Canada Wants Your Inversions. More Please, Says Finance Minister

Lost amidst all the breast-beating and rending of garments last week over Burger King's "inversion"—its planned merger with Canada's Tim Hortons to lower its corporate tax burden—is that Canadian officials are quite pleased with the whole arrangement. American pundits may denounce "corporate deserters," but Canada's Finance Minister Jim Oliver is laying out the red carpet for any international investors interested in a relatively low-tax environment.

"Canada has moved to a highly competitive tax regime," Oliver announced in response to questions about the deal. "We moved corporate taxes since we've been in office from 20 percent to 15 percent and 11 percent for small companies. We believe this has been a constructive move that is designed to retain capital in this country, which results in more business expansion and more employment."

How about that? Instead of bitching and moaning about economic patriotism, Canadian officials see a need to compete with other jurisdictions to create an attractive environment for business.

And then Oliver went to Australia to see if any businesses there wanted to follow the lead of Burger King and Warren Buffett in moving their cash to the Great White North. At the Austraian Financial Review, John Kehoe wrote:

Canadian finance minister Joe Oliver has seized on Warren Buffett's $US3 billion ($3.2 billion) investment in the country's leading fast-food business, urging Australian investors to follow the billionaire's lead to take advantage of low corporate tax rates and pro-business policies.

Mr Buffett caused controversy in his home country of the United States last week after he pledged to help finance American icon Burger King's $US11.4 billion merger with Canadian coffee and doughnut chain Tim Hortons.

Burger King's new headquarters will be based in Ontario, partly because corporate tax in Canada is lower than the high 35 per cent federal rate in the US.

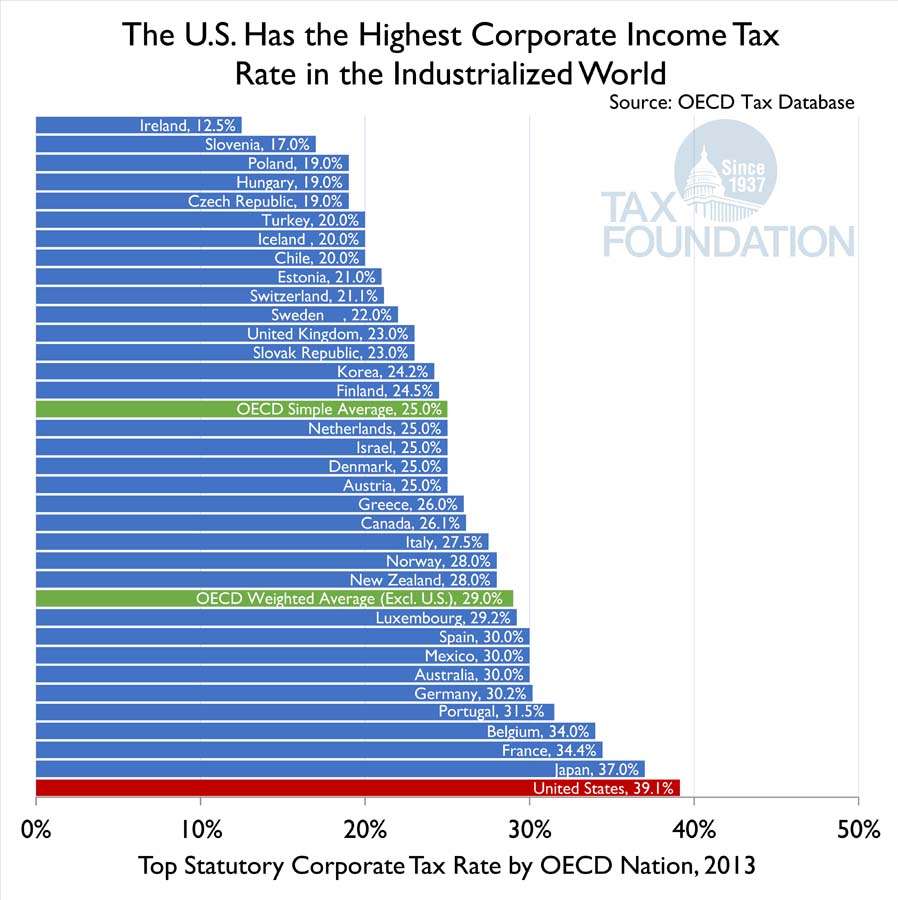

Specifically, the United States has the highest corporate tax rate among developed nations, according to the Tax Foundation. "They currently face the highest statutory corporate income tax rate in the world at 39.1 percent. This overall rate is a combination of our 35 percent federal rate and the average rate levied by U.S. states." The average across the 33 countries of the Organization for Economic Cooperation and Development is 25 percent.

Canada's overall corporate tax, including provincial rates, is just a hair higher than average at 26.1 percent. The U.S. isn't even trying to compete—unless whining is a strategy.

Show Comments (99)