in the institution itself. But not with antitrust. In one popular industrial organization textbook, F.M. Sherer proclaims that "in the United States…the enforcement of the antitrust laws is the main weapon wielded by government in its effort to harmonize the profit-seeking behavior of private enterprise with the public interest." Likewise Kenneth Clarkson and Roger L. Miller, in another well-known text, say that "antitrust laws have been legislated and enforced in order to keep business behavior and markets competitive." And another textbook author, Marshall Howard, praises the Sherman Antitrust Act as the "Magna Carta of free enterprise."

These economists are not rare in hailing the antitrust laws. In a recent survey of a sample of 600 economists, 85 percent agreed with the statement that "antitrust laws should be used vigorously to reduce monopoly power from its current level."

So despite mounting evidence that antitrust is anticompetitive in its effects, there is strong sentiment in favor of even wider application of the antitrust laws! This apparent paradox, however, may have an explanation that is also quite revealing. The Sherman Act, considered by some to be the "Magna Carta of free enterprise," was probably never intended to promote competition! Instead, there is strong evidence that it was basically a legislative response to protectionist pressures in the late 19th century, much akin to the current clamor for an "industrial policy" designed to prop up the fortunes of US businesses that are under competitive pressure.

Like most government regulation, then, the Sherman Act was not designed to advance the "public interest" but benefited well-organized private interests, including 19th-century farmers, small businesses, and politicians. In short, it is a myth that the Sherman Act of 1890 was passed to promote and protect competition among businesses.

Major political support for the Sherman Act was first led by farmers' organizations such as the Grangers and the Agricultural Alliance, who were among the most potent political forces of the day. As historian Sanford D. Gordon recounts:

Perhaps the most violent reaction of any single special interest group came from farmers. Besides their active participation in the early anti-monopoly movement…the Agricultural Alliance…regularly denounced trusts. They singled out the jute bagging and alleged binder twine trust, and sent petitions to both their state legislators and to Congress demanding some relief. Cotton was suggested as a good substitute for jute to cover their cotton bales. In Georgia, Mississippi, and Tennessee the Alliances passed resolutions condemning the jute bagging trust and recommended the use of cotton cloth.

When cotton cloth, produced by southern farmers, was being replaced by jute, they sought legislation that would dissipate their competition.

Gordon found this to be characteristic of the farm lobby. During the 51st Congress, which passed the Sherman Act,

64 petitions and memorials were recorded in the Congressional Record, all calling for action against combinations. These were almost exclusively from farm groups.…Not a single voice spoke up either in favor of, or expressing any neutrality toward trusts.…The greatest vehemence was expressed by representatives from the Mid-West.

Many other groups soon joined in the antitrust coalition—small business organizations, academics, and especially "progressive" journalists. The Congressional Record of the 51st Congress is replete with examples of legislators voicing the complaints of small businesses in their districts that were being subjected to "unfair" competition from the trusts.

To this day, farmers and small-business owners are among the most effective special interest groups, for there are still large numbers of them in a majority of congressional districts. Needless to say, their interests do not necessarily coincide with the interests of the vast majority of consumers.

Urged on by these interest groups, Sen. John Sherman and his colleagues claimed that combinations of businesses—or trusts—restricted output, and this drove prices up. As legal expert Robert Bork concluded in an exhaustive review of the Congressional Record of the 51st Congress:

Sherman demonstrated more than once that he understood that higher prices were brought about by a restriction of output.…Sherman and his colleagues identified the phrase "restraint of commerce" or "restraint of trade" with "restriction of output."

If Sherman's claims were true, a look at the record should show a restriction of output in industries that were allegedly being monopolized by trusts. By contrast, if the tendency to combine into trusts was part of an evolutionary process of competitive markets responding to the rapid technological changes of the time, one might expect an expansion of trade or output in these industries.

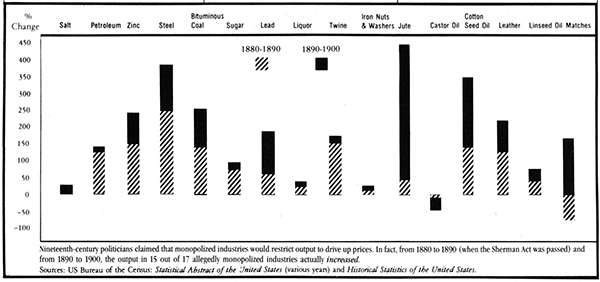

Being curious about this, I compiled from the Congressional Record of the 51st Congress a list of industries that were accused of being monopolized by trusts. The graph on page 36 shows the industries for which data on output from 1880 to 1900 are available. The striking thing about this list is that of the 17 industries, there were increases in output not only from 1880 to 1890, the year the Sherman Act was passed, but also to the turn of the century in all but two industries, matches and castor oil. These last two are hardly items that would warrant a national furor, even if they were monopolized.

