Forget Budget Wish Lists. A Sluggish Economy Calls For Much Less Federal Spending.

Yesterday, we had President Obama's budget proposal as ideological telegram, complete with a mindboggling price tag well beyond what the U.S. government can afford to spend. To be fair, many of his opponents in the Republican Party apply just that sort of "only the best for us" to every expensive toy on which the Pentagon wants to blow a billion bucks. But not only has the federal government been spending well beyond its means for years, but the economy is expected to be uncooperative—read that as sluggish—in years to come, requring even lower levels of federal spending if the behemoth on the Potomac isn't to go completely tits-up and leave American taxpayers holding the bill.

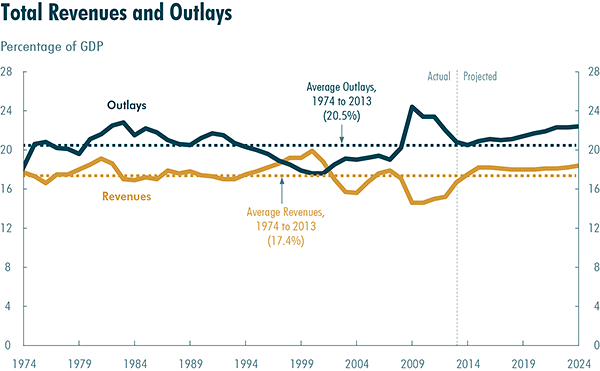

On February 4, the Congressional Budget Office (CBO) predicted:

the deficit is projected to decrease again in 2015—to $478 billion, or 2.6 percent of GDP. After that, however, deficits are projected to start rising—both in dollar terms and relative to the size of the economy—because revenues are expected to grow at roughly the same pace as GDP whereas spending is expected to grow more rapidly than GDP.

That growing gap between what we spend and what we can afford to spend has consequences, reports the CBO.

The large budget deficits recorded in recent years have substantially increased federal debt, and the amount of debt relative to the size of the economy is now very high by historical standards. CBO estimates that federal debt held by the public will equal 74 percent of GDP at the end of this year and 79 percent in 2024 (the end of the current 10-year projection period). Such large and growing federal debt could have serious negative consequences, including restraining economic growth in the long term, giving policymakers less flexibility to respond to unexpected challenges, and eventually increasing the risk of a fiscal crisis (in which investors would demand high interest rates to buy the government's debt).

That is, deficits build up debt, which acts as a net drag on the economy and prosperity and, oh yeah, further reduces the resources available to the politicians on their spending spree.

But, here's the sad truth: that "restraining economic growth," for whatever reason, is already a thing. In that same report, the CBO forecast sluggish economic growth to come:

the growth of potential GDP over the next 10 years is much slower than the average since 1950. That difference stems primarily from demographic trends that have significantly reduced the growth of the labor force. In addition, changes in people's economic incentives caused by federal tax and spending policies set in current law are expected to keep hours worked and potential output during the next 10 years lower than they would be otherwise.

Just a few weeks later, on February 28, the CBO specifically reduced expectations for potential output in 2017 by 7.3 percent.

So, the CBO itself says that federal policy is already acting as a drag on the economy on which sky-high plans for federal spending are based—and those spending schemes themselves threaten to further slow the economy.

Oh, swell.

Just last week, Reason science columnist Ron Bailey looked at predictions that the U.S. is entering an extended period of economic stagnation. He found some of the forecasts about declining technological payoffs to be unduly pessimistic, but agreed that "government debt overhang [will] slow growth," and probably by more than predicted. Ultimately, he believed we've been given "fair warning of the doleful direction in which the economic headwinds are blowing."

Not only are elected federal officials spending far more than we can afford, they're consuming the seed corn from which future economic growth must come, reducing the prosperity we all hope to enjoy as well as the resources on which officials hope to draw for their future spending schemes.

The longer this continues, the less the federal government will be able to spend in the future. And the less wealthy Americans will be.

Show Comments (66)