Are You Wasting Money on Life Insurance?

The "buy term and invest the difference" pitch has taken in many unwary buyers.

It happens all too often—some "investment advisor" hooks the unwary on "buy term and invest the difference."

"Buy term and invest the difference"—mercifully abbreviated here to BTID—has reappeared periodically ever since cash-value life insurance was invented. As each new crop of hopefuls has lost money on it, it has subsided or shifted practitioners or locale. But there is much ignorance or confusion among life insurance consumers.

This article is aimed at the investor who has no insurance background. In order to have a discussion of BTID, it is necessary to first describe the more common forms of insurance.

Life insurance is a rather simple idea. Since it is possible to determine the statistical probability of death for a given age group, it is also possible for many people to join forces to indemnify one another against the possibility of that statistical probability becoming an individual concern. Everyone dies sometime, usually without prior knowledge of the time of death. Life insurance mitigates the financial consequences of death (indemnifies), whether anticipated or unforeseen.

WHAT IS TERM, ANYWAY?

The most primitive form of life insurance is natural premium term insurance, most frequently encountered as yearly renewable term. Term insurance is a life insurance contract that promises to pay a specified amount (the face amount) to the beneficiaries of the insured if the insured's death occurs during the term of the contract. And that's all. If you die during the term, you win.

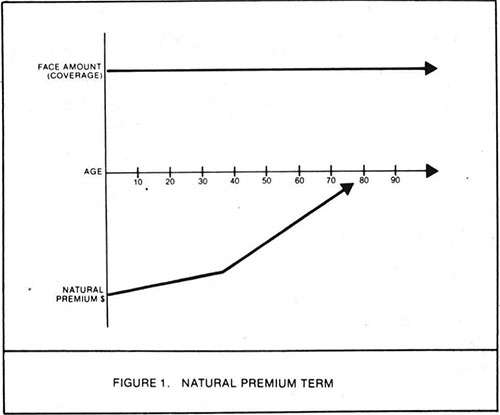

Premium refers to the payment(s) for an insurance contract. A natural premium is one that increases as the insured grows older, due to the increasing possibility of death. So with natural term, the life insurance contract follows Figure 1.

Some obvious observations are that natural premium term costs a lot of money after age 65 (and is no bargain after age 40), that the insurance under this contract is pure cost, and that there is nothing left if premium outlay ceases. There is term insurance on the market that is renewable to advanced ages, but a safe prediction is that any form of term insurance will be an expensive proposition after age 65. In fact, the vast majority of insurers do not offer the stuff for issue after that age.

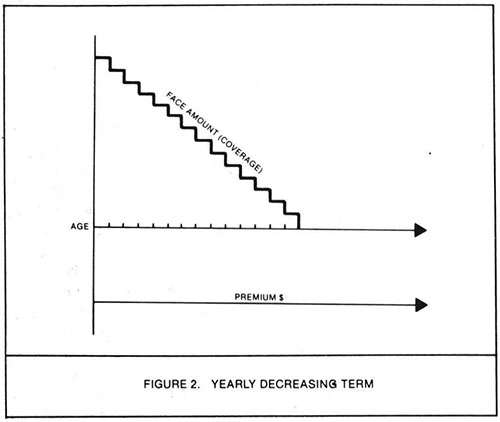

There are various arrangements of term. Most of them use a temporarily level premium, rather than a natural one, and offer decreasing coverage as the insured grows older. The most commonly encountered of these is yearly decreasing term, offered for terms of 5-30 years. In such contracts, the natural premium hasn't disappeared; it has simply been transformed. You pay a level premium throughout the term period, and you are insured for less face amount for the same premium dollar each year (see Figure 2).

The obvious application for these contracts is indemnity against death during a period of declining indebtedness. Hence, yearly decreasing term is frequently sold as "mortgage insurance"—a misnomer, as mortgage insurance is legally another kettle of fish that does not concern us here.

There are hundreds of variants of term insurance, but with the basics in hand we can move on to the more sophisticated realm of cash-value life insurance.

