Diamonds

The portable tax haven

What about off-shore tax havens? Tax lawyers, accountants, and financial and tax consultants sooner or later hear this question. Why the query? Those asking about foreign tax havens are interested in:

- secrecy in existence of property,

- secrecy in existence of income,

- security of property from predators such as governments and legitimate creditors, or

- the few remaining esoteric, legitimate tax savings available through international tax planning.

The questioner never cares about the fourth reason. The other three per se do not involve criminal behavior but would if the existence of the tax haven cache or scheme were denied on a tax form or at a conference, examination, or hearing. There is nothing illegal, even under our oppressive law, about a foreign bank account. The law is violated when a citizen confesses on a government form and lies about the off-shore bank account or entity—for example, when the haven seeker files a financial statement as the result of judicial proceedings enforcing an Internal Revenue Service summons and the financial statement understates assets by the amount on deposit in George Town, Cayman Islands.

But who will know—right? Wrong!

Who will know could easily be the Intelligence Division of the IRS. A few years ago, IRS special agents implemented "Project Leprechaun" in Nassau, George Town, and Miami. They had passwords and countersigns. Their lock picks and vans with electronic impedimenta were so sophisticated that the Impossible Mission Force would have been green with envy. The IRS hired prostitutes and gave them the code name "The Mata Hari Corps." Mata would entertain a bank official while Harry would pilfer the john's briefcase for the book with secret account numbers and, in some cases, code names that go with those numbers. In some cases, the IRS agent would look for the names of shareholders in secret haven corporations. Prostitutes were paid out of the Treasury of the United States—literally for once, and not just figuratively. The IRS is continuing its investigation of foreign tax havens with the same lack of gentlemanly courtesy.

IN SEARCH OF SECRECY

Three of these reasons for interest in foreign tax havens center on that precious and elusive quality: anonymity. Yet anonymity, both in the existence of property and in the existence of income, is not as certain as promoters of foreign tax havens have proclaimed. The culprits are the French, notoriously the most adept tax cheaters on the planet.

The French have sought the sanctuary of neighboring Switzerland to hide their wealth from the French Recezeur des Contributions Directes, whose appetite is just as insatiable as that of the Internal Revenue Service. The Swiss yielded to pressure from the governments of France and other nations. Within the last five years Switzerland and the Cayman Islands, a British Crown Colony—the two most popular tax havens for Americans—have set up the machinery to disclose information to nosy government agents. In Switzerland, this machinery takes the form of mutual disclosure treaties. In the Caymans, which have no such treaty with the United States, it takes the form of a new Caymanian law.

Under the new law, any government authority can gain access to Caymanian bank records upon the filing of an affidavit alleging behavior that would be a crime in the Cayman Islands. Although tax evasion is not a crime by Caymanian lights, there are enough crimes common to both the United States and the Gulf tax haven to enable the IRS or the FBI to swear to an entire buffet of criminal behavior instead of tax evasion, and government agents have been known to lie under oath when they really want to "get" somebody.

For access to Swiss banking records, all the IRS need do is claim that the depositor is suspected of tax fraud. The linguistic Swiss, however, through a decision of their federal supreme court, distinguish between tax fraud and simple tax evasion. The former is discoverable under the treaty; the latter is not. Most of what the IRS calls tax fraud, the Swiss call simple tax evasion, and privacy survives in spite of a treaty with the United States. The point is, however: the legal machinery exists to enable the Swiss to divulge bank secrets to the US government. The assurances that this does not or likely will not happen are assurances of government officers who can vacillate—and perhaps even lie as well and as frequently as American government agents.

Yet many are still captivated by the mystique of foreign tax havens with tropical cohorts helping Americans keep wealth from official predators and Zurich bankers regaling visitors with tales of international intrigue involving state treasuries purloined by escaping dictators. Then too, there is the status achieved when one has a foreign bank account or off-shore corporation.

While the prevailing motivation for fascination in foreign tax machinations is anonymity, the need for it becomes critical precisely when a government investigator, lawyer, or judge asks the direct question, "Do you own or have an interest in a foreign bank account or entity?"—a question that can evoke only three answers: "Yes"; "I refuse to answer on the grounds that my answer may tend to incriminate me"; and "No."

