Collecting Coins for Fun and Profit

The dramatic rise in the price of gold rekindled the interest of the American public in that king of all metals, while at the same time, continuing inflation convinced a large number of them that the man who said the dollar was as good as gold was not quite telling the truth. Many Americans also discovered for the first time that their government, in its benevolent wisdom, had determined that it was not a good thing for its citizens to own gold. So the question naturally arose, how should one go about obtaining that precious metal without arousing the anger of some over-zealous Treasury agent?

People who knew the gold laws knew that the bullion could be legally held so long as it was poured in an artistic shape—apples are nice. That was because the gold was then "jewelry" and was exempt under the law. Others, though, found it easier to go out and buy up old gold coins. And that is where this article really begins, because that is where people made their first mistake.

THE PROBLEMS OF NUMISMATIC INVESTMENT

Investing in coins, any coin, regardless of metal, is not the same thing as investing in bullion. Investing in bullion is really no different than investing in any other commodity, and that is where metals are traded—on the commodity markets. A coin is not a commodity—not if it is really worth saving. It is a unique piece of medallic art, and must be treated with the same sort of care and caution one would employ for a great painting. A person who buys a coin for its bullion content is about as wise as a person who buys a painting for its paint content.

Any coin, regardless of its bullion, has at least two components to its total value. Obviously, its bullion is worth something, and it is still possible to get coins whose value is almost entirely due to the bullion. But, in addition to the bullion component, all coins have a value brought on by their worth to collectors. Finally, gold coins have an extra component of value called premium which exists because of the present illegality of holding raw gold bullion. Thus, we can say that the total value of a coin is equal to its bullion value plus its premium value plus its numismatic value.

It should now be clear that a coin is a different good than the bullion out of which it is made. It behaves according to a supply and demand schedule quite different from bullion, and may go up or down independently of the metal. (As one example of how this might happen in the future, consider what will probably happen once the gold laws are scrapped at the end of December 1974. In that case, the bullion value of a gold coin will increase, since the large expansion of the market will bring on a rise in the price of gold. But the premium will then be zero, and if the sudden fall in the premium is not offset by an increase in the bullion and numismatic components, the price of such coins could actually fall.)

No American gold coin sells for much less than double its bullion value, so anyone who buys it solely for bullion is making a lousy investment. Unaware of the importance of date, mint, variety, or condition to the true value of the coin, the novice or the bullion-buyer has a lot of room in which to go wrong. It is true, he might still make money; then again, he might also get lucky in Las Vegas or at the races. It comes down to just about the same thing.

For a long time, now, libertarians have talked about the joys of operating in a free market. Well, dealing in coins is about as free a market as there can be in this world under its present management, and the reader would be surprised at just how fast those joys can turn to sorrow. In a free market, it is truly caveat emptor. There is no one to turn to if a mistake is made. The responsibility of succeeding lies primarily with the buyer. Even getting stuck with a counterfeit can be a problem, as it might not be possible to get one's money back. Also, the rules of buying and selling are different. People used to seeing posted prices and paying same are likely to be confused by the practices of bargaining which go on at dealer bourse tables. It's like being in a foreign country. One must always remember: once that dealer sells his coin, it is gone forever, so he must squeeze every dime out of it he can. If he thinks you will pay it, he will ask the highest price. It is up to you to talk him down.

I have tried to be sober about numismatic investments to begin with because I wish to impress upon the reader that there is no sure method by which one can make money, whether by buying coins or anything else. If making money in coins was such a sure thing, who would bother to work for a living? However, for those who are willing to learn, and are willing to risk losing a little money for the knowledge they will need, then perhaps the rest of this article will help them learn more and lose less.

ON COINS AND COINS

There are coins and there are coins. The former are genuine; the latter leave a certain something to be desired. So the first problem confronting a new collector is to determine whether the coins he is being offered are real.

If the reader gets the same government propaganda I do, he "knows" that Uncle Sam turns out high-quality work while counterfeiters turn out shoddy merchandise. Well, I have seen some fakes that took an electron microscope to detect, and I would say that constitutes pretty good forgery.

