Trump's Antitrust Enforcer Says 'Big Is Bad'

Federal Trade Commissioner Mark Meador wants conservatives to sacrifice Americans’ economic well-being to break up big businesses.

The anti–free market views of the Trump administration's antitrust enforcers are coming into full view, and it's boding poorly for the American economy. Abigail Slater, assistant attorney general for the Department of Justice's Antitrust Division, recently delivered her "America First Antitrust" speech, which outlined a populist agenda that punishes firms for being large. Days later, Mark Meador, commissioner of the Federal Trade Commission, published his "Antitrust Policy for the Conservative" essay, which evinces prejudice against big companies.

"Big is bad," says Meador, who calls on conservatives to "reaffirm that concentrated economic power is just as dangerous as concentrated political power." Meador does not explain how market power is morally analogous to political power and the use of coercion but challenges conservatives to oppose bigness in private business the way they do in government. But there's good reason to be against one and not the other.

Increasing the size and scope of government entails a commensurate reduction of the private sphere and personal liberty; Microsoft, Walmart, and Häagen-Dazs increasing their market shares does not. Meador disagrees, describing antitrust law as the means to prevent "anarchistic private tyranny" and encourages conservatives to "reject a laissez-faire or libertarian approach to antitrust law."

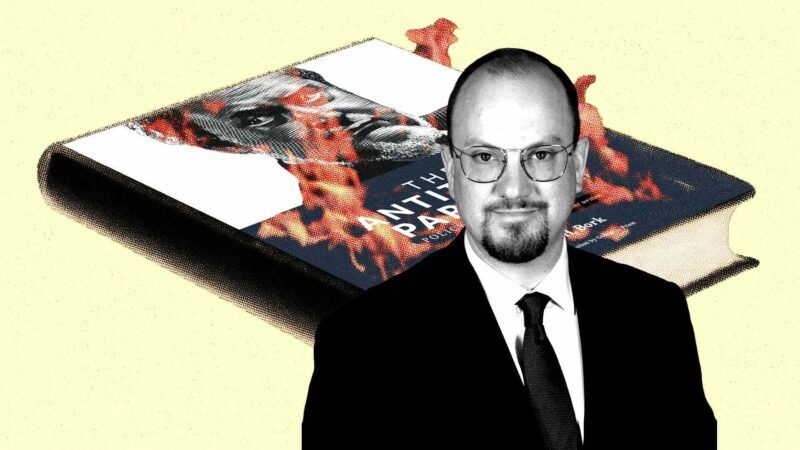

Meador associates the libertarian approach principally with legal scholar Robert Bork's consumer welfare standard, which holds that the Sherman Antitrust Act (1890), the oldest antitrust statute enforced by the DOJ and FTC, was intended to and should promote economic efficiency. Meador rejects Bork's understanding of consumer welfare as economic efficiency, narrowly redefining it as "trading partner surplus." Replacing a holistic conception of consumer welfare with Meador's myopic one will prevent even economically efficient mergers and acquisitions from taking place, retarding innovation and productivity—a cost that Meador is willing for consumers to pay.

Meador says that a conservative approach to antitrust law should be "more concerned with avoiding Type II errors [false negatives] than Type I errors [false positives]." This means antitrust officials should be more worried about accidentally allowing anticompetitive mergers and acquisitions than preventing competitive ones. Slater, however, lauded antitrust for its ability "to make targeted, incisive cuts to remove the cancer of collusion and monopoly abuse [rather than imposing] ex ante regulations." Slater praises antitrust for minimizing unnecessary economic intervention, which allows firms to serve consumers and expand the economic pie. Meador contradicts the DOJ's top antitrust official by calling for precisely the opposite.

Meador describes permissionless innovation as a progressive impulse and says, "We do not celebrate the inexorable forward march of progress precisely because not all that is innovative is good." Skepticism of innovation recalls the Biden administration's permission-slip economy, which cost the economy an estimated $1.8 trillion.

Meador also observes that "monopolists…often innovate to entrench and protect their monopoly rather than disrupt it." This is true; firms innovate to differentiate their products to obtain and retain pricing power to increase their profits. For example, Apple introduced the graphical user interface in January 1983 to steal Microsoft's market share, whose MS-DOS was a cumbersome command-line operating system. The primary beneficiary of such innovation is the consumer; the firm's motivation is irrelevant. Moreover, the example Meador cites as evidence of innovation not benefiting the consumer is that which profits from a government-granted monopoly over its intellectual property: the pharmaceutical industry. The solution to this inefficiency is less economic intervention by the state, not more of it.

When firms are incapable of differentiating their products through in-house innovation, "there is still the possibility of acquisition to obviate the competitive threat," says Meador, citing the technology sector as an example. Meador recognizes that "the potential for acquisition has led to an explosion in VC funding for start-ups" and says this has diminished "truly disruptive innovation." While economists don't know if acquired startups' innovations reached their "full potential," Big Tech's Magnificent Seven—Apple, Nvidia, Microsoft, Alphabet, Amazon, Meta, and Tesla—accounted for over half of the S&P 500 index's 25 percent return and one-third of total U.S. market capitalization in 2024. Cracking down on Big Tech acquisitions decreases the expected profitability of acquiring startups (as antitrust enforcers intend), thereby disincentivizing entrepreneurship and innovation as an unintended result.

Meador quotes Sen. John Sherman—the namesake of the aforementioned act, which has been used by the Trump and Biden administrations to prosecute Alphabet for its successful search engine (Google)—who said, "If the concentrated powers of this combination are entrusted to a single man, it is a kingly prerogative, inconsistent with our form of government." Meador, like Sherman, does not identify a principle to determine when the exercise of private property rights amounts to the exertion of a "kingly prerogative." If anyone is exercising such a prerogative it is President Donald Trump, who is using political power to act as "a king over the production, transportation, and sale of any of the necessaries of life," as Sherman was so worried, with his unconstitutional tariffs, subsidies, and industrial policy that arbitrarily reallocate capital to favored industries. Yet, the New Right opposes free trade even as they admit Trump's protectionism will impoverish Americans.

Meador is unqualifiedly right that economics cannot identify what a person's or society's ends should be. He is also right that economics (like all sciences) "depends upon various assumptions and caveats, all of which can and often is rendered moot by marketplace realities and 'facts on the ground.'" As such, it is fallacious to claim that economic analysis of the anticipated effects of mergers, acquisitions, and other firm conduct can prescribe what the government should do—it can only attempt to describe what will happen. The limitations of the consumer welfare standard are reason for humility in its application, not its redefinition.

Meador concludes conservatives must reject what he says are libertarianism's lies, but conservatives should reject Meador's false equivalency of economic and political power.

Show Comments (22)