International Monetary Politics

Few people fully realize what the International Monetary Fund is and what a significant effect the little-known group of finance ministers can have on everyone's financial security and life style. After nearly five years of inactivity, the IMF met in September 1975 and January 1976 for what the press publicized as "cataclysmic decisions." Rumors existed at the September conference in Washington that the 20 leading central bankers might "take their marbles and go home." By the time the interim committee met in Jamaica last January, most reporters had grown bored with the whole affair. One secret that has yet to enter the newspapers is that the central bankers did agree to do away with the official price of gold at $42.20 per ounce. That's a de facto 72-percent devaluation of the U.S. dollar and should have been front-page news in every newspaper in the world. Yet it was a mere footnote in one of the back pages of the IMF reports.

Although the Jamaican meeting was significant, the real issue lies in the very existence of the IMF, founded at Bretton Woods, New Hampshire, back in 1944. The structure of the IMF makes it an economic time bomb, and the international community is getting closer and closer to a blow-off stage. Under the pretense of mutual protection of its member countries, the IMF, along with the International Bank for Reconstruction and Development, has manipulated trade and controlled gold and currencies. Yet the manipulations have been a failure. Billions of dollars will change hands in the next few years as the financial world is turned upside down and the international network set up over 30 years ago will completely collapse. Farsighted people who can appreciate the economics of the situation will probably have tremendous opportunities and countless fortunes are likely to be made.

WHY THE IMF?

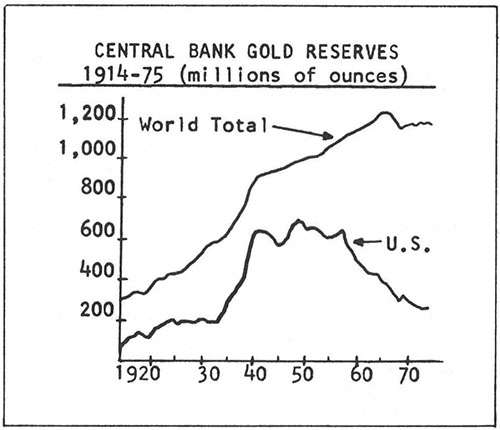

World finance was relatively stable until World War I, which strained the existing system. As nations were forced into a global struggle, new interdependence evolved. Finance ministers, thinking they needed a new world financial system, amended the existing gold standard and moved away from gold. From that time on, every breakdown led to new changes in the system, moving the world further away from gold. Many nations began to distrust gold, although dilution of the gold standard, not gold, was the real enemy. Central bankers failed to realize that their troubles were brought down upon them by their own manipulations and currency distortions. So during the twenties, during the depression, and after World War II, the system moved even further from the gold standard.

Trade wars and currency controls were set up during World War II, when the system began to break down for the last time. Finally, in an attempt to solve the monetary crisis, representatives from the international financial community met at Bretton Woods in 1944 and drew up the agreement that founded the International Monetary Fund and the World Bank. The goal was to restore and expand world trade through borrowing, lending, and the use of funds. In the 30 years before Bretton Woods a belief had grown that there was not enough gold in the world to meet international needs. Central bankers failed to realize gold had simply been priced too low (in currency) for nearly a century.

