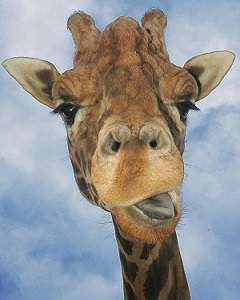

Looking to Buy a Giraffe? Detroit Can Hook You Up.

The bankrupt city starts putting price tags on everything, considering sales or privatization

Detroit's going-out-of-business sale is looking to be quite the affair. The Detroit Free Press examined the disparate and sometimes unusual assets left in the city that may be sold in order to pay off its debts:

A healthy, breeding female giraffe from the Detroit Zoo could fetch $80,000 on the open market. Detroit's half of the Detroit-Windsor Tunnel was valued a few years ago at $65 million. A prototype of the 1963 Ford XD Cobra owned by the Detroit Historical Museum carries an estimated price of $1 million. …

Detroit is teetering on the brink of the largest municipal bankruptcy in American history. The city's emergency manager, Kevyn Orr, and his team have said they want to evaluate everything owned by the city as they begin negotiations with creditors in the face of $15 billion to $17 billion in debt and future pension obligations.

Orr already created a tsunami of controversy when he acknowledged late last month that billions of dollars worth of art owned by the city and housed at the Detroit Institute of Arts were vulnerable to creditors. But he potentially could sell or privatize numerous other city assets, too, from public parks to operations of the city's Water and Sewerage Department to sundry treasures found in some of Detroit's other cultural institutions.

Though, as the story points out, "sold off" may not be the right term. Residents may have images in their head of pieces of the city being loaded up in moving trucks (or cartoony railroad zoo cars as the case may be), but privatization might be more useful (and necessary) for the city's future:

Orr's spokesman Bill Nowling said Friday afternoon that putting price tags on artwork, giraffes or real estate doesn't mean those assets actually will be sold. It means that Orr and his team need to have a full picture of the city's valuables and operations so that they can discuss the financial status rationally when meetings with creditors begin this week.

"We're looking at every function and every asset of the city to see how it provides value to the citizens of Detroit and ask the question, is there a better operational model that will allow it to provide more value through less cost or more revenue?" Nowling said.

It's important to note that selling individual assets won't help much if Orr cannot bring city revenues and city expenses into line. If city spending continues to outstrip revenues from taxes and other sources, selling DIA artwork — or zebras — merely would put off the day of reckoning for a few more months or years.

"Those are onetime fixes, and really, as part of the restructuring process we're not interested in those as much," Nowling said. "They don't provide the long-term stability that you want in your city's finances and the level of quality of services that are provided to residents."

A privatization expert quoted in the story suggests that the Detroit Zoo might not be a good potential revenue generator for the city even in private hands. While he may be correct in the context of the billions of debt and obligations Detroit owes, it's still likely a better choice. Reason TV reported in March how Tulsa, Okla, saw an increase in attendance and quality at their zoo once it was handed over to a private nonprofit to operate. Watch below: