So Much for Hubbert's Peak Oil Theory: $20 Per Barrel Oil Soon?

Peak oil theorists wrong again.

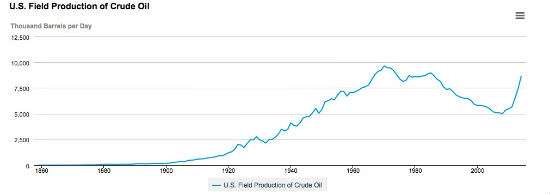

All right, the headline might be a tad hasty. Nevertheless, geologist M. King Hubbert famously (and so far) correctly predicted in 1956 that U.S. domestic oil production in the lower 48 states would peak around 1970 and begin to decline. In 1969 Hubbert predicted that world oil production would peak around 2000. Hubbert argued that oil production grows until half the recoverable resources in a field have been extracted, after which production falls off at essentially the same rate at which it expanded. This theory suggests a bell-shaped curve rising from first discovery to peak and descending to depletion.

In fact, daily U.S. oil production did "peak" at an average 9.6 million barrels in 1971. In January, U.S. production averaged about 9.2 million barrels per day. If Hubbert were right this should not be happening. The problem with Hubbert's analysis and that of his many peak oilist devotees is that they overlook how market prices can change the definition of "recoverable resources" by means of encouraging new technologies and the search for new reserves. In the current case, fracking has made once unrecoverable resources recoverable. As a consequence, U.S. petroleum production has dramatically ramped up from its nadir of 5 million barrels per day in 2008.

As a result of flood of new supplies, storage tanks in the U.S. are filling up and the amount of stored crude is at an 80 year high. Since last summer the price of oil has fallen from $107 per barrel to $50 today. Some analysts are suggesting that this glut could cause a second price collapse to as low as $20 per barrel later this year. That would be only slightly above the average per barrel low (in real dollars) of $17.23 in 1998. If prices fall that far, then drilling and production will be cut back and prices will rise again. Nevertheless, what is happening now to U.S. and global oil production and prices was supposed to be impossible according to peak oil theorists.

Show Comments (102)