Obamacare Inflicts IRS Paperwork on New Victims

People who have rarely had to deal with the calculations required by tax forms may find this a bit...challenging.

Forget the incompetent launch of the Healthcare.gov website. Forget the soaring costs of coverage under Obamacare. Forget what the healthcare scheme's impositions have wrought upon employment. Perhaps the Affordable Care Act's most-resented wrong against the American people will be initiating those previously exempt to the dull, often incomprensible grind of Internal Revenue Service paperwork.

Since the tax agency is tasked with enforcing compliance with Obamacare, it is responsible for figuring out, after the fact, whether the people who received subsidies for their coverage—really, advance tax credits—received too little, too much, or just enough. Actually, it leaves the calculations to the recipients, many of whom are low-income and so have previously avoided the mental and logical gymnastics inherent in IRS forms. Well, aren't they in for fun!

According to Kathy Kristof of CBS's MoneyWatch:

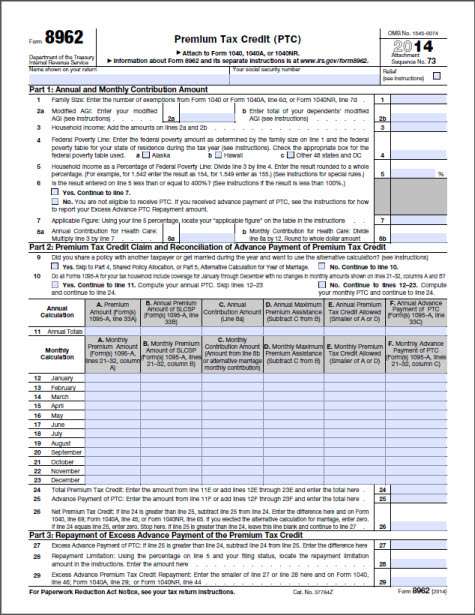

If you received discounted insurance through a health exchange, you'll need to fill out the mind-boggling Form 8962. Although this two-page form officially has just 36 lines, there are actually 90 spaces on just the first page that need to be filed in -- up to six spaces for each official "line."

To put the correct figures in several of these spaces, you'll need to complete charts and worksheets found elsewhere in the 20-page instruction booklet. If you are, say, divorced and sharing expenses with your ex-spouse, you'll also need to fill out the second page of the form. Though this page has just seven lines, there are 37 spaces. Worse yet, according to the IRS, completing that page requires cooperating and sharing both insurance and tax information with your ex-spouse -- not exactly a walk in the park for those with acrimonious splits.

The actual form is here (PDF). While I've (occasionally) seen worse, I pay an accountant to deal with that crap now. People who have rarely if ever had to deal with the calculations within calculations required by tax forms may find this a bit…challenging (as I would without my accountant). And then about half of them will have to cough up part of that healthcare coverage subsidy to the government at the end.

Does anybody think this will end well?

Show Comments (48)