Paper Crisis

We didn't really have an international debt crisis before, but Congress is doing its best to create one.

We face global financial ruin from an "international debt crisis," the authors of countless recent books and articles warn us. They tell us why the crisis exists and, typically, how to avoid the disaster that it is ushering in. But a close examination of both the logic behind the crisis prediction and the evidence submitted to support it reveals the forecast to be, at best, premature, and at worst, a convenient fiction popularized by those now benefitting from the political results of its general acceptance.

Weak arguments and scarce evidence have, of course, never discouraged government action, so in November 1983 Congress approved an administration plan to grant the International Monetary Fund (IMF) an additional $8.4 billion, if not to actually solve the anticipated crisis, to at least frighten the bogeyman away for the time being. The sad irony of this tale is that the very measures that Congress has just taken to remedy this doubtful crisis will only make its advent more likely.

First to warn us of the possibility of an international debt crisis were the banks that made loans to foreign governments—loans now thought to be vulnerable to default—and the various governments that received those loans. And those same parties are also the principal beneficiaries of present government efforts here and abroad to insure this debt by subsidizing its repayment. Their authoritative voices warned of a financial collapse, and a press ever eager to exaggerate disaster echoed the doomful pronouncements. Thus egged on, governments of net lender countries moved to shield indirectly, by way of IMF subsidies, their domestic banks from the risks naturally associated with international debt. The international banks want the subsidies as a means of costlessly increasing the security of their international loans. The debtor governments want the subsidies as a new source of income. Both benefit from these subsidies and therefore both claim that a crisis exists; but what is the basis of this assertion and how have these various interests been able to convince so many of its validity?

The mechanics of the crisis, as foreseen by its "victims" and their unwitting allies in the press, are deceptively simple: As a debtor government progressively borrows more money, the cost of servicing its debt rises proportionately. Because the borrowed funds are not always invested in productive ways, however, they frequently do not generate sufficient income to cover the interest cost associated with borrowing. The interest cost must therefore be paid out of the general-income sources of the debtor government. But as the total cost of servicing the debt rises in proportion to its sum, it becomes an increasing strain on the budget of the debtor government. As a debtor government accumulates more foreign debt, it reaches a point at which it can no longer cover out of general revenue the servicing costs of all of its unproductive debt. The government then defaults. The lending banks suffer losses as a result, sending financial shock waves throughout their native countries and the rest of the world. This is the theory.

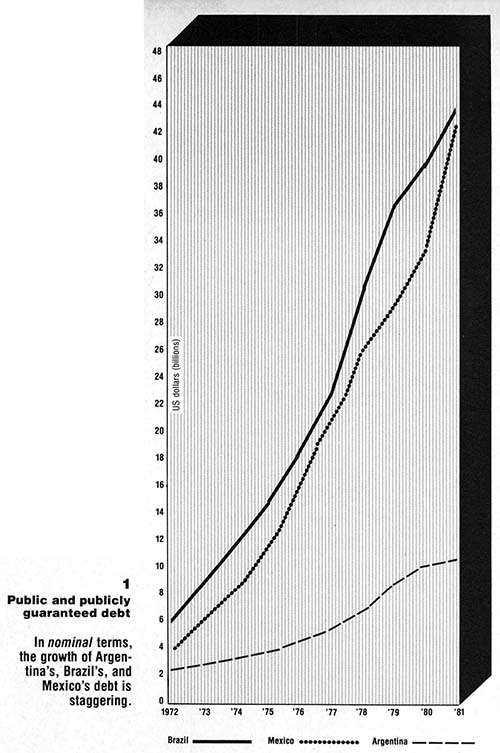

The evidence supporting this theory is that government-held debt is rising, as a matter of record, at a seemingly astonishing rate and many heavily indebted governments are, also as a matter of record, claiming increasing difficulty in servicing their debt. The three debtors most vociferous in their claims of hardship are also the three largest debtors: Argentina, Brazil, and Mexico. And in nominal terms the growth rate of their debt is staggering (see chart 1, page 31). From 1972 to 1981 these countries' combined debt grew at an average annual compounded rate of 26 percent; by 1981 their combined debt was about eight times what it had been in 1972. Two of these three countries, Argentina and Mexico, have already been forced to suspend servicing payments temporarily at one time or another due to an apparent shortage of funds. The crisis, it would seem, is already here.

