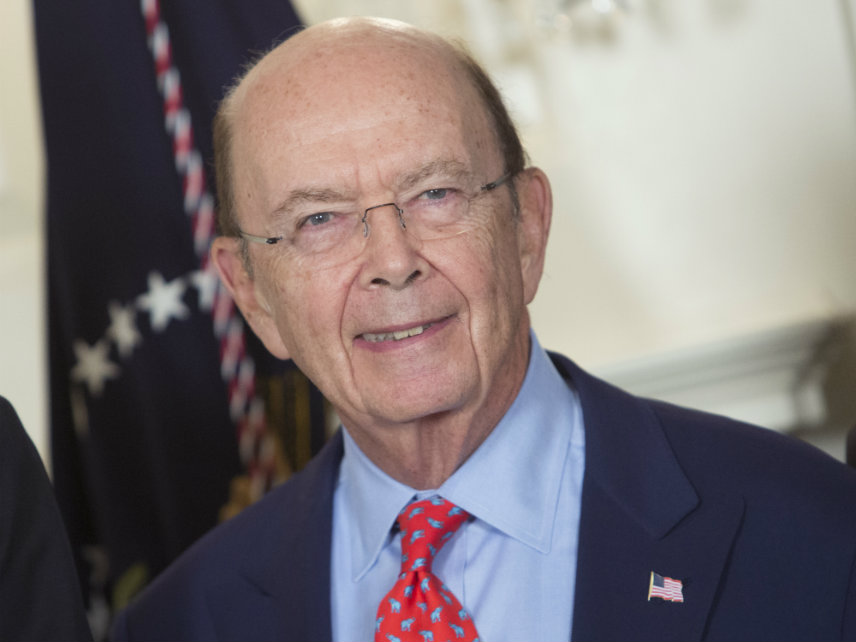

Commerce Secretary Wilbur Ross Should Shut Up About Soup Cans, Already

If he believes this economically illiterate nonsense, he shouldn't be trusted to run the Department of Commerce. If he doesn't believe it, neither should you.

Commerce Secretary Wilbur Ross has been carrying a can of Campbell's soup to television studios all over Washington, D.C., this week as he makes the case for tariffs on steel and aluminum imports.

"Let's put it in perspective," he said during one such appearence on Fox Business. "There's about 10 cents worth of tin plate steel in this can. So if it goes up 25%, that's a tiny fraction of one penny. That's not a noticeable thing."

Not a noticeable thing? Maybe that's true when your "perspective" is reduced to the size of a single can of soup. Blown up to it's proper scale—the United States' steel imports during 2017 were valued at more than $29 billion—an increase of 25 percent looks, well, a little bit more significant. The 25 percent steel tariff (and a 10 percent tariff on aluminum) that President Donald Trump signed Thursday will increase costs for businesses and consumers, will likely trigger job losses in industries that consume steel and aluminum, and may trigger a trade war with Europe.

Surely Ross knows this. He's the secretary of commerce. He's got degrees from Yale and Harvard Business School. He's worked for investment banks and run a private equity firm. Somewhere along the way, he must have taken a class or two in macroeconomics and learned about the distorting effects that tariffs have on national economies.

But you wouldn't know it if you listened to him over the past two weeks.

"He intentionally makes it sounds as if it is nothing when the overall cost to any particular industry is actually a much bigger deal," says Reason columnist Veronique de Rugy, a senior research fellow at the Mercatus Center.

For starters, Ross' math is wrong. A 25 percent increase on something that costs 10 cents is not "a tiny fraction of one penny." It's more than 2 cents. But on other appearences—like this one on CNBC, where he wondered "who in the world is going to be too bothered" by a small increase in the price of soup—Ross has claimed that a soup can contains 2.6 cents worth of steel, so maybe he's confused about how tariffs will affect Campbell's soup.

Campbell's, by the way, is not laughing off the tariff the same way Ross is.

"Any new broad-based tariffs on imported tin plate steel—an insufficient amount of which is produced in the U.S.—will result in higher prices on one of the safest and more affordable parts of the food supply," the company said in a statement.

Mathematics aside, Ross' larger point is either woefully illiterate of economics or deliberately misleading.

Ross assumes that companies can pass all the cost onto consumers or absorb the original cost increase without reducing their consumption of steel or aluminum or of labor, and without deciding to move their production outside of the United States.

"How can he assume," de Rugy says, "that lower profits resulting from higher costs have no impact what companies do and on how many workers they can hire or keep employing?"

While American steel manufacturers would benefit from the tariffs, a far larger slice of the economy would be hurt. According to 2015 Census data, steel mills employ about 140,000 Americans and add about $36 billion to the economy, but steel-consuming industries employ more than 6.5 million Americans and add $1 trillion to the economy.

Trump's tariffs could grow the steel, iron, and aluminum industries by about 33,400 jobs, according to a policy brief released this week by the Trade Partnership, a Washington-based pro-trade think tank. On the flipside, the tariffs are projected to wipe out more than 179,000 other jobs. That's about 146,000 net job losses—or five jobs lost for every job gained.

No matter how inexpensive a can of soup might be, it becomes significantly harder to purchase one if you don't have a job.

This isn't theoretical. The effects of tariffs are well-documented. Barack Obama's tariffs on Chinese tires cost American consumers an estimated $1.1 billion in return for preserving 1,200 jobs in the domestic tire industry. When George W. Bush put tariffs ranging from 8 percent to 30 percent on steel imports, it dealt a $4 billion hit to the economy and led to 200,000 job losses.

Is that what Ross means when he says a steel tariff is "not a noticeable thing"?

This isn't just bad economics; it's bad politics. Ross' soup-can schtick comes off as uninformed and painfully out of touch. It's no different from what happened after Republicans passed their tax bill in December: Those tax cuts will save the average American about $1,000 annually, but Democrats such as House Minority Leader Nancy Pelosi (D-Calif.) attacked those savings as "crumbs." Now it's Republicans making themselves look foolish for assuming that everyone can absorb an unnecessary, government-imposed hit to their wallets.

Does Ross really believe the sales pitch he's been making for Trump's tariffs?

If he doesn't, then neither should you. And if he does believe it, he's too economically illiterate to be trusted to run the Department of Commerce. Maybe he can be reassigned some place where numbers don't matter. Like the Pentagon.

Show Comments (50)