LIBRA

Electronic-age barter

When a monetary system collapses because of irresponsible action by government, how does commerce continue? One universal medium of exchange, of course, is gold. But when that same irresponsible government not only denies its citizens access to or effective use of this medium but squanders the national stock of it, gold is not a viable alternative. Petroleum is fairly universal but a bit messy to carry around in the pocket!

How about barter? Barter goes back about as far as civilization itself and certainly came before any monetary system. It is still widely practiced in Africa, South America, and the islands of the South Pacific. The inhabitants of islets of the Solomon Islands to this day barter with residents of the main islands, trading fish for vegetables and pigs. While not strictly barter, commodity money is certainly related; coconuts are still a medium of exchange in the Nicobar Islands in the Indian Ocean. Customs laws permitting, American cigarettes are a valued medium of exchange abroad, despite cancer warnings and a devalued dollar.

BEATING INFLATION AND TAXATION

Barter is gaining momentum in the United States as the most practical way to defeat the ravages of inflation and shortages and to sidestep the tax authorities in their zeal to become partners in every transaction. An orthodontist I know of had a luxurious home built almost entirely by exchanging the labor of craftsmen and contractors for his professional services in straightening their children's teeth. Some of his building materials were obtained in the same way. Tax-free trade among such items as vegetables, meat, fish, poultry, eggs, and milk is common in every farm community. We see weekly barter at the flea markets and swap meets at drive-in theaters across the country. Real estate trades are commonplace, ranging from the International Home Exchange to a current trade in escrow in my own community, in which a gas station, garage, home, and propane dealership, complete with tools, stock in trade, and two tow trucks, is being exchanged for 17 acres and a home. Securities trades go on every day as companies merge or reorganize. Large corporations seeking scarce materials but owning other scarce materials trade for them, and there are even thriving businesses to broker such transactions. During the materials shortages of 1973 and 1974 such practices were commonplace. So barter is not uncommon even in developed nations; indeed, international trade and trade balances depend on offsetting products and raw materials between the nations trading them.

The basic problem with barter, whether practiced internationally or individually, is that of bringing traders together. The "barter broker" is a necessary element. If I can design a microwave communications system for an oil company or an electronic control system for its pipelines, how can I find a client who will furnish me gasoline in wholesale lots in exchange for my work? Or if I have a Chippendale chair to trade for medical services, how do I find a physician who would like my chair?

AN ELECTRONIC BROKER

Modern data systems offer a partial solution to this problem. I have coined the acronym "LIBRA" from "Library of Information on Barter Recalled Automatically." LIBRA would be a computer—more properly an electronic data processing (EDP) system, since the computation involved is elementary—programmed to accept, file, process, and retrieve inputs from people willing to trade on a barter basis, listing their stock in trade, ways to reach them, and their needs. Anonymity through the first part of the bargaining process—possibly a necessary defense against inquiry by the tax collector as the idea catches on—can be preserved, as with a Swiss bank account, by a number and P.O. box or "drop" address and by other means known to EDP people but unwise printed at this stage.

The operation would be financed, at least until the monetary system indeed collapsed, by an entry or registration fee coupled with a small transaction fee. It might be organized as a cooperative corporation, in which all earnings must be returned to members in proportion to their use of the corporation, much as farmers cooperatives are organized. The latter are treated as nonprofit corporations for tax purposes federally and in most states.

In the larger cities there could be remote terminals—keyboard and cathode-ray-tube machines or Teletype machines—that would connect to LIBRA and to which clients could go and, upon proper identification, make their inquiries of the computer. A monthly publication could be distributed listing an abstract of the categories of goods and services available, for example, "Automobile mechanic, Orange County area" and "Antique furniture, Santa Cruz area," with a referral number. A LIBRA member seeking such specific goods or services would send his inquiry and transaction fee to LIBRA headquarters or the nearest terminal office and would receive the code numbers and drop addresses of those who can satisfy that need, whereupon they could bargain directly.

MULTIPARTY TRANSACTIONS

The availability of such a data bank would permit multidirectional transactions that are impossible by ordinary methods. I trade you a radio station design in exchange for your used sports car, but you deliver the car to a surgeon who performs a surgical operation on a patient who conveys to me some real estate that I want. LIBRA can be programmed to put such multiple transactions together, given input data on wants and needs of the members.

