Trustbusting for Fun & Profit

"After creating one of the most dynamic and well-run organizations in the United States' industrial history…the reward is the threat of divesture, regulation, or forced reduction in size."

—Dan McGurk, President

Computer Industry Association

For many years, conservative economists were among the most vocal spokesmen for a vigorous antitrust policy. The late Henry Simons, patriarch of the "Chicago School," advocated a strict limitation on company size as part of his "positive program for laissez faire." And only a generation ago, University of Chicago economist George Stigler argued (in FORTUNE magazine, no less) that the Antitrust Division should "break up the giant companies."[1]

Recent analysis and research, much of it by Professor Stigler himself and by his former students, has now discredited this simple identification of "competition" (meaning textbook equilibrium, not the dynamic process) with firm size or market shares.[2] Other work, notably D.T. Armentano's THE MYTHS OF ANTITRUST, has shown that actual antitrust enforcement has been capricious and often anticompetitive in its effect.[3] This should not be too startling. There is something vaguely paradoxical about charging government with the task of defending competition, when government itself enforces most collusive pricing—through regulatory agencies, occupational licensing, "fair trade" laws, etc. The most blatant of private cartels, such as sports organizations and labor unions, are also essentially exempted by law from antitrust prosecution, as are most insurance companies, export associations, agricultural coops, and other pressure groups. That doesn't leave much, of a positive nature, that antitrust could do, even in theory.

Public policy and the paperback exposes are, as usual, a generation behind the advances in economic knowledge. Specialists in industrial organization now commonly agree that any realistic appraisal of competition must consider: (1) a broad view of markets—including foreign and used goods, rentals and leasing, potential competitors, and similar products or services from nominally-different "industries;" (2) a dynamic perspective—including the entry and growth of new firms, and the rapidity of technological change; and (3) a consideration of information costs—including buyer sophistication, availability of consumer-oriented publications and advertising. In short, economists now see competition in the same light as do those who are engaged in it—as a complex, continual process of trying to get and retain customers through changes in price, design, services and selling efforts.

IDENTIFYING IBM's COMPETITORS

A good example of the new approach was the affidavit of M.I.T. Professor Franklin Fisher in the widely-publicized antitrust case of Telex vs. IBM Professor Fisher pointed out that data processing is a young industry in which constantly changing technology creates opportunities for new firms and risk for the old ones. Because of interchangability, for example, more and more companies are producing portions of data processing systems as well as peripheral equipment such as disc drives and terminals. The number of companies who lease data processing equipment has grown from 30 in 1966 to 150 in 1969, according to Dr. Fisher. One out of five companies use a service bureau to process data, as an alternative to leasing or purchase.[4] On this broad view of the choices facing a prospective data processing customer, the number of competitors has grown from 11 to 1,757 in eighteen years (the trial court's findings in Telex vs. IBM state that the number of competitors went from 13 in 1952 to 1,773 in 1970), and IBM's share has fallen from 68 to 38 percent. The fact that firms from all of these IBM-substitutes are actively involved (e.g., by funding the Computer Industry Association) in getting IBM broken-up or regulated indicates that they regard themselves as competitors of IBM. The plethora of ads specifically mentioning IBM as the adversary (e.g., Dictaphone's "Bad News for IBM" ad) lends further support to the broad market view, as does the classified section of any trade publication—which typically includes myriad firms offering to buy, sell or lease used or new IBM data processing equipment.

Even if we consider only the manufacturers of complete data processing systems, their number has increased from 25 in 1962 to 62 in 1970 (the Telex decision says 3 in 1952, 96 in 1972). IBM's share of this narrowly-defined market declined, by Dr. Fisher's calculations, from 69 percent in 1952 to 54 percent in 1970. A misleading piece of information was widely circulated to the effect that IBM computers were 65 to 70 percent of those "in use":[5] But many of those "in use" were built before most rival manufacturers even existed, and some of IBM's toughest competitors are firms that lease or sell used IBM equipment or computer time. Concentration statistics also carefully define the market to exclude analog and specialised (e.g., NASA) computers—areas where IBM isn't faring too well. Or, they talk about IBM's share of the world market, which shouldn't be any concern of the U.S. government.