The "No" answer would be a lie under oath and the crime of perjury. True, there is virtually no chance of "getting caught" with sophisticated foreign tax planning; however, the anonymity becomes vital to prevent prosecution, and foreign government agents are still government agents and therefore cannot be trusted.

If that is not enough: property with a foreign locus is not portable. Portability is as important to those interested in foreign tax havens as is anonymity, and a foreign tax haven's main deficiency is that it is foreign.

WHY DIAMONDS?

The perfect tax haven is anonymous, portable, not foreign, liquid, and appreciating in value. It, of necessity, would be property of intrinsic value. Gold and silver have too much mass in relation to value to be portable. Art treasures are not liquid. The ideal tax haven is one that is the property itself, property that combines anonymity, portability, availability, and liquidity. And what property haven meets these criteria? Diamonds.

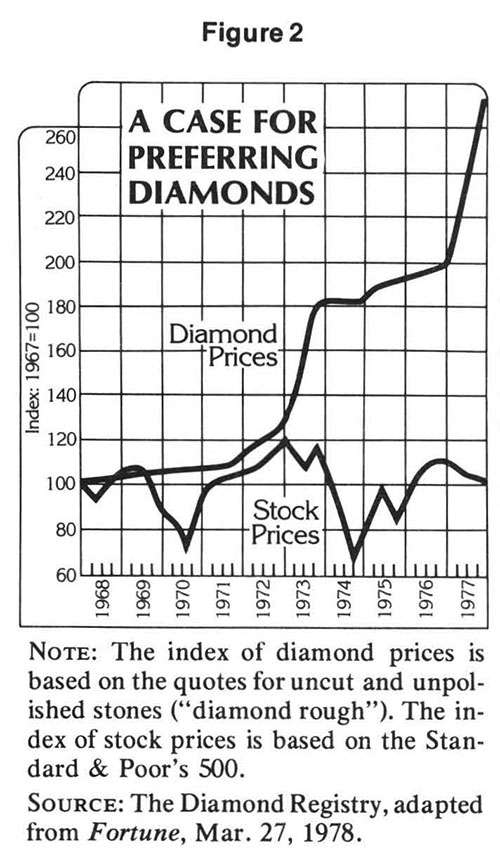

Over the last seven years, diamonds of investment quality have appreciated in value, on the average, better than 25 percent per year. The prospect for more appreciation is even greater.

Inflation increases the value of diamonds, as does whatever happens in Africa. South Africans are buying and hiding diamonds, thereby reducing the supply. Miners must dig deeper into the volcanic pipe to find diamonds. Diamonds found deep in the pipe are poorer in clarity and color than those found near the surface. (The 44.5 carat Hope Diamond was found in a stream in India!) Black majority rule in South Africa, especially if won by rebellion or invasion, most likely would trigger the flooding of the diamond mines with water kept out only by the skill and technology of white Afrikaaner technicians. This is precisely what happened in Angola a few years ago.

The market, uninfluenced by any government and therefore free, in one sense, is yet manipulated upward by the supplier, DeBeers Consolidated Mines of South Africa. Liquidity, however, can still be a problem for short-term investment of less than 18 months, but as investor demand for diamonds continues to increase, so does liquidity.

The biggest obstacle to diamond investment is the mystery that surrounds diamonds and the resultant inability to be certain that the price of the diamonds purchased is the lowest possible price. This mystery can breed sharp practices and fraud.

Yet diamonds remain the hardest of the "hard money" and offer the investor more advantages than foreign tax havens. Hard-money advocates increasingly are adding investment-quality diamonds to their doomsday portfolios. The sparkle has been dulled, however, by certain cloudy practices that have crept into this, one of the fastest-growing new investment markets. Many investors are disappointed because, even though the price of investment diamonds has risen substantially, the resale value of their investment has not risen as much. In some cases, these investors find out a year later that it is difficult to sell the diamonds for what they paid for them and that they must wait 18 months or two years to realize a gain. Diamonds can be a good investment and a near-perfect hedge against inflation, but only if investors understand basic principles of diamond economics and if investment diamond houses avoid the temptation to exploit confusion. For the savvy investor dealing with the credible investment house, diamonds can be the best investment for these sorry times of government money grabbing, double-digit inflation, and monetary uncertainty.

