How to Cut Your Taxes

The highest taxes in U.S. history are on the way. It is estimated that when the people who were born during the Baby Boom after World War II all retire, the workers who remain will have to pay 70 percent of their wages just in social security tax, let alone Federal income tax, state taxes, etc. These are the overt taxes. Then there is the insidious tax of inflation. In addition, some people disagree strongly with the way the government is spending tax money, such as financing the war in Vietnam, running railroads, subsidizing an inefficient postal system, and paying farmers not to plant. So as people contemplate the burdensome load and evident squandering, they have decided in various ways to reduce the amount of taxes they must pay.

You can no longer leave it to some tax expert. The best way to minimize an unbelievably heavy tax load is to become an expert yourself. It is not enough to make wise investments if you ultimately wind up paying out most of the profit in taxes. You must do intelligent tax planning, in connection with a good international tax attorney if you have a net liquid worth of over $100,000. If you cannot afford to or do not choose to take this route, perhaps the information in this article will be of benefit to you.

There are basically three ways to reduce one's taxes: legal-conventional, ideological, and illegal. We will take each of these three ways and examine it in detail. First I should point out that the ideological method encompasses legal, contestably legal, and illegal means. It is not the purpose of this article to attempt to classify these techniques as either legal or illegal, nor to justify these means, but simply to present them as a news item.

SHELTERS VS. HAVENS

The most common of the legal methods is the tax-sheltered investment, normally in the form of a limited partnership. The investor (a limited partner) puts in funds. Because of special tax considerations the entire indebtedness of the partnership can be added to the "tax basis" of the partnership. This allows for very rapid depreciation of, for example, rental property. Thus an individual could place $2,000 into a tax-shelter investment and deduct perhaps that much or more from his income tax because of loans to the partnership. Some of the more popular tax-shelter investments today are: cattle feeding, real estate, farming operations, equipment leases, and movie production. It should be noted, however, that these investments simply delay the paying of tax. Eventually, when the partnership is liquidated, the taxes come due.

Now a word of caution. I have seen many, many stupid investments in tax-shelter situations. This brings us to one of McKeever's cardinal rules: a tax-shelter investment must first of all be a good, solid, sound investment and secondly should have tax advantages. Do not jump into these types of investments merely for the saving of present taxes. First make sure it is a good sound investment that you would like to make even if there were no tax advantages. Then, if this is true, double-check the tax advantages and be sure the investment fits into your overall plan and objectives. Then proceed.

A tax shelter is a useful device for minimizing the taxes on income you have already earned. In contrast, a tax haven will be of benefit, not for income, but only for the elimination of capital gains. The funds that would have been paid in taxes can be reinvested, obviously causing your capital to multiply much faster over a number of years.

Tax-haven countries are those having little, if any, taxes and having governments that foster their status as tax havens. Most of these countries make their revenue either from import duties or from taxing their own residents. Some of the most popular tax havens for North Americans are: the Bahamas, the Cayman Islands, Costa Rica, Liechtenstein, the Netherlands Antilles, and Panama. In choosing a tax haven one would have to compare the relative advantages and disadvantages of these countries in detail. A few brief words of comment will have to suffice here.

International money tends to be quite fickle. Several years ago the Bahamas fell out of favor and the Cayman Islands became the new tax-haven darling. Now almost the opposite is happening. The Cayman Islands have seen the failure of the Sterling Interbank and the International Monetary Bank, and now one of the major banks, the Bank of Montreal, has closed its operations there. The Cayman Islands are still a very valid tax-haven, and those with trusts and companies based there should not worry nor try to move their tax base. But the Bahamas are beginning to come into favor again. They have already been through what is likely to occur in Bermuda and the Cayman Islands, having made the transition to a native government, developed political parties and unions, and been through all the other struggles of an emerging nation. The Bahamas have accomplished this very successfully and are reemerging as the major tax haven in the Western Hemisphere—as a mature tax haven.

As to the other locations, the islands forming the Netherlands Antilles, since they have a tax treaty with the U.S., can be beneficial in certain unique cases, mainly if income is going to be derived in the United States. In Central America the two favorite tax-haven countries are Panama and Costa Rica. Panama is best if you are going to distribute a large number of shares of stock to a large number of people, and Costa Rica is without peer when it comes to bearer share companies. Both countries tax income and capital gains generated within them, but not outside of their borders.