The problem of determining the authenticity of a coin is not all that difficult, however. A counterfeit is detected by its mistakes, and since no two engravers can duplicate each other's work, detection of a fake is almost always possible. Furthermore, the quality of the fakes decreases as the numismatic value of the piece declines. To pass as a numismatic counterfeit, a coin must be as close to the government product as possible. That means proper gold content, alloy, design, etc. So a coin which has a low collector's value will be better protected against a good forgery. There is just not enough profit in the process to justify the risks involved.

The new collector should understand that every part of the design on a coin is there for a reason. The first true coins were nothing more than crude bullion bars with a stamp placed on them by the local king guaranteeing their weight and fineness. The problem of counterfeiting immediately arose (for monetary rather than numismatic purposes), so a more intricate design had to be employed to deter this.

But the scoundrels didn't lose any sleep over this. They just found a way around the problem. The first thing they did was plane gold off the face of the coin. To combat this, mints employed dies which raised the design above the field. Then the dishonest fellows shaved metal off the edge or "clipped" the coin. To put a stop to this, the mints put designs or reeding on the edge. But the cheaters could not be convinced to quit. They took a scoring tool and stripped the gold away from the coin right around the rim. So the mints retaliated by putting denticles around the rim, and thus we come up with the modern coin.

The typical forgery is made in a small private mint. Many are cast replicas and most of these can be easily detected. Casting by any process causes distortion brought on by the cooling of the metal. Sandcast coins tend to have highly irregular fields and look mottled to the naked eye. More difficult to detect are counterfeits made in a centrifugal casting machine. This process is called "lost wax" casting, and it can be tough to spot without a glass. Under a glass, the field is once again likely to appear irregular, and inspection with a 30 power microscope will usually disclose a number of small craters formed when residual air bubbles burst as the coin cooled. The designs are likely to appear smaller than what is proper, but forgers often take this into account and enlarge them so that the cooled, contracted end product will appear to be correct.

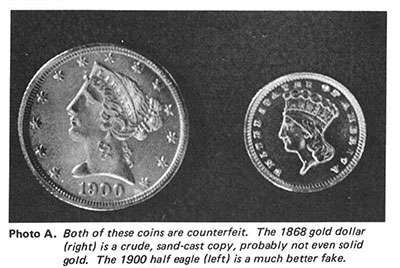

The coins in Photo A are good examples of common fakes. The gold dollar on the right is a crude sandcast copy, probably not even solid gold. The mottling of the surface is visible, even in the photo. The half eagle at left is a lost wax job; the color of the gold (which does not show in the photo) indicates it is of Lebanese origin, probably brought back by some foreign traveler and smuggled through customs. Under a microscope, the craters are evident. In addition, the stars are wrong, along with the rim (appears to be sawed off a bar). Finally, the pit in front of the ear is apparently a casting mark.

As I have said, a counterfeiter is caught by his mistakes. These occur either because the mint used is inadequate to the task or because the faker is ignorant. As a general rule, collectors are somewhat unwilling to talk about those mistakes that are made out of ignorance. Otherwise the counterfeiter might get the word and go back and do the job over—and do it right this time. Instances of this are on record.

One can be a little bit more liberal in talking about errors that occur from an inadequate manufactory. No counterfeiter can set up his own mint complete with presses, dies, rolling mills, punches, assay office, etc. Such installations are just too difficult to hide for any great length of time—one might as well put up a billboard on the White House lawn! Common errors of this type include uneven reeding, edge over the rim (caused by forcing an unreeded cast coin through a broach), blunt or irregular stars, splitting along the edge or through the coin (caused by shrinkage—not to be confused with die cracks, where metal is raised above the surface of the coin), and weak or irregular denticles. One should also be on the lookout for tooling marks such as saw strokes or casting spurs.

By far, the most difficult fakes to detect are those that begin as genuine government coins. Counterfeiters take one of Uncle Sam's own masterpieces and then turn it into another one of Uncle Sam's masterpieces. Some of the more common alterations: addition or removal of mintmark, recutting of date or replacement of same, removal of designer's initials, addition or removal of other special marks. Some of these are easy to detect (e.g., turning a four into a one leaves too great a space between "one" and previous number); others require special knowledge (e.g., removal or addition of mint marks for early American coins revealed by striking characteristics of the coin—branch mints used inferior presses and the resulting work was of lower quality than comparable Philadelphia coins); still others require the opinion of an expert who either has access to a good fake library (such as Stack's in New York) or to transparencies made from known genuine coins or the original dies (no two dies are ever exactly alike, even if made by the same man using the same machine). And, if that fails, the only thing one can do is send the coin to ANACS (American Numismatic Association Certification Service) or to the government for their opinion.