Nor is this a case of huge IBM versus pathetic little rivals. Manufacturers of mainframe units are all well up the list of Fortune's 500: Honeywell, Sperry Rand (Univac), Burroughs, Control Data and National Cash Register. Significantly, the data processing revenue of IBM's seven largest competitors grew three times as fast as that of IBM from 1967 to 1970.[6] Manufacturers of other data processing equipment include Xerox, GM, AT&T, Litton, Hughes, Westinghouse and Singer. Raytheon, Sylvania, Bendix, TRW, GE, Underwood, Packard Bell, Philco, and RCA have also dabbled in the field, and remain as potential competitors. It isn't easy to feel sorry for these "little guys." The truly small minicomputer market—which is dominated by Digital Equipment, Data General and Intel—is doing well and presents a possible threat to IBM, because huge and expensive computers may soon be replaceable by expandable systems of combined minicomputers.[7]

To argue on the basis of market shares, however, is to imply that market share alone is an adequate measure of competition. If IBM were inefficient in supplying wanted products and services, or if it failed to make risky innovations (like the System 360), IBM's share of the rapidly expanding market would be quickly eroded.[8] That is, the structural theory leads to the paradoxical conclusion that price-gouging or complacent inefficiency on the part of IBM would increase "competition" by reducing the leading firm's share of the market.

THE OTHER C.I.A.

The fact that some of IBM's competitors have formed a free-spending organization, the Computer Industry Association, invites suspicions that they may simply be looking for an easy way to bring IBM down to their level, to avoid the challenge of providing better products and services at lower prices. "It is time to stop being divided and conquered," says the C.I.A. literature, "It is time to work together for a more competitive industry." In other words, here we find competitors colluding in the name of increasing competition. "Our recommendations reflect the thinking of the entire industry," says C.I.A. President Dan McGurk, "As a result the recommendations cannot be challenged as self-serving."[9] But notwithstanding McGurk's self-serving view, entire industries do have a common interest in getting government regulation to protect them against low prices, or against pressures to maintain a fast pace of technological advance. "If you take all of the [C.I.A.'s] proposed regulatory restraints on IBM and implement them," says McGurk, then IBM "will be under regulation similar to the FCC regulation of the telephone company."[10] Let the buyer beware.

On October 31st, the chief executives of Control Data, Honeywell, NCR and Sperry Rand, met with Thomas Kauper, Asst. Attorney General in charge of the Antitrust Division of the Department of Justice.…They asked for separate pricing of IBM's products; a prohibition against 'predatory' and 'discriminatory pricing'; an injunction against 'premature announcements' of new products. In addition they asked that IBM be required to license its patents and 'know how' for hardware and software to all comers on a reasonable royalty basis; to disclose [at no cost?] interface specifications between separate hardware products, media and software at time of announcement or two years before first deliveries…; and that IBM would be required to sell any unique device on an OEM basis to other manufacturers until such time as an alternative source for a similar device came on the market; and a limitation on IBM's rate of growth to no more than that of the overall market.…

[T]hese four big companies…are to be congratulated for setting aside their differences in favor of the best interests of the industry and [by definition] the nation.[11]

Isn't it quite obvious what is going on here? As Dan McGurk himself even noticed, "it seems that anyone who proposes a divestment or market practice change in this industry has some self-serving end in mind."[12]

THE TELEX DECISION

What makes sense in economics rarely makes sense in politics or law. The antitrust laws are unique in that the Justice Department wins about 80 percent of the time, and three-fourths of the wins are settled by consent decree.[13] This is because antitrust verdicts are unpredictable, and treble damages can be staggering (perhaps $30 billion in the pending Justice case against IBM). The vagaries of the law were inadvertently catalogued by Judge Sherman Christensen in the Telex vs. IBM decision:

Neither the actual exclusion of competitors nor the realization of unreasonably high profits are elements essential to the offense of monopolization.…A specific intent to monopolize is not an essential element of the offense of monopolization…[and] it is not essential that monopoly be accomplished by unreasonable restraint of trade or predatory practices.

Monopoly, in short, is whatever individual judges say it is—after the fact (this is the so-called "rule of reason").

