Will Cigarettes Someday Replace Marijuana in the Drug War?

States see big increases in smuggling as taxes jump.

New York's huge taxes on cigarettes and the black market they have created got some major, unwanted attention last year, when New York City's enforcement against the sale of loose, untaxed cigarettes (loosies) led to a deadly encounter between the New York Police Department and Eric Garner.

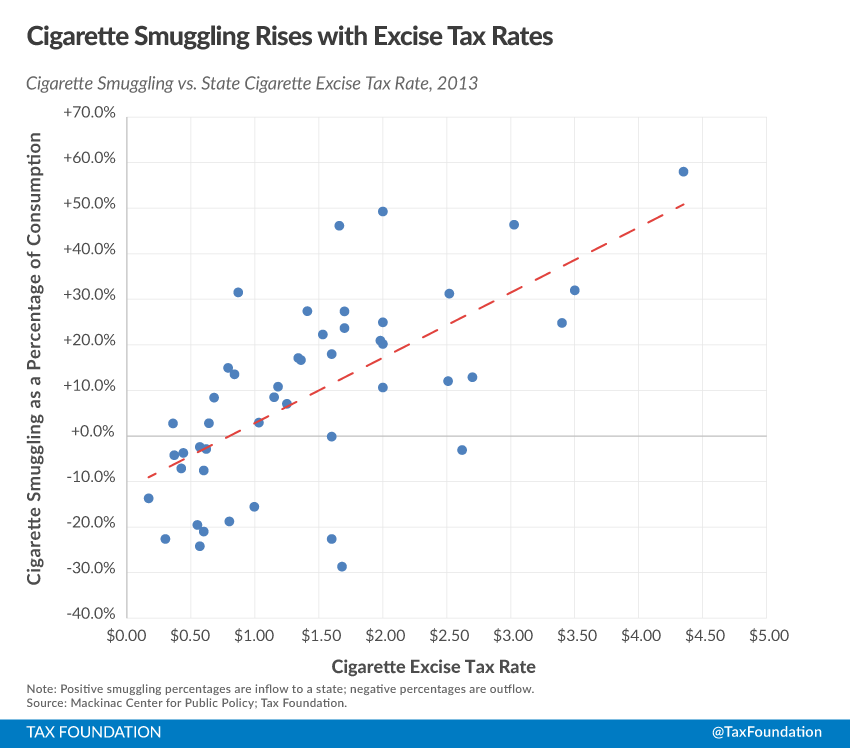

Every year Michigan's Mackinac Center for Public Policy attempts to calculate how much of the cigarette market is taken up with smuggled or black market cigarettes. This year they've partnered with the Tax Foundation in Washington, D.C., to truly delve into the numbers from 2013. They get these numbers by comparing the adult smoking rates per capita to actual legal cigarette sales.

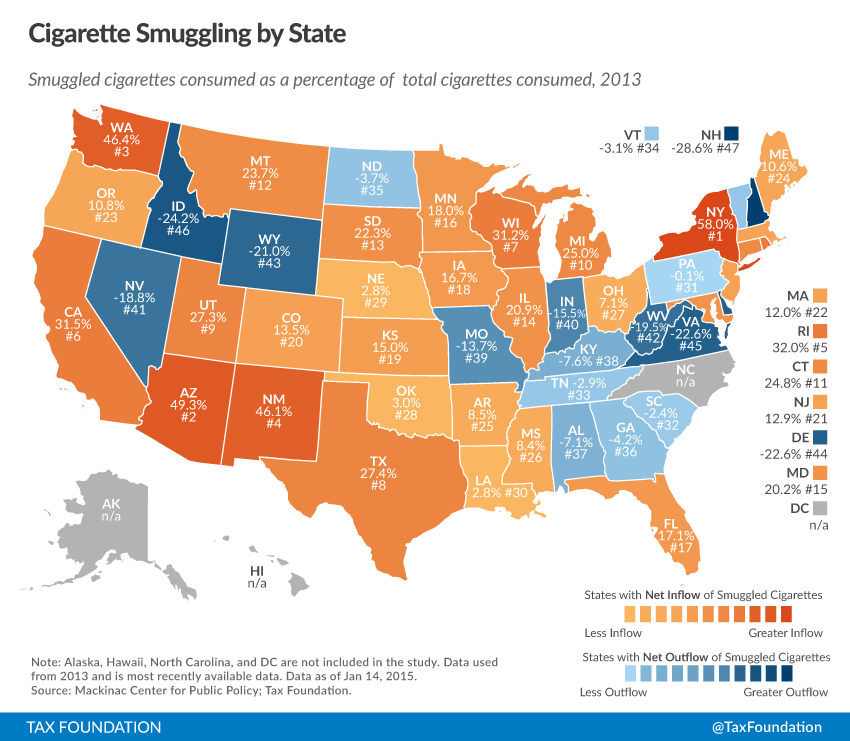

The latest report has New York on top of the list of states as having the greatest consumption of smuggled cigarettes at a whopping 58 percent of the total state market. It's the only state above the 50 percent mark. Arizona, Washington, and Rhode Island, just beneath New York on the list, are edging ever closer, though.

Furthermore, the top 30 states on the list have all seen increases in the consumption of smuggled cigarettes since 2006, many of them seeing percentage jumps in the double digits. Unsurprisingly, many of the states have also increased the taxes applied to packs of cigarettes during that time. The Tax Foundation points to Illinois, a state struggling with significant debt, to show how attempts to get more revenue from sin taxes can backfire:

Smuggling in Illinois has also increased dramatically, from 1.1 percent to 20.9 percent since the last data release. This is likely related to the fact that the Illinois state cigarette tax rate was hiked from $0.98 to $1.98 in mid-2012. This increase in smuggling may continue in future data editions, as more recent increases in both the Cook County rate (from $2.00 to $3.00 per pack, effective March 1, 2013) and the Chicago municipal rate (from $0.68 to $1.18, effective January 10, 2014) have brought the combined state-county-municipal rate to $6.16 per pack of cigarettes, the highest combined rate in the country.

As a result, the Tax Foundation noted, Illinois fell short of its revenue predictions when it calculated how much it would receive from the tax increase.

Check out this lovely chart and map by the Tax Foundation helping document the rise in black market cigarettes:

Read more here. As taxation and regulations regarding cigarettes make it harder and harsher for people to legally acquire and smoke their cancer sticks, this black market is going to continue expanding, even as the laws slowly loosen over marijuana possession and use.

Show Comments (9)