Congress Could Make It Harder for Local Pols to Blow Your Money on Stadiums

Bipartisan proposal would prohibit the use of tax exempt municipal bonds for stadium projects. That won't end stadium giveaways, but might reduce them.

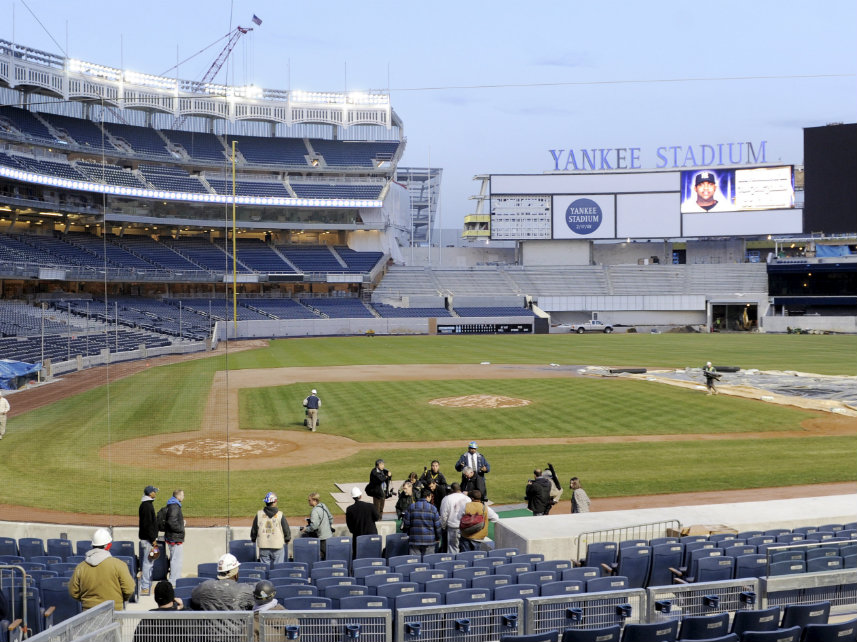

When New York City agreed to build a new stadium for the most valuable baseball team in the country, the Yankees, they partially paid for the project by issuing more than $1.6 billion in municipal bonds.

That means Red Sox fans in Boston ended up indirectly helping to build their rivals' new home.

A bipartisan bill introduced this week in Congress proposes to close the federal tax loophole that made that possible. The bill, sponsored by Sens. Cory Booker (D–N.J.) and James Lankford (R–Okla.), would not be the end of government-subsidized stadiums, but it would stop local officials from shoveling part of the cost onto the backs of taxpayers well outside their own jurisdictions.

The $1.6 billion in municipal bonds issued for the construction of the new Yankee Stadium is a record. But New York isn't the only city to take advantage of a loophole that ropes taxpayers from all across America into subsidizing stadiums. According to a recent analysis by the Brookings Institution, a centrist think tank, since 2000, 45 major professional sports stadium projects have been financed in part by more than $13 billion in municipal bonds.

Those bonds are meant to be used to pay for roads, sewer systems, schools, and other municipal infrastructure needs. They are exempt from federal taxes as a way of encouraging investors to buy them at lower interest rates, saving cities money. Those $13 billion in untaxed bonds for stadium projects have reduced federal tax revenue by $3.2 billion since 2000, according to the Brookings' estimate.

"It's an unseen subsidy," Victor Matheson, a sports economist at the College of the Holy Cross, told Reason on Wednesday. "It's a tax break that we never get to vote on, and it's one that don't even think about and don't see."

The bill introduced by Booker and Lankford would end the federal tax exemption for municipal bonds issued for stadium projects. Bonds issued to pay for infrastructure and other public projects would still be sheltered from taxation.

"It's not fair to finance these expensive projects on the backs of taxpayers, especially when wealthy teams end up reaping most of the benefits," said Booker in a statement. He pointed to the fact that decades of economic research shows little or no correlation between stadium projects and overall economic growth.

On that point, Booker is correct. The last three decades have been a sprawling cross-country experiment in the grand promises of economic growth spurred by building stadiums. The reality is you can build it, but the promised payoff rarely comes.

The Yankees got $492 million through the backdoor subsidy created by the federal tax exemption for municipal bonds, the Brookings study says. The New York Mets scored the second largest subsidy from taxpayers, $214 million for the construction of Citi Field, which opened in 2009 at a cost $815 million, more than $600 million of that funded by the public.

"Using billions of federal taxpayer dollars for the subsidization of private stadiums when we have real infrastructure needs in our country is not a good way to prioritize a limited amount of funds," said Lankford. "Everyone likes free federal money to build their expensive stadiums, but with $20 trillion in federal debt, this is waste that needs to be eliminated."