These ambiguities create paralyzing uncertainty and violate the "rule of law" ideal, since it is virtually impossible to know beforehand whether or not many actions are legal or illegal. Yet strict adherence to per se rules is equally undesirable, because there is no clear evidence of anticompetitive behavior or "structure" that would be applicable in all cases. "IBM lawyers were so certain of their legal grounds in the Telex case," says FORTUNE, "that the company made no serious attempt to settle it before trial. After all, they could have reasoned, similar marketing practices had been upheld by a federal judge in Phoenix who summarily dismissed Greyhound's complaint.[14]

BUNDLING AND PREDATORY PRICING

In the Telex case, Judge Christensen found that IBM priced equipment and services in bundles to prevent users from buying part of their needs elsewhere, used long-term leases to keep customers from switching to competitors' new offerings, and monopolized part of its own product (?) by not giving rivals advance notice of changes in the interface or "plug" between components. Christensen also found Telex guilty of stealing IBM trade secrets, which is one source of the "substantial error" the judge later confessed to in determining damages: If Telex's very existence was largely conditional on a parasitic relationship with IBM, how could Telex be said to be victimized by IBM to the extent of a sizable multiple of Telex's recent profits?

The charge against IBM of "bundling" or tie-selling has little long-run significance. If buyers aren't pleased with the whole package deal, or if the package is priced to yield monopoly profits, entrepreneurs will have a tremendous incentive to assemble rival packages—possibly from several sources. Similarly, there are many companies now leasing IBM and other equipment who would provide short-term leases if customers wanted them. Nor is it true that large capital requirements are a barrier to competing with IBM: Money from stocks, bonds and loans is available in virtually unlimited amounts if the opportunity presents itself.[15] Finally, the Quixotic efforts to enlist IBM's help for sharpies who want to copy portions of IBM systems can have only one result: IBM will simply build integrated systems without many separate components.

The main issue, then, is the suspiciously familiar charge of "predatory pricing." Yet if IBM cut prices where it faced tough competition and raised them where it did not, as charged, then any antitrust action should logically be directed toward the high-priced monopolized market, not toward the low-priced competitive lines. "Monopoly power," said Judge Christensen," is the economic ability to charge unreasonably high prices"—not unreasonably low prices. Yet antitrust, like other government regulation, has a long tradition of being used to protect firms from "cutthroat" competition—i.e., low prices. The Federal Trade Commission Act of 1914 was mainly concerned with stopping practices which were "unfair" to other sellers. The Robinson Patman Act of 1936 was intended to restrict discounts (which are the main instrument for dissolving cartels), and to "protect small business in particular."[16]

Jack Biddle of C.I.A. estimates, in an interview, that IBM cut prices of peripheral equipment by something like 16 percent on the average, and raised other prices by about 5 percent (not an astounding rate by recent standards). To put the 16 percent price cuts in perspective, IBM had long "reaped a profit of over 50 percent on several items," according to FORTUNE' so that plug-compatible manufacturers were easily able to undercut IBM on such items by "around 20 percent."[17] "There wasn't any evidence that IBM reduced prices below cost and reasonable profit," admitted Judge Christensen, and "Telex products were at all points in time listed at lower prices than comparable IBM products."[18]

This is the familiar issue of "gravy-skimming," where new entrants are attracted to those products on which a firm has been earning "monopoly profits" (other examples are the "interconnect" communications equipment suppliers, United Parcel, and chartered flights). Far from being evidence of monopoly power, such price cutting is proof that prior market power is slipping. Until recently, peripheral equipment has accounted for sixty percent of IBM's revenue. If IBM always had the power to raise prices of computers, without losing customers and attracting new rivals, it would not have waited until now to do so. Actually, mainframe computer prices have fallen continually and drastically, while product performance improved exponentially. IBM's recent price changes are not evidence of monopoly.

Judge Christensen's injunction requiring "substantially uniform mark-ups" would simply prevent prices from attracting resources to areas where demand exceeds supply, and to items where high risk can be offset by initially high mark-up.

