The Great Inflation-Deflation Debate: Another Round

Inflation—Not Now, But Soon

If you think inflation is dead, you could lose your shirt.

Howard Ruff

The "malarial economy" is the fundamental model for my investment decisions. It is based on the fact that, just like the fevers and chills of malaria, certain investments go up with the fevers of inflation and down with the chills of recession, and vice versa. I have concluded that although the Fed has not invalidated this malarial cycle, it has somewhat altered the timing, delaying inflation and its attendant bull market in gold.

The years 1980 through 1982 were a terrific example of the Fed's power to distort the economy. A fairly sharp recession started in 1980, caused by high interest rates that had been dragged up by inflation. The Fed loosened the money supply to end the recession, and it worked. But when it found that inflation was not dead, the Fed tightened up and drove interest rates to a post-Civil War high that thrust us into a long and deep recession.

If the Fed had not interfered with the cycle, the recession would have been shallower and shorter, and we would now be up to our hips in inflation, probably looking at $1,000 gold. However, the increased depth and severity of that double-dip recession wrung a lot of inflation out of the economy, but not all of it. As a result, this time it is taking longer to create the inevitable inflation that always results from government deficits and money creation. There is usually a two-year time lag between an inflationary event and higher inflation and gold. That has probably been extended to 2½ years—which means inflation should take off again some time this year.

Those who believe that inflation is dead cite among their reasons the character, wisdom, and skill of Federal Reserve Board Chairman Paul Volcker. The media describe him like the little Dutch boy sticking his finger in the dike until Congress can come to the rescue by cutting $50 billion out of the projected deficit.

But imagery is dubious. First, it is politically impossible to make $50 billion in real cuts. Second, even if they do succeed, cutting only $50 billion out of a $225-billion deficit—which is probably understated in the first place—is laughable when you consider the sheer size of the problem. It's a Band-Aid on a gaping wound. Finally, it is naive to believe that Volcker, simply by keeping the money supply tight, can resist the flood of increased purchasing power caused by the flood of new federal debt.

When foreign money stops pouring into the United States (sooner or later, foreign investors are going to run out of cash), and when industrial-capacity usage takes the slack out of the economy by rising closer to the crucial 84 percent level (it's over 80 percent now), Volcker will have to ask himself a simple question: "Do I hold the money supply firm and let interest rates take off into the stratosphere, causing a recession or depression—or do I relax the money supply to accommodate this wave of federal spending, in order to prevent the breaking of the economy's back?" It's just that simple.

History tells us that if this government insists on spending hundreds of billions of dollars more than it takes in, no force on earth can prevent a flood of inflation. There is not a single example in all of recorded history of a nation inundating itself in debt, living way beyond its means, spending far in excess of what it collects in revenues, and not ending up in a ruinous inflation that buries it up to its hips in worthless paper. To suggest that in the face of the monstrous forces building up, one man can prevent this—especially in a democratic society—is absurd.

Inflation delayed is inflation made even more powerful. It's like tying down the safety valve on a boiler. The pressure gauge is gold, and there are increasing signs that the bottom in the metals is behind us. First, there's a silver production shortage. As happens at all major bottoms, demand for silver at the grassroots, small-investor level is booming—ask any coin dealer—while low copper and silver prices have caused a lot of mine shutdowns. We have early symptoms of a classic supply-demand squeeze that will cause higher prices shortly.

Also, the dollar has lost some steam. Though it hasn't broken, it is badly bent. Currency intervention by central banks has taken a lot of the speculative pleasure out of the dollar, because speculators don't know when they'll be whipsawed by some central bank. With some of the speculative heat out of the dollar, the raw fundamentals of relative value will soon reassert themselves.

The Fed has kept interest rates historically high. This is helping to maintain a strong dollar, but it has also suppressed inflation and gold. If you artificially suppress a basic trend, then when it does eventually break out, it does so with greater violence than if things had been allowed to follow their normal course. For example, we had higher inflation in 1974 than we would have had if Richard Nixon had not imposed wage and price controls in 1972. Similarly, the coming inflation, which has been suppressed by the super-powerful dollar, will be even greater than it would have been had the Fed not created a powerful dollar.