THE CASH VALUE INSURANCE

Cash-value life insurance is most commonly termed ordinary or whole-life life insurance. These contracts vary greatly in structure and performance depending upon the type and quality of company offering them. The three classifications of underwriting, or insuring, companies are: stock companies, mutual companies, and "mixed" companies.

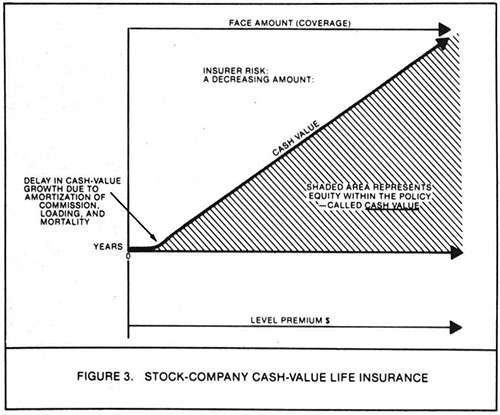

A stock company is one that is owned by stockholders. Contracts issued to indemnify against death of the insureds guarantee a cash value for the end of each policy year, following amortization of commission, loading, and mortality costs. Any profit made (that is, return above guaranteed cash values) is shared among stockholders or reinvested. This type of company varies widely in rates of return, liberality of contract provisions, and general packaging, but Figure 3 illustrates generally how contracts issued by such companies function.

Here we have achieved both a level face amount (coverage) and a level premium. The mechanism is elegant.

Should the insured die, the cash value is absorbed by the company, and the face amount is tendered to the beneficiaries. Should the insured live beyond the period for which he wishes to indemnify against his death, he may liquidate the contract and extract the cash value. In addition, the insured usually has the contractual privilege of borrowing up to a specified percentage of the cash value at a guaranteed rate of interest. This greatly reduces the tie-up of liquidity otherwise attendant upon such a contract and provides for many millions of persons their only infallible source of credit. The availability of such loans is, as stated above, a contractual guarantee.

Stock-company cash values frequently fail to equal premium outlay and often are rather pathetic reflections of weak companies. Nonetheless, ordinary or whole-life contracts with the worst of such insurers do indemnify against the financial consequences of death (though term does that) and are reasonably continuable into later life. With the better insurers in this category, the cash values are significant, and premium outlay is generally less per unit of coverage than with mutual companies.

Note, however, that the one really significant lack in the offerings of such insurers is that there is no protection against the effects of inflation, other than the obvious one of premium payments being in increasingly inflated dollars as the contract continues.

The obvious shortcomings of the whole life contracts issued by the stock companies are most frequently played upon by the peddlers of BTID, who conveniently ignore or denigrate the solutions offered by the best of the mutual companies.

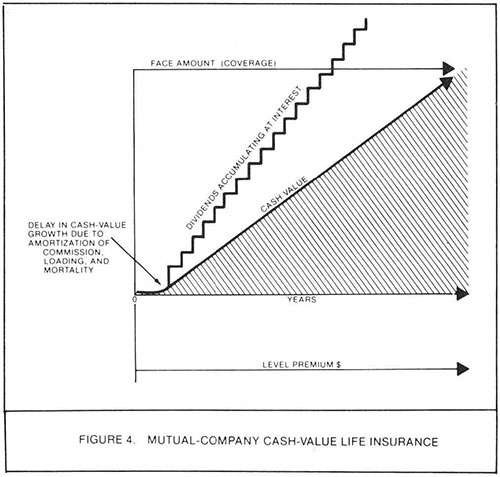

Mutual companies are owned, not by stockholders, but by the policyholders themselves. Such companies typically issue policies termed participating—meaning that the owner of the contract participates in the profits of the insuring company. Shared profits are called dividends, just as such profits are in stock ownership situations. Guaranteed cash values are represented, usually lower than those for similar coverage by stock companies. (Salesmen for stock companies tie themselves into intriguing knots trying to make the "guaranteed" in "guaranteed cash values" outweigh the overwhelming differences in return between their products and those of the better mutuals.)

Dividends paid by a mutual company are tax free, since the IRS defines such dividends as return of excess premiums. We have a hard-working insurance lobby in this country, and very deep support among legislators of all persuasions. That definition is very, very unlikely to change, technically incorrect though it is.