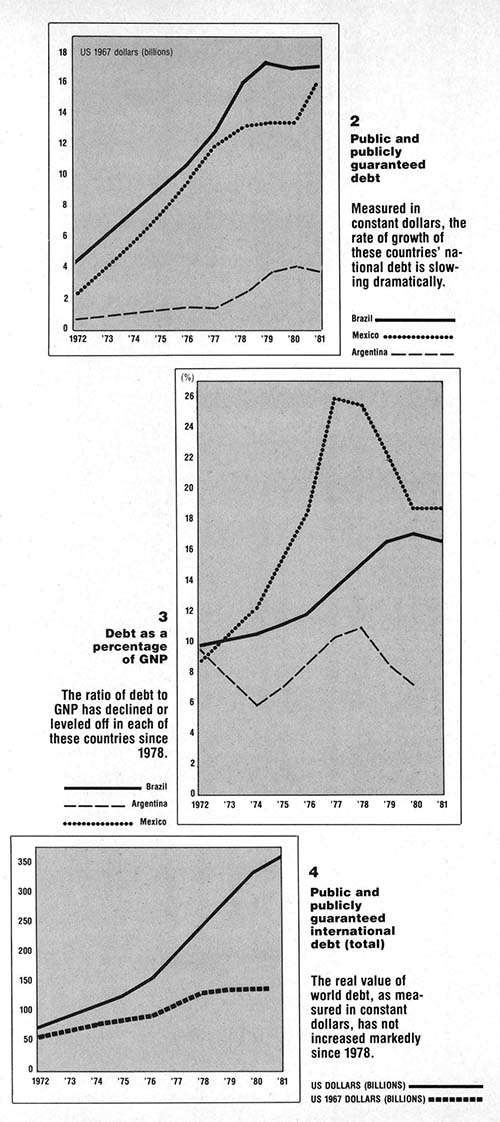

But however conclusive these facts may seem, they are compelling only because they are incomplete. In real terms, the rate of increase in the combined debt of these countries is not as impressive, and in fact their total debt grew at a rate only one-tenth as fast between 1978 and 1981 as between 1972 and 1978; clearly the rate of growth of these countries' national debt is slowing dramatically (see chart 2). And even where the absolute levels of debt commitments are already so high, an increase in publicly held debt does not necessarily mean an increase in the probability of default. According to the theory, it is the decreasing ratio of government income to servicing costs of government debt that is supposed to bring on collapse. So if a government's income is rising at a rate faster than or equal to the rate of increase in servicing costs, the danger of default may actually be diminishing.

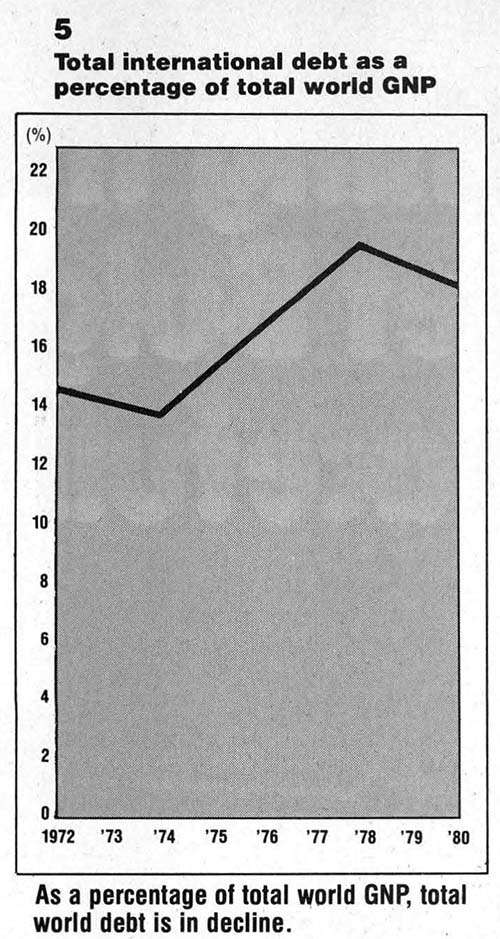

This, in fact, is the case in the three countries being examined. The ratio of debt (the source of servicing costs) to gross national product (GNP)—the total value of a nation's output of goods and services (the source of government income)—has declined or leveled off in each of these countries since 1978 (see chart 3). The same story can be told in terms of world debt. Its real value has not increased markedly since 1978, and world debt as a percentage of GNP is in decline (see charts 4 and 5). If the reason for the anticipated mass default is that the servicing costs of accumulated debt are becoming an increasing strain on debtor governments, we have nothing to fear. A level of strain higher than we are now experiencing has already been tested without incident.

