Illinois Governor Proposes a 'Fair Tax'

But it wouldn't be fair to small businesses

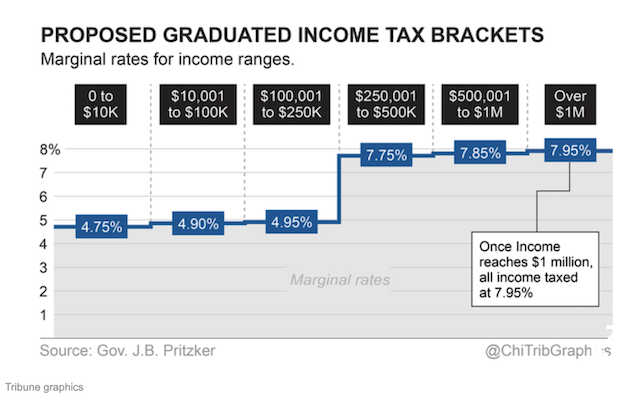

Illinois Gov. J.B. Pritzker has unveiled his graduated state income tax plan, which would raise taxes on those making more than $250,000 a year. Right now, the Illinois Constitution says everyone pays a 4.95 percent state income tax no matter what they earn.

The Democratic governor calls his plan a "fair tax," on the grounds that a billionaire like himself should not pay the same amount as someone who only makes $100,000 or $30,000. But what makes a tax fair?

As this graphic from the Chicago Tribune shows, the bulk of small business owners make up the $250,001 to $500,000 bracket. A raise in taxes will stunt growth in a state that's already bleeding population and jobs. Those small business owners will have to send more money to the government instead of reinvesting into their companies. Last year, surveys from two moving companies, North American Moving Services and United Van Lines National Movers, ranked Illinois as the top state that companies want to leave. Deron Lichte, president of Food Warming Equipment, told U.S. News & World Report that he had "no regrets about the move" to Tennessee.

Due to the high taxes, Illinois lost major corporations like General Mills, Mondelez International, and Butterball in the last five years. Even those with small businesses have left Illinois. Shane Beard owned two FastSigns franchises, but he became "fed up with the increasing tax burden and the unstable political climate." Beard and his wife relocated to San Diego, California, where he purchased another FastSigns franchise.

The conservative think tank Illinois Policy looked at other states that replaced their high taxes with a fixed income rate, similar to what Illinois has now, and found prosperity. North Carolina did this six years ago. State Rep. Ken Waddell found the fixed income rate "made the state more attractive" and described it as "a talent draw."

The fixed income rate in North Carolina caused their "lagging" economic growth to surge "past the national average." It helped double the state's annual wage growth, which also went above the national average.

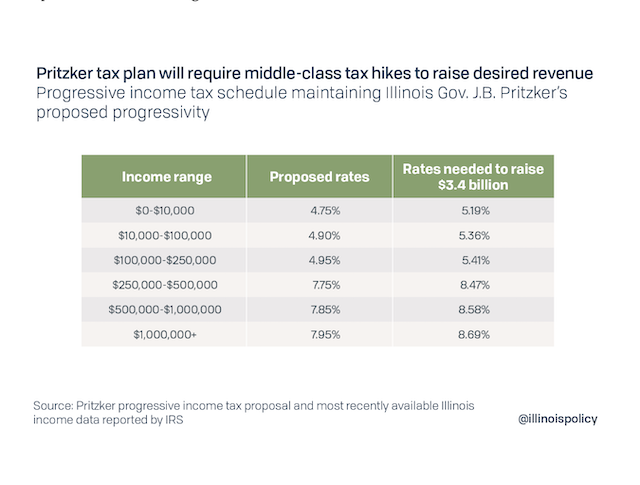

Pritzker's plan includes more than just his "fair tax." He also wants new taxes on marijuana, sports betting, insurance companies, and plastic bags, and he wants to raise taxes on cigarettes and e-cigarettes. Yet his plan comes nowhere near to what the state needs in order to close its budget gap, which stands at $3.4 billion. According to Illinois Policy's research, at the most the proposal will raise $2.4 billion.

The group also found that in order to cover the $3.4 billion hole, the state would most likely have to raise taxes in all brackets.

Pritzker's plan can't take effect for a while, since it requires an amendment to the state's Constitution. Each chamber must approve the change by three-fifths. The vote then goes to the people. It can't appear on the ballot any earlier than November 2020.

