Larry Kudlow Says Deficits Are 'Coming Down Rapidly.' He's Wrong.

Larry Kudlow says President Trump's agenda has been reducing federal budget deficits, but CBO estimates say otherwise.

Larry Kudlow, the director of the White House National Economic Council, told Fox Business on Friday that the federal deficit is "coming down rapidly" thanks to the major tax reform bill passed six months ago.

If only. In fact, projections show that the deficit will continue to rise unless Congress acts to make serious spending cuts or raise significantly more revenue.

Kudlow made his false claim during an interview on Morning with Maria, which was centered on the higher-than-anticipated growth achieved by the Trump administration on the six-month anniversary of the tax bill's passage. Because of the "enormous amounts of the new tax revenues," Kudlow said, "the deficit is coming down, and it's coming down rapidly."

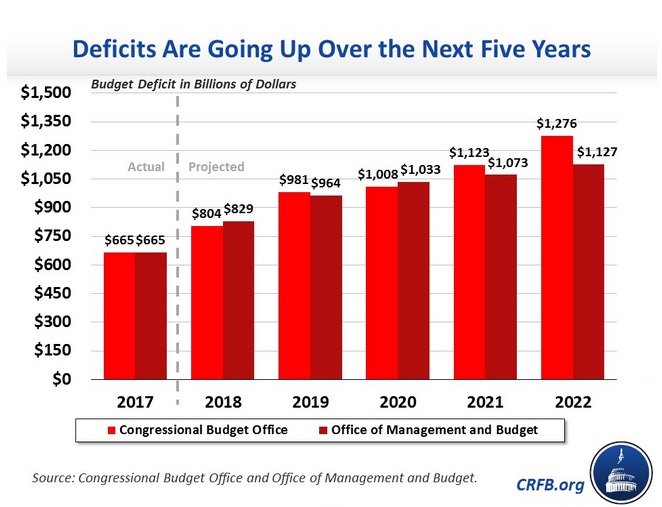

But according to the CBO's numbers, the federal deficit for the first eight months of fiscal year (FY) 2018 is $530 billion more than the deficit accrued in the first eight months of FY 2017. The CBO's forecast from April shows that the deficits will rise from $665 billion to $1.5 trillion by 2028.

Increased economic growth is a good thing, of course, and the famous "Laffer Curve" suggests that lower tax rates could produce higher growth and thus generate more revenue for the government.

But the increased growth generated by tax reform will not cancel out the federal government's current deficit.

"Not only are deficits not falling rapidly—they aren't falling at all," says the Committee for a Responsible Federal Budget in a fact-check of Kudlow's comments.

This shouldn't be news to Kudlow. During the debate over the tax bill last year, there was not a single projection that showed the bill would reduce the deficit over the long term. That includes the Treasury Department's own analysis of the tax cuts—an analysis that Treasury Secretary Steve Mnuchin promised would show that tax reform could "pay for itself." Even after accounting for economic growth, the Treasury's assessment largely agreed with other prominent projections saying the tax cuts would add about $1 trillion to the deficit over a decade after economic growth is included.

And continued growth is not a sure bet. Federal Reserve interest rate hikes will likely put a damper on the booming growth that Kudlow's argument rests on. Kudlow said Friday that he hoped the Fed would move "very slowly" on their interest rate hikes, a tried and tested recipe for recession.

A trade war could also exert a negative effect on the growth numbers that the current administration has been touting. Tariffs and their responses have cut America's supply of cheap goods and limited the markets for American goods in foreign countries, which bodes poorly for American businesses, who will probably have to end up laying off workers and cutting production.

If genuine deficit reductions are desired by President Trump and his administration, significant spending cuts are the only conceivable way to achieve this goal. Instead, the Republican-controlled Congress spent this year eliminating spending caps to pass a budget that hikes spending on the military and domestic programs. The Trump administration falsely claimed that the budget would also reduce the deficit.

Reductions to the tax rate are always welcome, but it's dishonest to pretend, as Kudlow did on Friday, that they are a silver bullet to our nation's serious fiscal quandary.

Show Comments (93)