GRADING A COIN

After genuineness, the greatest problem confronting the new collector is grading the condition of the coin. Coins come in all conditions from brand new to flat. Obviously, a collector would prefer to have a brand new coin rather than one that is badly worn. Furthermore, the mechanics of money and exchange contribute to the steep rise in prices paid for the higher quality pieces. When coins leave the mint, they are all new or "uncirculated." As they are used in transactions, they gradually become worn down to the point where they are no longer useful as money. Indeed, it might be noted just in passing, that one of the original purposes for putting complex designs on coins was to give the local businessmen an indication of how close to the established weight the piece actually was. Presumably, after the coin had worn down to the point where the design was no longer legible, such a piece was no longer "guaranteed," and, so, had to be weighed for bullion.

Most collectors begin on limited budgets and so are restricted to buying coins in the lower conditions: good, very good, and fine. As a result, they never learn to grade a coin properly. The condition of a coin is determined by what it has rather than by what it has not got. The wear accumulating on a coin in circulation can only be realistically judged by knowing what the coin looked like when it was new. But most collectors, particularly new ones, tend to judge the new coins by that with which they are familiar, i.e., the worn ones. This is like trying to build the Empire State Building from the top down. Invariably, such a person becomes an easy mark for a dealer who practices overgrading—claiming a coin to be in better condition than it actually is, with a correspondingly higher price.

The best way to not fall into this trap from the beginning is to do a little initial research on how coins wear. So, before you go out and buy any coins, find someone in your area who has a proof. A proof is a specimen striking made by the mint expressly for collectors. These coins are made from dies that come from the same master as the dies used for business strikes, but the coins are struck, usually twice, on hydraulic presses under greater pressure than coins made for general circulation. Because of this, a proof will carry the full impressions of the die. Compared to a business strike, the relief of the portrait will be exceptionally bold.

There should be no flat spots or fuzziness in any of the designs. The rim will have come up fully with the corners knife-like, like this: [, as opposed to the rim of a business strike, which tends to look like this: (. Proof coins are made from specially polished blanks or "planchets" and are struck on polished dies. As a result, the coins tend to have a mirrorlike surface not found on other coins struck under less managed conditions. In addition, the first coins to come off the press prior to the first polishing of the dies display a frosted appearance on all of the raised parts of the design. Since 1955, the United States Government has issued proof coins in sets sealed in plastic. I strongly recommend that all new collectors buy at least one of the cheaper of these sets (1961, 1962, or 1963), even if one does not wish to specialize in the modern designs. Such a set will serve as a handy reminder of what is possible in medallic art.

For those who wish to collect gold coins, you have a problem: all American gold proofs are rare. I know of none that sell for less than $500.00 (and that's a single coin). In addition, proofs made since 1908, when the designs were changed, have a different surface from that found on modern or "brilliant" proofs. So finding a gold brilliant proof is not going to be easy. Nevertheless, it is well worth the effort.

One thing a person should be careful about in searching out old proofs: back in the nineteenth century, when economic upheaval was an every-year worry, gold proofs had a tendency to get spent. If the proof was reclaimed right away, it might be returned to a collection in impaired state, i.e., it will sport hairline scratches or some surface wear. But, if one finds a gold proof that is still totally frosted, then he will know that the coin is still in original condition. This is because there is no known way to replace the original surface once it has been worn or toned away.

A proof will show what detail is possible with the dies being used, but, because it is made differently, it would be unfair to compare it directly with a common business strike. So, once one has looked at a proof, he should also try to obtain a business strike in mint state (also called gem uncirculated or MS70). A mint state coin is a regular business strike still in the exact same condition as it was when it was struck. A coin is either in mint state or it is not. Mint state is the only coin grade that is precisely defined. Because it is struck under lower pressure than a proof, a mint state business strike will not have as bold a detail. Still, it should have no scratches, nicks, or dents. Instead of the mirror surface and frosted detail characteristic of a proof, a mint state business strike will sport what is known as luster or "bloom." This is a deep rich coloring which extends outward from the center of the coin. When the coin is tilted in soft light, it will appear to be on fire. This surface is imparted to the coin when struck, and there is no way to duplicate it once it has been worn or toned away, short of restriking the coin. The surface of the coin actually becomes plastic as the metal is forced into the recessions of the die, assuming a characteristic microscopic flow or "scratch" pattern which causes the luster.

