The Coming Bull Market in US Commemorative Coins

US commemorative coins probably represent the greatest potential for profit in the coin market today. I seldom make near-term recommendations in coins, but if I had to choose a single series in which the leaders stood the best chance to double in the next two years, it would unquestionably be US commemorative coins in general and those mentioned in this article in particular. The "commems," as they are called in the trade, are genuine, legal-tender coins minted by the US government. Their attractiveness for medium- to long-term investment is based on low mintages, high quality (brilliant uncirculated condition), wide dispersion, low risk, and proven demand.

Three years ago, when I first began writing about commems, price dormancy was listed among their advantages, but that is no longer the case. After five years of slumbering, interest in US commemorative coinage has finally perked up. The long-time lid on commem prices is off, and further increases are ahead. Market leadership rotates in any investment area, and numismatics is no exception. I believe the commemoratives will assume that leadership this year and maintain it for two, three, or more years.

There are two basic investment strategies that can be used successfully in stocks, commodities, or coins. One is to buy undervalued issues that have been dormant in price and to wait until the public recognizes their value or until they come into favor. The other is to get in on a trend early and ride it up. The latter is generally the most profitable and makes the most efficient use of capital. Unfortunately, it is also the most difficult to follow in the coin market, because the coins may simply not be available. The trend in the commems is now clear. Although we are still early in the bull market, it will be increasingly difficult to find any quantity of the coins with the best potential. For this reason and because I feel strongly about the future of the commem series as a whole, my list of recommended issues is extensive.

In sharp contrast to the commemorative coins, but perhaps better-known to the non-numismatic public, are the commemorative bars and medals issued by private mints. These are not coins, and their limited-edition status is an illusion. Although last December's "60 Minutes" exposé of the principal manufacturer of limited-edition silver bars has dampened speculative buying, many would-be investors who purchased these items because of silver's potential for higher prices have watched their bars decline in price while silver rose.

The limited-edition fallacy has probably lured more dollars away from an uninformed public than any other single propaganda idea since Ponzi schemes. The theory is that by limiting the supply of a particular issue, an investment winner is guaranteed. In fact, sales are limited only by the number of persons foolish enough to put their money into another "get rich quick" scheme. The larger manufacturers have done sophisticated market research and know within tight tolerances the size of their potential market for any new item. This allows them to promote effectively, while limiting production of each issue to the size of its probable market. Consequently, the real market is properly saturated at the time of issue, and the illusion of the limited edition is perpetuated.

The problem for the buyer is that a secondary market for the private mint issues is virtually nonexistent. The forced sellers, who appear in any market, have found that the first tick down is a long one indeed. The manufacturers have chosen not to provide an after-market for their wares. Often, local coin dealers are the bearers of the bad news that the holders of limited-edition bars or medals can sell them only at intrinsic metal value, typically 10-50 percent of cost.

WHY COMMEMS?

The US commemorative coins are the genuine limited editions of today and the prime candidates for price appreciation in the future. In addition to their low mintage, they have the benefit of at least 25 years of market "seasoning," a historically proven collector and investor demand, and a broad, organized, and international market. If 10 percent of the money that has been spent in the past several years on the "instant rarities" issued by private mints were put into US commemorative coins, prices would double overnight, or perhaps triple or quadruple. This explosive potential for a multiple of current prices is unmatched in the numismatic market today.

As collector demand for the commems increases, the original low-mintage figures will act as a ceiling on the available supply, and prices will rise accordingly. Most of the commems have mintages under 25,000, and some as low as 2,000. These are minuscule quantities when compared to circulation-issue coins. For example, the Walking Liberty half series, minted from 1916 to 1947, a time period comparable to many of the commems, generally has mintages in the millions. The lowest-mintage coin of the series, the 1921-D, has a mintage of 208,000 and a current wholesale price of $2,750 in MS-65 condition. Silver commems of much smaller mintages are available in the price range of several hundred dollars per coin. Many more such examples abound.

Although the commems were minted by the US government, they were generally distributed by private groups sponsoring an event or memorial. With each design authorized by Congress under special legislation, these coins were sold by the Mint at face value to the sponsoring group. This group then resold the coins to the public at a premium in order to raise funds for a fair, festival, or monument. The commemorative coins provided a mechanism by which the government could support what were considered worthy causes without expending tax monies, and they offered the public a chance to contribute to the projects voluntarily.