DIAMOND SAVVY

Education in the investment diamond market starts with a basic understanding of these traps for the unwary:

Diamond dealers who don't know much more than neophytes about diamonds. The diamond market is virtually unregulated. There are no tests or requirements for becoming a diamond seller. And many people in this trade lack basic knowledge about the technology and economics of diamonds.

Antique shops, jewelry stores, gold and silver dealers, and pawnbrokers are becoming overnight "experts" in investment-grade diamonds. Usually having built up trust with the prospect from prior transactions, many of these part-time diamond dealers take advantage of that trust by overpricing. The diamond investor can protect against such overpricing by dealing only with professional diamond brokers selling only quality investment diamonds certified by the Gemological Institute of America (GIA), a nonprofit gem-grading laboratory located in New York City and in California in Los Angeles and Santa Monica.

The highest-quality diamonds, and generally the best investments, are called investment-grade, not to be confused with diamonds for jewelry, called cosmetic-grade, or with industrial diamonds. The primary keys to determining diamond quality are the four Cs: carat, color, clarity, and cut.

Carat is named after the tiny carob seed used since ancient times as a minuscule unit of measurement. A diamond's per carat value increases geometrically as the carat weight increases. So, a two-carat diamond of a particular clarity, color, and cut is worth more than two times the value of a one-carat diamond of the same clarity, color, and cut. Until recently, diamonds of less than one carat were not popular as investments in the United States, but that situation has changed, making the investment diamond market more accessible to small investors. An investor can purchase an investment-grade half-carat diamond for as low as $1,500. Currently, it takes $4,500 to start an investment portfolio with diamonds of one carat or larger.

Jewelers classify diamonds by color as white or blue-white, faint yellow, or other colors. True diamond professionals, however, do not grade colors with descriptive terms. In the language of the professional, the best diamond is not classified as white or blue-white. The highest color grade is D on the GIA color table for diamonds. A diamond is downgraded E, F, G, etc., as it takes on a color or becomes cloudy, losing what is called "the ice effect." To the untrained eye, these colors look alike. The only way a buyer can be sure of a diamond's color grade without actually matching it to comparison standard stones is to read the color rating on the GIA certificate. The optimum color grades are D, E, F, G, and H.

The highest clarity grade is flawless and, next to that, internally flawless. Stones of such quality are exceedingly rare, however. Even the next-highest clarity grade, VVS-1, is difficult to find on the investment market. The difference between a VVS-1, which stands for very, very slight inclusion of the first degree, and a diamond that is flawless or internally flawless is the presence in the VVS-1 of one to three tiny pinpoint inclusions in the stone. These only affect the grade when visible under ten-power magnification. As the number and size of inclusions increase, under the GIA clarity rating system, the grade drops from VVS-1 to VVS-2 to VS-1 to VS-2. Clarity grades below VS-2, like SI-1 and SI-2 and lower, are not acceptable as optimum investment-grade stones.