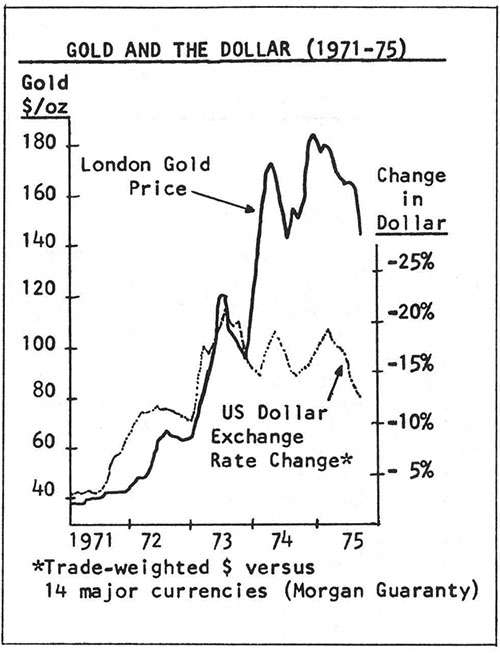

During the past 60 years, gold shortage fears have led governments to rely on paper money. Major holdings increasingly became pounds sterling, U.S. dollars, and gold. Then, within the last 15 years, the pound began to disintegrate, in 1968 breaking down in devaluation, and Britain is now entering the early stages of hyperinflation. International bankers began to hoard less sterling and concentrate more on dollars. Then the dollar became unreliable, particularly since 1971 devaluation, and exchange rates fluctuated with nations' reacting against the dollar.

The only reserve left is GOLD. Gold has stood the test of time as the only true store of value. But, once again, international manipulators attempted to decrease the role of gold. In 1970, with the Smithsonian accord, they created special drawing rights (SDR's), which are miscalled paper gold. This was the first step in the development of an international fiat system whereby currencies are backed with paper rather than gold. The general belief is still that there is not enough gold in the world.

With the September meeting, the IMF ministers decided to go the whole way, washing their hands of gold and creating an international SDR fiat system. The debate, of course, goes on as to whether the IMF charter will allow such a move without an amendment. The United States seems stubborn about decreasing the role of gold in international finance. And with the weighted voting system at the IMF, the United States holds almost one-fourth of the total vote—more than twice that of the second largest member, Great Britain, a country that appears to be even more irresponsible. In fact, due to the weighted system of voting, fewer than 10 countries can control a conference. At the Jamaican conference in January 1976, the IMF was put almost entirely under the thumb of the United States. Now, in order for a decision to pass, its advocates have to muster up an 85-percent majority. This is, of course, an impossible feat for any measure opposed by the United States, with its 20 percent of the votes!

THE BIG IMF BLUFF

Two major issues surround the IMF today. First, the more obvious abuse by IMF manipulators is the creation of SDR's. The biggest concern of finance ministers since the beginning of the 20th century has been the prospect of a gold shortage. The cry since World War I has always been that "there is not enough gold in the world." But the real problem is that gold simply is not priced correctly in the world market and has not been for nearly a century. If gold were allowed to rise to a certain level (devaluing most currencies by as much as 97 percent), there would be enough gold in the world to back most currencies with a reasonable amount of gold.

During the Jamaican conference the United States pushed through article IV, effectively banishing gold from the IMF structure. Before article IV, most currencies were fixed to the dollar, which was fixed to gold. Now all currencies, including the dollar, will be fixed to the SDR, which itself is fixed to a group of currencies. So currencies will flow according to the SDR's, which will float according to the currencies. How circular can a monetary system get?

World leaders suggest that gold is just another metal, that money is anything people will accept as a medium of exchange. It would be nice if a sound system could be developed that would work—one that would insure discipline, avoid deficit spending, monetary instability, printing press money, half-baked social experiments financed by taxes on workers—that would provide discipline in an impartial way. But as long as no such plan exists, we are stuck with gold. It's ironic that in the age of rockets and computers we must rely on shipping yellow-colored "rocks" back and forth across the oceans—such a primitive medium of exchange.

Why must we rely on a barbaric system of hoarding tons of "rocks" in vaults? The answer, of course, is that mankind is still barbaric. Gold is not outdated because gold is the only master that forces people to keep their word when trading with others. With threats of easy money, government meddling, political vote-buying, and unwarranted legal "counterfeiting" by expansion of the currency in circulation (inflation), gold is the only proven weapon against greed, lust for power, cheating, public distortion, and political manipulations for "the public good."

So let's put away wishful thinking and be realistic. It's realism that allows us to succeed, to survive, to make money. Gold has stood the test of time, and current disruptions in the domestic and international situation are once again proving gold to be kind. It's not merely to be a "gold bug" but to be realistic—why fight the truth? Wealthy men are those who seek truth and turn it to their advantage, whatever form the truth may take!

