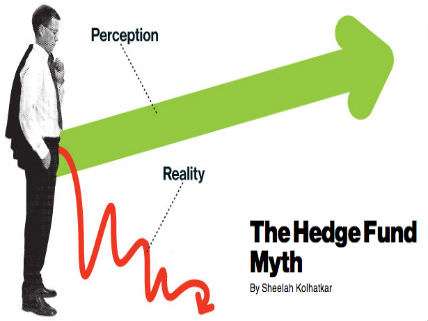

Poor Hedge Fund Managers

But their take-home pay is none too shabby.

The great thing about markets is that they encourage learning among participants. Sometimes the learning may take awhile, though. An article in today's New York Times reported that the executives who run the top 25 hedge funds took home $11.62 billion in compensation last year. However, the Times further noted:

For investors, 2014 was the sixth consecutive year that hedge funds have fallen short of stock market performance, returning only 3 percent on average, according to a composite index of 2,200 portfolios collected by HFR, a firm that tracks the industry. Hedge funds are lightly regulated private pools of capital open to institutional investors like pension funds, university endowments and wealthy investors.

For example, Bridgewater Associates executive Ray Dalio earned $1.1 billion while his All Weather Fund ended the year down 3.9 percent. in fairness, his Pure Alpha fund did rise 5.25 percent.

Three percent? In 2014, an S&P index fund would have returned 13.68 percent when reinvested dividends are included.

Hell, I just looked at my Merrill Lynch quarterly performance report and found that over the past 7 years the S&P average was 8.95 percent and my return (i invest in a lot of risky biotechs and infotechs) was 8.03 percent over that period. Sadly, at no point did my investments out-earn the S&P over the past 7 years, but my returns have never fallen below 7.9 percent per year in the past seven years. That's a lot better than 3 percent.

So are there any hedge funds hiring at a modest salary? I will work cheap - say, $10 million per year to start?

Show Comments (71)