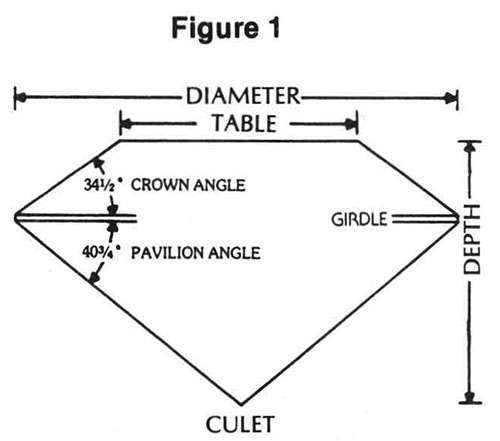

The cut, or "make," of a stone refers to the stone's physical dimensions, computed as ratios and expressed as percentages. The ideal investment stone is the round brilliant cut with 58 facets. Often, in order to save a portion of a rough diamond that excels in color and clarity, a diamond will be cut in a familiar round brilliant shape but not exactly according to the classical blueprint for that cut. To the degree that it varies from the classical exemplar in dimensions and shape, a diamond loses value. The GIA certificate for a diamond shows the stone's depth percentage, crown angles, and table sizes. The depth percentage reflects the relationship between the diameter of the diamond and its depth (Figure 1). Acceptable investment diamonds have a depth percentage between 58 and 63. The ideal crown angle for an investment stone is 34½ degrees. The crown angle will not be mentioned at all on the GIA certificate unless it is 30 degrees or less. The table size is a percentage expressing the relationship between the table, or the flat top of the stone, and the diameter of the stone measured at the girdle. For investment stones, the table percentage should range between 54 and 65 percent, with 60 percent preferred.

No "pedigree." By this time it should be obvious that the descriptive details of the GIA certificate are absolutely necessary in determining a stone's value. Yet many diamond houses palm off diamonds without GIA certificates! They rationalize that GIA does not evaluate diamonds under one carat—which is not true. People who say that are marketing diamonds with a brand "X" certificate that does not indicate poor crown angles. The California GIA labs have always graded smaller carats, and they always indicate poor crown angles (30 degrees or less), which rates a major reduction in that particular diamond's value.

Buying a diamond without a GIA certificate is like buying an automobile from a juvenile delinquent on a street corner without an automobile title certificate. The GIA certificate shows physical factors that determine value, but it also contains information that identifies a diamond so that the investor can be sure that the stone purchased is the diamond referred to in the certificate. For example, a micrometer is used to measure the dimensions of the stone. Like snowflakes and fingerprints, no two diamonds are exactly alike. Some diamond houses claim they are staffed by GIA graduates using GIA standards. In the same breath they mention the word certificate. But the paper presented upon delivery is not a GIA certificate and will not be accepted as certification by diamond professionals. This is important for two reasons: the diamond is usually worth less than represented because its color, clarity, or cut is not as claimed; and without a GIA certificate the diamond is hardly liquid if the buyer decides to sell.

"I can get it for you wholesale." Many diamond houses claim to be selling at wholesale or at wholesale prices. The term wholesale is a misnomer. Something that is not sold for resale cannot be sold at wholesale, and investment diamonds are not sold to be sold again at retail. Rather than selling diamonds at a set price—the price to the broker—and charging a brokerage fee, diamond dealers have been selling diamonds at a sale price that includes their profit. Most diamond dealers have mark-ups of over 35 percent; some even go over 100 percent. A few have mark-ups considerably below 35 percent.

Leverage. Using a "leverage contract" can be called trading diamonds on margin. A prospective diamond investor with $10,000 who is interested in buying a diamond for $10,000 is told that twice the amount's "value" can be "tied up" at current prices by using the $10,000 as a down payment and paying off the balance in usually six monthly installments with a little interest. There is one diamond house that even allows you five years to pay off your purchase. No diamond is delivered until final payment is made. Before delivery, however, the diamond house representative tells the investor that diamonds have risen in price and prospects look good for further increases—virtually always a truthful statement. The representative then suggests a "roll over" of the position originally costing $20,000 and now worth, say, $25,000 to "tie up" diamonds worth $40,000 to $50,000. Still, no diamonds have been delivered.

The nagging question is: Are those diamonds you are purchasing really there? Or is the whole thing a gigantic Ponzi scheme with no diamonds or very few diamonds to be delivered, with the investor merely moving from one diamond investment position to another on paper only? And some of these leverage contracts are not even on paper. The big danger with this musical chairs game is that the music might stop and you might not get a chair. There are many variations of leverage contracts in diamonds, and some are better than others. For example, a contract to buy specific diamonds in installments with delivery upon full payment maximizes safety in a leverage diamond contract.

The liquidity problem. Investment diamonds are today where gold and silver were in the years 1968-70. Then, liquidity of precious metals was not optimum, but those who invested in metals of proven intrinsic value before precious metal investments became popular realized gains as liquidity increased. Such investors hoped to hedge against inflation. That they did, and more. Eventually competition forced a stabilization of gold and silver prices by narrowing the gap between the bid price and the ask price. Price quotes from markets became common, so that today an investor can make one phone call and find out the current price of gold and silver.

