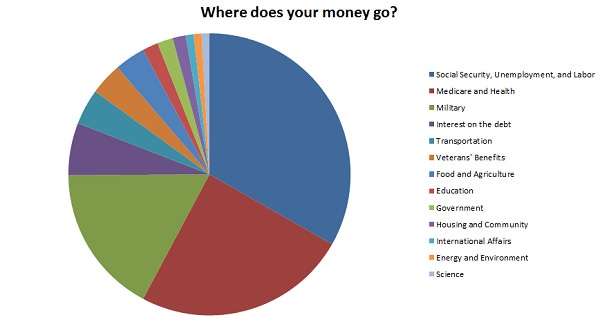

Where Does Your Tax Money Go?

Happy Tax Day. For supporters of big government it's a day to celebrate. How else would we have roads? For advocates of limited government it's a day to rue how large and wasteful government has grown. Despite the cry of "ROADZ!" only a small part of your tax dollar actually goes to roads. Assuming your tax dollar is evenly divided for federal expenditures and that money the federal government borrows is also evenly divided for expenditures, and using the president's proposed 2014 budget, your tax dollar is divied up as follows:

- Social Security, Unemployment and Labor - 33.24 cents

- Medicare and Health - 24.54 cents

- Military - 17.1 cents

- Interest on Debt - 6 cents

- Transportation - 4.1 cents

- Veterans Benefits - 3.7 cents

- Food and Agriculture - 3.5 cents

- Education - 1.8 cents

- Government - 1.8 cents

- Housing and Community - 1.5 cents

- International Affairs - .9 cents

- Energy and Environment - .9 cents

- Science - .9 cents

If you know how much you owe or you've paid already, multiply your tax bill times the number above and divide by 100 for personalized results. For ease of reading, mandatory and discretionary spending on domains like Health and Transportation were combined for the above list. Here it is in pie chart format:

Original numbers via National Priorities.

Show Comments (100)