If a big firm prices products below the going rate of return, it suffers the same loss per unit as competitors but on a larger and growing volume. If the lower prices only impose losses on smaller firms, then the larger firm is simply more efficient, and wouldn't need to use monopoly power to obtain monopoly power—whatever that means. Besides, any rivals driven out of business by below-cost pricing could easily return as soon as prices went back up. Predatory price cutting is therefore an historically rare and logically implausible strategy. If there are no barriers to entry, predatory pricing can only yield possible short-run gains at the expense of certain losses; if there are barriers to entry, established firms already possess monopoly power and predatory pricing would be redundant.[19]

THE BETTER THE BIGGER

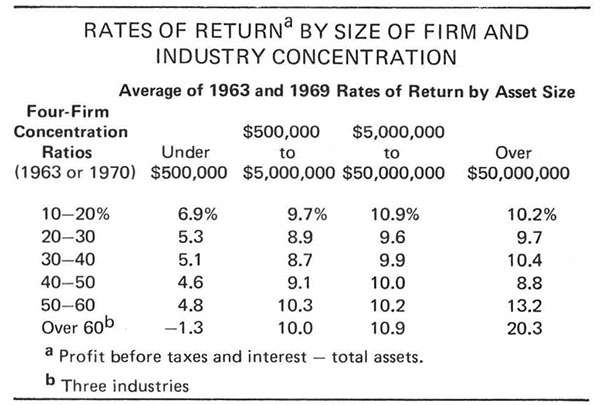

"The key to the monopoly," suggests Dan McGurk, "is IBM's ability to set large-volume manufacturing of components and therefore bring the price down." That suggests economies of scale. Elsewhere, however, the C.I.A. says that "Honeywell, Burroughs, Univac and NCR have proven that a mainframe company can be viable and efficient at the $1 billion dollar per year revenue level."[20] Some evidence on this point is reproduced in the table below.[21]

This data strongly suggests that firms are large—both absolutely and relative to their markets—because they are profitable, and not the other way around. Such firms cannot be profitable because of concentration—since monopoly pricing would also make smaller firms in the same industry equally profitable—but because of greater efficiency. Neither asset size (above $500,000) nor concentration (few firms) alone can explain the 13.2 and 20.3 percent profit rates of large firms which dominate their industries. This being so, efforts to reduce size or concentration, both of which appear to follow from efficiency, must be viewed with great suspicion.

Those who maintain that large size is not necessary to least-cost production often neglect the importance of services which are related to the product. No other computer firm has yet offered service facilities which are remotely comparable to those of IBM. The distribution and service outlets of car manufacturers are likewise a major explanation of concentration in that industry: How many separate makes and models could profitably be distributed and serviced in many small towns?

Jack Biddle, executive director of the Computer Industry Association, is not content with merely cutting IBM into pieces according to type of product, because "in each of those areas IBM would have a monopoly of that segment of the industry." In other words, the largest firm in any submarket is defined as a "monopoly." There should be no largest firms. What if, after being broken-up to the C.I.A.'s satisfaction, one of the IBM segments again rose to dominate some part of the electronic data processing industry? Biddle says, "When you get any company that has 70% of the market, even though it's one of those seven new companies into which IBM has been broken up…you break up the new company."[22]

Consider the dynamic implications of any such rule to automatically break-up any company that approaches a certain percentage of a narrowly-defined market. Wouldn't a firm that was nearing the limit have an incentive to raise prices, lower quality, or simply relax? Is that apt to benefit consumers? C. Jackson Grayson, former head of the Price Commission, notes that already "several heavy-industry companies reported that they feared competing too aggressively on price because they would capture a larger market share…and be subject to Justice Department or competitor antitrust suits."[23]

There is an irreconcilable conflict between helping competition and helping competitors. Many firms are quietly making a lot of money in data processing by providing better products at lower prices. Others find it easier and more lucrative to sue IBM—proving once again that antitrust laws seek victims without crimes.

REASON Contributing Editor Alan Reynolds is NATIONAL REVIEW's Associate Editor in charge of economics. His article attacking McGovern's economic program was listed by TIME as among the "outstanding journalistic contributions" of the 1972 presidential campaign.

NOTES AND REFERENCES:

[1] Stigler, "The Case Against Big Business," FORTUNE (May 1952), reprinted in H.C. Harlan READINGS IN ECONOMICS AND POLITICS (Oxford University Press 1961).