As with precious metals, the liquidity problem in diamonds is being solved by increased competition and volume caused by the popularity of diamonds as an investment. One wire house, or large investment broker, dealing in securities as well as other investments, Shearson Hayden Stone, has formed a company, Polygon, to deal in diamonds. This is a significant step in bringing liquidity to the diamond market because a buyer can be sure of selling a diamond in a known price range on the same day it is purchased if he or she wants to. E.F. Hutton is another wire house considering the brokerage of investment diamonds. In France, the Rothschild Bank and the IndoSuez Bank are already offering diamond investment programs.

Diamond brokers, as expected, are optimistic about the liquidity of investment diamonds.

Gerry Hauser of La Jolla Diamonds, a company that buys as well as sells investment diamonds, told this writer: "We handle the liquidity problem by affiliating with a member of the New York Diamond Dealers Club, one of 14 international diamond bourses. This maximizes the current liquidity. Nevertheless, we recommend holding a stone for at least 18 months and preferably longer before selling. This time period not only assures maximum liquidity; it exceeds the required holding period for capital gain treatment of any realized gain instead of tax treatment as ordinary income. Those who invest in diamonds do so as a hedge against inflation and are not interested in short-term gain or in speculating in the diamond market. Some investors 'liquidate' by trading their diamonds for real estate or other forms of property. For instance, you might have a stone appraised at $60,000 which cannot be sold immediately for more than $50,000 but which someone might exchange for real estate worth $60,000."

On the whole, the prospects for better liquidity in investment diamonds are bright. Liquidity is likely to be a factor in the rise of the price of diamonds the way it was in the rise of the price of gold in the early 1970s. So an investor who buys diamonds now before the coming increase in liquidity should realize the same sharp gains realized by early gold investors.

Buy back. The government objects to diamond sellers' promising to buy back a diamond at any price. No doubt this is supposed to "protect" people, but the government's reasoning here is as specious as the justification for government intervention at all. Nevertheless, buy back plans are tricky, and you can get less than you bargained for.

A typical plan involves a promise by the seller to buy the diamond back discounted 15 percent from the seller's list price, plus the seller charges an additional two percent handling fee to cover the seller in market fluctuation. One diamond house tacks on a buy-back commission to the sales price of the diamond when the diamond is sold to the investor. Such liquidity insurance is costly because the investor may never sell the diamond or may sell the diamond through another house, but he still pays the buy-back commission.

The low ball. Mystery still surrounds diamond pricing. An investment diamond dealer may offer, as an example, a one-carat round-cut diamond of fairly good proportions with a clarity grade of VVS-2 and a color grade of F for a bargain $7,000. Unlike security purchases, a diamond deal can never be consummated until the stone actually changes hands. When the dealer goes to the operations manager of the diamond house he finds out, to his chagrin and the investor's, that that particular diamond just happened to be sold as the representative was discussing this transaction with the investor. But, fortunately for the investor, there is another good deal in the inventory that just came in: a VVS-1, G color, 1.05-carat round diamond of better proportions. The price is $10,000. The first, bargain deal was in fact commercially impossible. The second is not good but is realistic and is profitable for the diamond house. If the prospect does not want to invest more than $7,000, a different-quality stone that is not such a good deal can easily be found in the inventory. This stone—one-carat, VS-2, F color—is the one the dealer had in mind all along.

As with buying a new car, the low ball is an effective sales technique because of the many variables that go into pricing. In automobile pricing the variables are automatic transmission, power windows, bigger engine, tape deck. In diamond pricing, the variables are carat, size, clarity, color, table and depth percentages, etc. The many variables in diamond pricing and the interplay between them make it difficult for the investor to spot the gap between the low ball and the commercially feasible price.

The rip off. One reason why investors buy diamonds is for their hard-money features—intrinsic value held anonymously by the investor. This trait of diamond investing is frustrated by the so-called leverage contract. It also is frustrated when stones are turned over to another for any reason, such as certification by a diamond laboratory or appraisal. A wise buyer always asks for a purchase order or confirmation describing the deposit and setting a value, even if this "value" is less than the actual value of the stones. Otherwise, the buyer has no proof of ownership.