Pritzker points to neighboring states Wisconsin and Iowa, which have higher state income taxes, to prove his plan will work. He said in his budget address that he believes the state "can accomplish [a progressive income tax] with a more competitive rate structure than Wisconsin or Iowa." He left out this important detail: Those states have balanced budgets.

Illinois spends, spends, spends. The state owes $8.5 billion in unpaid bills and $134 billion in unfunded pensions, along with the $3.2 billion budget deficit. Even if Pritzker closes the budget deficit, how will the state pay off the rest of its debt? How will the state handle new spending? Illinois needs $19 billion more to cover new spending in Pritzker's budget, which includes "funding a capital plan, investing in K-12 and higher education and pursuing projects in his 2020 budget."

Illinois cannot spend its way into prosperity. The government has to roll back its spending, balance its budget, and reduce taxes in order to keep businesses in the state.

*CORRECTION: An earlier version of this article mischarachterized Illinois Policy.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

"The Democratic governor calls his plan a "fair tax," on the grounds that a billionaire like himself should not pay the same amount as someone who only makes $100,000 or $30,000."

There is nothing whatsoever keeping him from paying as much tax as he likes. Except, of course, his desire to keep his money if other people get to also.

Did the governor use the term 'amount' or did the article author.

One of them is confusing rate with amount.

Did the governor use the term 'amount' or did the article author.

I don't know the specific quote, but my guess is the author. I've heard Pritzger talk about this proposal from a couple of sources and he's explicit that he shouldn't pay the same "tax rate" as someone who makes significantly less.

4.95 percent of a million is a whole lot more than 4.95 per cent of $20000. Why is a graduated tax more "fair" than a flat rate? Who gets to decide what's "fair"? My inner cynic feels that the rich get taxed at higher rates because they are an unpopular minority.

As fiscal policy, a graduated tax will not solve Illinois's problems since the Democrats who have dominated the legislature for most of the past 50 years have made spending their chief political appeal, and are unlikely to apply new revenue to old debt. New spending will be necessary to buy the votes, and they'll have little compunction about spending it.

Take it easy there Chief Wahoo. I'm not endorsing Pritzger's idea. I think it's an ideologically motivated non-solution necessitated by policies that Pritzger would've signed into policy himself if given the opportunity.

I'm just saying that Pritzger has said that he shouldn't be paying as little *proportionately* as someone who makes $100K or $30K and that the confusion between rate and amount is likely the author's.

Signed into law that is...

Google is now paying $17000 to $22000 per month for working online from home. I have joined this job 2 months ago and i have earned $20544 in my first month from this job. I can say my life is changed-completely for the better! Check it out whaat i do.....

click here ======?? http://www.payshd.com

Google is now paying $17000 to $22000 per month for working online from home. I have joined this job 2 months ago and i have earned $20544 in my first month from this job. I can say my life is changed-completely for the better! Check it out whaat i do.....

click here ======?? http://www.Theprocoin.com

Start working at home with Google! It's by-far the best job I've had. Last Wednesday I got a brand new BMW since getting a check for $6474 this - 4 weeks past. I began this 8-months ago and immediately was bringing home at least $77 per hour. I work through this link, go to tech tab for work detail.

+_+_+_+_+_+_+_+_+................. http://www.Just4Work.com

Just tax the rich more. Why didn't someone think of this before? I mean its not like the rich don't have options to leave the state or anything.

Or accountants to hire so they can find all the loopholes...

Flat tax of .00001% of earned income.

Define "earned income"...

Avantajl? bonuslar? ve Asyabahis Yeni Giri? Adresi ile h?zl? bir ?ekilde haberdar olun.

This guy gets it.

I don't suppose anyone needs to waste their time asking the Guv what "fair" means or how he arrived at that definition.

Fair means he doesn't have to pay it.

Fair is what your betters (who created this mess in the first place) say it is.

/Clingin' Kirkland

"Shane Beard owned two FastSigns franchises, but he became 'fed up with the increasing tax burden and the unstable political climate.' Beard and his wife relocated to San Diego, California, where he purchased another FastSigns franchise."

Uhh, what? Things must be terrible in Illinois if that guy is moving to California.

"California! At least we're not Illinois!"

(J)umbo (B)utt Pritzker cheated the tax man out of 40 grand when he removed the toilets out of one of his Chicago mansions claiming it was a distressed property. He's was also recorded trying to buy a government seat from Hot Rod Blagojevich but only one of them is in jail. But keep an eye on the Pigster he's going places. He spent 170 million to land this Governor's job and I suspect he'll want it back.

bit of a head fake with the whole "fair tax" thing

The state owes $8.5 billion in unpaid bills and $134 billion in unfunded pensions, along with the $3.2 billion budget deficit.

