Five Important Details from the GOP Tax Plan

Fewer income tax brackets, a bigger standard deduction, a lower corporate rate, and a new cap on mortgage deductions. But what about the deficit?

Republicans have been talking about reforming the tax code since well before the start of the year. Today we finally got a look at their proposal.

Here's five important details from the bill—with the important caveat that just about everything in it could be subject to change after it is introduced:

1. Fewer Income Tax Brackets

The current individual income tax system has seven brackets, with rates ranging from 10 percent to 39.6 percent. The highest bracket applies to income over $418,000 annually for individuals, or $470,000 annually for married couples.

In the GOP tax bill, those seven brackets would be collapsed to four brackets, with rates of 12 percent, 25 percent, 35 percent, and 39.6 percent. The highest rate would kick in at $500,000 for an individual or $1 million for a married couple filing jointly. Most people would see a small income tax reduction, though some people might end up paying a slightly higher rate depending on where they fall on the current spectrum.

Republicans propose collapsing seven tax brackets into four. See the rates and brackets in the bill. https://t.co/jU5Sw7MKKX

— Wall Street Journal (@WSJ) November 2, 2017

But that's not the most important detail for individuals and families. The bigger news is…

2. A Much Higher Standard Deduction

Yes, the government is going to let you keep more of your own money. How generous, right?

Currently, individuals can claim a standard deduction of $6,350 and married couples get a deduction of $12,700. Under the House GOP plan, the standard deduction would rise to $12,000 for individual filers and $24,000 for married couples. That means more people will likely choose to take the standard deduction instead of itemizing their deductions, which Republicans say will simplify the tax filing process.

But does it really? About 70 percent of Americans already use the standard deduction, and high-income earners tend to be the only ones who itemize. A higher deduction is nice for everyone, of course, but it won't make much of a different in how most people put their taxes together.

3. No Changes for 401(k) Savings, But a New Cap on the Mortgage Deduction

As I wrote yesterday, there was a fair bit of speculation about whether the Republican tax plan would lower or eliminate the current deduction for retirement savings, which encourages people to, well, save for retirement. The bill released Thursday makes no changes to how 401(k) plans operate, so that deduction remains in place.

But another major deduction in the current tax code—the one that allows homeowners to subtract mortgage interest from their taxable income—would be altered. Republicans would cap the mortgage interest deduction at $500,000 for new home loans starting next year. That's something the construction industry will almost certainly lobby to change as the tax bill goes forward, but it would affect only about 5 percent of all homebuyers.

Only about 5% of US mortgages are over $500k. But take a look at where they are in the US… (good chart via @NLIHC) pic.twitter.com/fAybZajulY

— Heather Long (@byHeatherLong) November 2, 2017

4. Corporate Income Tax Rate Cut From 35 Percent to 20 Percent

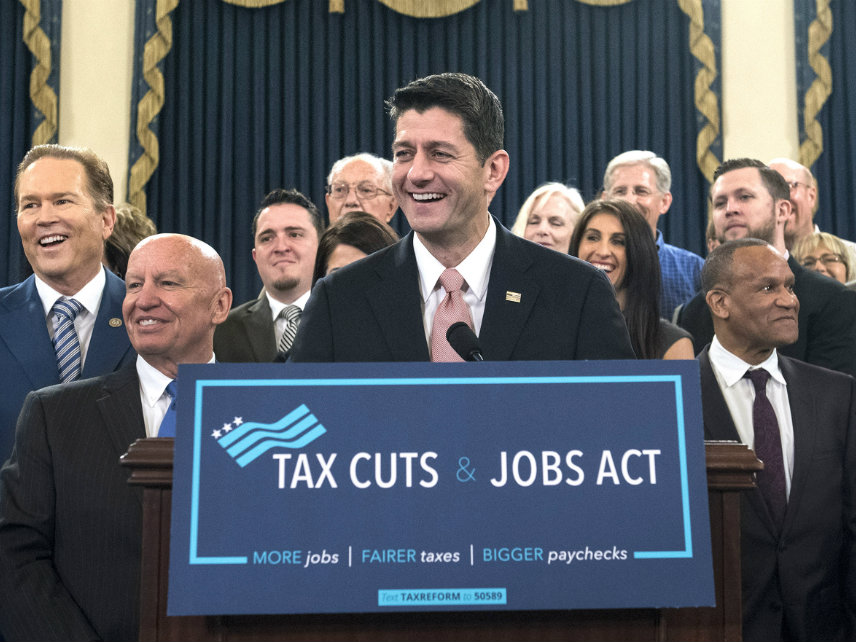

Maybe the most important part of the tax bill, politically, is the proposed cut to the corporate net income tax. The current rate of 35 percent would be reduced to 20 percent, something Speaker of the House Paul Ryan (R-Wisc.) said today will be essential to keeping America competitive in the global economy.

This has been the centerpiece of the Republican tax agenda since last year's election (and indeed longer). If there is one thing that unites the varied factions of the Republican Party, it's the notion that taxes on American businesses should be reduced. All the changes—mostly rather mild changes—to the individual income tax system are best understood as a way to sell this corporate income tax cut to voters.

But that doesn't mean that cutting the corporate tax rate is a bad idea. America has one of the highest corporate income tax rates in the world, and there is evidence that it hinders growth and encourages businesses to relocate overseas.

Cutting the corporate income tax rate "is an extremely important move," says Veronique de Rugy, a senior research fellow at the Mercatus Center (and a contributing editor here at Reason). But, she adds, "we still need to see how they will treat revenue earned overseas to assess the corporate plan fully."

5. Adding $1.5 Trillion to the Federal Deficit Over 10 Years

Cutting taxes is easy. Making those tax cuts without doing further damage to a federal budget that's already way out of whack is much, much harder.

The federal budget that passed Congress last month paved the way for tax reforms that could add up to $1.5 trillion to the national debt. As expected, the Republican tax plan will add about that much to the national tab over the next decade. The projections have to line up in order for the tax bill to clear the Senate without any Democratic votes—Republicans plan to use the reconcilliation process, which requires that legislation not add to the deficit beyond a 10-year window—and some deficit watchers are already warning that the tax plan might be worse than advertised.

"While it is encouraging to see the House move forward on tax reform, it seems each new vote and milestone is a step backwards for the cause of fiscal responsibility," says Maya MacGuineas, president of the Committee for a Responsible Federal Budget.

If only Congress could find the cojones to cut spending.

Show Comments (270)