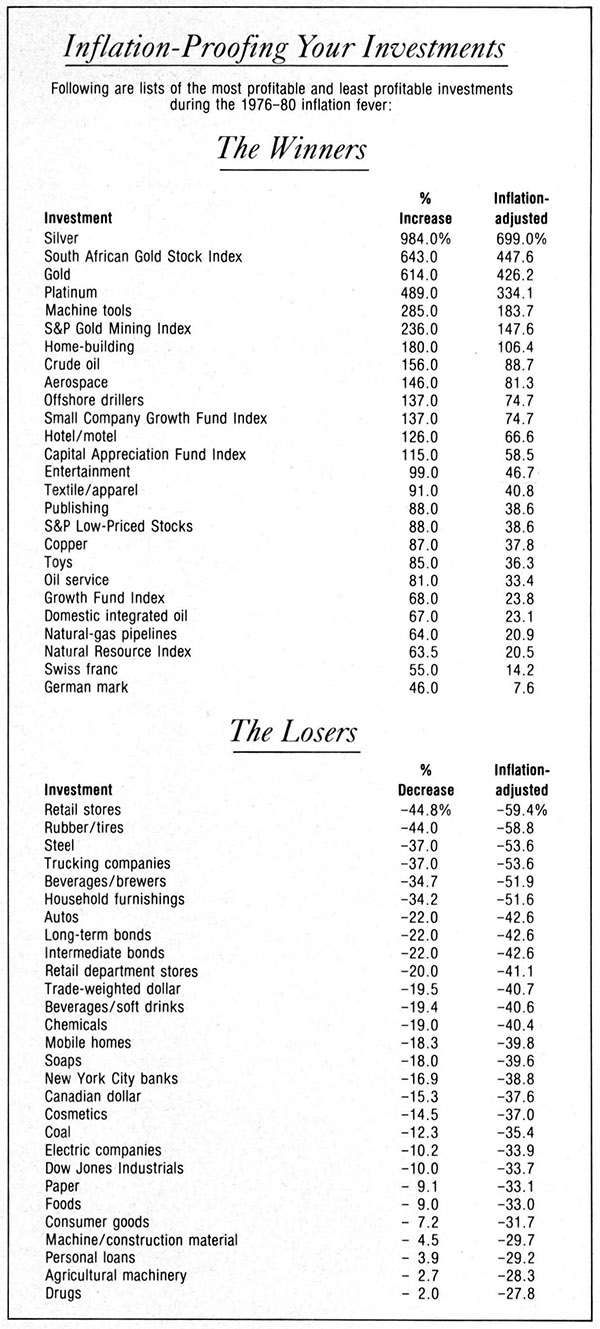

We recently completed a computer study that analyzed the performance of numerous investments in all phases of the malarial economy. From that we derived lists of the best- and worst-performing investments during the inflationary fever of August 1976 to January 1980 (see chart on page 49).

During this period, inflation turned some investments that appeared to be winners into losers, and some losers became even bigger losers. The Swiss franc and the German mark, which are generally believed to be good inflation hedges, were mediocre at best. They chalked up about a four percent and two percent annual return respectively during their best years—and that's before taxes, which would have wiped out the gains entirely. Indeed, if you account for the capital-gains tax, the winners list would look even shorter.

It shouldn't amaze anyone that the best performers were silver, gold stocks, gold, and platinum. It was also certainly to be expected that foreign currencies and most commodities went right along with the metals and that the Dow Jones and bonds were big losers during inflation.

How can you use these lists to make investment decisions? If you believe, as I do, that we're about to see an inflationary rerun of 1976–80, be sure your portfolio is from the winners list, and clean out the losers. If you disagree, do the opposite.

Howard. Ruff is editor of The Financial Survival Report and author of several books on investment and financial survival, including Making Money (Simon & Schuster, 1984).

Deflation—Here Now, More Coming

Gold under $300, oil under $10—you'd better bet on it.

James Dines

Inflations have been part of civilization at least since the days of the Hammurabic Code, 40 centuries ago, when wage and price controls were first established. Every period of inflation or hyperinflation has been followed by one of deflation, without exception. Be this a cosmic yin-yang, or sine-cosine in the sky, nobody knows. Perhaps each generation must relearn the lessons from the errors of their grandparents' generation, thus accounting for the periodicity of the Kondratieff, Juglar, and other demonstrable cycles. So where are we today?

Without a doubt, the 1970s was a period of inflation. Indeed, in 1980 most people saw a period of unending inflation. A few even predicted hyperinflation, the supernova of inflation. But in the late '70s, I specifically rejected the possibility of hyperinflation (yet), because that results only from the collapse of political institutions, such as after devastating wars.