President Barack Obama proposed eliminating tax exemptions for municipal bonds attached to stadium projects as part of his 2015 budget plan, but Congress didn't bite. There are plenty of reasons to be skeptical that Booker's and Lankford's proposal will get through the legislative process—sports teams and wealthy bond-buyers are likely to lobby against it—but bipartisan support is a step in the right direction.

Even if the bill does pass, though, it won't be the end of subsides for sports stadiums. It will just make it more expensive for cities to hand-over millions of taxpayer dollars to billionaire team owners. Matheson estimates that ending the tax exemption on municipal bonds will make stadium projects between 20 and 33 percent more expensive, since cities would not be allowed to offer bonds with a tax-free interest rate.

They might just find other ways to swindle taxpayers, though. As Patrick Hruby of Vice Sports points out, the very loophole that Booker and Lankford are now trying to close was inadvertently opened in the 1980s when Congress voted to close a previous loophole for federal tax-exempt private revenue bonds that had been used to fund stadium projects. Local governments simply turned to tax-exempt municipal bonds.

Ending unnecessary and counterproductive subsidies for stadiums will require more than an act of Congress. It will require local (and sometimes state) officials who make these deals with teams find the fortitude to say "no," even when the teams threaten to pick up and leave.

City officials in San Diego and Oakland rebuffed efforts by their professional sports teams. Officials in St. Louis did the same, causing the Rams of the National Football League to skip to Los Angeles and and its new taxpayer-funded stadium.

Booker and Lankford admit their proposal isn't a complete solution. As a trade-off for closing the bond loophole, the senators' proposal would change other federal laws to allow local governments to finance stadiums by levying new taxes on in-stadium purchases—things like food, drinks, and team memorabilia.

But soaking people who choose to patronize stadiums is better than getting taxpayers in Wyoming to pay for a new stadium in Florida, something that's happening now, thanks to more than $490 million in municipal bonds issued to cover the cost of the Miami Marlins' garbage stadium.

This piece has been updated to correct the spelling of Sen. Cory Booker's name

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Thank you Congress!

I did not think that I would be saying that today.

While I'm glad this is ending the federal practice, Mayor Cory Booker pledged 210 million dollars of Newark's money to Prudential Arena.

Don't hate the player hate the game.

I'm not sure offering to sell muni's is "forcing" taxpayers outside the jurisdiction to subsidize the crony capitalism, I don't buy the idea that the tax exemption is "costing" the government. Not giving the government money doesn't mean they "have" to get the money somewhere else, it's just money they don't have and don't need.

And as far as closing the loophole goes, NYC can still issue bonds for infrastructure like a public ballpark, right? And if they then grant an exclusive lease to the Yankees, well, it's still not the Yankees' stadium, it's NYC's stadium, isn't it? Sorta like how when the voters reject a bond referendum for a new courthouse annex or whatever, the city just goes ahead and signs a multi-year lease on a proposed new courthouse annex and that lease becomes surety for a construction loan for the mayor's brother-in-law to build a new courthouse annex anyways. See, they're not issuing bonds for a new courthouse annex, they're just signing a long-term lease for it.

I disagree. These tax exemptions do cost both the govt and the private sector. They force marginal rates on that particular tax base to be higher than they otherwise would because that tax base becomes narrower. Spending is NEVER affected by a particular revenue base - its a separate decision - and won't be as long as the dollar is the world's reserve currency. We ARE going to produce debt - period - because the financial sector globally prices everything everywhere off of that debt. Those tax exemptions/deduction also distort private investment decisions - just as much as direct intervention by the govt in markets.

And worse (from a classical liberal Adam Smith perspective - not libertarian), they always distort it in the direction of benefiting those who already have economic power/influence at the expense of those who do not. And that will always lead to harming free competitive markets.

Then what about the "cost" imposed by not laying every conceivable tax, & to the max?

Of course there's a cost to that. Only a halfbaked twit can think that all the costs are one side of a decision and 'cost' cannot even be defined on the other.

^^ This... 1000 times this.

It doesn't take any imagination for this. This is standard practice. Most stadiums about which the complaint of cronyism is made are legally public parks.

It's about like trying to stop eminent domain abuse by abolishing takings for private use, only to then see gov't take things that are nominally for public use but get sold to private entities.

Or how it is with borrowing authorities that in theory are not backed by gov't obligation, but in practice are treated as such. What's the dif whether you make them carry debt on this one's books or that one's, if nobody can stop them from drawing from the same pot?

Just as there was no chance in the world they wouldn't bail out banks. So what are you going to do, outlaw banking? Or see to it that banks, & all their creditors, never have legislative influence, by some kind of gag rule?