How can countries where there are no taxes benefit us? Look at the U.S. side of this situation. The United States wishes to attract foreign capital, so, if a foreign entity invests in the United States in any capital asset (stocks, bonds, gold, silver, land, real estate, etc.) and subsequently sells that capital asset for profit, the government does not levy any capital gains tax. If that foreign entity were located in a tax-haven country, there would not be any taxes from its country of registry either. If it is owned by U.S. citizens, however, they would be taxed on that income (or capital gains). Nevertheless, there are procedures by which such an entity can be used beneficially.

TAX HAVEN ENTITIES

There are two basic types of entities that can be established in most tax-havens: trusts and companies. (Liechtenstein has a unique third type, an Anstalt.) Since companies with shares of stock are familiar to most people, we will just say a brief word about trusts. There are three parties to any trust arrangement. There is the person that creates the trust by placing funds into it—in a typical family situation, the parents. This person (or persons) is called the grantor or trustor or settlor (interchangeable terms). Then there are the beneficiaries—in the family situation, the children—who receive the benefits of the trust. The third party is the trustee, usually a bank or a trust company, but it can be an individual, who is responsible for fiduciary management of the funds. The trustee can be very active, making the decisions, or very passive, taking his instructions from either the grantor or a beneficiary.

People establish domestic trusts because a trust is taxed as a separate person and not as part of the grantor. This means that creating a trust within the United States is like creating a new U.S. citizen. Similarly, creating a trust in one of the tax-haven countries is like giving birth to a citizen of that country. The trust has all the rights of any other citizen of that country and has an additional benefit—it can never die.

Since a U.S. national's creating a trust in an off-shore country is like giving birth to a nonresident alien, assets transferred or given to that trust are outside the jurisdiction of U.S. law. Foreign exchange controls imposed by the United States would not apply to funds owned by this trust. Similarly, if a messy family or divorce situation is projected, funds in a trust of this type would be untouchable. Off-shore trusts can thus provide asset protection. Doctors who are concerned about malpractice liabilities, by moving their assets to a trust of this type could, with proper structuring, immunize themselves against the grasping hands of malpractice suits.

Although the asset-protection trust assumes that the grantor is going to pay all U.S. taxes, using the trust to protect the assets only, trusts are also used as a tax-haven entity to minimize or eliminate taxes. These are complicated and should be set up by a professional. One of the key things to note is that if a trust has just a few beneficiaries and there is a term and a fixed distribution, the IRS would treat it as that beneficiary's income and tax it accordingly. International tax attorneys use a "spray" trust, whereby none of the beneficiaries has any definite right to distribution, that being left to the discretion of the trustee. There may be a hundred or more beneficiaries named, including all of the charitable organizations in the United States. I have even heard of cases where the director of the IRS was named as one of the beneficiaries—but that is going a little far! With a spray trust, since the true beneficiaries are just part of a long list, it is difficult for the IRS to determine tax consequences.

The trust has some nice advantages in that probate costs are avoided and, at least as far as the tax-haven countries are concerned, there are no inheritance or estate taxes. It has probably been the primary tax-haven entity in times past.

It is undoubtedly best to use a good international tax attorney to establish a tax-haven entity. The difficulty with a do-it-yourself approach is in making actual transactions with tax-haven entities. In drafting the necessary documents an attorney really comes in handy.

There is no way I could go through all the possible transactions in their proper form here, but a simple case will illustrate what is involved. You could loan to a tax-haven bearer share company a sum of money, payable in 20 years, with a small amount of interest to be paid, either annually or at the time the principal is returned. You would be subject to income tax on the interest. The tax haven entity could use the money to establish a Swiss bank account and open a brokerage account in the United States, whereby it could buy and sell stocks or commodities. A resolution by the board of directors would be needed in order to open bank accounts or commodities accounts. As the capital multiplies it could repay your initial loan—with no tax consequences, since it is a loan repayment. Here the only documents needed are for the loan and the resolutions by the board of directors. Your local attorney should be able to assist you with the loan document and the nominee directors of the bearer share company should be able to assist you with the resolutions.

Getting into noncash assets is more tricky, however. If you have an appreciated asset, it technically must be moved into the tax-haven entity at its appreciated value and capital gains tax immediately paid on any appreciation. There are ways to minimize the impact in such instances, but these need to be covered on an individual basis. Some type of professional counsel is necessary to assist you in more complex transactions involving real estate and the like.

