Piketty Is Wrong: Rich Families Don't Generally Get Richer

Corporate CEO pay is, however, way out of hand.

French economist Thomas Piketty made a huge splash last year with his Capital in the 21st Century in which he claimed that economic inequality increases as capital accumulates in the hands of the already rich. Piketty's analysis as been comprehensively analyzed and dismissed by other economists. One of the more informative and entertaining takedowns of Piketty is by Northwestern University University of Illinois-Chicago economist Deirdre McCloskey.

Alerted to a new study, "The Rich Get Poorer: The Myth of Dynastic Wealth," by The Economist's Buttonwood column, I thought I would share some that study's conclusions with Reason readers.

From the study:

We believe Piketty's core message is provably flawed on several levels, as a result of fundamental and avoidable errors in his basic assumptions. He begins with the sensible presumption that the return on invested capital, r, exceeds macroeconomic growth, g, as must be true in any healthy economy. But from this near-tautology, he moves on to presume that wealthy families will grow ever richer over future generations, leading to a society dominated by unearned, hereditary wealth. Alas, this logic holds true only if the wealthy never dissipate their wealth through spending, charitable giving, taxation, and splitting bequests among multiple heirs.

As individuals, and as families, the rich generally do not get richer; after a fortune is first built, the rich get relentlessly and inevitably poorer.

The "evidence" Piketty uses in support of his thesis is largely anecdotal, drawn from the novels of Austen and Balzac, and from the current fortunes of Bill Gates and Liliane Bettencourt. If Piketty is right, where are the current hyper-wealthy descendants of past entrepreneurial dynasties—the Astors, Vanderbilts, Carnegies, Rockefellers, Mellons, and Gettys? Almost to a man (or woman) they are absent from the realms of the super-affluent. Our evidence—used to refute Piketty's argument—is empirical, drawn from the rapid rotation of the hyper-wealthy through the ranks of the Forbes 400, and suggests that, at any given time, roughly half of the collective worth of the hyper-wealthy is first-generation earned wealth, not inherited wealth.

The originators of great wealth are one-in-a-million geniuses; their innovation, invention, and single-minded entrepreneurial focus create myriad jobs and productivity enhancements for society at large. They create wealth for society, from which they draw wealth for themselves. In contrast, the descendants of the hyper-wealthy rarely have that same one-in-a-million genius. Bettencourt, cited by Piketty, is a clear exception. Typically, we find that descendants halve their inherited wealth—relative to the growth of per capita GDP—every 20 years or less, without any additional assistance from Piketty's redistribution prescription.

Dynastic wealth accumulation is simply a myth. The reality is that each generation spawns its own entrepreneurs who create vast pools of entirely new wealth, and enjoy their share of it, displacing many of the preceding generations' entrepreneurial wealth creators. Today, the massive fortunes of the 19th century are largely depleted and almost all of the fortunes generated just a half-century ago are also gone. Do we really want to stifle entrepreneurialism, invention, and innovation in an effort to accelerate the already-rapid process of wealth redistribution?

Buttonwood observes:

Indeed, the authors point out that the rapid turnover of the Forbes 400 suggests that inherited wealth is unstable. Three-quarters of the families in the original list no longer appear on it.

Of course, dropping out of the Forbes 400 hardly indicates a descent into penury. But family wealth tends to dissipate over time. The Astors, Vanderbilts and Carnegies were among the wealthiest families of the late 19th century; not one of their descendants makes it onto the modern list. Indeed a Vanderbilt family reunion held in 1973 failed to find a single millionaire among the 120 present.

The study concludes:

When great wealth is achieved through entrepreneurialism, innovation, and invention, society benefits, jobs are created, and life becomes easier and better. For generations, this process has fueled American exceptionalism. When great income is achieved through entrepreneurialism, innovation, and invention, society again benefits for the same reasons. We find it puzzling that Piketty underplayed what even he recognizes as the major driver of growing American income inequality: the massive appropriation of the wealth of corporations by their executives. When it is objectively deserved, terrific; when it is not, it siphons resources out of the macroeconomy and hollows out the opportunity set for the populace at large.

As the researchers note, a significant driver of rising income inequality in the United States has been the increasingly outsized pay packages awarded to corporate CEOs. They do not see much evidence that 9-figure CEO compensation boosts shareholder wealth and argue for corporate governance reforms that more tightly align CEO pay with increased shareholder value.

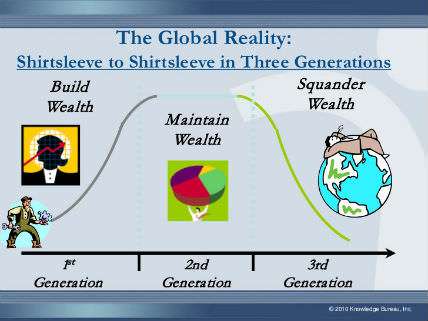

In an case, they find that the proverb "shirt sleeves to shirt sleeves in three generations" has more than a bit of truth behind it.

Show Comments (180)