"Ah, HA! Let's tax the unfunded pensions!"

The below signifies how low Reason has sunk as libertarian publication

Due to the high taxes, Illinois lost major corporations like General Mills, Mondelez International, and Butterball in the last five years. Even those with small businesses have left Illinois. Shane Beard owned two FastSigns franchises, but he became "fed up with the increasing tax burden and the unstable political climate." Beard and his wife relocated to San Diego, California, where he purchased another FastSigns franchise.

So Reason thinks that leaving Illinois because of high taxes to move to San Diego California makes their point

My god, you have lost your way.

I think its time for some introspection from the staff at reason

I think it makes their point pretty well. How bad must the business climate be in IL if moving to CA is an improvement?

yow.. I am from the quad cities (two cities in Iowa, 2 in Illinois, split by the river). things are already awful for growth on the Illinois side. Housing is selling around 9 to 1 iowa to Illinois right now.. this is gonna vacate anyone left on that side of river with money..

Tax the ...poor?

Me too. Glad to be in Iowa for the last 12 years.

I'm on the other side of the state looking to move to Indiana and I see the same thing, a glut of houses for sale on the IL side, and only a handful on the IN side

JB the Hutt is trying to make sure the populations of Rock Island and Moline go to 0. It's one beating after another for everywhere that isn't Chicago.

Iowa real estate might be doing better than Illinois near the Quad Cities, but Iowa's top marginal rate is a whopping 8.98%, on income over just $71,910!

http://www.tax-brackets.org/iowataxtable

This is a SIGNIFICANTLY more aggressive rate than Gov. Pritzker's marginal rates! AND - Iowa's per-capita spending FAR EXCEEDS Illinois's per-capita spending, by 40%.

ballotpedia.org/Iowa_state_budget_and_finances

Interestingly enough, Iowa's per-capita tax collection is only a shade higher than Illinois's. I'm guessing that this is thanks to the multitude of write-offs Iowans receive on their tax forms, plus the fact that in both states, the average median income is around $54k, comfortably under that $72k top bracket. But to be clear, Iowa does have aggressively graduated tax brackets, and if you're earning 6 figures in Iowa you're paying dearly for it.

Even though Illinois and Iowa collect similar amounts in state revenue, and even though Illinois SPENDS 40% LESS than Iowa, Illinois's per-capita DEBT is FAR WORSE. Why?

Here's my theory as to why Illinois is in worse shape than Iowa:

Anyone who has had to deal with high-interest credit card debt can attest to the strain it places on balancing the family budget. You can cut luxuries like cable tv, but you still have to pay rent and utility bills. You can only cut back so much, short of declaring bankruptcy.

Illinois's state budget is no different, and thanks to decades of operating at a deficit at the state level, our interest and pension obligations are out of control.

When will we finally hike taxes to deal with our debt problem? Should we do it now, or should we put it off another generation and continue operating at a deficit?

To those who believe Illinois can merely cut their way out of this mess, I think that is far too simple and it simply doesn't math out. Illinois's per-capita spending is ALREADY 40% LESS than Iowa.

I personally don't have kids, so I haven no selfish motivation to see Illinois deal with our debt problem today. But just to be clear, the longer we wait to pay off our debt, the faster our debt will grow and harder it will be to pay off, just like credit card debt. Maybe our state will declare bankruptcy at some point. I wonder what that would look like?

A few years back I moved from Illinois to Iowa.

In Iowa you can deduct federal taxes, local taxes, and vehicle registration, as well as the common Federal deductions, all of which of course reduces your taxable income.

Illinois on the other hand, your taxable is based on Federal AGI. No deductions, just personal exemptions.

After doing the math, I still pay less in Iowa than I would in Illinois.

Bonus is my property taxes are lower here while also having a nicer property.

Yeah, I remember Detroit raising taxes as its population declined in an effort to keep its budget balanced. How'd that work out for them, again?

Hmm, how about tax rates linked to party affiliation or voting record?

As used by politicians, "fair" is the worst four-letter word beginning with "f" in the English language.

As used by politicians, "fair" is the worst four-letter word beginning with "f" in the English language.

Some *ahem* free advice; every four-letter "f"-word uttered by a politician is always the worst version of the worst one.