So the big IMF bluff is this: the Federal Reserve can print paper government IOU's and pass them off as money, even though there is no gold backing. IMF ministers will try to make this bluff much easier on central bankers by establishing a kind of international Federal Reserve System that will "print" gold—from paper, of course! Then, since their pound sterlings and U.S. dollars are now unreliable, central bankers will hoard paper gold and tell their populace their currencies are "gold backed." In fact the currencies will be backed only by the length of time it takes for the world to eventually call their bluff. "All currencies will decrease in value and purchasing power over the long term unless they are freely and fully convertible into gold and that gold is traded freely without restrictions of any kind" (Kamin's First Law).

HYPERINFLATION AND COLLECTIVISM

The second major issue created by the IMF has yet to be discovered by news commentators. The IMF is a pooling of interests that forces member nations to become dependent upon each other. It's a form of collectivism of international treasuries and bankers. When a country joins the IMF and makes its deposit, it is entitled to certain drawing rights. A member country pays its quota in gold plus its own fiat money. Then the IMF attempts to balance trade accounts. When a member country encounters a balance-of-payments deficit and does not have sufficient reserves to cope with the problem, it can, through the IMF, exchange its own currency for foreign currencies equal to one-fourth of its original quota. Sounds all well and fine so far, but here's the clincher. A country can borrow even more funds if it "satisfies" the IMF by controlling its domestic monetary problems. Yet the greatest beneficiary of the IMF system since its formation 30 years ago has been Great Britain, a nation now experiencing inflation in excess of 30 percent! That's help? That's progress?

Under this system, a country can easily pass off its disintegrating currency to some other nation with a more stable currency. The member must repurchase its own currency within five years, but a lot can happen in five years. It took less than a year and a half for the German hyperinflation of 1922 to reach impossible proportions. The whole process is very interesting when you consider that the United States holds nearly one-fourth of the total vote (an effective veto) and Great Britain is the next largest voting member. These two members seem unable to control their own inflation. Now a system exists whereby they can pull the rest of the world down with them.

What will happen if a country tries to pass off its deteriorating currency for stable currency equal to the value of one-fourth of its quota when that original deposit consists almost entirely of SDR's or fiat gold? This is a huge engine of inflation!

WORLD ECONOMIC CRISIS

An interesting story was revealed in Southern California. A man recently emigrated from England to the Los Angeles area. He couldn't take money out of England, but he had to get out because of the unbearable inflation, over 30 percent. He saw his savings and fortune slowly being wiped out, so he left Mother England, taking hundreds of gold coins with him. In fact, he found that collector items were the best coins to take because some gold coins were even classified as legal tender. Great Britain outlawed the import of Krugerrands and other gold coins last April, but the man was wise, having the foresight to begin accumulating coins several years ago. Since regulations allowed him to remove coin collections, he took out collector items as well as diamonds and all the hard goods he could convert from the disintegrating British pound. There's a tremendous black market, he revealed, in Great Britain, in which gold coins command very high premiums. This man was so desperate he even bought as many airline tickets as he could, in an attempt to redeem them for cash when he came into the United States. Airlines have now grown wise and are refusing to redeem tickets bought in England into anything but pounds, which of course, are worth less than when boarding the plane in London. Think of the German situation in the twenties and be reminded of how worthless a currency can become.

Look back to the Vietnamese refugees last spring. When the Reds stormed across the borders and the United States withdrew, some of the South Vietnamese fortunate enough to get out of the country were able to take their wealth with them in gold and later convert it into needed goods. Some Europeans will tell stories of how those with gold and other precious metals were able to survive the great struggles in Europe during the war—how people were able to flee from Nazi Germany and occupied France during World War II with gold, silver, platinum, and diamonds.