Usually, the dividend is available for a variety of uses, to be discussed later. For now, to illustrate a mutual-company whole-life contract, Figure 4 shows the dividend, paid annually after amortization and accumulating at interest. Graphically, the only real difference between Figure 3 and Figure 4 is the presence of a dividend. We have a level premium and apparently a level face amount, just as in the stock contract. Observe, though, that we have actually achieved a couple of other very important things. First, with the dividend retained at interest as shown, or with the dividend being used to purchase either additional paid-up insurance or whole-life additions, we in fact have increasing coverage to offset increasing insurance needs and a mechanism to reduce the effects of inflation. More on that in a while.

Mixed companies are those which issue (surprise) both participating and nonparticipating policies. We need not consider them separately.

MUTUAL ADVANTAGES

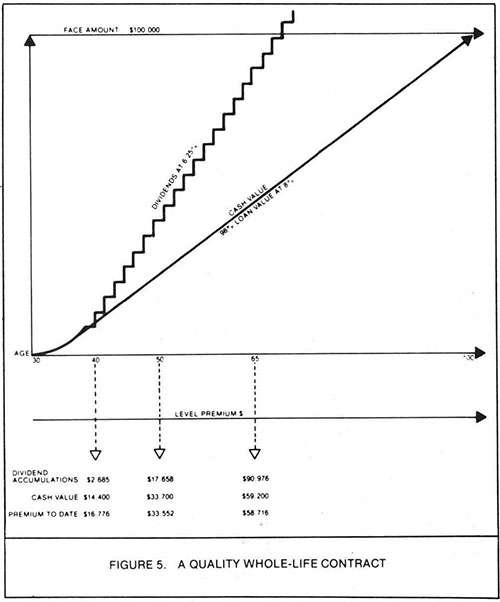

It should be obvious that the whole-life contract can be participating and still not be worth a hill of beans if the issuing company doesn't turn a regular profit. As stated above, the cash-value guarantees are generally lower in participating contracts. So the virtues of such contracts depend on the quality of the company offering them. The virtues of a good mutual-company contract can be seen by examining the specific New York Life contract illustration in Figure 5. We have a $100,000 policy on the life of a 30-year-old male. (Women, statistically, live three years and a smidgen longer, and their policies cost less). Assuming that the dividend remains at the 1977 level, and that the company continues to pay 6.25 percent on dividends left with the company at interest (a pessimistic pair of assumptions!), then in the 10th policy year, having paid $16,776 of premium (monthly payment by bank draft; annual rates are better), the combination of guaranteed cash value and dividends accumulated at interest, referred to as "total cash value," will be $17,085.

Because we have assumed successive payments of increasingly inflated dollars, we may partially disregard the effects of inflation. Remember, also, that we have chosen a top-line company with a long, unbroken record of dividend payments, and the dividend reflects this profit structure; so we can safely leave inflation out of the picture just now.

We have, then, a return over premium outlay of $309 in 10 years. That $100,000 of coverage hasn't cost a penny! At this point there are $2,685 of dividend accumulations, which can be stripped out if desired, and a cash value of $14,400; $14,112 of which (loan value = 98 percent of cash value in this policy) may be borrowed at eight percent if desired.

After 20 policy years, these figures are $51,358 of total cash value, consisting of a guaranteed cash value of $33,700 and dividend accumulation of $17,658. The total premium outlay is $33,552. At the insured's age 65, following the same assumptions, total cash value will be $150,176, total premium outlay $58,716. At that time, $59,200 would be the guaranteed cash value. Still disregarding inflation, should the company never pay another dime of dividend after initial sale of the illustrated policy, the coverage over 35 years would cost nothing but temporary liquidity tie-up.

