5 Ways Elon Musk and Other Billionaires Get Welfare for the Rich

Here's how to find it and put an end to it all.

Tech billionaire Elon Musk is known for leading Tesla and SpaceX, as one of the visionaries behind PayPal, and for hyping bitcoin and a bold plan to colonize Mars.

He's not just the planet's richest person, he's one of its biggest recipients of government handouts, according to Lisa Conyers and Phil Harvey, authors of Welfare for the Rich: How Your Tax Dollars End Up in Millionaires' Pockets—And What You Can do About It. Conyers is a veteran journalist and co-author with Harvey of 2016's The Human Cost of Welfare. Harvey is a successful businessman and philanthropist who supports many libertarian organizations, including Reason Foundation, the nonprofit that publishes this website.

By 2015, they write, companies led by Musk had already gotten billions of dollars in subsidies, tax breaks, and other handouts. New York state even shelled out $750 million to build a factory for Musk's troubled SolarCity operation and then said the company would pay no property taxes for a decade, saving Musk another $260 million. "He seems to have a magic touch," says Harvey. "He's gotten so good at raising money from state governments, getting subsidies, tax abatements, and so on, that sometimes it seems as though the states are lining up to offer him money to come and do business."

Musk is far from alone. There are thousands of other immensely rich people who are constantly bilking governments at all levels for special perks, carveouts, and handouts.

Here are five of the very worst ways they do that.

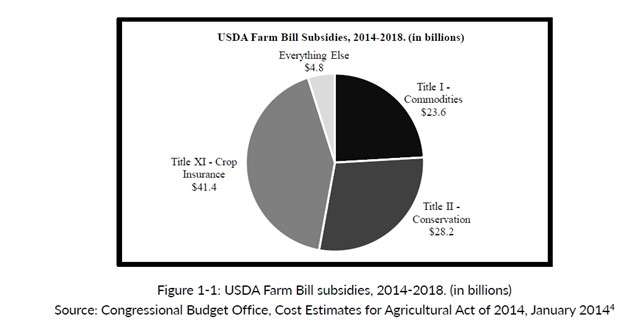

Since 1933, when Congress passed the first farm support bill, the government has been shoveling billions of dollars in the form of crop insurance, cash payouts, and other subsidies to the smaller and smaller number of American farmers. Recipients have included billionaire Penny Pritzker, who served as President Obama's commerce secretary and received $1.6 million in subsidies between 1996 and 2006, and Republican South Dakota Gov. Kristi Noem, who was part of a family business that got over $3 million in subsidies between 1995 and 2008.

2. Sugar Subsidies

If general agricultural subsidies aren't bad enough, the amount of government largesse specifically going to sugar producers is almost beyond comprehension. Because of protectionist tariffs and price supports, Americans pay around double the world price for sugar, thanks to efforts by billionaires like the Fanjul brothers, Alfy and Pepe, who were dubbed "the first family of corporate welfare" by Time magazine. "The Fanjul brothers give millions and millions of dollars to both sides of the aisle," explains Conyers. "That's how a lot of this stuff happens. You make friends on the Hill and you just make sure that your subsidy is renewed every year or every four years or whatever the case may be."