COMMODITY STRADDLES TO REDUCE TAXES

Commodity straddles can offer a large tax savings on income from capital gains (but not on income that is part of a taxpayer's trade business). The most common capital gains transactions are the sales of securities, commodities, real estate, etc. The gains fall into two categories: short-term (the asset is held less than six months) and long-term (held more than six months). For tax purposes you should aim to wipe out your taxable gains, or at least to change short-term into long-term gains. Long-term capital gains are taxable at one-half the income rate, up to a maximum of 25 percent on the first $50,000 and 36.5 percent on the balance.

The greatest advantage of commodity straddles is the deferral of capital gains from one year to the next. Deferral enables this year's total tax payment (minus the required straddle margin) to be used for one additional year (or longer, if you keep rolling it over). Another advantage is the opportunity to convert short-term into long-term capital gains. A third advantage, not often used, is the opportunity to convert a long-term capital loss, deductible for income tax purposes at only half the actual loss, into a short-term loss, which is fully deductible.

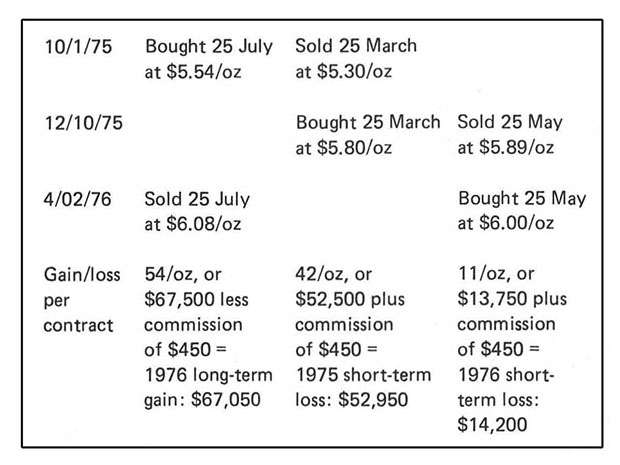

It is important to place tax straddles in a volatile commodity market that has substantial price movement and where the contracts in different months tend to move up and down together. Silver is such a market. The following is a hypothetical example of a straddle in silver futures for an individual in the 50-percent tax bracket, with a $50,000 short-term capital gain.

The results and tax consequences from the example are:

- A $52,950 short-term loss was realized in 1975 and no tax was paid on the investor's original $50,000 short-term gain. Of the excess of $2,950 short-term loss, $1,000 was used to reduce 1975 ordinary income.

- For 1976 a long-term gain of $67,050 was realized, taxable at one-half the ordinary income rate. Also, an additional short-term loss of $14,200 was deductible against any short-term profits in that year or against the long-term gain of $67,050.

Since the July contract dropped slightly relative to the March and subsequent May futures, the long-term gain was slightly less than the short-term loss and a small speculative loss was sustained. It should be understood by all those employing tax straddles that the volatility of the spreads between contract months can cause profits or losses. One can never be certain of entirely avoiding this risk. There are ways to minimize but not to eliminate it. The butterfly spread can be used to reduce this risk. Instead of buying 25 July and selling 25 March in the first step, a butterfly spread would entail buying 25 July and selling 13 March and 12 December. This would protect against a move in either direction of the spread because of interest rate fluctuations.

There are many variables in a successful commodity tax straddle. For example, if the carryover taxable gain in the following year results from the short side of the straddle, then the gain is classified as short-term, in spite of the length of time it was held. You would then have the opportunity to place another straddle to attempt to change the short-term into a long-term gain or to place another straddle later in the year to roll the gain into the following year.

IDEOLOGICAL TAX REDUCTION

A growing number of individuals are participating in what has been loosely called the tax revolt. These are individuals who believe, for moral or other reasons, that they should not pay taxes. Tax Strike News relates events in this area, and there is an increasing number of books on the subject. Much of the following is attributable to Hank Hohenstein, author of The IRS Conspiracy.

There are three basic methods by which the tax protestors register their resistance. The first approach is to file 1040 Form, but with "Fifth Amendment" in every space on the form. This is one of the basic methods suggested by Marvin L. Cooley in Tea Party 1976. If you take this approach, protect yourself as best as possible. Tax resistance services offer packets with all of the attachments that you should include with your 1040. For example, the Bill of Rights should be attached so that if your case is ever tried the Constitution must be considered relevant.

Some tax protestors hold that filing a Fifth-Amendment 1040 simply waves a red flag at the IRS, so they pursue the second course and don't file at all. If called in by the IRS the nonfilers give a variety of reasons for electing not to file. The central one is again based on the Fifth Amendment, that an individual may not be called upon to give self-incriminating evidence. One of the chief advocates of this "don't file" method is Lucille Morgan, author of How to Stop Paying Taxes Legally. Another interesting reason given by the nonfilers is that they are unable to tell how much "money" they have made. The point is that the Form 1040 asks how many dollars you have made. But a dollar is defined in the present Constitution and law as 1/42nd of an ounce of gold, and the "dollars" received as income are not convertible to lawful money, so defined.

