Atlanta Braves Are a Terrible Baseball Team, But "A Fairly Major Real Estate Business"

Small-town Southern taxpayers subsidize minor league ballparks for baseball's worst team.

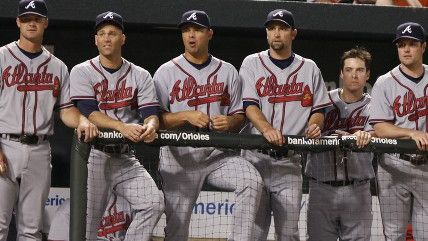

The Atlanta Braves are currently baseball's worst team, with a 7-20 record (and just 1 win in their home stadium, Turner Field), and a manager whose job is reportedly in jeopardy.

However, the team's billionaire owner, Liberty Media chairman John Malone, recently told Braves shareholders that they need not worry about their investment because "the Braves are now a fairly major real estate business as opposed to just a baseball club."

Malone knows that of which he speaks. Turner Field is only 20 years old and is widely considered a perfectly nice ballpark with all the modern amenities, but 2016 will be the final season in the House that Ted Turner Built because the team is building a brand-spanking new stadium in the Cobb County suburbs called SunTrust Park. More than half of the financing for the Braves new home will come from the taxpayers, as will the funding for the buses shuttling fans from the mall to the stadium.

Ira Boudway and Kate Smith write in a recent article for Bloomberg Businessweek that the public will provide $392 million of the $722 million needed to build the new stadium, an amazing figure given that it's no longer a secret that professional sports stadiums almost never provide a boost to local economies and in most cases are a drag on the public coffers.

But the Braves (valued at $1.175 billion) and Malone (reportedly worth $6.5 billion) aren't done with goosing the public to pay for their ballparks. The team's minor league system is dotted with publicly-financed ballparks throughout the Deep South. According to Boudway and Smith, "Over the last 15 years, the Braves have extracted nearly a half a billion in public funds" for three minor league parks to go with their soon-to-be christened major league home.

The Braves' modus operandi is consistent: they court a downtrodden city's political class, then threaten their current host city with leaving, and pit the two against each other as the cities offer up public money they don't have in order to keep or import a Braves minor league team.

The team wines and dines local pols with owner's box seats at Turner Field and visits from team legends like Hank Aaron. In turn, local officials impose new sales taxes and property taxes, as well as surcharges on tickets, parking, and purchases at local businesses to cover the costs of the stadiums. The elected officials generally negotiate with the team behind closed doors, often without providing any transparency of the process to the city commissioners tasked with approving the deals.

But it can always get worse, as in the case of Pearl, Mississippi, a city described by the Braves' hired "dealmaker," Tim Bennett, as "the trailer park capital of Mississippi, so that basically means it was was the trailer park capital of the world."

Of the consequences suffered by Pearl taxpayers because the stewards of their government decided to subsidize a billionaire's vanity project, Boudway and Smith write:

Altogether, the taxes and fees were supposed to be more than enough to pay the debt back. But just in case, Pearl pledged to cover as much as $950,000 annually from other sources if money didn't come in as planned. It hasn't. In 2014, the most recent year on record, the city paid $911,748, more than 5 percent of its general fund spending for the year, to cover shortfalls. The year before, it paid $967,944. [Mayor Brad] Rogers says he isn't sure why Pearl paid more than it pledged.

Boudway and Smith also note that the city of Pearl paid Bennett (the architect of the deal who so colorfully described the city as the "trailer park capital") more than $1 million as a finder's fee, or "about a fifth of what the town collects each year in property taxes."

Watch Todd Krainin's recent Reason TV doc on a taxpayer-funded minor league ballpark boondoggle in Hartford below.

Show Comments (18)