In addition, output in these industries generally expanded more rapidly than output in other industries during the 10 years leading up to the first trust-busting legislation. For some industries, there are records only of nominal output, while measures of real output are available for others.

In the nine industries for which nominal output is known, output increased on average by 62 percent—almost four times the 16 percent increase in nominal GNP (gross national product) during that period. Several of the industries expanded output by more than 10 times the overall increase in nominal GNP.

Real GNP (adjusted for changes in the price level) increased by approximately 24 percent from 1880 to 1890. Meanwhile, the allegedly monopolized industries for which some measure of real output is available grew on average by 175 percent—seven times faster than all other industries.

Furthermore, these trends continued to the turn of the century. Output expanded in each industry except castor oil, and on average, output in these industries grew at a faster rate than the rest of the economy. Industries for which nominal output data are available expanded by 99 percent compared to a 43 percent increase in nominal GNP from 1890 to 1900, while the other industries increased real output by 76 percent compared to a 46 percent rise in real GNP.

In summary, this evidence undermines the notion that the industries singled out by Senator Sherman and his congressional colleagues were creating a "rising tide of monopoly power," if one judges by Senator Sherman's own measuring rod of monopoly power: output restriction. These industries were expanding much faster than the economy as a whole—some at 10 times the rate.

And predictably, prices in these industries were generally falling, not rising, even when compared to the declining general price level. For example, the average price of steel rails fell from $58 to $32 between 1880 and 1890, or by 53 percent. The price of refined sugar fell from 9 cents per pound in 1880 to 7 cents in 1890 and to 4.5 cents in 1900; the price of lead dropped from $5.04 per pound in 1880 to $4.41 in 1890; and zinc fell from $5.51 per pound to $4.40. Although the general price level also fell by seven percent from 1880 to 1890, it fell proportionately less than all of these items.

Perhaps the most widely attacked trusts were those in the sugar and petroleum industries. But there is evidence that the effect of these combinations or mergers was to reduce the prices of sugar and petroleum. In fact, even Congress clearly recognized this!

Rep. William Mason admitted during the House debates over the Sherman Act that "trusts have made products cheaper, have reduced prices." The objection lay elsewhere. "If the price of oil for instance, were reduced to one cent a barrel," declared Mason, "it would not right the wrong done to the people of this country by the 'trusts' which have destroyed legitimate competition and driven honest men from legitimate business enterprises." Likewise, Sen. John Edwards, who played a key role in the debate, insisted that the lowering of sugar and oil prices "does not alter the wrong of the principle of any trust."

It turns out that the great beneficiary of competition—the consumer—was not the object of antitrust concern at all. Instead, it was less-efficient, "honest businessmen" who were being priced out of the market. It is surely not insignificant that these and other business owners were in a position to contribute to political campaigns.

Senator Sherman and his colleagues were right in one respect—there certainly was monopoly power in American industry during the late 19th century. It appears, however, that one function of the Sherman Act was to divert public attention from the real source of monopoly power—the government itself. Tariffs imposed by Congress were probably the major restraint of trade in the late 19th century, but the Sherman Act made no provision whatsoever for dismantling these.

In a particularly revealing statement, Sherman attacked the trusts during the Senate debates over his bill on the basis that they "subverted the tariff system; they undermined the policy of government to protect…American industries by levying duties on imported goods." It's an odd statement for a reputed "champion of free enterprise." It is perfectly consistent, however, with an alternative picture: that Sherman was a protectionist, not a free-trader. With output expanding and prices falling in the industries attacked by Sherman, monopoly profits previously secured through protective tariffs were being dissipated. This was not to the liking of the protected industries and their legislative allies such as Senator Sherman.

Indeed, Sherman's true colors were in clear view just three months after the act was passed, when, as chairman of the Senate Finance Committee, he sponsored a tariff bill. This was so transparently a piece of special-interest legislation that the New York Times dubbed it the "Campaign Contributors' Tariff Bill." It "now goes to the president for his signature, which will speedily be affixed to it," reported the Times on October 1, 1890, "and the favored manufacturers, many of whom…proposed and made the [tariff] rates which affect their products, will begin to enjoy the profits of this legislation."