To the contrary, I had always felt that the 1970s represented a period of rather routine inflation that would end with a rather routine deflation. And I believe that a deflation began in 1980, at which time gold, oil, real estate (especially farmland), and the Dow Jones Commodity Index reached apogees not surpassed since. The unwashed do not perceive this as a period of deflation, calling it instead in Orwellian fashion a "disinflation"—perhaps unsurprising at a time when President Reagan calls one of his missiles "the Peacekeeper." But here we are, in the fifth year of a deflation that is invisible!

A key perception in understanding the inflation-deflation cycle is that when government creates too much money, more paper chases the same amount of goods, and prices ineluctably rise. An ancillary key perception is that when prices rise faster than income, spending at some point must decline; prices are too high and will then fall of their own weight—a process I believe began in 1980.

The symptoms are numerous for those who would see; it is no accident that we have today what are called "street people" (like the hobos of the 1930s), a "rust bowl" (like the dust bowl of the 1930s), emotional farm foreclosures, soup kitchens, and stubbornly high unemployment. What we make of this is that the basic industry of the United States has been sliding into an ever-deepening depression since 1980—one concealed by an overlay of a dynamically high-growth technology sector that is too young in its cycle to be similarly affected. Strength in high technology explains why a state such as California is doing well, whereas basic industry states, such as in the Midwest, are doing poorly.

I realize that it is a daring and extreme minority point of view to suggest that we are in a deflation, inasmuch as the United States has been conditioned by 50 years of ongoing inflation. Nonetheless, many sound reasons for a deflation can be found. For one thing, there are simply too many commodities. When OPEC got greedy in the late 1970s and raised the price of its commodity too high, the whole world embarked on a frantic search for oil (perhaps condensing 20 years of drilling into a few). Indeed, an oil glut exists today for anyone to see.

A second factor is the historic opening up of the undeveloped world. Though in the '60s it was uneconomic, for instance, to mine huge copper deposits in faraway places due to the lack of financial and transportation infrastructures, that's changed. Mineral deposits are being opened up all over the world, all at once. In other words, a commodity glut can exist irrespective of the excess creation of paper money. That is why copper and sugar prices are so depressed.

Not only are commodity prices under pressure, but so are once-sacrosanct wages. When I began in 1975 predicting lower wages in my book The Invisible Crash, it was perceived as a preposterous prediction. However, wages in the United States have been ascending at an increasingly slower rate in this decade, and I predict they will actually decline sharply. In 1945, US workers were the best educated. This country had the best machinery, cheap capital, cheap land, and a hungry world to feed. Today, developing nations have the education, superior machinery, and the technological know-how that we've given them—and there is no way for our farmers to compete.

Since 1980 I have been predicting that China would go capitalist, and I think the signs are already beginning to emerge. In the last seven years China has been increasing its farm production at an average rate of 12 percent a year, and now it is suddenly the world's largest wheat producer! Have you considered the impact of one-quarter of the human race suddenly dumped onto the world labor market, willing to work for a paltry $2.50 per day? There is simply no way for the American labor force to survive in such circumstances, and all the US labor-union movement has proved is that a beggar mounted will ride his horse to death.

Since 1981 US poultry exports, for example, have plunged 37 percent to 551 million pounds, according to the Agriculture Department, with another 10 percent decline projected for this year. Our pork exports are also expected to plunge by a staggering 50 percent this year, from 1981 levels, while pork imports are expected to nearly double to almost 1 billion pounds from 1981 levels.

The truth is that the American worker, unless he is in some kind of high-technology field, is vulnerable to developing-nation labor competition—in other words, is dead as a dodo. One can throw the US farming industry into the trash can, just as we have lost our television industry and many others.

Not only are commodities, energy, and labor under pressure, but so is real estate. Obviously there is no surplus of real estate, because the amount of land is always fixed. But the country as a whole quite simply overbuilt in the 1970s, largely due to inflation and tax considerations (and those might soon be diminished). The resultant oversupply of buildings weighs heavily on many American cities. Price of capital is another consideration. Even here, Japan for example has an interest rate half ours—yet another lower-cost structure that enables them to sell at competitively lower prices.

None of the above sounds as if the United States is headed for an inflation. There will be periods of remission. Indeed, the financial newsletter The Dines Letter, which I edit, turned bullish on gold, copper, oil, and several other of the inflation hedges at the beginning of 1985, because we saw a temporary period of remission that would feature a rally in the inflation hedges. Thus, while I am looking for short-term strength in precious metals and other inflation hedges, by later this decade they will see substantially lower prices. If I'm right on the long-term deflation scenario, then sometime towards the end of this decade we will see gold under $300 an ounce, oil under $10 a barrel, interest rates below 5 percent, and many other now-unbelievable price levels.