But there is another, even more fundamental level on which the case for the international debt crisis fails: it fails at the theoretical level. It assumes that the unavoidable outcome of a failure of a foreign government to generate sufficient income to service its debt is default, and it thereby ignores the very definition of debt. Debt is a claim on assets, not on income. The prediction that debtor governments may someday be unable to service their loans out of current income may well be true, but that is not the only factor relevant to the determination of whether those governments will have the ability to repay their debt. When an individual fails to meet the agreed-to payments on his loans, the assets in his possession are assigned to his creditors. One does not simply default and walk away with nothing more than a bad credit rating. Similarly, when a government encounters difficulty in servicing its debt out of income, it ought properly to liquidate assets in its possession in order to compensate its creditors.

Much of the government-owned asset base in debtor countries is, after all, a product of the very funds that were borrowed: foreign governments typically have vast amounts of nationalized assets at their disposal. Among the 500 largest foreign-owned companies, Fortune magazine recently listed four government-owned Brazilian companies, with total stockholders equity of about $12 billion; two government-owned Mexican companies, with total stockholders equity of about $23 billion; and two government-owned Chilean companies, with total stockholders equity of about $2.5 billion. And though each of these governments owns literally tens or hundreds of additional companies and millions of acres of land, the abovementioned companies alone have enough equity to cover 25 percent of Brazil's debt to foreign banks, 53 percent of Mexico's, and 33 percent of Chile's. (Note, too, that I have valued these companies at book value, usually only a fraction of the actual market value of a viable company.)

The people of these countries are poor, but their governments are not. If there is going to be a problem, then, it will not be one of ability to repay the loans but of willingness. Most of the funds loaned by banks to debtor governments were invested in government-owned industry and business projects—the money has not disappeared.

Whether the insecurity of international debt is due to genuine economic problems in debtor countries or whether it is simply due to a reluctance on the part of debtor governments to honor otherwise unenforceable agreements, crisis-theory proponents might respond to my observations, the fact remains that default by a number of debtor governments is a real possibility. But as was demonstrated above, default for these governments is not a necessity—it is a matter of choice, and the inclination to default is not a new problem. It is one that has been successfully resolved by a mechanism already in place.

There is a natural reluctance on the part of debtors to service or repay their debt. Some outside incentive must therefore be given to the debtor to comply according to agreement. Within states, that incentive is usually the threat of legal recourse. Between states, at least in the world of international public finance, that incentive is the fear that foreign investment will be discouraged if contracts are not honored and debts repaid. Companies and banks that lose assets to a foreign government because the government fails to honor its agreements will also lose confidence in the government, and the nation's economy generally, as profitable objects of investment. And because foreign investment is such an important factor in promoting the growth of poorer countries, no rational debtor government would like to see such investment in its country discouraged. There are, therefore, incentives already in place to encourage service and repayment of international debt. Were such incentives not already at work, the crisis would have come and gone long ago as debtor governments would have defaulted on their debt years ago instead of continuing to service it.

As originally foreseen, then, the crisis will not happen. Taken as a whole, the developing countries of the world are fully capable of servicing and repaying their foreign debt. But a debacle of a different sort—in which the IMF, with taxpayers' money, will bail out more and more defaulting foreign governments—has now been made possible by Congress's recent efforts to avert the supposed financial ruin by subsidizing its would-be victims. As noted above, debtor governments are faced with a delicate balance of incentives and disincentives to repay their debt. And historically, governments have generally serviced their debts according to agreement. But IMF subsidies, recently made available to debtor governments apparently likely to default, will upset this balance; for such subsidization is a signal to other debtor governments, previously not expected to default, that if they only prove themselves sufficiently irresponsible, the IMF will reward them.

If at one time it was thought that a crisis could arise because one or two governments appeared likely to default, the crisis is now more likely, not less. The remaining debtor governments may be so emboldened by the success of their neighbors in receiving subsidies that they too may opt for the easy way out.

It is too late to reverse our decision to subsidize the IMF and, in turn, its beneficiaries. Now we can only hope that decision will not create a real crisis where once there was none.

Jon Osborne holds an M.B.A. in finance and accounting from the University of Chicago and has worked for the Midwest Stock Exchange.

This article originally appeared in print under the headline "Paper Crisis."

Show Comments (0)