Once a society is richer than destitute, they're going to force everyone to bail out the large & the small when they get in bad enough trouble, even if the trouble was self-inflicted. You adopt constitutional provisions against it, they'll institute a coup. The pressure is too great to resist, & always will be, until the enrichment of society gets to the point where nobody minds being "broke" any more.

Once a society is richer than destitute, they're going to force everyone to bail out the large & the small when they get in bad enough trouble

It never really works like that - unless you actually think that the large and small - powerful and powerless - provide comparable counsel to those who actually make the decisions.

Not taking is giving? Am I being dense or does this not make any sense?

Or what was said above.

Yeah, I was coming down here to make the same comment. NYC taxpayers will be paying off those bonds.

How about, instead of playing favorites, we eliminate the loopholes? I see no particular reason why "roads, sewer systems, schools, and other municipal infrastructure needs" deserve a tax break that other bonds don't get.

Yeah I am kinda leaning towards getting rid of the loopholes entirely myself.

How about residential mortgages? That's the biggest tax break around - by multiples probably.

Kill it. It's a massive distortion.

A distortion compared to what? There could be a wealth tax on people saving $ to buy a home. Why isn't taxing savings a distortion, while taxing income to pay debt not a distortion? To call something a distortion means you have in mind an "undistorted" or "neutral" or "natural" world, of which there ain't none.

What about the virtual loopholes that exist all around us, by things not being taxed, or not being taxed as much as they could be? There could be use taxes on bicycles, for instance, as there are on motor vehicles. There could be use taxes on shoes.

We should be for widening all loopholes, & multiplying them, until everything is a loophole. Trying to narrow or eliminate them is the opposite of what we should be doing. The article says the status quo came about via the elimination of a previous loophole.

I agree, it should be practically impossible for a typical human to complete their tax return without a supercomputer and a team of people in lab coats.

I dated a chick in college whose nickname was backdoor subsidy.

*Susy, fucking ingrate.

$Bazzilions of tax dollars for stadiums for ritualized violence, and we the taxpayers are forced to pay it... Baseball, football, etc.; they are all ritualized violence?

Can we just spare a bare few million for ritualized sex, too, at the local naked-titty-dancing club? A litlle CHOICE here, please?

Ritualized sex is FAR less likely to result in cracked ribs & broken spines & damaged brains than football, BUT, NOOOO, no tax dollars for ritualized sex... Tax dollars to SHUT HER DOWN!

How do we start a movement, Free the Naked Titties-Skin, Just Say NO to Pigskin!

Ritualized sex is FAR less likely to result in cracked ribs & broken spines & damaged brains than football

In that case, I submit that you're doing it wrong...?

How dare they cut the circuses! Why, next thing you know it will be the bread!

-Roman Peasant

& after that, the cheese!

??????ODo You want to get good income at home? do you not know how to start earnings on Internet? there are some popular methods to earn huge income at your home, but when people try that, they bump into a scam so I thought i must share a verified and guaranteed way for free to earn a great sum of money at home. Anyone who is interested should read the given article.....??????? ?????____try.....every....BODY..___???????-

Of course it's not fair. It's crony capitalism at its worst.

"It's not fair to finance these expensive projects on the backs of taxpayers, especially when wealthy teams end up reaping most of the benefits," said Booker in a statement. He pointed to the fact that decades of economic research shows little or no correlation between stadium projects and overall economic growth."

When will the stupid American public finally get fed up with the insanity of professional sports. The NFL is one of the most profitable corporations in America. If a team wants a stadium, then, by all means, let them build it and pay for it on land they lawfully purchase, and including all amenities, water and sewage, etc. And no real estate or sales tax advantages. You don't get these for your business. I know the word "fair" is an archaic word, but there is still a sense in most decent people yearning for the concept.

You or I have to build our business buildings with our own money. Few cronies are ever on hand to grant us the money to do so without using our money.

We either have a free market or we don't. And it seems that we don't. We have an ever oppressive elite continually burdening the suckers (citizens) with these self-serving and self-enriching schemes.

Why are we kidding ourselves. We should be holding feet to the fire of the elected criminals in office both federal, state and local.

Mother's Day in Germany is celebrated with heartfelt wishes stored by the children for their mothers. This day is also celebrated all across the globe in almost every country where people are very proactive. Flowers are basically sent to Germany as these items have a huge demand and are adorned by every mother. Hence, people Send Mother's Day Flowers to Germany to deck the lives of the mothers with an enthusiasm.

The issue isn't that something isn't taxed, it's that the Federal government is overspending in the first place. We should all want to be untaxed.

My best friend's ex-wife makes Bucks75/hr on the laptop. She has been unemployed for eight months but last month her income with big fat bonus was over Bucks9000 just working on the laptop for a few hours. Read more on this site -*