The first US commemorative was issued in 1892 for the Columbian Exposition World's Fair in Chicago; the last, in 1954 in honor of Booker T. Washington and George Washington Carver. The aesthetic and historical appeal of these coins contributed to demand in times past, as it does today.

Our investment selections are based on mintage, current price, and price history over the past five years. There is by no means a simple inverse relationship between mintage and price, and thus the concept of relative value is essential. As some coins within a series appreciate faster than others, there will follow a correction in which relative values reestablish themselves, either by an increase in price of the laggards or a sell-off in the high flyers. In the coin market, the former tends to predominate. Accordingly, we have looked at the below-average performers first and chosen a diversified list of recommendations.

Hand-in-hand with these statistical tools, I have relied on my own experience buying commems for clients, including market availability, demand, and condition over the past 15 years. If a high proportion of a given commem appears in circulated condition, this implies that a smaller percentage of the mintage is still available in uncirculated condition. The relationship between a given coin's market price in circulated and uncirculated condition is also significant. A high circulated price for the coin indicates that not many of that issue reached circulation and also puts a floor under the uncirculated price for the coin. Another consideration, relevant in only a few cases, is the existence of hoards that might act to depress prices.

WHICH COMMEMS?

Silver. The affordability of silver commems for most individuals will make a major contribution to future price growth. This is a market where the investor with as little as $500 or $1,000 can achieve some diversification, although there are also opportunities for those with more money to invest.

All of the silver commems have the 50-cents denomination except for the 1900 Lafayette dollar and the 1893 Isabella quarter. There are a total of 144 coins in the complete silver commemorative set, which includes all dates and mint marks and is currently trading at $20,500 wholesale in BU-65 condition (see below). In addition to those who put together compete sets, many people collect silver commems by type. Type collecting includes one example, generally the least expensive, of each major design. There are 50 different designs of the silver commems, and the typeset is currently trading at $9,600 wholesale.

Many of the silver commems were minted and sold as PDS sets, which include one each of a given design minted at the Philadelphia, Denver, and San Francisco mints in the same year. While some of these sets were broken up, there is a natural tendency for individuals and dealers to keep the sets intact, thus reducing the supply of that issue available in the market. As above, the 144-piece complete set would include all three coins of each PDS set, but only one coin of each design would be used in the 50-coin typeset. Where PDS sets are recommended, smaller portfolios may choose to include only a single coin of that type.

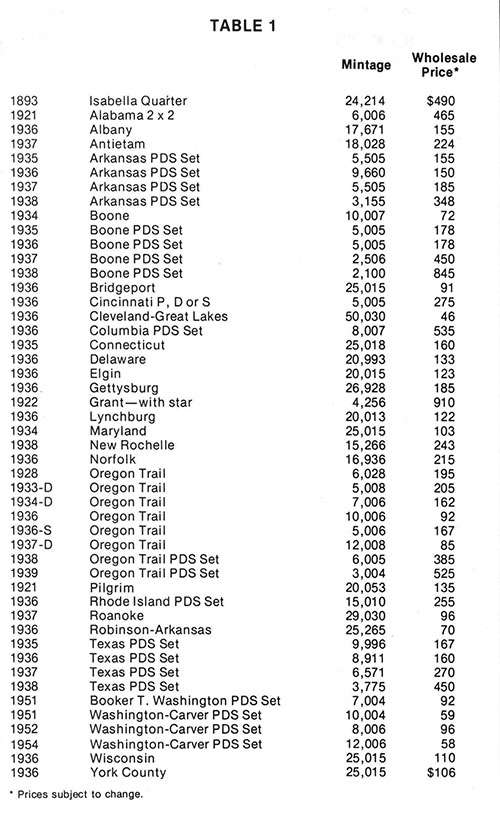

The issues listed in Table 1 are recommended for purchase at this time and can be expected to outperform the commem series as a whole. (Space considerations do not permit a discussion of each individual coin here.)