I'd like to hear a thoughtful counter argument from someone on the fairness, equity or morality of taxing people differently on the basis of their income. The following thought experiment is useful. We're all picking berries and we're paid by the flat. Let's suppose you work harder than I do and routinely pick more berries than I do. Your income is higher as a consequence. By what moral code or notion of fairness and equity do I have any right or claim on the extra money you make because you work harder?

After picking berries for a while, you believe you have a better way of picking than what everyone else seems to do. You decide to risk trying it and at first you pick less. Then slowly you begin to pick more berries until you are picking 25% or more berries than anyone else. You then hire other workers to work your system and you take a share of the profit. According to what morality, other than you have have it and we want it, do we have any claim on your superior production and income.

I think the answer is obvious. No one has any claim on your extra production. Moreover, the vast majority of government services are not related to income but to headcount and could be handled by user fees. So even proportional taxation over-taxes the most productive members of society.

What is the moral counter argument?

But...it's not FAIR!

While I appreciate your thought experiment, I think the mistake you're making is conflating government fiat with morality. What's the moral argument for the mob shaking down businesses for protection money? There's very little difference.

Whenever a con artist wants to fool the naive public, the call what they are selling "Fair," like "Fair Tax."

Many fools in the public cannot thinkl beyond that superficial label.

On sunday my check was 1500$ just do work on this website few hour and Earn Easily at home on laptop online .This is enough for me and my family.

>>=====>>>> http://www.Theprocoin.com

You know things in Illinois are bang-dead desperate when people are relocating from there to San Diego to save on their taxes.

Guy leaves high tax and politically unstable IL, for....low tax, politically stable...SAN DIEGO?

Must be for medical pot...

I'm confused about the guy who moved from Illinois to San Diego to stick it to the taxman.

I doubt he is saving on his taxes, but if he moved because he was going to get screwed for taxes, he might as well move somewhere nice. San Diego is pretty and always warm. And has a business friendly atmosphere, and a fairly sensible political approach, being a Navy town. Rich people are still moving to California, despite the taxes, because if you have enough money, you can have a really sweet lifestyle. Not to be a hater, but if you've got the bucks, would you really want to live in Iowa, Illinois, Indiana, etc... If you do live in these states that are landlocked and get so cold, cold, cold... I greatly respect your perseverance. Maybe you have a connection with your community and/or family. Maybe you like having lots of land or hunting. But if you won 100 million plus in the lotto, are you sure you wouldn't move somewhere warmer?

The guv thinks it should be a piece of cake to get his progressive tax rate. Yes, it will take some time but he sees no problem in getting it done. All they have to do is change the state constitution. Forget that the Illinois pols have been maintaining for years that they can't change the public pensions because... it says so in the state constitution and that would be impossible to change. Puke.

I don't think "moved to San Diego" tells the story that's trying to be spun here. CA taxes are higher all around than even the proposed taxes in IL. And it wasn't hard to fact check that.

There may be reasons why some people would want CA over IL but taxes aren't it. Weather, business opportunity (amazingly in spite of taxes) and more to see than corn. They have a much worse graduated income tax, worse sales tax, higher cost of living and I imagine worse property tax. For those that hate guns CA has stopped all crime by being worse than IL about violating gun rights.

?Google pay 95$ consistently my last pay check was $8200 working 10 hours out of every week on the web. My more young kin buddy has been averaging 15k all through ongoing months and he works around 24 hours consistently. I can't confide in how straightforward it was once I endeavored it out.This is my primary concern...GOOD LUCK .

click here =====?? http://www.Geosalary.com

The writer misses one key part of Pritzker's proposed 'fair tax': when income exceeds $1MM the 7.95% rate is applied to the full income, not just the marginal amount over $1MM. The other rates are truly marginal, but if you have taxable income of $1MM or more then you pay a flat rate on all income.

just before I looked at the paycheck four $6755, I accept that my friend could realey making money in there spare time online.. there friend brother haz done this less than 22 months and resently cleard the morgage on their appartment and purchased a great new Acura. I went here,

Start working at home with Google! It's by-far the best job I've had. Last Wednesday I got a brand new BMW since getting a check for $6474 this - 4 weeks past. I began this 8-months ago and immediately was bringing home at least $77 per hour. I work through this link, go to tech tab for work detail.

+_+_+_+_+_+_+_+_+................. http://www.Just4Work.com

As far as I am concerned - The only fair tax is a completely voluntary tax.

The problem is it won't work with our species at this point in our evolution....

my buddy's mother-in-law makes $72/hr on the . She has been without a job for ten months but last month her paycheck was $21863 just working on the for a few hours. Read more on this site