Once a coin is placed into circulation, a steady process of deterioration sets in. If the coins are placed unrolled in bags, as was the case with silver dollars and many gold coins, they will become scratched or dented with "bag marks." Such marks are apt to look like this: ((((, and are caused when the bag is moved around, the coin on top digging into the coin below, then being displaced and digging in again. Loose coins are also likely to pick up rim nicks as they strike the other coins edge on. Obviously, the more scratches, nicks, or dents in a coin, the worse its condition will be judged to be. No coin displaying such marks can be called gem. If the coin has just a few scratches or marks, it will be called choice uncirculated or MS65. Coins with a number of scratches are still called uncirculated or MS60, particularly if they are of a denomination and type commonly stored unwrapped in bags (e.g., early half dollars, silver dollars of the Morgan type, and gold coins made prior to 1908 with the exception of double eagles which were stored in bags after 1908 but rolled prior to then). However, prominent bag marks will cause the grade to be lowered to about uncirculated or AU on any coin.

Coins should be examined under a 10-power glass. A person should never trust his own unaided eyesight. I do not care how good one's eyes are, they are not good enough. Glasses more powerful than 10X are available, but I do not find them to be of that great an advantage, for, as the power of the glass increases, the width of the field decreases. One pays for the greater accuracy of the higher power glass with the lower accuracy which comes from not being able to see a large portion of the coin.

AN EXPERIMENT

The best way to see how a coin wears down is to wear a few down on one's own. So go to the bank and invest 50 cents in a roll of brand new pennies. One should examine a few of them under the glass in order to determine what they look like when new. Put five of the cents aside where they will not rub or be damaged in any other way. Then place another 15 or so in a purse or pocket and carry them around for at least a week, examining them at the end of each day. At the end of a week, compare them with the control group that was stashed away. The cents that were carried around should quickly pick up scratches and a few dents. Run the edge of a thumbnail around the rim of the coin. One should find some rim nicks on at least a couple of the pieces. Examine the high spots of the coin, e.g., the cheek and jaw of Lincoln. One should be able to pick up a little wear on at least a few of the specimens (the half life of cents is about 12 years, so one will have to look carefully). Notice that each coin will be worn differently. That is why grading is such a personal thing, in spite of the general standards. The overall condition of any coin can only be determined by judging the sum of all the defects, both on the obverse and the reverse.

Now, take some more new cents from the remainder of the roll and place them reverse down in a wooden drawer so they can touch edge to edge but not face to face. Slide them around by swirling the drawer so that the coins skid over the wood. After awhile, the reverses will show flat spots evenly distributed over the reverse of the coin while the obverse will still be new. Prior to the invention of coin holders, many people kept their coins stored in this manner, lying loose in a drawer. When they would open the drawer to show off their treasure to others, the coins would slide around and pick up this kind of wear. Stacking coins, particularly double eagles made after 1908, will also place this kind of wear on a coin (notice how, on almost any Saint-Gaudens $20, the breasts and knee of Liberty are worn flat, even on "uncirculated" pieces). Such wear is called stacking wear or cabinet friction, and a coin that has been subjected to it must be graded as no better than AU.

Copper is particularly subject to tarnishing, and if you happened to touch the face of a few of the cents with your fingers in placing the coins in your pocket, a few might already have become discolored. If so, this should impress upon the new collector never to handle collectible coins without gloves. I prefer white cotton gloves, but I doubt that colored ones will hurt. Stay away from wool. Wool is animal hair—a very hard substance—and can scratch the specimen.

If a situation should arise where a coin must be handled without gloves, it should be held by the edge between thumb and forefinger. Do not allow the fingers to come in contact with either face of the coins as the acids in the fingerprints will etch the surface. This is true even for gold coins since they are usually alloyed with copper.