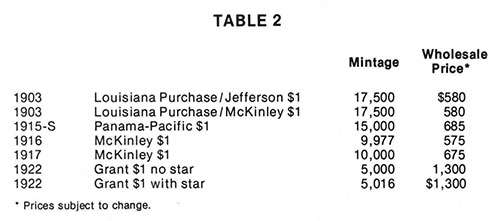

Gold. Currently trading at $11,250 wholesale in BU-65 condition, the gold commem set contains 11 coins. They are all $1 denominations except the $2½ Panama-Pacific and Sesquicentennial. Although some of these coins have been circulated or placed into jewelry, probably 80 percent of all the gold commemoratives are still retained in uncirculated condition. The gold commems received a wider distribution than the silver. Because of their higher face value and issue price, along with generally lower mintages, the gold coins tended to go into individual collections rather than into accumulations of quantity as some of the silver commems did. Consequently, no single holding is liable to appear and seriously distort the market price.

The low mintage of the gold commems relative to their current prices is dramatically illustrated by a comparison with circulation-issue gold coins. The common-date $1 gold coins in MS-65 condition are currently trading around $975 in the wholesale market. The least-expensive uncirculated US gold coin is the $5 Liberty, currently trading around $200 in MS-60 condition. Since over 8 million of this type were minted, the two Louisiana Purchase commems with mintages of 17,500 each and a wholesale price of $580 in MS-65 condition look like excellent buys.

Over the next three to five years, I believe the gold commemoratives listed in Table 2 will show above-average appreciation.

BUYING TIPS

The recommended commems should be purchased only in MS-65 condition. This is shorthand for "Mint State 65" and is also referred to as BU-65 or simply 65. It refers to a 70-point grading scale where 70 is perfect, although virtually no coins are MS-70. The numerical grading scale generally uses five-point intervals, down to the 12-point level. MS-65 is the high end of the uncirculated range; MS-60 is the low end.

Within the uncirculated category, there are substantial differences in price and appearance depending on the quality of the original impression and on the handling of the coin after it left the Mint's presses. An MS-65 coin is distinguished by a strong "strike" (impression) and a minimum of "bag marks." Bag marks are surface abrasions caused by coins jostling against one another during the minting process or the shipment of coins in bags. All coins, except for the few rare MS-70s, have some bag marks. In my 15 years of dealing in coins, I have seen only three collector coins that I would rate MS-70. MS-65 coins are the highest condition generally available and are considered the "top of the line."

The prices quoted here are wholesale prices for coins in MS-65 condition. They are subject to market fluctuations and do not include commission. When you purchase coins, request an itemized invoice listing the grade of each coin and the price paid. Also, request a written guarantee that the coins are genuine. These are reasonable requests, and you should only do business with dealers who are willing to comply with them.

Counterfeits of the following commems have been seen: 1936 Cincinnati 50 cents, 1928 Hawaii 50 cents, 1900 Lafayette $1, 1903 Louisiana Purchase/McKinley $1, 1917 McKinley $1, 1915-S Panama-Pacific $1 and $2½, and 1926 Sesquicentennial $2½. These counterfeits can be distinguished from genuine coins by proper inspection. It is important to deal only with established reputable dealers and to obtain a written guarantee of authenticity. Counterfeits are not prevalent, but they do exist. For every person I know who has inadvertently purchased a counterfeit, I know 20 who have been frightened away from coin investment by the threat of counterfeits and have thereby missed out on the real profits in rare coins.

There are two certification services that will authenticate your coins for a modest fee based on the value of the coins: American Numismatic Association Certification Service (818 North Cascade Ave., Colorado Springs, CO 80903), and International Numismatic Society Authentication Bureau (P.O. Box 19386, Washington, D.C. 20036). A primer on counterfeit detection is available in my article, "Detecting Counterfeit Coins," REASON, June 1976.

With these commonsense precautions and the help of a reliable and experienced dealer or broker, you can take advantage of the coming bull market in US commemorative coins. Although there are many excellent areas for profit in rare coins, the advantages I have outlined make the commemorative my first choice in an opportunity-packed field. A few individual issues have already done well, but the series as a whole has not moved up yet with much vigor. Therefore, I believe the major increases are still ahead. Select and purchase what you can afford, and hang on for the ride.

Mr. Perschke is president of Numisco, Inc., a rare coin brokerage firm. He also publishes two advisory services, the Numisco Letter on rare coins and the Independent Speculator on foreign currency and precious metals trading.

This article originally appeared in print under the headline "The Coming Bull Market in US Commemorative Coins."

Hide Comments (0)

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Mute this user?

Ban this user?

Un-ban this user?

Nuke this user?

Un-nuke this user?

Flag this comment?

Un-flag this comment?