During the 1984 presidential campaign Walter Mondale warned that huge federal deficits would drive interest rates higher, and perhaps he lost the election because interest rates fell instead. This is what scientists call an "anomaly," a surprising result in view of the logic. Well, it is no surprise at all to anyone who comprehends that we are in a deflation, which always features declining interest rates. Federal deficits are as big as ever, so why are interest rates declining? Those with in-depth understanding realize that we are in a long-term interest-rate decline, which will feature a long-term bull market in bonds.

But this in itself carries dangers. In 1970 the US government spent 7.4 percent of its budget on interest payments; in 1986 that figure will be 14.7 percent. Huge federal deficits are compounding the increase at a frighteningly exponential rate. How high a percentage of the budget could be allocated to paying interest? Twenty percent? Fifty percent? Surely sometime before we reach the 100 percent level there will be some kind of financial calamity, which, I expect, will start sometime around 1989. The banking system is already feeling tremors.

Now that investors have all learned what the inflation hedges are and purchased them in the 1970s, I doubt that many even recognize deflation hedges: US dollars, Treasury bills and bonds, bank and insurance stocks, stocks in food and soft-drink companies, preferred stocks, utility stocks, and other defensive issues. Unsurprisingly, these groups have all been market leaders recently.

One of the primary beneficiaries of deflation is the financial sector. (Technology is in a separate cycle and not necessarily a beneficiary of either inflation or deflation.) Indeed, it is interesting to observe the current boom in the bank and insurance industries (except the ones that loaned money on inflation hedges: oil, real estate, commodity-related investments). Again, this is confirmation from the world of reality. Some call this process the "deindustrialization of America." It is not. It is an international depression, masked by a technological growth that is shrugging off a deflation because of its own incredible internal energy.

Another profound deflationary phenomenon will be the commencement of what I feel is the coming "robotics age." The truth is, this development trend has already begun. I can foresee that in a few short years the entire computer industry will be a subsection of robotics. There is a factory in Japan, for example, that employs one nightwatchman, and the lights are out, because robots work 24 hours a day manufacturing in the dark. This is the face of the future. How low would human wages have to drop to compete with a robot-operated factory?

True, the robotics revolution should be seen as something in which to invest, and The Dines Letter is intensely interested in this area. But on the larger canvas, what picture is being formed? What will it mean to the concept of having a job? Are we at some nexus in history where we at last have "made it"? Where laboring for our bread is a thing of the past? A point when there is more than enough food for everyone? When having a job will be a tremendous privilege, and when there will be a guaranteed minimum income for everybody?

What would make me think I am wrong about the deflation scenario I've depicted? I expect gold to rally from around $300 an ounce towards the $400 area, but if gold got substantially higher—and especially if it made a new all-time high—gold as a barometer of inflation would suggest that we were headed for another round of inflation, possibly even a hyperinflation. However, I do not expect this to occur. Rather, I look for gold to suffer a decline to under $300 before the period of deflation is over.

On the other hand, I would be convinced that I am right that the United States is in a deflation if, for instance, the inflation rate declined to a minus number! After 50 years of living with inflation, some minus numbers in the inflation rate would convince me I am right about a deflation—and it would, of course, flabbergast the inflationists, who simply would not be able to explain it.

James Dines is the editor of The Dines Letter financial newsletter and the author of The Invisible Crash (Random House, 1975).

Inflation or Deflation—Who Can Tell?

Whatever the future, you can protect yourself with an "armadillo strategy."

Richard C. Young

In the last decade, the world economy has become increasingly complex and unpredictable. Today, depending on the evidence being considered at the moment, you can make a compelling case for deflation and depression, hyperinflation, and every economic scenario in between. As an economic and monetary analyst, I have my own carefully considered opinions on the subject. However, they are opinions, not guarantees of the future. No one can be absolutely sure what tomorrow will bring.

The major protagonists in the deflation versus hyperinflation controversy are urging investors to choose sides. They claim an individual's financial future depends on betting the right horse. This may be true for speculators trying to make a killing in the financial markets, but it is emphatically not the case for capital-preservation-oriented investors, who should be preparing themselves for any economic eventuality.

The "Financial Armadillo Strategy" is designed to preserve and enhance individual wealth in every conceivable future economic environment. Like the armored little creature from which it gets its name, the Financial Armadillo Strategy is both offensive and defensive in nature. It adapts to a wide range of investment climates and promises to endure, whatever economic upheavals may be on the horizon. The armadillo has survived since prehistoric times. Armadillo-strategy investors will be among those to survive what could truly be a tumultuous economic future.