If the cents were allowed to wear down further, they would eventually become very fine, then fine, very good, good, fair, and finally poor. As the determination of these lower grades is much discussed and readily available, I shall not go into them here. Except for coins that are particularly rare and cannot readily be had in the higher conditions, it is my opinion that coins purchased for investment as well as enjoyment should not be obtained in grades lower than extremely fine. It is always better to spend a lot of money on one quality item than to spend little on a lot of junk. Coins in the lower grades are usually bought by small-time collectors who cannot afford anything better. Because such coins are usually slow movers, and because of handling costs, bookkeeping, etc., dealers cannot pay anywhere near the market price for these items. As a result, they have a very poor profit records.

CHOOSING A DEALER

It is important to become associated with a dealer whom you can trust. This is particularly true for those who are new, and picking a home dealer is probably the most important decision one has to make early on. In order to be of use to you, a dealer must be honest and be willing to go out of his way to get the pieces or type of material you want. In addition, he should have a good grip on what is going on in the short-term market. And, of course, he should be willing to tell you about it.

It is easy to test a dealer's honesty. Honest dealers do not overgrade. Just remember there is no one system of grading because no two coins wear down exactly alike, so minor differences of opinion are bound to arise. When in doubt, stick to your own system. But recognize that a dealer grades his own way, and that he is not a crook just because his system is slightly different than yours. If there is a big difference, however, then stay away from him. This sort of fellow will leave you holding the bag.

Another person I would be wary about is the double-grader. All of us try to get the most for our dollars, and coin dealers are no exception. But the double-grader is a special kind of pest. Such a person uses a very strict system when he is buying and a very loose one when he is selling. As far as I am concerned, such a dealer cannot be trusted. Sooner or later, he will stick you with a lemon.

Also beware of the person who misuses "split-grading." All coins tend to wear down gradually, and there is no one point that can absolutely be defined as "fine." The Brown & Dunn standards establish minimum criteria for specific grades, e.g., very good—three letters of LIBERTY must show; fine—all of LIBERTY must show. But such systems leave a large gap between the two grades. What of the coins that have 4, 5, or 6 letters in LIBERTY showing? All are VG-F. But anyone who says they are all equally valuable is either fibbing or joking. And, as a general rule, anyone who asks half again the price for half again the grade is asking too much, particularly if one is considering the higher grades.

Another fellow to stay away from is the dealer who sells cleaned or "whizzed" coins without saying they are cleaned or whizzed. By cleaning, I do not mean soaking a coin in solvent to remove grease, dirt, or oil. A cleaned coin is one that has been dipped in a chemical compound or polished with paste to remove tarnish. A whizzed coin has actually been buffed or etched with an acid or even reingraved so as to disguise wear. Coins held for investment purposes should never be cleaned or polished other than what is necessary to remove foreign matter. Cleaning coins is an art in itself, and, until one learns how, all I can say is don't do it. A collector can tell when a coin has been cleaned, and many—particularly the old-timers—do not like it. Most whizzed coins can be detected with a 10-power glass, and I have never seen one that can escape detection with a 30-power microscope.

TIPS ON BUYING

Volumes could be written on what are the best buys in coins today, and I won't try to add to that here. Basically, I believe a person should collect what appeals to him, and use his common sense—don't think you will make money saving Lincoln Memorial cents when over 6 billion are made every year (by comparison, the largest yearly mintage of half eagles ever was 5,708,802 in 1881—and most of these have since been melted); and stay away from government promotions (Uncle Sam has discovered that many coin collectors are big suckers when it comes to new releases—witness the Carson City dollar fiasco). I happen to collect gold coins, particularly Coronet half eagles, by die variety (that makes me something of a screwball—only about 20 people in the country do that). A knowledgeable person can make a lot of money doing that. But I do it first because I like it. Which is probably why I make money. The following list gives some beginner-oriented comments on United States gold coins in general. And libertarians might also be particularly interested in collecting the private or "territorial" issues from back in the gold-rush days. Rare pieces and a present small market make for a lot of room to get rich in.

$3 gold pieces

All very rare, particularly in Unc. Caveat emptor! Overgrading is very common due to the large spread between AU and Unc. Present demand low, mostly type material.

Gold dollars

Type II rarest of all regular issue gold ($4 pieces are patterns). Uncs. can run $3,000 or more. Best buys are Type I's. They are about twice as rare as the equally priced Type III's. Again, caveat emptor!

Quarter eagles

Indian series most popular gold series by date, there being only 15 coins with only one rare one, 1911D. This last one a good buy at less than $1,000. Presently sells from $900 up. Coronets are tough to get, particularly top quality. Very underpriced. They are the most uncommon of the commonly available gold.

