"Stamping" Out Inflation

Can pieces of paper issued by the government protect you from paper money?

During the past decade, stamp collectors have seen their hobby—philately, to those in the know—turn into a premier investment field. Especially in the last five years, stamp values have zoomed to stratospheric levels, and many collectors now have to compete with the pushy new investor dollar in order to complete their specialties.

The year 1847 saw the first issue of US, stamps—a 5-cent brown specimen showing Benjamin Franklin, and a 10-center picturing George Washington. In 1960 you could buy an average used copy of the Franklin stamp for $20. By 1970 its price had reached $50 and then jumped to $95 by 1975. By 1980 it had soared to $900, a gain of 847 percent in five years, amounting to a compounded rate of increase of 45 percent per year. For the 1970-80 decade the annual rate was 29 percent—still well above inflation.

The 10-cent stamp didn't do quite as well, only rising 444 percent from 1975 to 1980, for a compounded rate of 34 percent per year. Most classic US stamps rose at least 100 percent during this time, and some jumped by as much as 1,000 percent. If instead you had been smart enough to buy gold at $150 in 1975 and sell it at $700 five years later, you would have realized a 31 percent annual return. Thus many stamps performed as well or better than well-timed gold and other "hard assets" during those years.

With this impressive price appreciation, it is small wonder that many investors have been turning to stamps, and the resultant infusion of investment funds has in turn accelerated the increase in values. Of course, this has not occurred in a vacuum. The escalation of stamp values has paralleled that of real estate, precious metals, rare coins, gems,and other tangibles. The engine behind this movement has been inflation. Precisely because they are inflation hedges, the increasing demand for such investment vehicles has intensified their price rise.

But there is another factor behind the steady appreciation of stamps as well as coins: scarcity. The supply of genuine, fine scarce stamps is fixed and even declining as fires and other disasters take a small annual toll. Since most stamps are tucked away for long periods of time in collectors' albums, only a relative few are on the market at any given time. Meanwhile, the collectors have been increasing in number. The logical result of a tight supply and a steadily increasing demand has been the dramatic rise of stamp values not just during the last few years but the last few decades. This is likely to continue as long as paper dollars increase at the rates we've seen recently.

But price appreciation alone would not be sufficient to make stamps an attractive investment medium for the general investor. The lack of easily accessible and fluid markets keeps many esoteric collectibles confined to the domain of specialists. Not so with stamps, for there is a large, liquid market. Philatelists like to boast that theirs is the world's largest collecting hobby. The stamp market is made up of a worldwide network of thousands of dealers, philatelic agencies, brokers, wholesalers, auction houses, retail stores, clubs, and millions upon millions of individual collectors who buy, sell, and trade among one another.

The stamp market also offers freedom. The stamp trade is among the least regulated in the world. Sales and income taxes are applicable (of course), but there is no securities commission or commodity bureau to skew stamp prices, license dealers, or make the market go through contortions. In philately, supply and demand reign in supreme majesty.

Buyers and sellers in the stamp market can call upon the services of philatelic organizations that offer stamp insurance and expert evaluations, as well as an ample body of literature and information to guide traders.

Another reason why some investors are attracted to stamps is their privacy and portability. If you value your privacy, you can purchase stamps without any publicity, and they are easily stored in a small area. By weight, rare stamps are among the most valuable commodities on earth. They can be concealed and carried across hostile borders much more easily than, say, gold coins. During periods of war and chaos, with currencies, equities, and bonds collapsing into rubble, stamps have often served as a store of value, keeping wealth intact. A number of Europeans managed to preserve some of their assets during World War II through stamps.