The third method of tax resistance that is proving very popular is that of forming your own church or affiliating with an existing church as a branch and enjoying the attendant tax benefits, for which tax deduction approval must be obtained from the IRS. Furthermore, if a person's income is less than $15,000 a year he can take a "vow of poverty," giving all of his income and assets to the church. This way he pays no taxes and has to report nothing because churches do not have to file any forms with the IRS.

All three of these methods are risky. The constitutional provisions and the tax laws at issue are the subject of much legal controversy and are constantly being reinterpreted by the courts. For a more detailed discussion of how best to employ these methods and of the attendant risks, see the articles by Karl Bray and David Bergland in the April 1976 REASON.

AVOIDING TAXES ILLEGALLY

Finally there are, of course, clearly illegal methods of evading taxes. These include not reporting some of your income, not reporting capital gains on custodial accounts in Switzerland, siphoning off cash and not running it through your books, and so on. These are all criminal offenses and are punishable accordingly. If you have acted illegally in tax matters it is my strong advice to get it all cleaned up as quickly as possible and make yourself 100 percent legal.

If you are going to break the law or lie, then one of the best means is an off-shore bearer share company. A true bearer share company is one whose stock certificates have typed on them the word "BEARER" instead of the actual owner's name. Such a stock certificate is legally owned by whoever is physically holding the certificate. If there is only one stock certificate for a company, then whoever physically holds that certificate owns the company. Now for you to actually hold that certificate and own a foreign company without reporting it to the IRS is illegal. (Some interesting dilemmas could arise. If someone were to ask you whether you own the company, you could hand the certificate to a trusted friend and be able to answer, "No, I do not own it." Of course your friend, asked the same question, can return the certificate and also answer in the negative.)

In Costa Rica, for example, you can have such a company with bearer share stock. The only place where the name of the true owner of the company is recorded is in a book that you have in your possession. The Costa Rican government itself cannot find out who owns the company. Since there is no tax on income earned outside of Costa Rica, and assuming that there is no income from within Costa Rica, only an information return has to be filed that says, yes, we are still in business. Since there are no taxes being levied, there is no need for reporting to that government any financial information about the company.

In some tax-haven countries, such as the Cayman Islands, the stock certificates are made out to attorneys, their secretaries, etc., who have signed them, and the shares, in effect, become bearer shares. The advantage of the bearer share company is that it is cheaper to establish and easier to utilize than a trust. Do not forget that if you really are the legal owner, however, you are required by law to report this to the IRS.

YOUR FINANCIAL FUTURE

Whatever you think of the propriety or the appropriateness, in your personal situation, of tax rebellion, it is clear that everyone needs tax planning. At some point the governments of the various countries who are adopting a "Santa Claus" attitude will have to increase the tax burden to unbearable proportions. When the social security and welfare program was first started in the United States, there was one beneficiary to every 143 workers. Today it is one to every 2.5 workers. If this trend is extrapolated, eventually the system collapses. I recently saw a bumper sticker picturing a little red wagon with about 20 children piled on top of it. As the sticker asked, "Who's going to pull the wagon if everybody wants to ride?" Eventually the attitude of sitting down and letting the government take care of things will break the back of those producers left providing for the free loaders.

The development of your tax plans and tax strategy should begin now. The cleanest approach, for those who can afford it, is the use of the tax haven. After this would come techniques, like the commodity spread or tax-shelter investments. These are the normal methods used for decreasing the "official'tax" levied by the government. Others, because of their own ideologies, have elected to protest or resist paying any tax at all. In any case, you should sit down and carefully think through your stand on taxes, decide how much tax you're going to pay (our tax system is one of self-assessment), and then choose the best vehicle to help you achieve this objective.

Jim McKeever is an international consulting economist dealing with investments, tax havens, international affairs, and physical survival. He was formerly the editor of Inflation Survival Letter and is currently the editor of McKeever's Multinational Investment and Survival Letter. Copyright 1976 by Jim McKeever.

This article originally appeared in print under the headline "How to Cut Your Taxes."

Hide Comments (0)

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Mute this user?

Ban this user?

Un-ban this user?

Nuke this user?

Un-nuke this user?

Flag this comment?

Un-flag this comment?