America Has a Really, Really Lousy Tax Environment, Says New Report

Remember all of that "inversion" buzz about nasty, greedy corporations relocating overseas to escape their patriotic duty to be milked by the United States government? "Even as corporate profits are higher than ever," President Obama told us, "there's a small but growing group of big corporations that are fleeing the country to get out of paying taxes."

But…Could it be that those companies—and individuals—are fleeing because the United States tax system so truly sucks that it isn't even slightly competitive with the deals offered by other countries? Let's see what the Tax Foundation has to say on its new International Tax Competitiveness Index:

The United States places 32nd out of the 34 OECD countries on the [International Tax Competitiveness Index]. There are three main drivers behind the U.S.'s low score. First, it has the highest corporate income tax rate in the OECD at 39.1 percent. Second, it is one of the only countries in the OECD that does not have a territorial tax system, which would exempt foreign profits earned by domestic corporations from domestic taxation. Finally, the United States loses points for having a relatively high, progressive individual income tax (combined top rate of 46.3 percent) that taxes both dividends and capital gains, albeit at a reduced rate.

That puts us behind Italy, but ahead of Portugal and France. Yay.

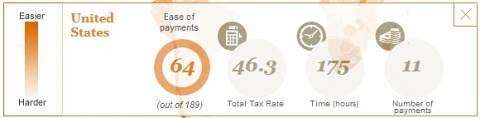

The Index squares remarkably well with the shitty rating the United States gets from PricewaterhouseCoopers in its international rankings of ease of paying business taxes.

Maybe, just maybe, people have growing reason to think the land of opportunity has an overseas address.

No wonder American voters are down in the dumps over the country's economic prospects.

Show Comments (40)