The primary objective of any capital-preservation-oriented investment program is to grow financial assets at a rate greater than inflation with nominal investment risk. Historically, US Treasury bills have been the single best vehicle for achieving this goal. Because T-bills, like all US Treasury securities, are backed by the "full faith and credit" of the US government, there is virtually no capital risk. As long as Uncle Sam is alive and kicking, your principal and interest are guaranteed. Except for a seven-year stretch between 1973 and 1980—a period of rapidly accelerating inflation—Treasury bills have provided an inflation-adjusted real rate of return. Consequently, the 90-day T-bill yield is a yardstick against which all conservative investment programs are measured.

A conservative investor could buy nothing but T-bills and be financially secure in a deflationary or stable-inflation economy. However, if runaway inflation is in the cards, T-bill investors run the risk of a yield that lags behind inflation, as was the case from 1973 to 1980. The challenge is to find an investment portfolio mix capable of matching the Treasury-bill yield while at the same time offering a long-term hedge against accelerating inflation.

The Financial Armadillo Strategy achieves this objective with a portfolio consisting of 4- to 7-year T-notes (another type of US Treasury security) and gold. The yield on 4- to 7-year T-notes is generally higher than that offered by 90-day T-bills. For example, today 5-year T-notes are yielding approximately 11 percent, compared to the 8 percent provided by 90-day T-bills. If you were to buy $20,000 worth of T-bills yielding 8 percent, you would receive a $1,600 return on your investment in a year, assuming a stable T-bill yield over the year. For $15,000 invested in 5-year T-notes yielding 11 percent, you would receive a comparable $1,650 return.

Due to the longer maturity of the 5-year T-notes, "purchasing-power" risk is increased. If the inflation rate goes from 4 to 15 percent in the 5-year maturity period of the T-note, you could expect a negative inflation-adjusted return. However, if you use the $5,000 saved in purchasing 5-year T-notes instead of T-bills to buy gold as inflation insurance, you could probably count on a positive real return even with soaring inflation.

During the inflation wave of the '70s—at the same time T-bill yields were lagging behind inflation—gold went from approximately $42 per ounce to over $800. I doubt if we can expect such a dramatic run-up during any future inflationary wave, but it is fair to assume that the price of gold would react favorably to a return to double-digit inflation. This 25 percent portfolio position in gold would more than compensate for the negative inflation-adjusted return on 5-year T-notes.

During a deflationary crisis, it is open to question whether the price of gold would decline. If investors are frightened in any extreme economic environment, inflationary or deflationary, gold might hold attraction. However, let's assume that gold does drop with deflation. T-notes would appreciate sharply as interest rates collapsed, producing substantial capital gains in addition to yield—something T-bills don't offer.

Let's consider what you could expect from the Financial Armadillo Strategy in a relatively stable disinflationary environment such as we are now enjoying. The yield on T-notes, assuming inflation and interest rates remain stable for the next five years, would retain approximately the same market value. The T-note portion of a portfolio would provide a rate of return substantially above the rate of inflation and comfortably above the T-bill yield. While the price of gold could conceivably go down, I'm confident it wouldn't drop far below its current price, a price consistent with my historical value guidelines.

The Financial Armadillo Strategy is as easy to implement as it is effective. T-notes can be purchased through your local commercial bank or stockbroker. (They are generally sold in minimum denominations of $5,000.) Gold coins can be easily purchased at numerous dealers and stored in a safe-deposit box at your bank. Certificates of gold ownership are also available at major banks throughout the United States. (Do not buy gold shares for your Financial Armadillo program. A gold share represents nothing more than a fractional interest in a hole in the ground, vulnerable to any number of natural or political disasters.)

It's not easy for individuals to ignore the often emotional advice given by financial pundits on either side of the inflation-deflation issue. Even an extremist can, on occasion, be correct, and those who follow such advice can make a quick killing. However, when extremists are wrong, their disciples can be wiped out. It's better to be safe than sorry. The Financial Armadillo Strategy offers a common-sense way to deal with the unknown.

Richard Young is president of Young Research & Publishing, Inc., and managing director of Newport International Investments, Inc. He is the publisher of Young's World Money Forecast, The Young Forecast, Young's International Gold Reports, and Young's Economic Strategy Reports.

This article originally appeared in print under the headline "The Great Inflation-Deflation Debate: Another Round."

Hide Comments (0)

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Mute this user?

Ban this user?

Un-ban this user?

Nuke this user?

Un-nuke this user?

Flag this comment?

Un-flag this comment?