The Times noted that Sherman's speech in support of the bill "should not be overlooked, for it was one of confession." Senator Sherman had withdrawn this speech from the Congressional Record for "revision," but not before a Times reporter had obtained an unabridged copy of the original. As the reporter wrote:

We direct attention to those passages relating to combinations of protected manufacturers designed to take full advantage of high tariff duties by exacting from consumers prices fixed by agreement after competition has been suppressed.…Mr. Sherman closed his speech with some words of warning and advice to the beneficiaries of the new tariff. He was earnest enough in his manner to indicate that he is not at all confident as to the outcome of the law. The great thing that stood in the way of the success of the bill, he said, was whether or not the manufacturers of this country would permit free competition in the American market. The danger was that the beneficiaries of the bill would combine and cheat the people out of the benefits of the law. They were now given reasonable and ample protection, and if they would resist the temptation attaching to great aggregations of capital to combine and advance prices, they might hope for a season of great prosperity.…He did hope, the Senator concluded, that the manufacturers would open the doors to fair competition and give its benefits to the people.…He hoped the manufacturers would agree to compete one with another and would refuse to take the high prices that are so easily obtained.

For Senator Sherman to say that a protective tariff would not harm consumers if only manufacturers would not raise prices is contradictory, to put it mildly. Sherman's intention was clearly to isolate American manufacturers from international competition and then, when the protected industries raised prices, to blame it on "dangerous combinations of capital."

Such hypocrisy led to a complete reversal of the editorial position of the New York Times. For years the Times had been a foremost proponent of antitrust legislation. After observing the behavior of Sherman and his congressional colleagues during the months following the passage of the Sherman Act, the editors concluded:

That so-called Anti-Trust law was passed to deceive the people and to clear the way for the enactment of this…law relating to the tariff. It was projected in order that the party organs might say to the opponents of tariff extortion and protected combinations, "Behold! we have attacked the Trusts. The Republican party is the enemy of all such rings." And now the author of it can only "hope" that the rings will dissolve of their own accord.

For centuries, monopoly has been associated with governmentally imposed barriers to free trade such as tariffs, import quotas, professional licenses, and monopoly franchises. But all of this is immune from antitrust law. It appears that the Sherman Act was passed to help draw public attention away from the actual process of monopolization in the economy, among the major beneficiaries of which have always been the legislators themselves. By interfering with the competitive process, Congress became perhaps the one interest group to benefit most from the Sherman Act.

Where were economists during all of this? They were not even asked their opinions of the proposed antitrust law, and it is easy to understand why: they were nearly unanimously opposed to it. The historian Sanford D. Gordon has surveyed all articles and books written by economists on the topic of antitrust prior to the Sherman Act. A large majority, he found,

conceded that the combination movement was to be expected, that high fixed costs made large scale enterprises economical, that competition under these new circumstances frequently resulted in cutthroat competition, that agreements among producers was a natural consequence, and the stability of prices usually brought more benefit than harm to the society. They seemed to reject the idea that competition was declining, or showed no fear of decline.

One of the best younger economists, John Bates Clark, said this about trusts:

Combinations have their roots in the nature of social industry and are normal in their origin, their development, and their practical working. They are neither to be deprecated by scientists nor suppressed by legislators.…A successful attempt to suppress them by law would involve the reversion of industrial systems to a cast-off type, the renewal of abuses from which society has escaped by a step in development.

Economists' opposition to antitrust legislation was so universal that even Richard T. Ely, who founded the American Economic Association and who believed that "the doctrine of laissez-faire is unsafe in politics and unsound in morals," was opposed to it.

So it should really come as no surprise that antitrust law, for the past 90 years, has been anticompetitive in its effects. Contrary to popular mythology, the Sherman Act was never intended to promote competition. Instead, its sole purpose was to protect (some) competitors.

When the aging Senator Sherman, who was about to retire, became involved in the antitrust issue, he had just gone through an exhausting and unsuccessful attempt to secure his party's presidential nomination, and perhaps he saw the antitrust issue as his final claim to political fame. Whatever else may be said of the Sherman Antitrust Act, one thing it did accomplish was to make Sen. John Sherman at least as famous as his elder brother, Gen. William Tecumseh Sherman, of Civil War notoriety. But like slavery, antitrust laws should be abolished.

Thomas DiLorenzo teaches economics at George Mason University. He has written a paper on the origins of antitrust, forthcoming in the International Review of Law and Economics.

This article originally appeared in print under the headline "Competition (Except Where Prohibited by Law)."

Show Comments (0)