Donald Trump's Billion-Dollar Tax Loss Is a Diversion From More-Serious Matters

Like the fixation on Gary Johnson's "Aleppo moments," this stuff stymies serious conversation about first-order concerns like government spending.

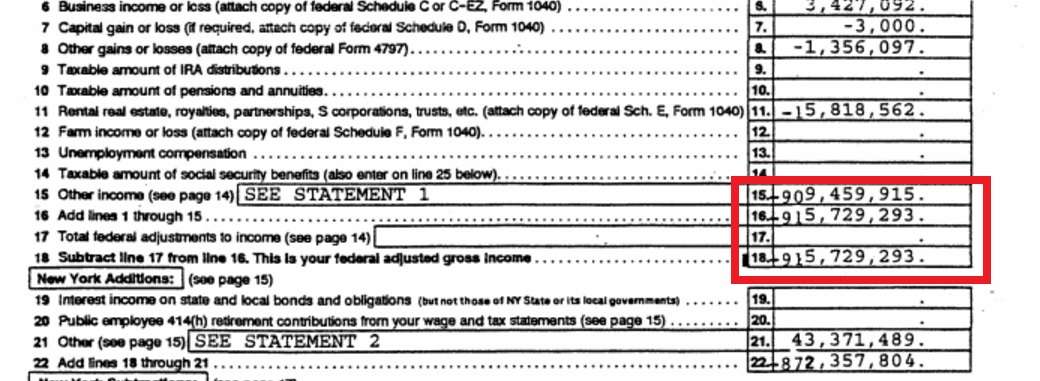

If you care about substantive policy debate, it's not good for Donald Trump that The New York Times has published a few pages of 21-year-old state-tax returns showing he declared a $916-million loss in 1995.

Cue another week wasted with trivial distractions from what we should be talking about in the final month-plus of a presidential campaign. Care about foreign policy, government spending, and more? Maybe we'll get around to hashing all that out after the election. But don't hold your breath.

To be sure, a billion-dollar write-off is a lot of money and, as the Times suggests in the story's headline, it means "He Could Have Avoided Paying Taxes for Nearly Two Decades." This adds fuel to the fire that Hillary Clinton lit during last week's presidential debate when she said that there are only sketchy reasons for Trump not to release his federal tax returns to the public, as presidential candidates have almost all done since 1976. A billionaire who doesn't pay any taxes who dares speak for the common man! Ouch, even though there's no reason to think there's anything at all illegal or even fuzzy about Trump's taxes. This will harden Clinton supporters in their contempt for Trump and it will do the same for Trump supporters toward Crooked Hillary, especially if a Clinton operative is unmasked as the leaker. For the record, here's the Trump campaign's official response:

Mr. Trump is a highly-skilled businessman who has a fiduciary responsibility to his business, his family and his employees to pay no more tax than legally required. That being said, Mr. Trump has paid hundreds of millions of dollars in property taxes, sales and excise taxes, real estate taxes, city taxes, state taxes, employee taxes and federal taxes, along with very substantial charitable contributions. Mr. Trump knows the tax code far better than anyone who has ever run for President and he is the only one that knows how to fix it.

As I type, Trump and Clinton surrogates are duking it out on the Sunday morning shows, explaining why this unmasks Trump as a uniquely awful plutocrat or reveals him to be the single person who can dismantle our terrible tax code and replace it with something that will allow economic growth. This story, like the Miss Universe controversy that immediately preceded it, clearly puts Trump on the defensive. Given his softening in the polls after a weak debate performance and the rapidly approaching end of the campaign season (there are just 37 days leftt), the tax revelation forces Trump to engage an issue that has nothing to do with the core issues that put him in a tight race to the next president.

Whatever. Sucks to be Trump right now. But you know what? No laws apparently have been broken and this doesn't even amble into the territory of bad judgment that many of his (and Clinton's) actions do. As Seinfeld's Kramer would note, most of us don't even know what a write-off is, and Trump is the one who's writing it off.