With nations now closer together and the international IMF setup, major economic crises can be transmitted worldwide. In the past it was possible to run and hide in some foreign country (or some foreign currency). Commentators have been advocating this quite a bit recently. But it's no longer possible. Today the international network is such that when hyperinflation comes it will spread like hell fire. There will be no place to run and hide—no country will provide the security. The only security is to stay put and seek personal survival and a profit strategy.

A PROFIT STRATEGY

The mismanagement of the past must eventually be reckoned with. Governments have put off until tomorrow for many years, and finally tomorrow is arriving. The inevitable return to a gold standard will force us all to pay for our sins and start over again. Paper dollars will become worthless and gold will become very dear. You can protect yourself, survive monetary chaos, and make big profits, too. Why will you make big profits? Because you will be in the very small minority who will actually comprehend what is going to take place and act upon it. You will not be doing any magic, you will simply be trying to preserve your capital while others sit and reap the tragic results of 40 years of inflation and deficit spending—hyperinflation.

You will come out on top simply by putting your money into hard assets when the financial world is turned upside down. Your goal should be to secure independence by being able to anticipate future economic events—not just to speculate but to preserve what you have. Several bestselling books and many prophets of doom have made their mark in the past few years, and many uninformed people have gotten involved in the top of a recent gold market. Gold is not to be purchased by speculators who are shooting solely for short-term gains. Government officials would have you believe that gold is simply another commodity—why prove it by trading gold and gold coins back and forth like pork bellies? Gold will probably soon test its 1973 lows somewhere around $90 per ounce. Then, when inflation breaks out in late 1976, gold will turn around and seek new highs, sometime in mid-to-late 1977. When inflation comes again in the next two or three years, it will be more like Great Britain's.

Gold is your currency insurance. It should be held like an insurance policy, and if disaster comes you will be all the better. If disaster doesn't come, you will still be in good shape. History shows that 35 ounces of gold will buy an average-sized car. It did 30, 40, even 50, years ago, and it probably will 30 and 40 years hence. Gold is not a piece of metal or a simple commodity, but the basis of value itself. That means if gold were to go up or down in price, then everything else would go up or down proportionately. So the holding of gold is a matter of insurance to maintain your financial position.

You should map out a financial strategy that will allow you, as a member of the informed minority, to make a lot of money while other people are just running around reacting to situations. You shouldn't react—you should anticipate. That's where the real secret of wealth lies. A strategy for huge profits in the coming monetary crises entails the simple formula of first gaining your currency insurance in the form of gold or gold and silver coins. Then you can speculate in hard goods such as real estate, or tangible things. The secret is to be as self-sufficient as you can. Owning your business is probably the best hedge against inflation. Don't hide as some people have been advocating.

Sociological studies show the United States is little different from previous societies. Of course when the people on welfare wake up some day to find the till empty, there may be some rioting and revolution. It probably will not be like the work-together Germany of the twenties and early thirties, but there will not be total destruction either. If unrest comes, it will probably be more like the chaotic French Revolution.

Two more hints on planning your future. Try to acquire as many skills and become as self-sufficient as you possibly can. Those who rely upon others to exist will be the ones hurt the most. And be careful borrowing. The time to borrow is during inflationary periods, for the beautiful advantage leverage can provide. But you can put your position in jeopardy by borrowing. Own outright. Do not put yourself in a position where some third party can grab your assets. After the fiat inflation accompanying the French Revolution, Napoleon rose to power with the immortal words, "I will pay cash for everything." So take a positive strategy for survival and money preservation and you will find you actually will obtain huge profits in the future.

Richard A. Marker is the author of the new book, IMF—Engine of Inflation. He is currently associate editor and economist for The Forecaster, a well-known economic newsletter. Marker studied monetary economics, Austrian-style, at the University of Virginia. After teaching economics, he studied international economics as a research analyst with a major Wall Street firm. He has advised several Congressmen in Washington and has been a frequent financial columnist.

This article originally appeared in print under the headline "International Monetary Politics."

Show Comments (0)