Most investors probably aren't worrying, yet, about such calamities, but they do worry about the increasingly uncertain international economic climate. We live in an age of unpredictability. Scores of books, newsletters, and ads insist that a depression, hyperinflation, and social turmoil are imminent. Even without such scenarios, high inflation, shaky and unpredictable stock and bond markets, and roller-coaster gold and silver rides make a good case for a healthy diversification of one's assets. Any one investment medium, whether real estate, gold, stocks, cash, or stamps, is vulnerable and has risks. Diversification into many baskets is a wise strategy, and stamps offer a stable alternative for a share, perhaps up to 20 percent, of one's investment eggs.

Economic considerations aside, however, people are also attracted to stamps by their sheer beauty and interest. The 19th-century issues especially are miniature works of art, beautifully engraved, rich with detail. A nicely arranged stamp album can be a pleasing miniature art gallery. And some stamps, such as the Confederate issues, have a historic interest, as well.

So, many investors fall in love with stamps and then buy them for their enjoyment as well as the economic return. But to the investor, as opposed to the collector, such amour has its dangers. Emotional involvement can make the investor buy too high and then not want to sell at all. The rule should be: enjoy your stamps, but not too much!

WHAT TO DO FIRST At this point, the novice philatelic investor may say, "Fine, I'd like to invest in a few stamps, but how do I know which ones to select?" The first thing to do is run out and buy a current stamp catalog. In the United States most stamps are described using the Scott Catalog numbers, so you may as well have a copy. If you are only interested in US stamps you can get just its US Specialized volume, either at a stamp store or by mail. It's also a good idea to acquire a Minkus Catalog (volume one for the United States and the British Commonwealth), which will give you some extra information. The Brookman catalog is smaller and has the most up-to-date prices, and the Harris Postage Stamp Price Index lists past prices as well.

Be sure to read the front section of the Scott Catalog, "Information for Collectors." It offers a good education on stamp paper, printing methods, and perforation types. If you can say what a tête-bêche pair is, you pass the test. Often an issue will be reprinted with a slightly different style, and a seemingly minor printing change can result in a huge difference in price. So it is wise to be able to tell the difference between, say, an engraving and a photogravure.

Unless you are already a stamp specialist, it is usually best to start investing in the stamps of the country you live in. These offer the most fluid market. And since you want to buy scarce stamps, you would be wise to concentrate on the 19th- and early 20th-century items.

With a very few exceptions, the smart stamp investor avoids buying new issues. Thousands of people are buying mint sheets of stamps from the post office on the sadly mistaken notion that they are building a fortune. The main beneficiaries have been the post office and future collectors. Precisely because so many thousands have been so foolish, stamp collectors can now buy most US stamps issued during the last 40 years at close to face value. Buying mint sheets from the post office should be considered not an investment but an act of charity.

The same goes for new and recent foreign issues, current first-day covers, and commercial gimmicks such as gold foil "stamps." Nowadays, many governments crank out stamps by the score to sell to stamp collectors. If you buy them, you are simply subsidizing some postal administration's deficit. This should not be confused with making an investment.

And what are the few exceptions? Occasionally there will be a new issue with a very limited printing, such as the 1976 Bicentennial Souvenir Sheets, which have risen substantially above face value. But except for these special situations, the only thing an investor should do with new issues is use them for postage.

SIZING UP STAMPS In your stamp catalog you will notice that the prices are in two columns. The first is that of a mint, or unused, stamp; the second, of a used, or cancelled, one. These catalog prices are only a rough indication, though, because the actual price of a stamp, whether used or unused, is determined by its condition. Catalog prices are for "fine" stamps, which means decent copies. A very fine or superb stamp—well-centered, with good coloring and no damage—will fetch a higher price, while an "average" or poor stamp—off-center, faded color, very heavy cancels, tears, or other damage—can fetch a substantially lower price.

As an investor, you want to buy only top-quality stamps. Since they are scarcer, they are likely to appreciate faster than the more common stamps of poorer condition. Although you will have to pay more for them, you will be able to sell them at top prices.

But going for top quality doesn't tell you whether to buy used or mint stamps, and here we enter controversial territory.