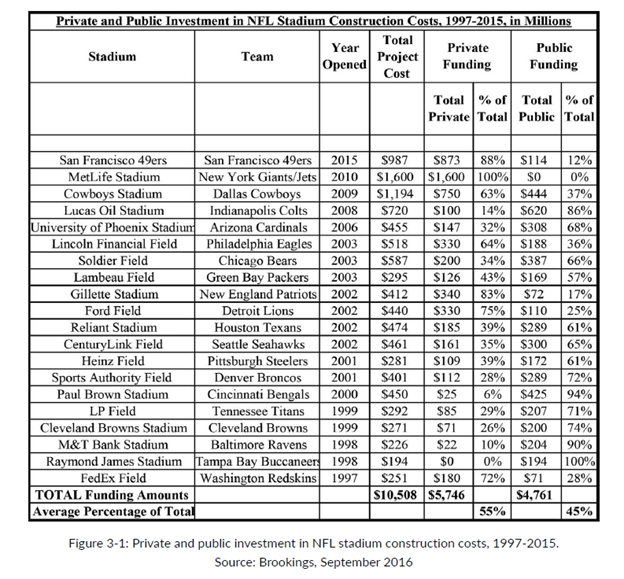

The typical NFL, MLB, or NBA team owner is worth at least hundreds of millions of dollars but they rarely shy away from shaking down cities, states, and even the feds to pay for new stadiums. That explains why between 1997 and 2015, almost half of all construction costs for new NFL stadiums were covered by taxpayers. In the case of Raymond James Stadium, home to Super Bowl champs the Tampa Bay Buccaneers, taxpayers ponied up 100 percent of building costs. The team basically gets all revenue generated at the stadium too.

But it's not just big-league teams that rip off taxpayers. There's the case of the minor league baseball team the Hartford Yard Goats, who bilked that perennially broke city for a new home. The millionaire owners of the team convinced city officials to pony up for a new stadium in 2016, explains Conyers. "The stadium ended up costing the city $67 million," she says. "Which is exactly the amount of money that the city is in the hole right now."

4. Mickey Mouse Subsidies

Nobody will be surprised that Mickey Mouse's owner, The Walt Disney Company, is the heavyweight champ among theme park operators when it comes to sweetheart deals. Disney "holds assets worth over $92 billion, has a stock market value of $152 billion, and returned $2.3 billion to investors in 2017 alone," write Conyers and Harvey. "Bob Iger, chairman and CEO, earns $45 million a year." So of course Disneyland, located in Anaheim, California, needs handouts.

Twenty-five years ago, Anaheim built Disney a new parking structure that cost $108 million and then leased it to the company for the high price of $1 a year. In 2015, the city agreed to exempt the park from paying entertainment taxes for 45 years, and in 2016, it agreed to a $650 million tax rebate on a luxury hotel Disney built near "The Happiest Place on Earth."

5. Energy Freebies

As Conyers and Harvey note, the energy industry has been the best performing sector of the S&P 500 for many years, with revenues topping $238 billion in 2018. Over the past decade, Peabody Energy, the largest private coal company in the world, sucked up around $275 million in state and federal subsidies while generating $5.6 billion in revenue in 2017 alone. Exelon, a power company that specializes in nuclear energy, generated $34 billion in revenue in 2017, the year after it gulled New York state into giving it $7.6 billion to keep four aging and underperforming nuclear power plants going. And when it comes to renewable resources like wind and solar, Elon Musk's ability to make it rain with tax dollars speaks for itself.

All is not darkness, insist Conyers and Harvey, even as they catalog how the tax code, zoning laws, and other sorts of government policies routinely get revised to specifically and uniquely benefit the ultra-rich. One success story they point to involves residents in Louisiana who pushed back against the decades-long exemption from property taxes that major oil and gas producers like ExxonMobil had. The exemptions were a well-kept secret until a group of citizen activists stumbled across their existence and then kicked up a fuss that led to reform.

"They stumbled upon this little committee that was rubber-stamping requests for from these oil companies," relates Conyers. "They started a public education campaign just saying, 'Hey, you know, how much better would our schools be, how much better would our police forces be…how much better would our roads be if those guys would just pay their fair share?' They managed to get the law changed so that now when those companies go and ask for those tax breaks, they have to make presentations to local school boards and fire departments and police departments and say: 'Hey, we don't want to pay taxes and support you because we don't think we should.'"

The authors of Welfare for the Rich point to the growing number of websites such as Good Jobs First and Sunlight Foundation that track subsidies and handouts as places both to get energized by and to get information about how to claw back public dollars that are going to gild the pockets of mega-corporations and the billionaires who own them.

By the time Elon Musk makes it to Mars, hopefully he'll be paying his full fare.

Show Comments (51)