Britain Should Emulate Singapore

Free trade, low taxes, cheap energy.

Andrea Leadsom's withdrawal from the Conservative Party's leadership race ensures that Home Secretary, Theresa May, will become the next Prime Minister of Great Britain, on Wednesday afternoon. What should May's priorities be?

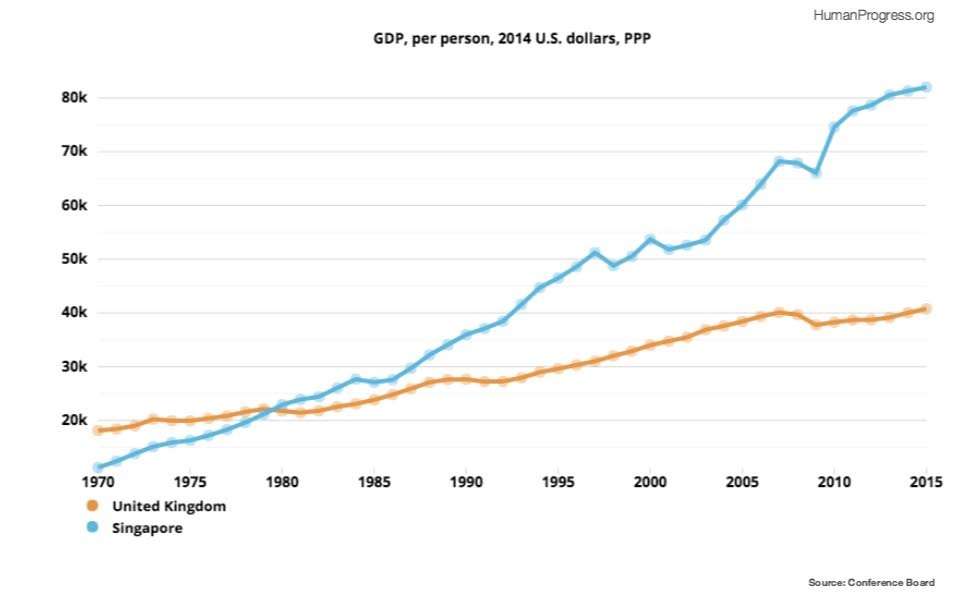

First, she should endorse Chancellor of the Exchequer George Osborne's suggestion to cut the corporate tax rate from its current 20 percent rate to a 15 percent rate, which would make it the second lowest corporate tax rate in the OECD. In fact, she should go even lower and match Ireland's 12.5 percent corporate tax rate. That way, the newspapers will not write about a "tax cut," but instead about the "lowest" tax rate in the rich world. A low corporate tax rate will indicate to the rest of the world that Britain will retain its business-friendly environment.

Second, Great Britain should commit itself to a program of trade liberalization. The consensus among the great and the good, including The Economist and The Financial Times, is that Britain must do everything it can to remain a member of the EU's single market. I think that such a commitment will weaken Britain's negotiating position vis-à-vis the EU and encourage the latter to make unreasonable demands. Additionally, it would oblige Britain to retain many of the job-killing EU regulations pertaining to the functioning of the single market.

Instead, Britain should opt for unilateral trade liberalization: eliminating all tariffs on goods and services vis-à-vis the rest of the world. Such legislation would come into effect following Brexit, which is to say, in about two years. That should give companies plenty of time to adjust and to make future plans. Additionally, the free trade legislation could be passed with the current Tory majority in Parliament and thus be in place before the next election and before the possible return to power of a more dirigiste Labour Party.

Decline in the cost of inputs would make British outputs, including British exports, more affordable and, consequently, more competitive. Reduced cost of British goods and services would thus offset much of the EU's tariff on non-EU countries, including Britain. Importantly, reduction in the cost of goods and services would provide relief to the British citizenry.

Third, Britain is currently committed to the EU's immensely expensive green energy policies. This self-inflicted wound makes heating a luxury for many poor Europeans and contributes to making European enterprises less competitive overseas. British commentators believe that Theresa May will be open to a more customer-friendly energy policy. Undoubtedly, she will be crucified by the affluent progressives in London, which is fine since they opposed Brexit and would not vote for the Tories anyway. She will also help the "energy poor" public and the manufacturing sector.

What shall we call this approach to Britain's future economic development?

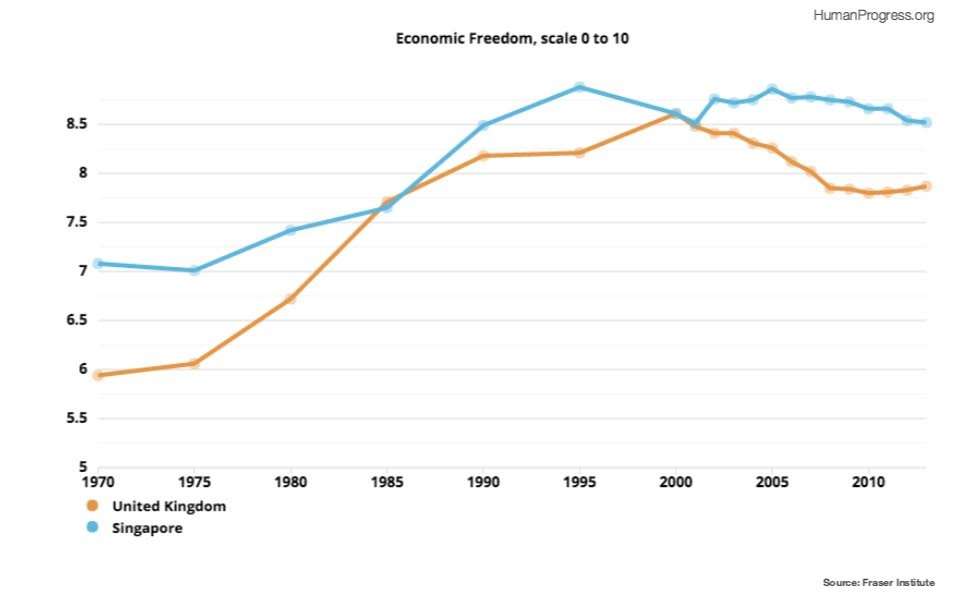

Roger Bootle, a respected commentator and executive chairman of Capital Economics, has called it the "Singapore effect." "When Singapore separated from the Malaysian Federation in 1965," he wrote, "it apparently faced a grim future. But the realization that no one was going to do it any favors acted as a spur to effective government….We could do the same. We need a strategy that lays out the path to reductions in corporation tax, lower personal tax, investment in infrastructure and cheaper energy."

Bootle is right. Free trade, low taxes, and cheap energy will make Britain an economic powerhouse and chart the course for other EU countries to follow.

Show Comments (14)