Another rule: never show a diamond dealer or anyone else two stones at the same time, but wait until the first stone is examined and taken off the table before the next stone is displayed. Examination of two stones at the same time facilitates a switch of a stone of lesser value or even a fake diamond. Of the fake diamonds, the most realistic is cubic zirconium, a man-grown crystal with a weight about 1.5 times that of diamonds but worth only about $60 per carat.

Again, the GIA certificate and a check with a micrometer to make sure the diamond offered is the one referred to in the certificate protects the buyer from a switch of a phony stone for a diamond. A good way to ascertain the authenticity of a diamond is to instruct the seller to mail the diamond through GIA, which then certifies not only the grading of the diamond but also the authenticity.

DIAMONDS FOR PROFITS

Figure 2 shows the performance of diamonds compared to stocks. Note the smooth, steady, upward rise in investment diamond values. Prices are set by DeBeer's marketing arm, the Central Selling Organization, headquartered in London. This sales entity markets 85 percent of the world's diamonds. When demand is low, it withholds supply, and in the first half of 1978, for example, DeBeers placed four surcharges on rough diamonds in fulfillment of its stated objective of supporting market stability.

This writer does not advise diamonds as a medium for tax fraud. What the harried American investor does with the anonymity and the portability of his or her diamonds is none of this writer's business. As with foreign tax havens, merely keeping wealth cloaked with anonymity is not a crime even under the Internal Revenue Code. The taxpayer becomes a "criminal" by government standards when the existence of property is denied on a financial statement or when income in the form of gain is not reported on tax returns. The fact that such "crimes" are hard to detect when anonymous wealth is kept in the form of diamonds does not make tax evasion any less a "crime." It merely reduces the government's ability to detect the "crime" and to prosecute.

Perhaps the greatest potential loss in government revenue resulting from the anonymity and portability of diamonds comes in the area of death taxes. An elderly or dying taxpayer with property that appreciated, for instance, from $100,000 to $1,100,000 may well be tempted to liquidate his recorded property holdings and purchase $1 million worth of anonymous and portable investment diamonds to distribute to the objects of his bounty. This lifetime giving is subject to the federal gift tax, which is the same as the federal estate tax and which can be over 70 percent. Even if the cynical entrepreneur once submitted a truthful financial statement to the government or to a bank (same difference), the missing million cannot be traced to the recipients of this "criminal" largesse without their help. Perhaps Daddy Warbucks lost the proceeds from the sale of the estate in Las Vegas or Atlantic City. If the diamond transaction is discovered, which is unlikely in this scenario, that young gold-digger whom Daddy had ensconced in a condominium had cajoled the old fool into giving her those diamonds, thereby defeating the valid probate claims of bereaved heirs, etc.

About the only recourse available to the IRS is setting aside a transfer they can only imagine, assessing imaginary transferee liability, or using their "indirect method" of determining income by computing net worth based on visible purchases, bank deposits, or expenditures. If members of Daddy's family keep their mouths shut and do not flaunt their windfall, the IRS forage is frustrated.

Daddy did not just become a "tax criminal" in the twilight of his life. He probably rode the rising price of diamonds, selling for a gain, failing to report it, and replenishing his diamond investment portfolio with lower-priced stones in the unlikely event he needed diamonds to show the tax collector that he still had the original stones in the same number and even the same total carat weight. He probably gave the diamond broker a fictitious name.

Such opportunities, illegal though they may be, do not present themselves with foreign tax havens. Diamonds are, indeed, a tax haven at home.

John Joseph Matonis practices "antigovernment law" in San Diego, Calif., and Washington, D.C. He has won two cases against Food and Drug Administration regulations. Since 1973 he has been defending against the IRS's assault on property and freedoms.

This article originally appeared in print under the headline "Diamonds."

Hide Comments (0)

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Mute this user?

Ban this user?

Un-ban this user?

Nuke this user?

Un-nuke this user?

Flag this comment?

Un-flag this comment?