During the past few years a worldwide interest (some call it a fad or craze) has grown up around mint, never-hinged stamps. These must be post-office fresh, with nary a trace of hinge mark, fingerprint, coffee stain, or any damage whatsoever. (A hinge, for you tyros, is a specially gummed piece of paper used by collectors to mount stamps.) Naturally, such earlier stamps are extremely scarce, since back in the olden days collectors weren't so fussy and used hinges, or worse. A mint, never-hinged (MNH) stamp therefore commands a price premium as high as 25 percent or more above the price of a hinged mint stamp.

Many stamp collectors now believe that the MNH "craze" has gone too far and that it is mainly investors who have fueled the recent rush. The number one rule in stamp investment is: the ultimate price is determined by collector demand. Moreover, a market has developed for regumming hinged stamps, and often even the experts have a hard time telling a regummed stamp from an MNH.

There is another problem with mint stamps, hinged or not. Over the course of time, the gum interacts with the stamp's paper and can eventually damage the stamp. This has already occurred with some 100-year-old stamps. Ultimately, all mint stamps are doomed to self-destruct unless extraordinary steps are taken to preserve them.

Thus, while the MNH investors may well continue to enjoy superior price performance during the next decade or so, eventually the realities of collector demand and the physics of gum and paper can catch up with them. If you want to leave your stamps to your grandchildren, it's better to buy only used stamps.

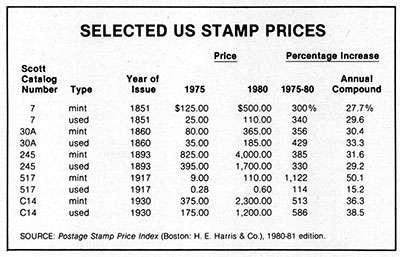

My own preference is to concentrate mainly on fine used classics. A comparison of recent prices with those of 5 and 10 years ago shows that in many cases used stamps have performed as well as or better than many mint ones (see table below). So why worry about the gum?

SHOPPING AROUND If you should want to branch out into foreign issues, the best ones are those of the relatively wealthy industrialized countries with an active home market. These include the United States, Canada, Western European countries, Israel, South Africa, Japan, Australia, and New Zealand. A good speculation might be a large country that is industrializing rapidly, such as China or Saudi Arabia. Stamp collecting in the People's Republic of China has recently been given an official okay, thus a huge potential demand both there and in Taiwan could send the early, scarce issues skyrocketing.

In the United States, most of the issues up to about 1926 and the air mails to 1934 could be considered good investment material. The cheap, common stamps selling for $2.00 or less should be avoided. Common stamps will always be cheap, no matter how old.

Compare recent prices with those of 5 or 10 years ago to see which ones have advanced the most. (Get an old catalog or the Harris index.) If a particular stamp has recently doubled or tripled within a year, however, it's best to stay away. Stamps do occasionally have their fads and their ups and downs. By diversifying over several issues, you will most likely enjoy a steady and rapid price rise in your investments as a whole.

When you sell your stamps, you may want to determine the compounded annual rate of increase to compare with alternative investments. The formula for computing this is: R = 100 x (Ln I)/N. Subtract the selling price from the buying price to get the net increase, I. Calculate the natural log (not the base 10 logarithm) of I (easiest with a math calculator). Divide this figure by the exact number of years, N, figured to the day (for example, 5.68 years). Multiplying by 100 gives you the percentage rate of increase, R.

Just as stock investors keep up with the market via specialized newsletters and papers, stamp investors subscribe to stamp newspapers and other periodicals to keep up with developments and get news of auctions and sales. The two main stamp newspapers in the United States are Linn's and Stamp Collector. Canadian Stamp News is handy for Canadian stamps.