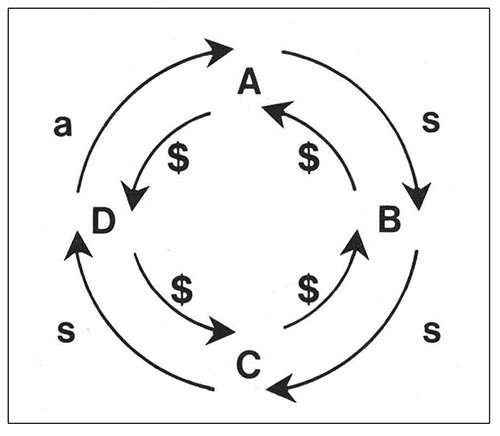

Consider the tax advantages. As the diagram indicates, Party A renders services to B in exchange for cash. A takes the cash and pays it to C for an asset. C uses the cash to hire D to do work for him, and finally, D has B do work for him. Money has changed hands four times around the circle in this example, and in each case the sticky hand of the tax collector is inserted into the transaction. A must pay tax on his income, but B may have no deduction for his expense. C may have a capital gain or earn ordinary income on his sale to A. D has tax on this income and so does B. How much better if the inside circle of the diagram is eliminated: A works for B, B works for D, D works for C, and C hands over an asset to A! Each gets more value received.

The IRS, of course, has rules seeking to tax even the "fair market value" of property received in lieu of income, but it is clear that exchanges of property are not taxable as income, and in certain statutory cases such as the sale of a residence where there is cash consideration intervening, the transaction is treated as a tax-free trade if another residence is built or purchased within the allowable times and other conditions are met (see J.K. Lasser, Your Income Tax [New York; Simon & Schuster, 1973 ed.], par. 29.011).

The rules are unclear on whether an exchange of services can be regarded as income. If a plumber plumbs an electrician's new home in exchange for the wiring of his own, I find no rule saying that each must hand over cash to the IRS. Services received simply are not included in the definitions of types of income in subchapter B, part I of the Internal Revenue Code. In any event, who is to determine the fair market value and how is the IRS computer to know of a transaction?—no forms have ever been printed to file such information, although, it must be admitted, that could be taken care of in short order.

INFLATION-PROOF CURRENCY

LIBRA could also be programmed to furnish a substitute currency, the IOU's of its members. You as an attorney, for example, agree with LIBRA to furnish 10 hours of legal services in exchange for the two gold crowns you have already received from a dentist who does not require your services. The dentist has a credit balance with LIBRA and you, the attorney, have a debit, both equivalent to 10 hours of your legal services. Later on, when a carpenter needs legal services and the dentist needs a new patio constructed, LIBRA balances the accounts. LIBRA can thus provide a kind of banking function, but all without reference to a monetary system.

If necessary, to establish more precise values, LIBRA could use some of the "paper gold" politicians fondly refer to by establishing a "gold unit" value for each debit or credit entry. One GU, for example, could be one-sixteenth of an ounce (or 20 or 30 grams) regardless of free-market price. One's savings, in the form of credit balances in GU's, would be inflation-proof with LIBRA. The participants are effectively trading in gold. The 10 hours of time one owes to the LIBRA bank remains 10 hours of time independently of inflation, and may be valued at 10 GU.

Naturally there are many details to be worked out. Safeguards would have to be established to prevent LIBRA from engaging in some deficit spending of its own if it moved from brokering into banking. Contracts would have to be framed to avoid misunderstandings and allow for future impossibility of performance, such as by death, etc. There are legal details to be worked out and security measures to be devised. LIBRA might become one of those "tax loopholes" that demagogues, to tighten their grasp on an ailing economy, are always seeking to plug. LIBRA's modus operandi might have to be flexible enough to keep it ahead of the politicians. But it is to be hoped that by the time it is really needed, the politicians will be too busy coping with the wreckage they created to bother with such a "harmless" endeavor.

Libertarians would be well advised to prepare some such system; it may be necessary a lot sooner than many people believe! Let the data processing experts and attorneys come forward in these honorable pages and debate the issue. How do we cope with the collapse of our monetary system?

R.W. Johnson is an independent consulting engineer in electronics and radio communications and has authored over 100 papers in professional and trade publications in his field and one popular book. Although his principal education has been in engineering, he has done graduate work in business administration and law. He is currently working on a book about energy and its mismanagement; a portion of the book appeared in REASON in May 1975.

This article originally appeared in print under the headline "LIBRA."

Show Comments (0)