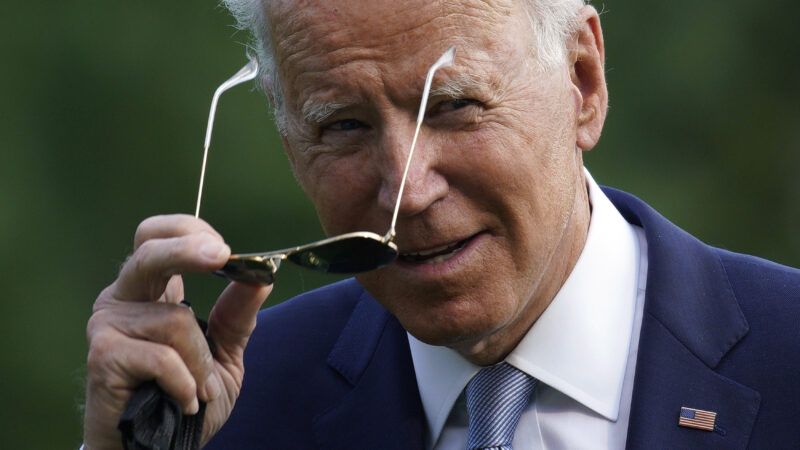

Biden's New Death Tax Hits the Middle Class While Excluding Certain Wealthy Investors

The American Families Plan hits individuals with identical net worths very differently.

President Joe Biden's American Families Plan (AFP) would impose a capital gains tax at death while essentially doubling the capital gains tax rate. With a major exception for large investors, it would make these changes without grandfathering existing unrealized capital gains.

This death tax would likely hit single taxpayers who own their homes more than married couples, because the appreciation of a home is not impacted by the owner's marital status. A single person with a reasonable mortgage and some modest other capital gains assets at death could have her residence's value eaten away by the new tax plus the mortgage.

Consider a single woman who has owned a New York apartment, her only asset, for 40 years. Jane has never made anywhere near $400,000 a year, so Biden has promised to not raise her taxes. She has two adult children who are also firmly in the middle class. Like all New York residential property, Jane's apartment has increased in value dramatically since her purchase after her husband's death in 1981. And like many widows, she refinanced her apartment to pay for her children's college educations, for weddings, and for a couple of vacations. Today, her $200,000 apartment has a fair market value of $2,000,000. She has a mortgage of $1,500,000.

A 40 percent capital gains tax at death after the exclusions allowed in the AFP would result in a tax of $220,000. Add the costs of the mortgage, and her children or grandchildren would see their inheritance reduced from $500,000 under current law to $280,000.

Many middle-income Americans who have only dreamed of a year with $400,000 in taxable income would be faced with this potentially confiscatory tax at death. Taxpayers who expected to leave a nice nest egg for their children or grandchildren would see a significant portion of it go to the federal government instead.

Under the AFP, the maximum federal rate on capital gains would increase from 23.8 percent to 40.8 percent. This would be calculated with two exemptions during life and an added third exemption at death. During life and at death, taxpayers would exclude $250,000 ($500,000 for couples filing jointly) on gains from the sale of a personal residence, and taxpayers would exclude up to 100 percent of income from any qualified small business stock gains. At death, there would be an added exclusion of $1 million of capital gains ($2 million joint).

Current law excludes anyone with less than $11.7 million of net worth ($23.4 million for married couples) from any death taxes. Today, this means that $11.7 million can be passed along to family members without any reduction. But the AFP would subject taxpayers with a net worth far lower than $11.7 to a death tax. This levy would allow no deduction for any debt, whether that debt is secured debt on specific assets or personal unsecured debt.

Without grandfathering of gains at the date of passage, millions of taxpayers would see decades of investment and planning for their families reduced or evaporated in an instant.

During life, a taxpayer can determine if there should be a sale of any capital asset; a tax on the unrealized gain at death would not provide such a choice. A tax on unrealized capital gains at death would for some taxpayers result in tax rates approaching or exceeding 100 percent of the net worth of leveraged property.

For example, a taxpayer who has owned rental real estate for decades would have a tax basis after depreciation equal to the land value at acquisition. A long-owned residential rental property in Southern California could easily have a fair market value of $2 million and a tax basis of only $10,000. If a descendant had other gains in excess of the exemptions, a gain of $1,990,000 would result in a federal tax of around $800,000. If there was an existing 60 percent mortgage, the proposed tax plus the mortgage would sweep away 100 percent of the equity, leaving nothing for the family of the deceased.

The White House fact sheet on the AFP claims that it would ensure "that the wealthiest Americans play by the same rules as all other Americans." But there is one exception to the lack of grandfathering of unrealized capital gains: the continuance of the 100 percent exemption for capital gains taxes from sales of qualified small business stock (QSBS). Such stock is issued by an active domestic C corporation, and it is most often found in the hands of very wealthy investors. The public has the opportunity to purchase stock in such a corporation only if there is an initial public offering, but the opportunity to buy it is rarely available to smaller investors. This is the domain of Wall Street venture capitalists.

So the AFP is exempting perhaps billions of dollars of capital gains income from exactly the income group who Biden has stated he wants to tax. At the same time, the law would create a death tax for millions of middle-class Americans.

Show Comments (134)