Half eagles

Only United States coin made in all mints. Coronets sport all mintmarks, are popular for this reason. All Uncs. prior to 1879 are scarce. Series is of medium rarity. Indians are becoming very popular due to the low number in the series and the incuse design. 1908 S, 1909 O, and 1911 D are rare, particularly Unc. At least 100 but probably less than 150 1929's extant. Most are from two hoarded rolls and Unc. Price revolves around $3,000.

Eagles

Indians rank with coronet 2½'s in availability. Coronets a bit more common, but not particularly popular, being saved primarily for type sets and bullion. Both tens and twenties usually come heavily marked.

Double eagles

Liberties and Saint-Gaudens of equal availability, as common as Indian 2½'s (those who could get their gold to Switzerland in 1933-4 chose the biggest coins to save). Bullion and type material, mostly.

The 1911 D quarter eagle and 1909 O, 1911 D half eagles are commonly faked. Forgers usually start with a genuine coin from another mint, so it is best to have these certified by ANACS or the government. It will help when you sell them later.

I have a standing policy with regard to finding fakes on dealers' shelves—turn it over to the Secret Service. Any professional dealer should know the difference between real and fake (or at least ought to be better at it than I am). If the guy was fooled but legitimate, then he will be educated. And if he isn't legitimate, he will really be educated. Once one knows what he is doing, this is a good policy to adopt. The government isn't bad all the time.

In summation, then: (a) learn to grade properly; (b) know your coins and everything about them; (c) find a dealer you can trust; (d) buy the best quality you can find and afford; and (e) use your head for something beside separating your ears. These are the secrets to profitable investments in numismatics. And you will find the subject rewarding in other ways as well.

One final word of advice: the various state governments are cracking down on the imposition of sales taxes on coin sales. Taxes in excess of three percent can destroy any of your short-term profits before you ever see them. I will simply point out that no state may legally impose a tax on any article that is exported from that state, nor may it tax any imported article for any amount greater than is necessary to carry out its inspection laws. How you dodge the tax is your problem.

SELECTED REFERENCES

• Walter Breen, Varieties of…, Hewitt Bros., Chicago. Breen is the expert on U.S. gold varieties. He has written pamphlets on all denominations except double eagles. Useful for any gold collector.

• Martin R. Brown & John W. Dunn, A Guide to the Grading of United States Coins, Whitman Publishing Co., Racine WI. The fifth edition is now out.

• Richard A. Long, "A Common Sense Approach to Grading," The Numismatist, Jan.-July 1973. The Numismatist is the official publication of the American Numismatic Society. I understand these articles are going to be reprinted as a pamphlet. Box 2366, Colorado Springs, CO 80901.

• Don Taxey, Scott's Comprehensive Catalogue and Encyclopedia of U.S. Coins, 1971, Scott Publishing Co., New York.

• Walter Thompson, How United States Coins Are Made, Hewitt Bros., Chicago.

• R.S. Yeoman, A Guide Book of United States Coins, 28th ed., Western Publishing Co., Racine, WI, 1974. One should try to get back issues from local dealers. "Red Book" prices for rare material are not always accurate and all prices listed are out of date by publishing time, but the books are the reference backbone of the hobby.

In addition, the new collector should try to get a few auction catalogues throughout the year, particularly the ANA Auction (handled this year by Paramount International Coin Co., Englewood, OH).

ANACS (American Numismatic Association Certification Service), Box 87, Ben Franklin Station, Washington, DC 20044. Write first for schedule of fees.

Coins sent to the government should be sent to: Technical Staff, United States Mint, Dept. of the Treasury, Washington, D.C. Coins deemed counterfeit will be turned over to the Secret Service and not returned.

Always send coins by registered mail in protective packaging. Store coins in a safe place like a safety deposit box. Coin collections are not covered by normal insurance policies.

Robert B. Crim has collected coins for over 10 years; his specialty is United States half eagles, coronet type.

This article originally appeared in print under the headline "Collecting Coins for Fun and Profit."

Hide Comments (0)

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Mute this user?

Ban this user?

Un-ban this user?

Nuke this user?

Un-nuke this user?

Flag this comment?

Un-flag this comment?