Of course, we cannot ignore inflation altogether, any more than we can ignore the possibility of devaluations, runaway inflation of the Austrian variety, or widespread atomic holocaust. Because the participating contract is open-ended, it is safe to assume that currently occurring rates of inflation can be accommodated by the reflected profit structure, as postulated above. Devaluations of the American currency relative to the other world currencies are met best by possession of gold, silver, and large doses of fortitude. Here, the flexibility of the whole-life contract becomes very evident. Immediate anticipation of such a currency shift may be met by stripping out the dividend accumulations and fully borrowing up the loan value (98 percent) of the cash value, leaving a whopping two percent of the current cash value subject to devaluation. (You bought gold futures or the real thing with the cash, right?) Following readjustment of the economy, the cash value may be fleshed out again to regularize the policy if desired. Current time for such a course of action is around eight days on the West Coast for NYL. It can be done faster, but remember the 90-day clause on savings deposits, similar hedges against runs on other forms of cash tie-up (such as certificates of deposit), that habit of closing the market when stocks drop drastically and there is possibility of a panic.

Cash-value life insurance represents readily available money for the wary money-market watcher as well as for the average family. For atomic holocaust, shred the contract and use as you would an out-of-date catalog—sorry. But in the Great Depression, banks went like tenpins, and insurers puttered along at the same old stands. In the stock market setbacks of 1966, 1969, 1970, and 1975, cash values continued to be paid at the guaranteed rates and the dividends of the big mutual insurers never even boggled.

BTID VS. WHOLE-LIFE

Now we have some specifics for discussion, and we can begin on BTID. The basic argument for BTID is that it is theoretically possible to take the same dollar outlay as a whole-life contract entails; buy term insurance to match; and, through astute management, better the return on the dollar outlay, by using the difference between the price of term and that of whole-life as an investment base.

An interesting observation at this point is that the whole phenomenon of BTID is usually targeted on the already allocated whole-life dollar. Seldom is the victim new to insurance. The war cry of the BTID peddler is "How much money are you wasting on life insurance?" Most BTID schemes are assembled to take advantage of money that is already budgeted as long-term outgo, money that is more vulnerable than that available for elective spending. The BTID peddler has a good idea that the consumer doesn't fully understand his policy and knows that people like to be considered unique and self-directed. So the whole-life contract is represented as good only if you have no self-discipline to manage your own money or are unable to cope with the intricacies of finance. Of course, those who buy the BTID scheme often find that they have less control of their finances than they had with their old whole-life contract, but it is an expensive lesson to learn.

This aspect of BTID persuasion is occasionally quite ruthless. I recently heard of a chap who is preying on the members of a fundamentalist religious group, packing along a Bible to demonstrate his piety and to assist in establishing the expectation that the world is going to end in another 17 years (exactly). With this approach, he succeeded in replacing a great number of whole-life contracts in religious homes. That sort of callousness seems to be little short of criminal, but it is making money for the perpetrator.

I am not going to say that it is impossible to use term, invest money that otherwise would be put into a whole-life contract, and wind up with more money than a whole-life contract would yield. But to thus increase the return on your premium dollar means increasing the risk or decreasing the flexibility of your investment in whole life. Whole life is not the only thing you should have in your portfolio; it is the first thing you should have there if you have a dependency situation or intend to establish such a situation.

Let's look at some figures for New York Life early renewable term insurance for our hypothetical man. A $100,000 yearly renewable term policy will cost, for that same 30-year-old male, $3,241 over 10 years. That much, despite the fact that such term insurance with NYL, unlike any other term I've ever heard of, pays a dividend after the third year. Of course, only the cruder forms of BTID use yearly renewable term, but many are very crude indeed; and this form will make a point without going into generation-long comparisons.

Consider the dollars available for investment, after substituting yearly renewable term for whole life. In the first year, there is $120 available every month. By the 10th year, the price of the term has increased to the point where there is only $100 available every month in that year. Now, any investment must overcome the pure cost of insurance and yield enough to beat the performance of the whole life. Can it be done? Of course. But without increasing the risk? Highly doubtful. And the cost of reentry to permanent insurance, should it be needed for later life, has gone up. Assuming that the price of that particular contract remains the same for 10 years, $100,000 of whole life initiated at age 40 would entail outlay of $24,336 for 10 years as opposed to $16,776. That's quite a penalty for a decade of BTID.

