Elizabeth Warren Plans To Destroy Capitalism By Pretending To 'Save' It

Warren's plan would overrule corporate leaders' control over their own businesses. This is also known as "socialism."

Sen. Elizabeth Warren (D–Mass.) thinks she knows what ails capitalism: There aren't enough people telling the biggest businesses what to do.

Try to contain your surprise that Warren believes the profit motive is ruining capitalism. She wants the largest corporations in the United States to be legally answerable to people other than their shareholders, and she's introducing a bill to force it.

Warren's "Accountable Capitalism Act" would require that corporations that earn more than $1 billion in revenue a year (note "revenue," not "profits") would need a federal "charter" in order to operate. This charter would obligate these companies to consider all "stakeholders," not just shareholders, when making decisions. The bill would also require these corporations to permit employees to elect 40 percent of the company's board of directors; a super majority of 75 percent of directors and shareholders would have to approve political donations. (Gee, I wonder if somebody will propose something similar for unions?) Shareholders would be permitted to sue the company if they felt its actions were driven purely by profit and did not reflect the desires of its many "stakeholders."

The justification for all this is the common, economically sketchy claim of income inequality; that the rich are getting richer and that wages are stagnating. Warren complains in a Wall Street Journal commentary that shareholders have "extracted" $7 trillion in profits since 1985 that "might otherwise have been reinvested in the workers who helped produce them."

That number may look huge when presented this way, but it breaks down to $233 billion a year when calculated over 30 years. The United States' total Gross Domestic Product for 2016 was more than $18 trillion. (For extra fun homework, imagine taking this to its logical socialist conclusion, and calculate how much money each American would get from that $7 trillion profit figure if it were forcibly redistributed annually over that 30-year period.) Furthermore, Warren's argument assumes that because the money didn't get "reinvested" back into workers—in the form of, say, increased wages—those workers did not benefit from whatever it was that money did instead—like improvements to the machinery or software they use.

It's interesting that progressives (and many nominal conservatives) invoke "economic multipliers" when the government spends our tax dollars on subsidies and grants within the private sector. Entire communities, we are told, benefit when tax dollars are given to just a handful of politically connected firms. That money must acquire some special magic when it passes through a legislator's hands, because private sector profits apparently just get buried in a great big hole.

The truth is that our marketplace looks nothing like it did in 1985, and this is a good thing. Our options and our technologies have expanded dramatically and are increasingly accessible to more and more people. It's telling that none of that seems to be a consideration in Warren's proposal. Here's a reminder about the entire "growing income inequality" nonsense: Our middle class is shrinking because more people are moving up the economic ladder, not down.

Warren explains that she wants to essentially force these companies to use the "benefit corporation" model, which prizes a set of values above just profits. She notes that successful companies like Kickstarter and Patagonia have embraced such a model, and that it's legal in several states.

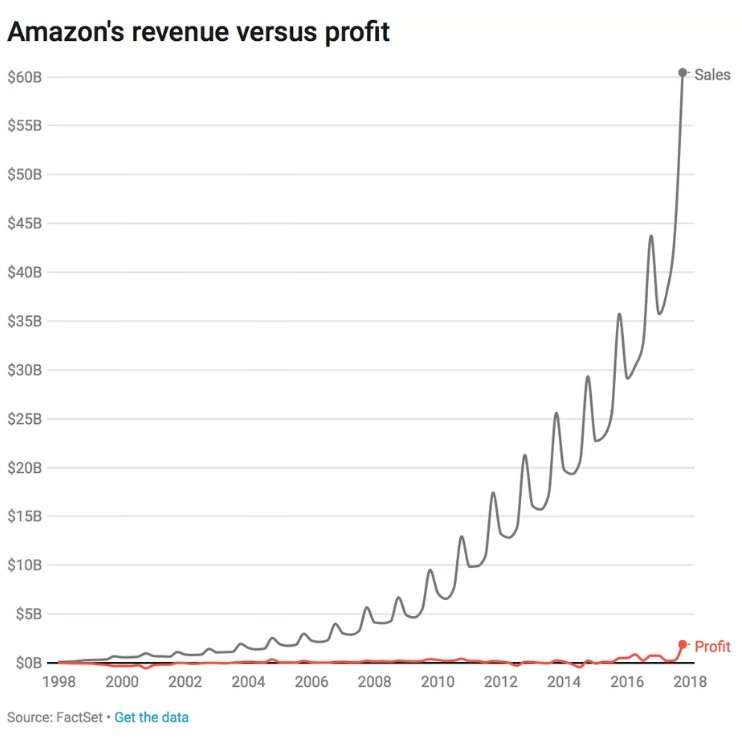

So, stay with me here: If these types of business models are so successful in the American market, then why wouldn't corporations adopt such a model voluntarily? We shouldn't need a federal bill at all! And what about companies that are reinvesting? Amazon brings in billions in revenue annually, but has operated for most of its lifetime barely making a profit. That it has recently started to increase its profit margin has inspired headlines over how dramatically their profits have increased. But here's what it actually looks like over time, courtesy of ReCode:

Amazon made the decision to invest in growth over profits for the long term, and the market has rewarded that decision. Now, it's getting the profits it passed up for years. Amazon is not legally operating under the public benefit corporation business model, but it certainly did operate for most of its lifespan with priorities other than profit. Yet Warren doesn't mention Amazon at all in her commentary. Why aren't they an example of a model corporation?

Warren even complains in her commentary that "companies are setting themselves up to fail" by funneling earnings to shareholders rather than reinvesting them. Assuming this is true, what does this have to do with her? Let them fail. This is why there is a marketplace. Why keep a poorly managed company alive if it's not creating value and drawing customers?

But Warren isn't really concerned about businesses failing. She's worried about the ones that succeed despite operating in ways that she doesn't like. What she really wants to is put the federal government in a position of evaluating and approving how companies grow. She wants to substitute the decisions of people who run businesses with the prejudices and preferences of people who think like she does. And she wants to use the courts to enforce her ideas of how corporations should be managed.

I brought up Amazon for a reason. Even though Amazon heavily reinvests in its own growth over profits it has constantly been getting crap over its low wages. Under Warren's bill, employees could essentially use the government to force Amazon to raise its wages. This would have benefited a certain number of employees, but it also would have done so at the expense of the company's growth. It would be creating fewer jobs. It would be smaller. There are some people who would see this as a good thing, but it could also result in a marketplace where people don't have the broad access to products and supplies that we have today. And that is not even getting into all the technology investments Amazon is responsible for that are making our lives better in any number of ways and will continue to do so in the future.

Warren says she wants American corporations to be looking out for "American interests." They are. They're just not always the same as Warren's political interests. She doesn't grasp the difference.

She has an apparently champion for her bill in Matt Yglesias over at Vox. Yglesias has also noted how frequently zoning regulations and NIMBY types keep much-needed urban housing development at bay. So he realizes when too many people have regulatory veto power over market decisions, stagnation is the outcome, and it ends up hurting any number of people. Why would this be any different?

Show Comments (381)