Money: Free Money and Other Problems

The combination of inflation and taxation is a marvelous mix. When you add government regulation of interest rates, the results can be bizarre.

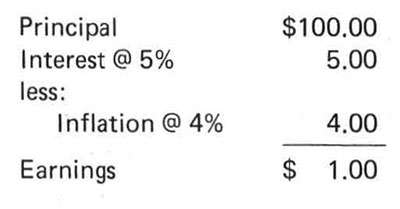

To take a simple situation, let us assume a 4% annual rate of inflation. The government, in its majesty, has decreed that demand savings deposits should pay no more than about 5% p.a. interest. On a one hundred dollar account, we come out with these figures:

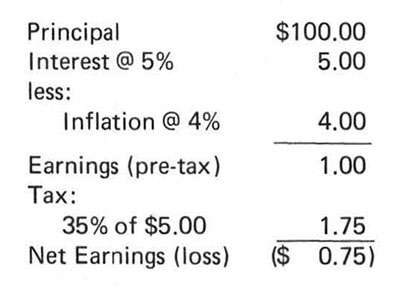

There are probably worse things than earning one percent on your money, as any Penn Central shareholder will tell you. Of course, the preceding figures were pre-tax earnings. If our saver is in the 35% bracket, he still has to figure his tax on the full, inflated-dollar figure, thus:

This is what the economist euphemistically calls a negative rate of return. It could also be called the expropriation of the small saver. Whatever you call it, it is not an incentive to thrift.

In a free market situation, of course, inflation would be just another variable in the millions of individual calculations which comprise the market price of interest and rates would reflect depreciation of the currency just as they reflect time preference and risk. Where free markets in money exist, this is the case; the small saver today, however, is "protected" by ceilings on interest rates which effectively prevent him from receiving a realistic rate of return on his savings. In fact, as we saw above, it may result in an annual loss on these savings. These controlled rates restrain only the small saver; the larger saver, with blocks of $100,000 or so at his disposal, has a variety of free market rates to choose from to achieve a more realistic of return.

The "protection" afforded the small saver is of questionable value as he loses each year through inflation and controlled bank rates more than was lost in all the bad old days of free banking. It is simply one more example of the folly of attempting to "protect" a person by depriving him of his freedom to look after himself.

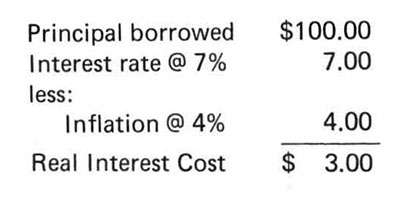

One obvious consequence of holding down interest paid to savers is to decrease the costs to borrowers. In the case of borrowers, the arithmetic above works in reverse:

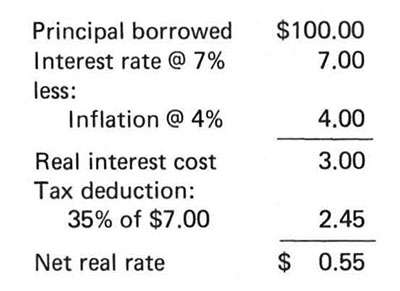

This, of course, is also a pre-tax figure. For reasons of policy, all interest expenses are tax deductible, so our borrower in the 35% bracket gets a tax deduction on the full inflated interest rate, thus:

Needless to say, if either the rate of inflation or the tax rate of the borrower is slightly higher, the net real rate can easily be negative. This is true, for example, in our case above when the borrower's tax rate reaches the 45% bracket or the rate of inflation reaches 4½%.

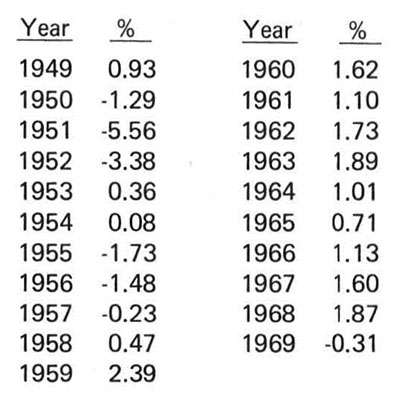

These very low (or negative) net real rates of interest are not future hypotheticals; they have been a fact for several decades. Using average building society interest rates, standard tax rates, and government inflation figures, researchers at Manchester University arrived at these figures for net real rates of interest on home loans in England:

These figures, which should not be too greatly different from the US results, suggest a few interesting points.

To begin with, the supply of newly built housing is relatively inelastic. This means that the low (and sometimes negative) cost of mortgage borrowing which serves to drive up the demand for more and better quality housing has the effect of increasing the purchase price of homes. Thus, homeowners receive a steady capital appreciation on their home, over and above the normal increase due to a rise in the general price level. Since most homeowners qualify for the nonrecognition provisions of the tax law, this artificially induced capital appreciation usually escapes the income tax entirely.

On the subject of taxation, the individual who uses his savings to buy a heavily mortgaged home also has the advantage over his more prudent neighbor who puts it away in a savings account because the mortgagor pays no tax on the rental value of his home, while the saver must pay tax on his "earnings" before he pays his rent.

Ecologists will realize that this subsidization of home ownership has the effect of accelerating the urbanization of the countryside. By lowering the cost of housing for young couples, it is also possible that young families are encouraged to expand their families sooner than they might otherwise do.

Because the benefits of low-to-negative interest rates and built-in capital appreciation increase with time, they serve to benefit the older homeowner over the more recent. The newer homeowner will thus pay proportionately more of his income for housing than will a longer-established homeowner.

It can even be said that these artificially low home loan rates, for the reasons above mentioned, have the effect of impeding entry into homeownership by the poor and minorities by increasing the initial purchase cost.

Should real estate taxes on homes ever be significantly reduced or eliminated, this would be of course an additional, one-time capital gain benefit to existing homeowners.

If any conclusions are to be drawn from the foregoing, they would include the usual one that government intervention in the market invariably produces unwelcome side effects, frequently quite the opposite of those intended by its advocates. For another, home ownership, real estate taxes notwithstanding, appears as a largely favorable vehicle for forced saving investment, particularly for higher bracket taxpayers with older mortgages. Thirdly, a number of independent government policies, including inflation, all point to increasing the real dollar and/or nominal dollar value of home ownership. Fourthly, none of those policies seems likely to be reversed in the foreseeable future.

Copyright 1972 by Davis E. Keeler.

This article originally appeared in print under the headline "Money: Free Money and Other Problems."

Show Comments (0)