[2] I. Kirzner, COMPETITION AND ENTREPRENEURSHIP (University of Chicago 1973); Adelman, "The Two Faces of Economic Concentration," THE PUBLIC INTEREST, Fall 1970; G. Stigler, THE ORGANIZATION OF INDUSTRY (Irwin 1968) Chs. 4, 5, 6, 8, 10, 16, 18, 19; Schwartzman, "Attention Monopolists: Senator Hart Is Watching," CHALLENGE, Sept./Oct. 1973; Brozen, "The FTC's Outmoded Campaign Against Advertising, REASON, June 1973; Burck, [on the UCLA economists] in FORTUNE, April 1972; Manis, "Free Enterprise and the Monopoly Myth," REASON, Sept. 1971; Evans, "The Fallacies of Trust Busting," HUMAN EVENTS, Nov. 10, 1973.

[3] R.E. Low (ed.), THE ECONOMICS OF ANTITRUST (Prentice Hall 1968) (essays by M. Adelman, D. Dewey, and S. Whitney); Bork & Bowman "The Crisis in Antitrust," FORTUNE, Dec. 1963; R.W. Grant, THE INCREDIBLE BREAD MACHINE (Bray 1966) pp. 74-85; D.T. Armentano, THE MYTHS OF ANTITRUST (Arlington House 1972); Armentano, "The Great Electrical Equipment Conspiracy, REASON, March 1972; Armentano, "Capitalism and the Antitrust Laws," REASON, Jan. 1972.

[4] Cerullo, "Service That Will Make You Smile," INFOSYSTEMS, Oct. 1973.

[5] THE NEW YORK TIMES on January 7, 1973 said IBM had 67% of machines "in use"; by June 3, 1973 the figure had slipped to 65%. Others round upward to 70%.

[6] THE NEW YORK TIMES, January 7, 1973.

[7] Bruun, "Researchers Pioneer Application Advance With Minis," INFOSYSTEMS Oct. 1973. For examples of how giants like NCR can be threatened with instant obsolescence, see ELECTRONICS, Oct. 25, 1973.

[8] "IBM's $5,000,000,000 Gamble," FORTUNE, Sept. 1966.

[9] ON LINE, Oct. 15, 1972; Jan. 15, 1973. Available through C.I.A., 16255 Ventura Blvd., Encino, Calif. 91316.

[10] McGurk, "Can the U.S. Government Afford to Win the Largest Antitrust Suit in History?" transcript of speech at Drake Hotel in New York, June 7, 1973 [hereinafter cited as McGurk speech].

[11] ON LINE, Nov. 1, 1973.

[12] McGurk speech, supra note [10].

[13] Ibid.

[14] Beman, "IBM's Travels in Lilliput," FORTUNE, Nov. 1973 .

[15] "Intel started in the enviable position of having so many would-be investors that it could choose those it preferred.…[Intel] has never used its line of bank credit." Bylindky, "How Intel Won Its Bet on Memory Chips," FORTUNE, Nov. 1973.

[16] M. Green, THE CLOSED ENTERPRISE SYSTEM (Bantam 1972) chs. 12 & 14. On the importance of discounting, see G. Stigler & J. Kindahl, THE BEHAVIOR OF INDUSTRIAL PRICES (NBER, Columbia University Press 1970). Control Data's 1968 complaint against IBM was partly based on the fact that the latter was discounting.

[17] Beman, "IBM's Travels in Lilliput," FORTUNE, Nov. 1973. Beman says IBM cut lease rates 8 to 16% (and more for some users), and raised prices on central processors by 3 to 8%.

[18] "IBM May Have Won More Than Indicated By Amended Judgement, Many Lawyers Say," THE WALL STREET JOURNAL, Nov. 13, 1973.

[19] For some hypothetical and anecdotal examples of where limited predatory pricing may make sense, see Yamey, "Predatory Price Cutting: Notes and Comments" THE JOURNAL OF LAW & ECONOMICS, April 1972. Yamey's arguments don't appear to apply in the IBM/Telex case.

[20] McGurk speech, supra note [10].

[21] From Harold Demsetz, THE MARKET CONCENTRATION DOCTRINE (American Enterprise Institute 1973).

[22] ON LINE, Aug. 20, 1973.

[23] Grayson, "Let's Get Back to the Competitive Market System," HARVARD BUSINESS REVIEW, Nov./Dec. 1973.

This article originally appeared in print under the headline "Trustbusting for Fun & Profit."

Show Comments (0)