Auctions are excellent markets for stamp investments, since the buy/sell spread is only the commission, usually about 20 percent. Retail stores and mail dealers usually have a larger spread, depending on the price—the cheaper the stamps, the higher the spread. You can visit stamp stores and dealers and examine the stamps you are interested in, noting the prices of specimens of various conditions. You can shop around and buy the best items at a given price range. When you bid at auction, you can try to buy the stamps at or somewhat below the current market price. Because of the buy/sell spread, stamps should be considered a long-term investment.

Stamps in most states are subject to sales tax. You can avoid this government surcharge by buying from out of state.

PROTECTING YOUR STAMPS Counterfeits and altered stamps are sharks that infest the philatelic waters. Knowledge is your best protection. You can avoid getting bitten by having your stamps evaluated by experts. The Philatelic Foundation and other stamp societies offer this service and will send you a certificate of genuineness for a rather nominal price. Be sure to notify your dealer or auction house that you are sending the stamp to be evaluated. They should then refund your money if the stamp turns out to be a fake.

You can also rely on an investment stamp dealer or broker to select or buy your stamps and to guarantee their authenticity. Then you only have to be concerned with the reliability and judgment of the dealer or investment firm. Most dealers are honest, and you can usually avoid the few crooks by dealing with well-established firms that advertise that they are members of the APS, SPA, or ASDA societies.

If you invest in stamps, it is wise to invest also in stamp insurance. This can be purchased by joining some of the stamp societies, such as the American Philatelic Society (Box 800, State College, PA 16801) or the Society of Philatelic Americans (Box 9041, Wilmington, DE 19809). Besides the insurance and the availability of experts, you will get a monthly magazine with information and ads.

Remember that stamps are but bits of paper and very fragile. They should be stored in envelopes free from tape or acidic paper, or in stockbooks. It's best to use protective mounts if you keep them in an album. Store them in a cool, dry, dark location with good circulation and an absence of silverfish. Most bank vaults are okay. Stamps should be handled with a good pair of tongs, not with oily fingers.

Theft is always a problem. Security and privacy are your best protectors. It's a good practice to tear off the address labels from your philatelic periodicals before discarding them and to use a post office for your stamp mail.

If your stamps are stolen, call the police or your favorite protection agency and then immediately call this number: 813/898-7238, day or night. It is the APS stamp theft hot line, available to all, whether members or not. They will give you advice and notify stamp dealers to be on the lookout for your stamps.

An excellent way to protect your philatelic investment is to microfilm your stamps. Keep the negatives separate from your collection. This will be of great help in recovering and identifying any stolen stamps.

FUTURE PROSPECTS The primary investment reality today is the rapid depreciation of paper currencies. Another is heavy income taxation, which not only penalizes interest and dividends but also the price appreciation of equities. These two factors alone will, on the average, make tangible investments an attractive alternative. They will generally increase in value at least as much as the inflation rate, and the increase is not taxed until the sale, and then at the relatively favorable capital gains rates. On the negative side, a deflationary depression could bring down the prices of tangibles.

A great advantage to stamps is their flexibility. They come in all price ranges, from a few pennies to million-dollar items. You don't need to start out with a small fortune, as you do with diamonds. They are light and easier to ship than, say, coins. On the other hand, they are much more easily damaged.

Stamps have less intrinsic value than gold, gems, or even paintings. After all, we are dealing with a hobby. But in the end, what counts for the investor is the market value at present and in the near future. Even without inflation, the scarcity and wide demand for stamps would continue their decades-long steady increase in value. Inflation only accelerates this increase.

Large as philately is compared to other hobbies, the stamp market is still rather tiny compared to equities, commodities, or even gold. It doesn't take much money to move the market. As more stamp firms advertise in the Wall Street Journal and as investment firms increasingly turn their eyes toward stamps, there exists a potential for an even greater price explosion than has been seen in the past few years.

Fred Foldvary is the editor of Postage Paid, a philatelic journal, and has contributed numerous articles to philatelic magazines. He has been collecting and investing in stamps for 25 years.

This article originally appeared in print under the headline ""Stamping" Out Inflation."

Show Comments (0)