So if you anticipate a need for insurance in your later years, you are unquestionably better off using a whole-life contract initiated as early in your life as is feasible. Term carries a conversion privilege, as a rule, permitting the later purchase of whole life of like amount. So term as a temporary solution to your insurance needs is not to be despised if that is all you can afford or if your insurance needs are truly temporary. As a rough rule of thumb, if you anticipate less than 10 years of need for insurance, you might consider term insurance rather than whole life.

UNMENTIONED FACTORS

The cruel part of the BTID scenario is that the vast majority of victims never invest the money "freed" by dropping their whole-life contract and substituting term. In that case, a person who had made a good sound investment at an age when it was, perhaps, feasible for him to realize something from the whole-life contract finds himself saddled with an increasingly expensive term contract that never pays back a dime. Or, the "difference" is invested, but the investment doesn't perform quite the way it was supposed to, or it just plain flops.

There are BTID schemes available that are quite complex and present much more sophisticated arguments than that Bible toter I mentioned. One of these was presented in the Ruff Times in July of 1977. As closely as I could figure out from the article it involved ten year renewable term, renewable to age 100, which is unusual, and a form of investment through an insurance company which carried stringent penalties for early withdrawal. Great stress was placed on the "confiscation" of cash values that occurs when someone dies holding a cash-value policy. As demonstrated earlier, however, if there is no buildup of cash values to reduce risk to the insurer, there can be no permanently level premium arrangement. But this is casually or venally ignored by those who are attempting to shake loose a premium dollar or two.

The Ruff Times scheme was interesting in that the verbal gymnastics were particularly tortuous; after discarding mutual company dividends from consideration because of their tax-free status, the fellow who was selling the BTID idea mentioned that the investment portion of his package was tax-free as it earned and on distribution because of a section of the Internal Revenue Code. I found myself seized of an awful suspicion that the section would turn out to be the same section granting immunity to mutual company dividends; all the arrangements were going through an insurance company, and I've never heard of anything else carrying that immunity from taxation. In short, as nearly as I could figure it, what was being offered was an opportunity to surrender whole life contracts and buy a plan that was stripped of all flexibility, but that was nothing but a distorted sort of participating contract.

There are some other considerations in the comparison of whole life versus BTID. Foremost of these is the widely available waiver-of-premium rider. Under that rider, which is sold as a matter of course on many whole-life policies, if the insured becomes totally disabled, the company will pay the premium for his policy, following a qualifying period. With NYL, if total disability lasts six months, the company will refund premiums back to the date of onset of, and will continue to pay them for the duration of, the disability. It is a very rare investment that will continue to grow without the owner's ability to invest—and what BTID package contains a waiver of premium on the investment section of the package?

Another consideration that BTID advocates seldom mention is that of distribution. Assuming that a policyholder wishes to take monies accumulated in a whole-life contract, arrange an annuity payback, and so avoid the taxation penalties inherent in lump-sum distribution, such arrangements are usually guaranteed within the whole-life contract. The person liquidating any other form of investment is forced to go to an annuity or insurance company and purchase an annuity at the then-current market price. There is usually a discount on the purchase of an annuity with monies accumulated in a vehicle sold by the annuity vendor, as well as a guaranteed annuity rate in the whole-life contract, should the insured find that, when he goes to arrange his annuity, the market price has become forbidding or unfavorable, in comparison with the guaranteed rate in the whole-life contract.

Yet another consideration is the "ease of dollar insertion." The whole-life contract provides for convenient payments of picayune amounts of dollars through an extended investment period. To best the performance of whole-life, the BTID schemes must permit equal ease of investment without significantly increasing the labor involved on the part of the user. If a BTID package means putting in any study of the market, or takes appreciable time to transact on a recurring basis, then the investor's time loss becomes a factor.

So, if approached with the BTID scam, consider the computations and comparisons made here. May you live happily to cash in your policies!

David Sutton sells life insurance for New York Life Insurance Co. He is also an outdoorsman, farmer, and survival expert.

This article originally appeared in print under the headline "Are You Wasting Money on Life Insurance? ."

Show Comments (0)