Far more important, this sort of story is a major distraction from actually serious issues tied to the current state of the world and the specific proposals that candidates have laid out in their bids to become the country's next leader. As Matt Welch demonstrated with respect to foreign policy and failed military interventions, we already know that the "Media Would Rather Talk About Gary Johnson's 'Aleppo Moment' Than a Damning New Report on Hillary Clinton's Actual War." And as Brian Doherty pointed out, it turns out that Gary Johnson's trade-and-diplomacy vision for "has impressed even the foreign policy mavens at Foreign Policy magazine." Even as Aleppo is now being besieged by Syrian government, Iranian, and Russian forces and the president has dispatched new troops to Iraq, neither Trump nor Hillary have engaged in meaningful foreign-policy discussion about the United States' role in the world.

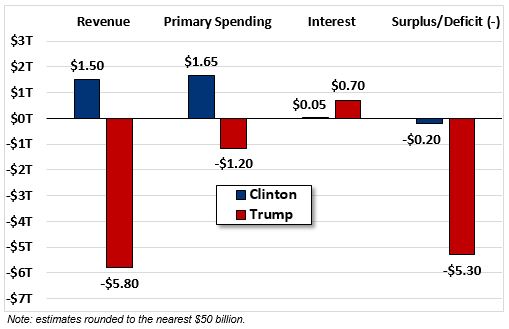

And consider this: According to the latest numbers from the Committee for a Responsible Federal Budget, Hillary Clinton would hike spending and taxes over the next decade from its already-upward trajectory and historically high levels, while Trump would reduce expected increases in spending but slash tax revenues by far more (thus resulting in yet-bigger deficits). If you care about this sort of thing, only Libertarian Gary Johnson has pledged to submit a balanced budget in his first year while reducing spending and simplifying taxes. Both major-party candidates have signed on to a host of new federal programs (such as paid family leave) and Clinton is pushing for free in-state tuition at public colleges and a doubling of the federal minimum wage. Where Clinton says she wants to expand Social Security and Medicare, two of the largest federal spending programs, Trump has said that he would leave benefits untouched. Neither bothers to offer credible ways to pay for such stuff.

Persistent and high levels of debt correlate strongly with lower-than-average economic growth, so now dig this:

Both candidates' plans to increase the debt come on top of current law projections that already estimate that debt will grow by $9 trillion over the next decade. As a result, under Clinton's plans debt would grow from nearly 77 percent of GDP today to over 86 percent by 2026; under Trump's plans, debt would grow to 105 percent of GDP by 2026.

Note also that CRFB is talking about debt held by the public, a subset of overall government debt. When you add what government agencies owe each other (such as FICA taxes supposedly earmarked for Social Security, Medicare, and more that are spent on other things and replaced by IOUs), the gross debt owed by the government is at or above 100 percent of the economy. Read more from CRFB here.

Even among the content-lite campaigns of recent memory, the 2016 general race has failed to generate much in the way of serious policy discussion. On the Republican side, Donald Trump bullied and vanquished his primary opponents by talking incessantly about the phantom menace of illegal Mexican immigration that peaked almost a decade ago and that 90 percent of Republicans didn't even care about. At other times, we were treated to disquisitions about the size of his cock, his admiration of Vladimir Putin, and his apparent lack of basic legislative process. On the Democratic side, the Sanders insurgency goosed Clinton's already-expansive vision of government so the former secretary of state is now promising just about everything to everyone without any pretense of paying for it. She is explicitly running as a continuation of Barack Obama, whose personal charm obscures the sad fact that over 60 percent of Americans agree the country is going in the wrong direction (only about 30 percent think it's headed in the right direction). Gary Johnson, the most-successful third-party candidate in decades, has voluntarily stepped in more dog piles than he should have, but is at least bringing some serious policy talk to the campaign while also providing a counter to liberal and conservative visions of bigger government.

The Trump tax story will likely be joined by other "October surprises" sprung on the candidates. Here's hoping the next bombshell will actually spur a substantive discussion about the policies we need to create a more free, more fair, and more prosperous society. But let's not kid ourselves, right?

Show Comments (340)